2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:31

Let's consider in detail the types and forms of wages that are used in accounting.

There are two generally accepted forms of wages - these are the main and additional types of payment for work performed.

Most often, employers use the main forms of wages when they calculate for the amount of time worked, the quality of the work done: payment according to tariff categories, piece rates, salaries, various types of additional payments for performing work at night, for harmful working conditions, for seniority, management, etc.

Wage Forms

Additional payment - separate payments provided by law. These include payment for vacations, grace hours, for the time of performance of state or social activities, payment of benefits upon dismissal of an employee, etc.

Nowadays, such forms of wages as hourly and contractual payment for work performed are often used. The amount of remuneration for worktime is set by the hourly rate. To do this, you need to multiply the hours worked by the amount of payment for a certain period of time.

The hourly rate is calculated by dividing the established salary by the rate of hours worked.

Hourly calculation for work performed is used in professions where the technological mode is set:

- mass production;

- automated production;

- production with a predominance of hardware processes.

Hourly pay is beneficial in that it allows you to effortlessly increase the interval of work without changing its payment.

Types and forms of wages

The advantage of the hourly wage rate is that you are paid for the number of hours actually worked. This is beneficial for entrepreneurs in that when the economic situation of the company worsens, it can reduce the employee's working time compared to a normal working day.

There are also such forms of wages as piece (piecework) and hourly wages. The value of the first depends mainly on the amount of goods produced or work performed. Dependence is determined by calculating the price for one unit of manufactured products. The data for the calculation are the price of labor per day or hour and the norm of the quantity of products that the worker produces on average per day or hour.

Price per item can be calculated as follows:the hourly or daily price of labor must be divided by the rate of output.

As for piecework wages, as one of the varieties of the form of wages, it is necessary to establish a measure of the intensity (intensity) of the employee's work. This is done using the rate of production of the volume of goods that the worker produces for a specific time. Such production norms are paid in a certain amount. That is, the more fruitful the worker works and produces more products, the higher his wages will be.

There are a number of theories regarding the payment of working hours:

- performance theory;

- marginal productivity.

Pay for work is the price of a person's labor.

Wage forms:

- nominal - the amount of money that the employee receives for his work;

- real salary - the means of subsistence that an employee can purchase with their earned money.

Recommended:

Deductions from wages: interest, examples of calculation of deductions

Not all employees know what deductions from wages are made by their employers. Some naively believe that all collections in favor of the state are limited solely to the payment of personal income tax in the amount of thirteen percent. However, in reality, the total amount of deductions from wages is several times higher

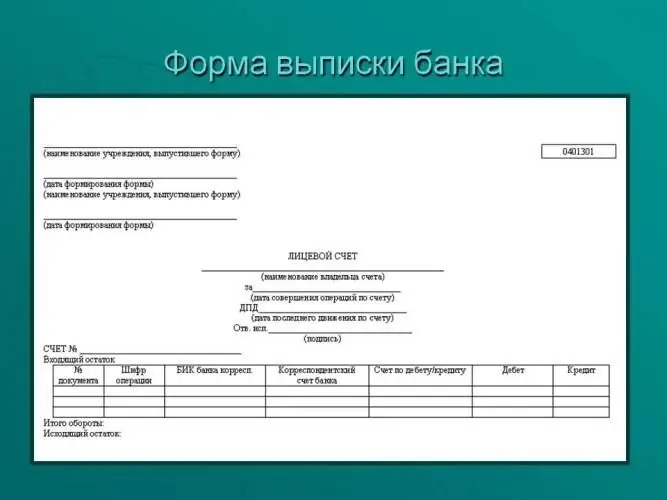

A bank statement is The concept, necessary forms and forms, design examples

When purchasing any banking product, any client, sometimes without knowing it, becomes the owner of an account with which you can carry out income and debit transactions. At the same time, there must certainly be a certain tool that allows any client to exercise control over the movement of their own funds. This is a bank statement. This is a document that is usually issued upon request to the client. However, not everyone is aware of this possibility

Mutual settlements between organizations: drawing up an agreement, necessary documents, forms of forms and rules for filling out with examples

Settlement transactions (offsets and settlements) between business entities are quite common in business practice. The result of these operations is the termination of the mutual rights and obligations of participants in civil relations

Documents for property deduction: general information, required forms and forms

Registration of a property deduction is a procedure that many citizens of the Russian Federation are interested in. This article will show you how to get it. What needs to be prepared? Under what conditions and to what extent can one claim a property type deduction?

Time wages - what is it? Varieties of time wages

Wages calculated depending on the time actually worked is called time wages. This is a form independent of the result of the duties performed. Only a certain period of time is taken into account. Consider the order of its calculation and varieties