2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:28

The program "1C" uses several accounts to account for expenses: 20, 23, 25, 26. On the account. 20, the "Subdivisions" separator is provided (there is a checkmark in the "Accounting by subdivisions" column in the chart of accounts), as well as 2 subcounts: "Cost items" and "Nomenclature groups". We will talk about the latter in the article.

General information

"Cost items" is a breakdown by type of expenditure. This subconto is negotiable. This means that on the 20.01 ("Main production"), information is summarized only on turnovers, but not on balances. The main purpose of subconto is to analyze the composition of expenses. However, it is also used for tax purposes. As practice shows, there are no particular difficulties with it.

"Subdivisions" - this, as the name implies, the divisions of the enterprise. Considered from a cost accounting point of view, they are objects for collection.production costs. Simply put, departments are the facilities that produce the product. Accordingly, it is important and necessary for the management of the enterprise to know what expenses they incur.

Now let's turn to the concepts of "nomenclature", "nomenclature groups". The latter, in their essence, are activities (produced goods). Nomenclature groups are introduced based on the requirements of the organization of accounting at a particular enterprise. We can say that these are the financial flows of the company. But we can say this only in relation to those types of activities, the implementation of which is carried out by third parties. After all, products can be used within the enterprise.

Rules "1C"

Nomenclature groups in accounting are designed to summarize information about costs and receipts by type of activity (product). They compare the actual expenses of the enterprise.

First, you need to correctly determine the types of activities that will be allocated, and the order of their correlation with units. In other words, the accountant must understand how many types of activities he will provide for each department, or, conversely, how many departments will carry out the same work.

For example, take the production of pipes. This activity can be carried out by shops 14 and 15. The two departments are thus engaged in the production of the same product, and the costs are collected as a whole for "Production of pipes", i.e. for one type of activity.

Nuances

In practice, a situation often arises when a division produces only one type of product for which costs are collected. For example, there is a "Velesovo blanks shop". He has only one type of activity - preparations. At the same time, the enterprise also has another subdivision - "Pavlovo Billets Workshop". It is also engaged in the production of blanks, i.e., similar activities.

If we assume that the essence of the work of the shops is the same, then to collect the costs for it, one main item group called "Blanks" should be used.

If these divisions produce different products and, therefore, carry out different types of activities, then you need to select 2 groups.

Conclusions

Based on the above information, when filling out the account. 20.01 and analytics for it is necessary:

- Determine which business unit will collect costs or reflect output.

- Set what activities the selected division conducts or what products it produces. At this stage, you must act very carefully so as not to accidentally select "someone else's work".

Important moment

Please note that not all item groups (types of activity) can receive receipts (account 90). The fact is that enterprises often perform intermediate operations. They are links on the path to a profitable activity.

For example, there issubdivision "Procurement shop", nomenclature group, respectively, "Procurements". Most likely, account 90.01 will not be filled in for the production of blanks. However, this group will collect all the costs that were incurred to release the final product. These costs will be transferred to the costs for the type of activity "Production of shaped pipes", "Production of round pipes".

Special occasions

Consider the following situation. Suppose that the unit has several types of activities, but when writing off the next costs, it is impossible to say exactly which of them will be spent on. For example, an enterprise car transports employees, travels on orders, and can be used to transport small loads. But spare parts are written off on the car. What should an accountant do?

There are two ways out of this situation.

In the first case, a common item group is created for the unit, called, for example, "Distributable costs". In fact, it can be formed for all departments. This greatly optimizes the work. Write off expenses if necessary. 20 or 23, you need to select the appropriate unit, and then the desired group.

It will not release products, so it will not close automatically. At the end of the month, it will be necessary to automatically or manually write off the entire amount of costs for each unit, distributing them according to the relevant types of activities (if there are more than one). Can it be doneby physical values of production volume by division (cubic meters, hours of operation, etc.).

The second option is to apply the account 25.

Conclusion

Account 20.01, as we found out above, is used in accounting to reflect the costs arising in the main production. Here are the units for which costs are collected and which are engaged in the production of products. The same account reflects the types of activities (goods). No additional sub-accounts need to be created.

Separation of costs and volume of output of goods is carried out by subconto "Nomenclature groups". For the correct organization of accounting, it should therefore be clearly defined which departments work at the enterprise, what specific types of activities they are engaged in. The main thing is not to confuse anything, otherwise it will be very difficult to figure it out later. Accountants need to be especially careful at enterprises whose divisions carry out similar activities.

Recommended:

Horizontal division of labor is The levels of management in the organization, the concept of goals and objectives

For the efficiency of the enterprise, horizontal and vertical division of labor is used in management. It provides for the detailing of the production process and the distribution of powers between managers of different levels. In order to improve the performance of the company, it is necessary to know the principles of the division of labor, as well as correctly determine the goals and objectives of the organization

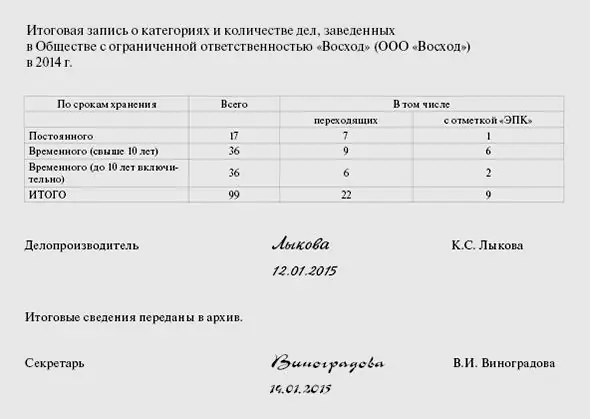

Nomenclature of affairs of the organization: samples of filling. How to make a nomenclature of affairs of the organization?

Each organization in the process of work is faced with a large document flow. Contracts, statutory, accounting, internal documents… Some of them must be kept at the enterprise for the entire period of its existence, but most of the certificates can be destroyed upon expiration of their validity. In order to be able to quickly understand the collected documents, a nomenclature of the organization’s cases is compiled

How to convert rubles into hryvnias? Features of the exchange of Russian money for Ukrainian and vice versa

The article describes the main methods of exchanging rubles for Ukrainian hryvnias. In addition, quick ways to find out the current exchange rate are listed. The article will be useful for those who need to exchange hryvnia for Russian currency

A consolidated group of taxpayers is The concept and goals of creating a consolidated group

In the article below we will get acquainted with such a phenomenon as a consolidated group of taxpayers, consider the concept and goals of creating such an association, and also find out how beneficial it is for entrepreneurs

316 Infantry Division of General Panfilov. The history of the division, the feat of the fighters

The immortal feat was accomplished by the 316th Rifle Division in 1941, during the defense of Moscow. Many people know it as the Panfilov division, and the heroes are called Panfilovites. There were 28 fearless soldiers who, at the cost of their own lives, thwarted the German tank offensive. But now many historians doubt whether the feat was accomplished then, because new facts were discovered, secret documents were found. We will try to restore the course of events and shed light on the true picture of that famous battle