2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:28

Regardless of whether you knew about the rules of record keeping, you will face large fines for posting revenue without proper documents - receipt orders. An example of how to fill out this document can be found below. The tax authorities regularly carry out such spot checks. How to get everything right and avoid trouble?

Incoming Order: sample

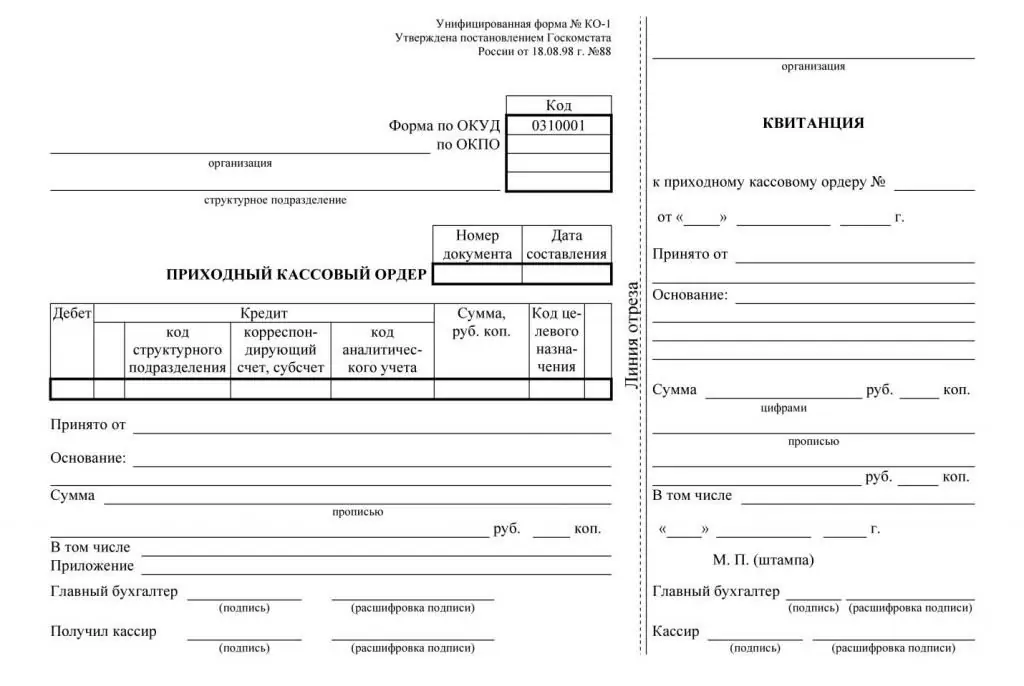

Financial documents are drawn up only on unified forms: in legible handwriting and without corrections. The development of documents of the corresponding samples is carried out by a state organization - the State Statistics Committee of the Russian Federation. PKO is no exception. A sample form of a credit order - form KO-1. Her classifier number is 0310001.

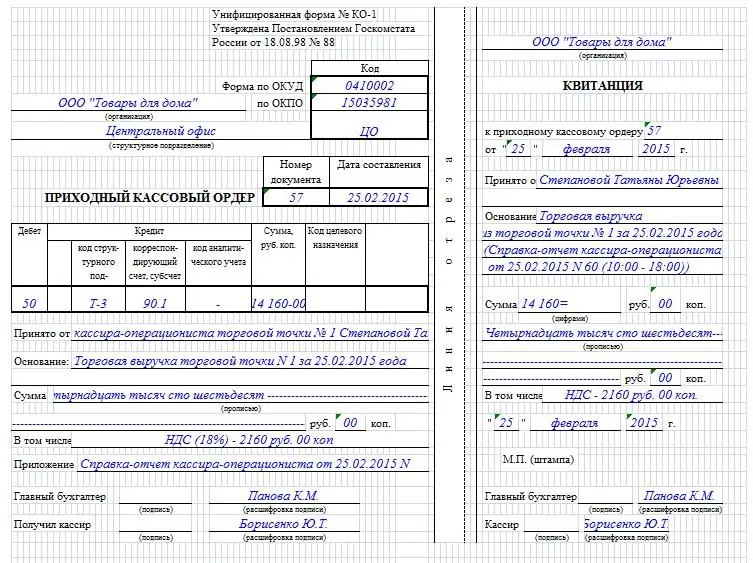

The photo below shows a sample receipt order:

Please note, at the top right it is indicated that this is the unified form of KO-1. It consists of 2 parts: the receipt order itself - a sample on the left (remains at the cash desk) and a receipt - on the right(issued to the person who deposited the money).

Each issued order is assigned a serial number, which is entered in a special journal. In addition, in order to take into account cash, a cash book is kept. Each cash register operation is entered into it: in the income or expense column.

How to organize the cash flow?

The main rule is that employees who fill out an incoming order according to the model above and accept money at the cash desk must be different. It looks like they control each other. If the same person issues the warrant and accepts the money, there may be abuse of office.

As a rule, an accountant draws up a cash receipt order. But the cashier takes the money. Strictly speaking, it is not necessary to introduce the position of a cashier into the state. Every employee can perform his duties.

