2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

Undoubtedly, deposits are an excellent investment of funds with the aim of their further increase. However, global instability sometimes makes you think about the fate of your savings. And this happens against the backdrop of closing banks and other financial institutions. But what if, for some reason, your guarantor decided to wind down his business or suddenly declared himself bankrupt? The Investor Protection Fund will help you solve the problem. What is this organization? Where is she? And how does it work?

Company information note

After the referendum in Crimea, many Ukrainian banks were forced to close and leave their native land. There are several reasons for this, mainly due to the fact that a new political wind has blown.

Thousands of Ukrainian investors ended up with nothing on the same occasion. Confused, they did not know where to turn and how to get their money back. The non-profit autonomous organization "Depositor Protection Fund" came to their aid.

Fund Overview: Founding

The Foundation is a non-profit organization founded in early April 2014. This company was established on the basis of the federal law “On the Features of the Functioning of the Financial System of the Republic of Crimea and the Federal City of Sevastopol for the Transitional Period.”

The founder of this company was a government organization, better known as the Deposit Insurance Agency. It was she who took the "Depositor Protection Fund" in the Crimea under her warm parental wing. Alexander Nikitovich Kuznetsov was appointed Executive Director of the company.

Goals and objectives of the organization

From the moment the fund was founded, it had one main task - to pay monetary compensation on deposits that were previously opened in Ukrainian banks. It should be noted that far from all credit organizations fell under this procedure, but only those that, as of March 16, 2014, operated in the territory of the republic on the basis of a license from the NBU, but were forced to stop their work.

It is noteworthy that the non-profit organization "Depositor Protection Fund" issued compensation only for those investments that were made before the beginning of April 2014. Among the main goals of the company, of course, was the elimination of panic and the restoration of calm among the confused population.

How much is the refund?

According to the current Russian legislation, the amount of compensation on deposits was no more than 700,000 rubles, taking into account one bank andclient. It is noteworthy that the fund itself also had limited funds to pay compensation. According to preliminary data, this amount did not exceed 60 billion rubles. According to the fund itself, about 25.8 billion rubles were issued in 2015.

Additional compensation for depositors

After some of the depositors received compensation for the money invested, many citizens were dissatisfied. The thing is that a certain percentage of the republic's residents had deposits in dollars, and their amount significantly exceeded the minimum set by the fund.

In order to eliminate discontent among the masses, it was decided to allocate an additional 245.738 million rubles. Moreover, this amount, according to the fund, was collected at the expense of the so-called second property contribution of the Autonomous Republic of Crimea. However, only those depositors who managed to submit a corresponding application to the organization before June 8, 2015 could count on the additional payment.

Which banks pay compensation?

It is worth noting that not all banks in Crimea cooperate with representatives of the fund and, accordingly, pay compensation payments to the population. The press service of the organization for the protection of the rights of depositors mentioned only three credit institutions authorized to make payments. These include the following banks:

- CHBRD ("Black Sea Bank for Development and Reconstruction").

- RNKB ("Russian National Commercial Bank").

- "Genbank".

Future plans andfund work today

Currently, 201 branches of the fund operate in Crimea. All of them are present in 22 cities of the republic. Among them there are such as Y alta, Sevastopol, Simferopol and others. For example, in Simferopol, the fund's representative office is located at the following address: st. Rubtsova, 44/A. In Sevastopol, there is a similar branch on Heroes of Brest Street, 116. It is noteworthy that almost all branches work from Monday to Thursday from 9 am to 6 pm, and on Fridays - from nine to 4:45 pm. In addition, the organization has an official website fzvklad.ru.

According to preliminary information, the "Depositor Protection Fund" in Sevastopol and other cities will operate for no more than three years.

When does en titlement arise?

Each contributor is eligible for payments. However, this is possible under certain conditions. One of them is the timely submission of an application within a strictly prescribed period. The second important point is the decision of the Bank of Russia regarding the closure of a particular banking organization or its division in the territory of the republic.

Which bank depositors can receive compensation?

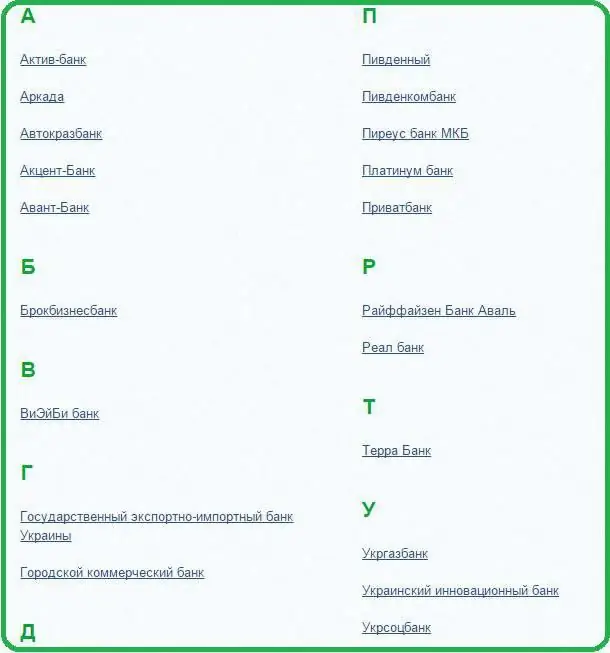

Former depositors of the following banks are currently eligible for compensation:

- "Asset Bank".

