2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:34

Incoming and outgoing cash orders act as primary documents. They confirm financial transactions related to the issuance and receipt of funds. Registration of incoming and outgoing cash orders is carried out according to certain rules. Consider the basic prescriptions.

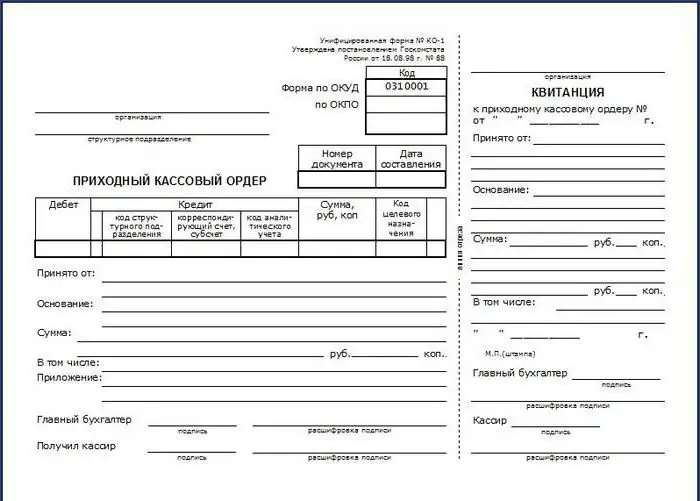

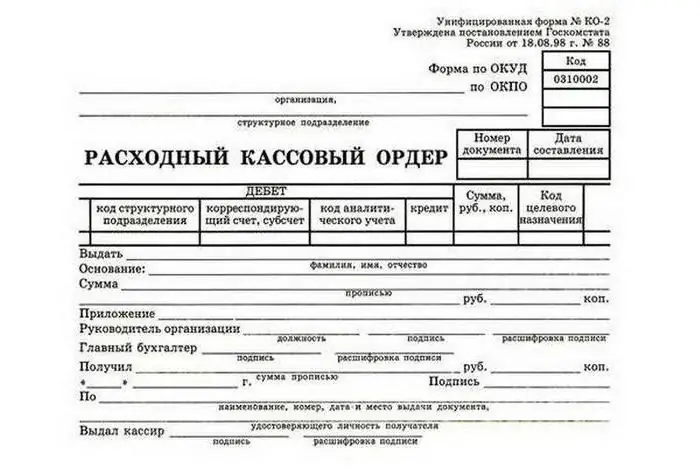

Expenditure and income cash warrant: blank

When receiving cash, the teller enters the relevant information in the KO-1 form, and when issuing - KO-2. Filling in the receipt and expenditure cash orders is carried out in such a way that the specialists checking the documents can clearly understand their content. All required details are included in the paperwork. The basis on which they are drawn up is entered into the receipt and expenditure cash warrants. They also provide a list of attached (accompanying) documents.

Nuances

Incoming and outgoing cash orders are signed by the responsible officer immediately afterthe corresponding operation. The documents attached to them must be canceled with a stamp or the mark "Paid". At the same time, the date must be put down in order to avoid re-use of papers. According to the current rules, no corrections are allowed to be made to incoming and outgoing cash orders, even if they are stipulated.

Form KO-1

You need to fill in the receipt order in one copy. The form has 2 sections. The first is a direct receipt order, and the second is a tear-off sheet - a receipt. The latter is issued to the person who contributed the funds. The line "Basis" indicates the content of the operation performed. For example, it can be "payment of invoice No. 321 dated February 1, 2017". In the field "Including" the amount of VAT is given. The amount is indicated in numbers. If the tax is not provided, then you should write "Without VAT". The "Application" field lists the documents that accompany the order. The offsetting account is set depending on the source of funds. The subdivision code is indicated by the operators of separate structural departments of the enterprise. The "Debit" cell must contain the cash account in accordance with the plan. The numbering of documents is end-to-end, set for one year. The form must not contain out-of-order numbers or doubled codes. OKPO is considered a mandatory requisite. Information is indicated in accordance with the certificate issued by the state statistics authority. The name of the organization is indicated in the same form in which it is present in the founding documentation. If athe company has approved analytics codes, they must be indicated in the order. There is a "Purpose" box on the document. It is only to be completed by non-profits with eligible funding.

Features of assurance

The receipt order is endorsed in the accounting department. If there are no specialists authorized to approve the document, then this is done by the head of the enterprise. The director of the organization, by his order, may assign the obligation to sign orders to another employee. At the same time, his candidacy must be agreed by the head with the chief accountant. If the director of the enterprise independently conducts financial transactions, then credit, expenditure cash orders, cash book are compiled and signed by him.

Stamping

The imprint should be located on the part of the form marked "M. P." and grab the receipt. The legislation does not provide for special rules for stamping. In practice, it is customary to have 60% of it on the main part, and 40% on the receipt. Some recommendations are given in the resolution of the State Statistics Committee No. 88 of August 18, 1998. The legislation also does not establish a specific list of details that must be placed on the seal of the teller. It is advisable to include in the stamp information that was previously considered mandatory:

- Enterprise name (full and in Russian), legal type.

- Location.

- Registration number.

Document for disbursement of funds

Expense order is also issued in one copy. When issuing funds to an employee for reporting, the form should be drawn up in accordance with his written statement. It may be in free form. The application must be signed by the head of the enterprise. It states:

- Amount to be issued.

- Deadline.

- Date.