Only beforehand, a liability agreement must be concluded with him. In addition, there is a special document - "Obligation of the cashier." It's like the Hippocratic Oath of doctors. His employee must also sign.

Without these two documents, do not file a claim against the cashier if there is a shortage at the cashier.

How to fill out a cash receipt order?

Physically, the PQP does not have to be filled in manually. This can also be done on a computer. There is special software for this - it automates routine processes. You just need to fill in the required fields: specify the amount anddate.

By the way, you don't have to buy an expensive software package for this. You can use any service on the Internet to issue a receipt online.

There are cash registers that, when recalculating cash, automatically generate PKOs. But they are not cheap. Such equipment is used by banks and large companies that constantly work with large amounts of cash.

Which of these ways to choose?

Each of the above methods has its pros and cons. The easiest way is to fill out the form of a cash receipt order manually. If you have to do this no more than 1-2 times a day, then you should do it.

However, with a large number of such operations, the disadvantages of this approach are obvious. This method is too time-consuming, and not every accountant has a legible handwriting - later the tax authorities may have questions about this.

If, nevertheless, cash receipts are filled in manually, then this should be done only with a blue ballpoint pen and only in legible handwriting. Do not use helium or oil ink.

Online services may not be available. Often this happens at the wrong time and for reasons beyond your control. Thus, you cannot somehow influence the situation in this case. This is the main disadvantage of this method, although it is free.

The best option is to install a software package for accounting. It automates not only the issuance of cash receipts, but also other routine operations. And youyou can always keep the situation under control.

Filling out a cash receipt order: step by step instructions

How to fill out an incoming cash order? A sample of a completed order is shown in the photo above. And here is the step-by-step instruction:

- according to the journal, assign a number and date to the document;

- the amount is written not only in numbers, but also in words;

- indicate the numbers of the corresponding accounts for money transfer;

- fill in the line "Basis" (what kind of operation was performed);

- calculate VAT or mark "excluding VAT";

- indicate attached documents.

Remember that the cashier may not accept the form of the cash receipt order - the sample signature of the chief accountant or the person replacing him, in accordance with the order, must clearly match the signature on the receipt.

In addition, when accepting money, the cashier must:

- check once again that each field is filled in correctly;

- check signatures with samples;

- check for supporting documents.

Moreover, the amount of funds deposited must exactly match the specified one.

The question often arises, does the cashier have the right to accept part of the money indicated in the cash receipt order? The answer to this question is unequivocal - no. If at least a penny is not enough, the money is not accepted, the order is crossed out and sent for re-issuance. And this is fair. After all, otherwise the cashier will have to reimburse the difference from his own pocket.

Rules for storing cash orders

What happens after the money is deposited into the cashier? Although all information is entered into the journal and cash book, the order itself is stored for another 5 years. Moreover, this period does not take into account the year in which the document was drawn up.

At the same time, you should be aware that individual entrepreneurs on the simplified tax system "Income" or simplified tax system "Income minus expenses" may not keep records of cash transactions. They just need to keep track of income. But for an LLC, the execution of these documents is mandatory.

Summarize

Incoming cash order refers to primary cash documents. Capitalization of funds without its registration is possible only for individual entrepreneurs. And then, only in cases permitted by tax laws. For an LLC, the execution of this document is always mandatory, regardless of the taxation system.

A full-time accountant is required to fill out a cash receipt order. Or a manager, if there is no accountant in the state. Moreover, the order must be filled out correctly, have the signature of the chief accountant (manager) and the seal of the organization with all the details, as well as all the necessary applications. Also, blots and corrections are not allowed.

A sample filling and a receipt order form are given in the relevant sections of the article. An important nuance: the order can be filled out both “by hand” - with a blue ballpoint pen and legible handwriting, and on a computer. But blots and corrections are strictly not allowed.

Recommended:

Courier documents: individual order, invoice, order form, document delivery rules and courier working conditions

Working in the delivery service is very popular today, especially among ambitious young people. A courier is not just a person delivering parcels, but a trained specialist who has certain skills and can bring a parcel or correspondence to the specified address with high quality and promptly

Drafting a shift schedule: sample. Order to change the shift schedule: sample

Many questions are raised by such a task as scheduling shifts. You can always find a sample of this document, but there are many subtleties that will be discussed in this article

Inventory is mandatory: cases, order, timing

Inventory is required for each company at least once a year. The article lists the situations when the verification must be performed on the basis of legal requirements. The rules and stages of the inventory are given, as well as the nuances of formatting the results

Order to reduce staff: sample drafting, draft and form. How to draw up an order to reduce the staff?

In a difficult financial situation, an enterprise is sometimes forced to carry out a special procedure, at the initial stage of which an order is drawn up to reduce staff. A sample of such a document must correspond to a certain form and take into account all the subtleties of labor legislation

Incoming and outgoing cash orders: registration procedure, filling rules and sample

Incoming and outgoing cash orders act as primary documents. They confirm financial transactions related to the issuance and receipt of funds. Registration of incoming and outgoing cash orders is carried out according to certain rules