2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:29

There are various types of risks in the relationship between large suppliers and buyers. Among them, a fairly common situation is when it is not possible to sell all the planned goods due to the refusal of the transaction by one of the parties to the contract. This results in significant financial losses for the supplier company. To prevent such cases, a number of contracts for the supply of products (usually expensive and in large volumes) apply the principle known as "take or pay". What does this mean, what is it and how did this mechanism appear? How and does it always work? You will learn about this by reading the article.

The essence of the principle

The "take or pay" condition is a fairly common mechanism in relations between large corporations, including international corporations. It consists in the following: when concluding an agreement on the supply of a specified volume of products, the supplier and the buyer assume certain obligations. The first must provide, within the period stipulated by the contract, the maximum quantity of goods in accordance with the fixed by both partiesvolume agreements. The second is to pay for the specified quantity of products, regardless of how much was actually purchased in the relevant period.

The meaning of the "take or pay" condition

The application of this principle allows minimizing the risk of financial losses associated with the inability to sell the planned volume of products. Even if the buyer refuses to purchase the goods in the maximum quantity (fixed in the contract), he will have to pay the entire cost. This can be seen as a pen alty for not fulfilling the terms of the contract. In the business environment, this is called the "take or pay" principle. If such a risk mitigation mechanism were not used, then the supplier would have to include it in the pricing formula.

The story behind the take-or-pay principle

For the first time this system of building relations between the parties to the supply agreement was introduced in the late 50s of the twentieth century in the Netherlands. This was due to the development of the Groningen gas field, which turned out to be a very expensive undertaking that required the investment of public funds in the gas transportation and production infrastructure. The money spent had to be returned, and there was only one way to do this - by ensuring uninterrupted supplies of large volumes of gas and paying for them in full. This is how the "take or pay" principle, actively used today, was invented.

The State of the Netherlands has concludedmulti-year contracts. They provided for the maximum volumes of goods that counterparties were obliged to purchase within a certain period. If they refused to comply with the conditions, they paid a fine. At the moment, one of the most famous followers of this principle is the Russian company Gazprom.

If the condition did not work: a good example

Gazprom actively applies the "take or pay" principle in its relations with Chinese and European partners. Many of the company's intergovernmental agreements on gas supplies have a term of 25 years or more. Usually everything works well, but once there was a mistake.

The terms of the agreement on the contract, concluded according to the specified principle with the Czech company RWE Transgas, were violated. The buyer refused to purchase gas in the maximum volume that was provided for in the contract and did not want to pay a fine. As a result of litigation (due to the violation of the "take or pay" principle), "Gazprom" was the loser. The Vienna Arbitration Court recognized the right of the Czech company to withdraw less gas than stipulated by the terms of the contract, without having to pay any fines.

Dissatisfaction with the condition among international partners

Despite the fact that the "take or pay" principle is actively used in the export policy of Russian companies, many counterparties have repeatedly expressed dissatisfaction with it. Such strict conditions of international contractsabout the supply of gas did not like, in particular, the Italian and Ukrainian partners.

Thus, Eni threatened Gazprom with refusal to renew the contract if the "take or pay" principle is not excluded from its terms. The dissatisfaction of the Italian partners can be understood, because due to the shortage of gas volumes, it lost 1.5 billion euros (for 2009-2011).

Ukrainian counterparties also complain. Thus, under the contract between Gazprom and Naftogaz (valid until 2019), gas supplies to Ukraine in the amount of 52 billion cubic meters annually are provided. For 2013, the application from partners was submitted only for 27 billion cubic meters. In this case, the company will have to pay at least 33 billion cubic meters. meters, as well as possible fines for shortfalls in the amount of two billion dollars.

Some analysts say that the era of the dominance of contracts with such harsh conditions is gradually ending. This applies not only to the Russian "Gazprom", but also to other world corporations. How events will develop, only time will tell.

Conclusion

The principle of "take or pay" can be called a very effective tool to reduce the risk of financial loss. For suppliers, this is an opportunity to sell their products in full, and otherwise reduce losses from "underpurchases". But, as it turned out, not all buyers like this condition (and can afford it). Some experts consider the principle too rigid and predictrefusal to use it. In any case, it is still working (albeit with obstacles), and many companies are quite happy with this state of affairs.

Recommended:

State corporations are Description, list, history of occurrence

Today the most important role in the economy of the Russian Federation is given to state corporations. They serve as the largest employers who ensure the full development of entire industries. Some of the state corporations have a position close to a monopoly

What money to take to Bulgaria today?

Bulgaria is a great resort for our compatriots at a reasonable price and with excellent service! But how to pay for it?

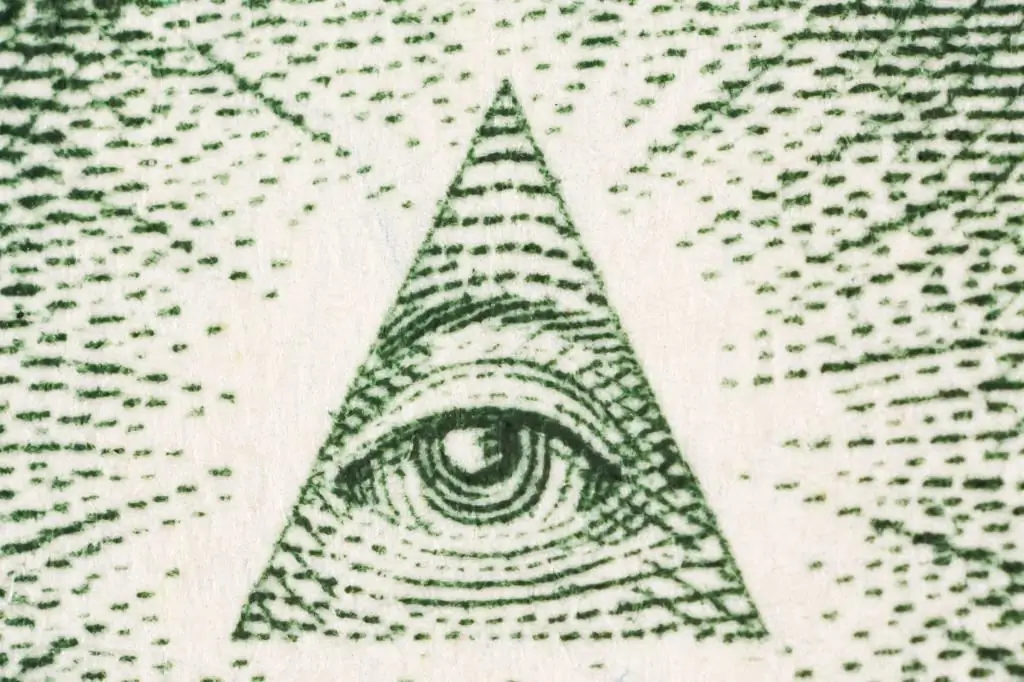

Pyramid on the dollar: the meaning of the symbol, the history of occurrence

Although the US fiat currency has gone through many changes, its design has been largely governed by practical issues. Of particular interest is the symbolism of the images on the dollar bill. In particular, people have always wondered what the pyramid with an eye on the dollar means

Danish krone. History of occurrence

The emergence of the currency of any country was preceded by a variety of historical events. The Danish krone is also evidence of important phenomena in the life of the monarchy

What is a zip code? Definition and history of occurrence

Often, when registering a user, foreign sites ask him for a ZIP code. Not everyone knows how to decipher this abbreviation. What is a zip code? How did it appear and for what reasons? We will talk about this in our article