2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:29

More and more new organizations appear on the modern economic market. They have different forms of ownership, are engaged in specific activities and are subject to certain taxation regimes.

Types of organizations

There are many legal entities and individuals who are engaged in business activities in Russia. These are IP, LLC, OJSC, CJSC and many others. All these enterprises differ from each other, but there are similarities. According to certain criteria, the type of organization is selected, which continues to operate at the entire stage of the company's activities. But in this article we will focus on JSC. This is a certain type of organization with its own regulations, rules and reporting.

Property Forms of Enterprises

As mentioned earlier, organizations are of different types: OJSC, CJSC, LLC, individual entrepreneurs, partnerships, private entrepreneurs and many others. All this is called forms of ownership. But due to the fact that in this article it is JSC that is considered, let's talk about it.

JSC is the most strictly regulated form of ownership. There are many requirements for such organizations, but they also have their own advantages. They arethat the company can produce its own shares and sell them. And here it doesn't matter to whom. It can be either one of the founders of the company, or any other investor who wants to become a shareholder. The purchase of shares occurs at the highest price (whoever pays the most becomes their owner). Thus, it is possible to increase the investment of participants in the activities of the company.

However, there are also disadvantages. Unlike all of the above forms, the members of the company are fully responsible to the organization. This means that if the company makes a profit, then it can be distributed among shareholders, but if there is a loss, then all participants incur losses, that is, they must pay all debts.

I would also like to note that the number of shareholders in an OJSC is not limited.

What is OJSC

So, let's figure out what an open joint stock company is. OJSC is an organization created by several participants (shareholders) who invested their money in the form of shares in the authorized capital of the company.

As with any new organization, an initial investment in the venture is required to get started. To do this, several people (it doesn’t matter if it is a legal entity or an individual) are united into one group and begin registering an enterprise. Due to the fact that the authorized capital consists of shares of each participant, the joint-stock company will be the form of ownership.

Next, you need to find out what the enterprise will be: open or closed. The difference lies inthat in a CJSC, shareholders are exclusively the founders of the company, while in an OJSC, any natural or legal persons can be shareholders, regardless of whether they are founders or not.

What are OJSC stocks

As mentioned earlier, the authorized capital of an OJSC consists of shares of the founders of the company. However, not all people understand the meaning of the word "share". So, a share is an emissive security that is provided to a person or company in exchange for the amount of money contributed to the initial capital of a new organization.

There are two types of shares: common and preferred. The difference between them lies in the fact that the owner of a preferred share has a guarantee of a stable income from the company's activities and the initial receipt of dividends upon their distribution. However, regardless of the type of share, a member of an OJSC has the right to vote at the general meeting. One share equals one vote.

The founders of the company thus create a block of shares that shows the importance of who owns it.

Activities

Regardless of the form of ownership of the organization, an enterprise can engage in any type of activity. That is, there is no difference in how the company is registered; this does not affect further development. Only the tax regime depends on the type of work chosen. And an open joint-stock company is an organization that can be in any mode, the legislation of the Russian Federation does not impose restrictions on this matter.

Accounting in OAO

JSC are commercial organizations. It follows from this that all accounting in such firms is carried out according to the general chart of accounts and rules. The only thing you should pay attention to is the Law “On Joint Stock Companies”. It describes in detail the conduct of activities and accounting in OJSC.

So, in order for the company to start working, it is necessary to draw up an accounting policy for the company and a working chart of accounts. Next, the initial capital of the company is entered into the balance sheet. Then the work itself begins. All expenses and incomes are accounted for in certain accounts, as described in PBU. At the end of the year, all income is transferred to account 99, and then to 84. That is, there are no differences in accounting.

The entry is double: one amount is indicated in the debit of one account and the credit of another. Balance sheets are compiled, etc. At the end of the year, financial statements are prepared, consisting of 5 forms.