- Privatbank.

- Brockbusinessbank.

- Raiffeisen Bank Aval.

- Terra Banka.

- Ukrgasbank.

- Ukrsotsbank.

- UkrSibbank.

- Deltabank.

- Oshchadbank.

Consequently, citizens who were previously registered in these banks as depositors can safely apply to the "Depositor Protection Fund" for compensation.

Where can I get information about the start of payments?

Before receiving compensation for payments, former depositors of Ukrainian banks should periodically review the reports of the following publications:

- Krymskiye Izvestia.

- Krymskaya Pravda.

- "Glory of Sevastopol".

- Sevastopol News.

Also, those who had deposits in dollars and hryvnias should periodically look at the official website of the organization, because it is in these sources that the proposal of the "Deposit Protection Fund" is published to acquire claims or rights on deposits.

How long does it take to apply?

After the publication of the announcement, a countdown of 90 days begins, during which contributors can come to the nearest collection point and submit an appropriate application. Or there is an option to send an application by mail. If instead of the depositor the documents are submitted by his relative, then, in addition to the main package of documents, the fund must provide a notarized power of attorney.

What documents do I need to apply?

When applying to the "Depositors and Shareholders Protection Fund", the depositor will have to submit the following documents:

- original passport or any other identity document;

- original contract or passbook,on the basis of which the deposit was opened;

- original document, according to which the deposit was previously opened;

- original identification code;

- original of other documents giving the right to claim compensation for deposits.

Depositor missed application deadline: what to do?

If the contributor missed the deadline for applying for compensation, he must apply to the protection fund. At his request, the deadline for processing documents can be renewed. However, this is only possible if the aforementioned deadlines are missed for good reasons. For example, due to serious illness, injury, etc.

When is the decision to issue compensation made?

The decision to refuse or allow the payment of the "Depositor Protection Fund", as a rule, takes within 10 days from the date of filing and fixing the application. However, according to the press service of the organization, representatives of the fund may not invest in these terms. For example, the reason for this may be the lack of this or that information.

A depositor can be informed of a positive or negative decision on the issue of compensation in one of two possible ways: by e-mail or by phone.

What happens after a positive response to an application?

After the fund has approved the depositor's application, it needs to visit a financial institution that maintains contacts with a non-profit company. What banks in Crimea work with it, we described above. Here you need to draw up an assignment agreementclaims or rights on frozen deposits. And then it remains only to wait for the receipt of the amount of compensation. Moreover, you can receive it either in cash or to an account opened with this bank.

When is the deposit paid?

Payment of compensation is carried out no later than 15 working days from the date of fixing the fact of submitting the application. After that, the depositor has every right to apply to the bank for receiving payments.

In a word, do not miss the publication in the press and on the website. Write an application in time and receive the promised payment from the "Depositor Protection Fund".

Recommended:

Essence and concept of organization. Form of ownership of the organization. Organization life cycle

Human society consists of many organizations that can be called associations of people pursuing certain goals. They have a number of differences. However, they all have a number of common characteristics. The essence and concept of organization will be discussed in the article

An autonomous institution is a type of government organization

An autonomous institution is a state organization established by the Russian Federation, its subject or municipality. Its purpose is to provide services or perform work in scientific, educational activities, in the areas of he alth care, social protection, employment, culture, sports and other

How much taxes does an employer pay for an employee? Pension Fund. Social Insurance Fund. Compulsory Medical Insurance Fund

The legislation of our country obliges the employer to make payments for each employee in the state. They are regulated by the Tax Code, Labor Code, and other regulations. Everyone knows about the famous 13% personal income tax. But how much does an employee actually cost an honest employer?

Which pension fund to choose: reviews, rating. Which non-state pension fund is better to choose?

The pension system in the Russian Federation is built in such a way that citizens independently decide where to direct their savings: to form the insurance or funded part of payments. All citizens had the opportunity to choose until 2016. For two years in a row, the ability to distribute savings has been suspended. For all Russians, deductions from wages (22%) form the insurance part of the pension. Therefore, the question remains, which pension fund to choose to fulfill these tasks: public or private?

Instruction on labor protection for an engineer on labor protection, equipment operation

Almost every large enterprise has a labor protection specialist. The essence of his work is to maintain safety standards in the organization. No less important is the presence of a special document called "Labor Protection". All these things will be discussed further