2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:33

Currency transactions are transactions the subject of which are monetary values. They must be regulated by law or by certain international agreements.

Currency exchange operations carried out with foreign banknotes are conditionally divided into current and those associated with the movement of capital. The first category is becoming increasingly important today. Foreign exchange transactions related to the movement of capital are activities that are carried out on a limited scale. There are a number of reasons for this. Their implementation is associated with serious risks, and registration is a complex process. Capital flow operations are carried out under foreign trade transactions, are concluded under loan agreements, are associated with the purchase or sale of banknotes of another state or checks, and may take place when acquiring shares, shares, deposits from non-residents.

Actions with currency are made by individuals, banks, financial institutions, enterprises, various companies and funds. They are divided into urgent and cash.

When crediting or debiting funds to an account, in some cases, you may need a certificate ofcurrency transactions. It is provided to the bank to control the client's finances. It indicates the TIN, account number and some other data.

Currency transactions are an object of both banking and state supervision and control. Consider their main types that are used on the international market.

"Spot" - immediate supply of money supply. It accounts for 9/10 of all transactions in this category. The exchange rate is strictly fixed at the time of delivery. The essence of this operation is the acquisition of foreign money through banks that are counterparties, 3-4 days after the transaction was concluded.

"Swap" (exchange) - the purchase and sale of two types of currencies, their immediate delivery. This is combined with a simultaneous counter-deal using the same types of banknotes. Thus, the bank sells the currency with the condition of immediate delivery and at the same time buys it. This operation can be carried out not only with money, but also with interest, gold, loans, securities, etc. There is an international corporation of dealers specializing in "swap".

Short-term deals are often made. Such foreign exchange transactions are a mutual agreement on the supply of foreign money after a certain time after its conclusion. In this case, the course to which they are guided is indicated in advance. In fact, it is fixed at the time of the transaction.

Arbitrage currency transactions are an attempt to buy banknotes cheaper,

to sell them for a higher price. Thus, their meaning isreceiving benefits. The acquisition of currency is combined with a counter-deal. The factor that brings benefits is the difference in rates or their fluctuations. Such arbitration can be of two types. A simple one is working with only two currencies, and a complex one is working with several at once. There is also the so-called conversion arbitrage. This is an attempt to acquire the necessary currency on the most favorable terms. In this case, you need to work with competitive quotes from different banks. Another type of operation is actually speculative arbitrage, which was discussed above. It is expressed in working with exchange rates and benefiting from their changes. Large speculators use a variety of techniques that allow them to achieve their goals faster. For example, they can artificially create panic so that the population begins to buy up or, conversely, acquire one or another currency.

Recommended:

Financial transactions are Definition of the term, types, essence of finance

Financial transactions are an integral element of business activity, necessary to ensure its stable operation. Each enterprise carries out various financial transactions, which is associated with its organizational and legal form and line of business. In the article we will consider the main types of financial transactions, we will study their features

REPO transactions. REPO transactions with securities

REPO transactions are procedures during which the sale of any valuables is carried out, accompanied by their repurchase after a specified period at a price fixed at the time of the transaction. Repurchase is mandatory, representing the final (second) stage of the transaction

Multicurrency payment solutions - security of financial transactions

Multi-currency payment solutions allow you to pay in any currency with a single account. When making financial transactions, there are no difficulties, the user can make payments in the public domain and safely

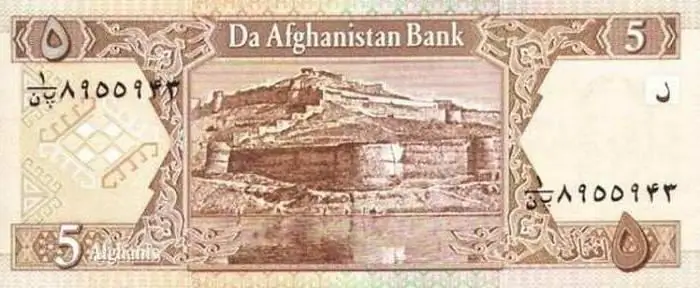

The currency of Afghanistan: the history of the currency. Curious information about the currency

Afghan currency Afghani has almost a century of history, which will be discussed in this material

What is a currency? Russian currency. Dollar currency

What is the state currency? What does currency turnover mean? What needs to be done to make the Russian currency freely convertible? What currencies are classified as world currencies? Why do I need a currency converter and where can I find it? We answer these and other questions in the article