General meeting of shareholders

At the beginning of the new calendar year, a meeting of all the founders of the society is held. This is called the annual shareholders' meeting. After the end of the financial year, all members of the company gather in the company to clarify problems in the organization. At the same table, all people look through the company's statements, sign it, identify inaccuracies, pluses and minuses of the past year. Also at this meeting, a decision is made on the distribution of profits. However, in order for the meetings to take place, before the end of the calendar yeara list of issues to be considered by the shareholders is drawn up and all participants are notified about them. After that, the consent or refusal of the founders must be received. If someone refused, then the meeting can be rescheduled for another date. Only in this way is it necessary to gather all the shareholders.

However, participants can gather more often. This is called an unscheduled meeting. At such events, questions are de alt with that cannot be left for later. An unscheduled meeting must be convened either by the director of the company, or certain of its founders who are engaged in the conduct of business.

Company reporting

And finally, it is necessary to say about the reporting of OJSC. It is strictly regulated by law. Large fines are imposed for violations, the main thing here is not to make a mistake. But first things first.

The reporting of the enterprise begins with the closing of the company's accounts. This is done according to the rules of accounting. Further, the reporting itself is formed, which is mandatory for all organizations. However, the JSC makes full reports, without cuts and omissions. A distinctive feature of the reporting of OJSC is that it is submitted quarterly. But it is necessary to compile it every three months only for shareholders so that they can track the receipt of profits and expenses of the enterprise. For the tax service, reporting is submitted once a year. But that's not all.

OJSC must conduct a regular audit at the end of the year. To do this, an agreement is drawn up with a third-party organization forchecking the correctness of record keeping and tracking errors, if any. Only after that the reporting is considered complete.

But even in this form it cannot be taken. It is necessary to convene the annual meeting of shareholders and submit reports to JSC. Members of the society must sign it. Only after that, reports can be submitted to the tax authority at the place of registration.

And a few words about the publication of reporting. JSCs are obliged to publish it on their website. Otherwise, the organization will be fined. Five forms of reporting must be posted on the Internet along with an audit report.

Recommended:

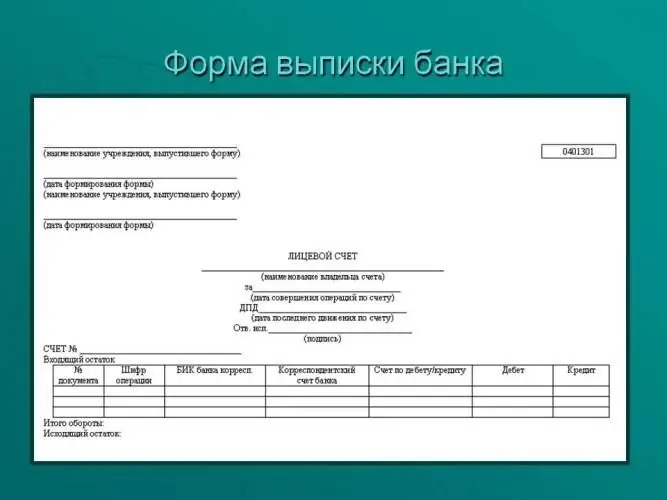

A bank statement is The concept, necessary forms and forms, design examples

When purchasing any banking product, any client, sometimes without knowing it, becomes the owner of an account with which you can carry out income and debit transactions. At the same time, there must certainly be a certain tool that allows any client to exercise control over the movement of their own funds. This is a bank statement. This is a document that is usually issued upon request to the client. However, not everyone is aware of this possibility

Mutual settlements between organizations: drawing up an agreement, necessary documents, forms of forms and rules for filling out with examples

Settlement transactions (offsets and settlements) between business entities are quite common in business practice. The result of these operations is the termination of the mutual rights and obligations of participants in civil relations

Types and forms of ownership. Content and main features

Private, municipal, state and other forms of ownership are recognized and protected in the Russian Federation. You can learn the main forms of management from this article

Large Russian enterprises. Industrial enterprises of Russia

Industry is an important component of the country's economic complex. Its leading role is determined by the fact that it supplies all sectors of the economy with new materials and tools. Among other industries, it stands out for its district- and complex-forming functions

Registration of ownership of real estate. Registration of ownership of the apartment

According to the current legislation, the ownership of real estate is subject to mandatory registration with the relevant authorities. This applies to houses, apartments, offices and other residential and commercial premises