Document content

The field "Reason" indicates the operation performed. For example, it can be "refund of overspending according to report No. 123 of 2017-02-03". In the "Application" field, primary and other documents are indicated. Their numbers and dates of compilation are given. Applications can be applications for the issuance of funds, invoices, and so on. Rules for registration f. KO-2 are provided for in the Methodological Recommendations approved by the Decree of the State Statistics Committee No. 88. It is not allowed to make any corrections to the expenditure order. The document is also signed by the chief accountant, manager or other person authorized by him. Entrepreneurs who keep records of costs and income or physical indicators, according to tax laws, may not issue expense orders.

Actions of teller

When disbursing funds on expense orders, the cashier must check:

- Presence of mandatory signatures and their compliance with samples.

- Equalityamounts in words and figures.

- Availability of documents given in the form.

- Matching full name in the warrant to the information provided by the recipient.

After that, the teller prepares the required amount, transfers the payment document to the person receiving them. In the order, the recipient must indicate the number of rubles (in words) and kopecks (in numbers). The person also puts his signature and date. The operator must count the prepared money. In this case, the recipient must see how the cashier does it. The entity that accepted the funds also counts them under the supervision of the teller. If this is not done, subsequently the recipient cannot present a claim to the cashier for the amount issued. After that, the operator must sign the payment document.

Important points

The cashier issues funds exclusively to the person whose details are indicated in the warrant. The latter presents a document confirming his identity. If the issuance is made by proxy, it is necessary to check the compliance of the full name. recipient, given in the warrant, information about the represented person. A document confirming the authority of the actual recipient is attached to the payment form. If several payments will be made by proxy or in different organizations, a copy is attached to the order. The original must remain with the operator who made the last issue.

Accounting for incoming, outgoing cash orders

At the enterprises that make up the documents discussed above,control over cash transactions. To do this, you need to keep a journal of cash receipts and debit orders. It contains the details of payment forms before their transfer to the operator. Orders issued on statements for the issuance of salary and other similar amounts are entered into the book after the funds are provided to the recipients. The corresponding rule is enshrined in the Instructions approved by the Decree of the State Statistics Committee No. 88.

In practice, the question often arises: for what period is it necessary to open a register of receipt and expenditure cash orders? It should be noted that the legislation does not provide for any time limits. In this regard, issues related to the period of use of the journal, the accountant decides independently. You can open the book for a year, month, quarter. The number of operations should be taken into account when making the appropriate decision.

Responsibility for breaking the rules

For enterprises that do not comply with the requirements for conducting cash transactions, the measures provided for by law are applied. Liability is established by various regulations. Among them is Presidential Decree No. 840 of July 25, 2003. Chapter 15 of the Code of Administrative Offenses provides for Article 15.1. It fixes the measures of responsibility for violation of the rules for working with cash and the procedure for carrying out cash transactions. In case of exceeding the amounts intended for settlement with counterparties, non-receipt (partial or complete) of the funds received, non-compliance with storage requirementsfree money in excess of the limits, an administrative fine is provided: 40-50 minimum wages - for officials, 400-500 minimum wages - for organizations.

Conclusion

Order execution is a very responsible task. As mentioned above, corrections, errors and blots are not allowed in the documents. The operator responsible for compiling them must remember that the order is a form of strict accountability. Therefore, damage to documents should not be allowed. In the absence of any of the required details, the completed order will be considered invalid.

Recommended:

Outgoing correspondence: registration logs, accounting, samples, filling rules

Accounting for incoming and outgoing correspondence is part of the office work that must be maintained in any enterprise. How to properly format and maintain a correspondence log? What methods of its registration exist?

Transfer of a director to the position of general director: procedure for registration, sample filling out an order, features

In the work of each company there are personnel changes. Of particular difficulty is the transfer of a director to the position of general director. In order to avoid legal violations, it is necessary to know the procedure for appointing a leader, the legal subtleties of terminating or changing the labor function of a curator and his successor

Rules for filling out UPD: types of services, procedure for registration with samples, necessary forms and relevant examples

There are many questions about the rules for filling out the UPD (universal transfer document), because there are a limited number of samples with already entered data. The tax authorities are accustomed to returning the paper for correction without explaining what exactly is incorrectly drawn up and how to correct the error

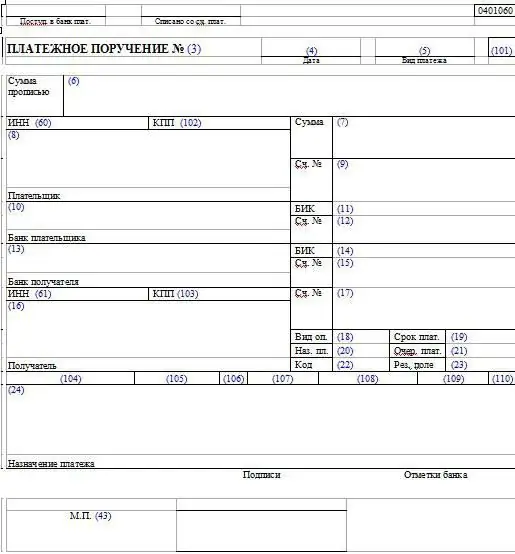

Samples of filling out payment orders. Payment order: sample

Most enterprises pay various taxes and fees to the budget. Most often this is done with the help of payment orders. How to compose them correctly?

How to keep a cash book correctly. Cash book: sample filling

In accordance with domestic law, all organizations are required to keep free finances in the bank. At the same time, most of the settlements of legal entities should be made among themselves in a non-cash form. For cash flow, you need a cash desk, an employee who will work with it, and a book in which transactions will be recorded