2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:28

Standards help bring different situations to a common denominator. How does it look in the financial sector? First of all, this approach relates to reporting. In this case, the financial standard helps to bring information about the position of the organization into a typed form.

Introduction

There are different financial reporting standards. Some of them are aimed at the control of civil servants, others are engaged in the study of various private and public structures. A certain financial standard can be introduced within the enterprise in order to collect all the necessary information and process it appropriately. Moreover, not only reporting can be affected in them, but certain requirements for conducting activities are often put forward. For example, the amount of borrowed funds should not exceed 10% of the total amount of all money used. If this requirement is not met, then decisions must be made to bring the situation to the desired form. The most popular and well-known are the international financial reporting standards. That's why,analyzing the essence of this phenomenon, we will focus on them.

What does international practice offer?

The first step is to start with a definition. International Financial Reporting Standards, also known as IFRS, are a set of accounting approaches that specify how specific types of transactions and other events should be accounted for. By whom are they prepared? This is done by an organization called the International Accounting Standards Board. It is she who determines how best to maintain and present accounts so that there are no problems in the future. The financial standard in this case was introduced in order to have a "common language" of accounting. After all, if each company does everything the way it wants, and even the states make their own changes, then checking information from the regulatory authorities of different countries will be a difficult matter.

What is it for?

IFRS were introduced to maintain transparency and stability in the financial world. This allows investors and businesses to make sound decisions as they can see what is happening with the company they are planning to invest in. It is also convenient for government oversight bodies to work. IFRS is accepted as a standard in many parts of the world. The biggest beneficiaries of this are international businesses, as well as those who invest in them. This situation has developed due to transparent practice. After all, investors like to know exactly howthings are real.

How does it work?

International financial standards cover a wide range of accounting transactions. At some points in business practice, they may even be mandatory. IFRS is based on a number of principles. They affect assets, liabilities, capital, expenses and income. There are quite a few of them, but to get an idea of the essence, it is enough to give just a couple as an example:

- Principle of accrual. This means that events must be displayed in the appropriate period, regardless of when the cash flow occurred.

- Business continuity principle. It implies that the company will operate in the near future and the management has neither the need nor plans to curtail activities.

The information provided, according to IFRS, must contain:

- Statement of financial position. Also known as balance.

- Statement of comprehensive income. May be submitted as a single form or provide for a profit and loss split. It is also acceptable to allocate other income, equipment and property.

- Statement of changes in equity. It contains information on retained earnings for a given financial period.

- Cash flow statement. It displays the financial transactions that were carried out in the company for the specified period.

Is it difficult to switch to another reporting?

Change the company's financial standard,to make it meet international requirements is not so difficult. In short, this process is as follows:

- Accounting policy is being developed.

- Select functional currency and presentation money.

- Opening balances are being calculated.

- Transformation models are being developed.

- The corporate structure of a company is assessed to identify associates, subsidiaries, joint ventures and affiliates that should also be included in the accounting records.

- Specific features of the company's business are determined and information is collected that is needed to calculate the transformation adjustments.

- Regrouping and reclassifying financial statements.

Automation plays a special role in this. In practice, it is possible to introduce, as well as comply with, the IFRS financial standard without it, but it is very labor-intensive. Fortunately, there is a choice of various complexes and platforms, which will allow you to choose exactly what meets your needs. You can use the already existing default settings or create the necessary configuration yourself.

Recommended:

Forecasting and planning finances. Financial planning methods. Financial planning in the enterprise

Finance planning combined with forecasting is the most important aspect of enterprise development. What are the specifics of the relevant areas of activity in Russian organizations?

What is financial grant assistance. Financial assistance free of charge from the founder

Property owned by an LLC and its founders exists as two separate categories. The company cannot rely on the money of its members. Nevertheless, the owner has the opportunity to assist the company in increasing working capital. You can arrange it in different ways

Financial leverage or financial collapse?

Throughout the times, technologies, cultures, lifestyles and beliefs have changed, but only one thing has remained unchanged - money. For centuries, they have been daily present in people's lives, performing their functions

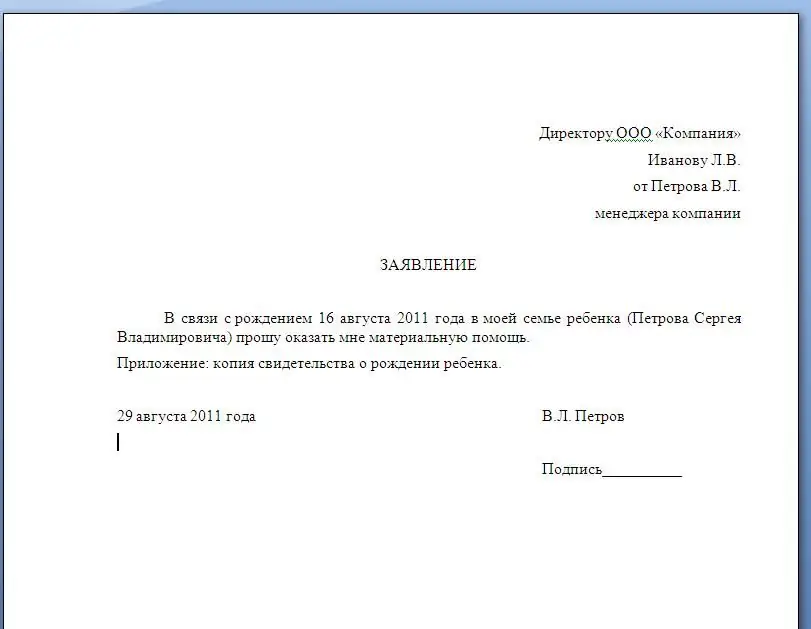

Application for financial assistance: sample and form of writing with an example, types of financial assistance

Material assistance is provided at work to many employees who have significant events in their lives. The article provides sample applications for financial assistance. Describes the rules for assigning payments to the employer

Financial oligarchy - what is it? Methods of domination of the financial oligarchy

Financial oligarchy is an international phenomenon, implying the concentration of material capital in the hands of a certain group of persons who act in their own interests in order to enrich