2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:29

One of the main motives for the successful work of any employee is the level of wages. Interest in its increase has a beneficial effect on the desire to achieve better results. And the employer successfully uses this stimulating leverage by setting the employee a higher pay for certain achievements. He can do this in many ways, such as a higher salary, incentive bonuses, piecework pay, and so on. In ne

In the first version, the salary is understood as the monthly tariff rate. Although it can be either hourly or daily, and depends on the complexity of the work and the qualification level.

It's easy to calculate the monthly rate: multiply the hourly rate by the average monthly number of hours of work (the norm of working hours for the year is divided into twelve months). Moreover, the level of payment cannot be lower than the minimum wage established by the Federal Law. In addition, for the calculation of wages, a tariff scale is usually used, in which the tariff wage rates are distributed by category in ascending order by multiplyingby a certain coefficient, which depends on the industry of the enterprise. Remuneration is divided into time (depending on hours worked) and piecework (depending on the number of products or operations). In turn, piecework consists of direct, chord and indirect.

With direct worker is given a task (order) to perform a specific amount of production. His salary is calculated as follows: the tariff rate of this category of work is multiplied with the norm of time and the number of products produced. And if this norm is overfulfilled, and without marriage, then a premium is also charged on top (this payment is called piece-bonus). In addition, an employee can work on a piece-progressive system, when higher rates are applied to what is done above the norm.

With a piece system, salary is calculated as a percentage of revenue. This means - you need to have time to complete the task (to sell a given volume of products) within a certain period, from this you will receive the contractual percentage - your salary. Indirect is used for accrual

remuneration for workers who are not directly involved in the production process, but serve (control) equipped jobs. To do this, the tariff rate for their category is multiplied by the norm, then by the fact of production plus a bonus. This means that if the equipment works without interruption, then the output increases, and the employee is en titled to a stable salary with bonuses for processing.

In some cases where it is not possibleto determine how much work a particular employee has performed, such a form of payment as a collective-piecework is perfect. Suppose a team completed some object and received a certain amount for it, which was divided among all in equal shares. How good is this payment method? Yes, at least because there are no disagreements about the size of the salary, there are fewer delays, the quality of work is higher, and newcomers, with the help of the whole team, quickly get into the business. Therefore, it is not necessary to follow each worker to take into account what he has done. And it is better to spend this time on control over work processes. Again, a relief for the accountant - when calculating salaries, he does not need a tariff rate. It is only necessary to multiply the total rate of the team by the actual output, to which the bonus is added, if any. The total is then divided among all employees. Simply and easily! By the way, most European countries have long preferred this system, using it quite successfully.

When it is not possible to ration the work of an employee, a time-based system is used. And the salary is calculated according to the formula: the tariff rate of remuneration for the corresponding category is multiplied by the time worked - this is a simple time-based payment system. When a bonus is also charged for excellent quality, then this is already a time-based bonus. Although employers are not limited to this list of payment systems, they provide individual forms of payment for some employees. With highly qualified specialists, it makes sense to conclude a contract on a contractual basislabor, if the company is interested in retaining a good employee.

Recommended:

Tariff "Game", "Rostelecom": reviews. New tariff plan for World of Tanks fans

Choosing a tariff plan for the Internet is not such an easy task. Now in Russia, Rostelecom has launched an offer called "Game". What it is? How happy is this rate? What do clients think of it?

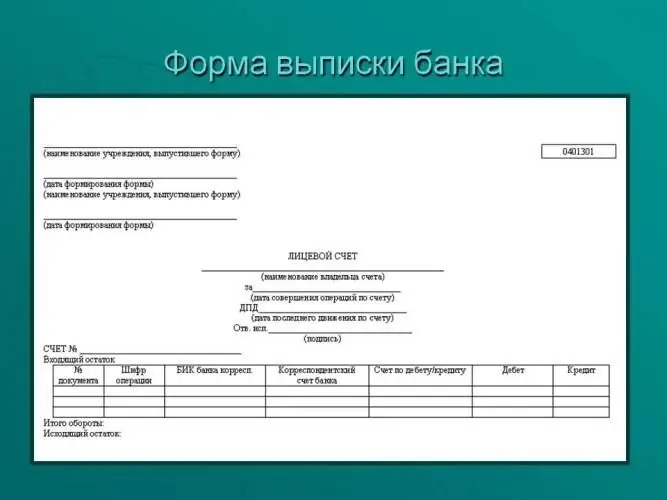

A bank statement is The concept, necessary forms and forms, design examples

When purchasing any banking product, any client, sometimes without knowing it, becomes the owner of an account with which you can carry out income and debit transactions. At the same time, there must certainly be a certain tool that allows any client to exercise control over the movement of their own funds. This is a bank statement. This is a document that is usually issued upon request to the client. However, not everyone is aware of this possibility

Mutual settlements between organizations: drawing up an agreement, necessary documents, forms of forms and rules for filling out with examples

Settlement transactions (offsets and settlements) between business entities are quite common in business practice. The result of these operations is the termination of the mutual rights and obligations of participants in civil relations

Documents for property deduction: general information, required forms and forms

Registration of a property deduction is a procedure that many citizens of the Russian Federation are interested in. This article will show you how to get it. What needs to be prepared? Under what conditions and to what extent can one claim a property type deduction?

What is a tariff category, a tariff coefficient?

Each worker should receive a salary in the amount corresponding to his qualifications. The tariff system of payment provides that an employee of a certain category must perform work that, in terms of complexity, corresponds precisely to his category