2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:31

Personal income tax, abbreviated as personal income tax, is familiar not only to accountants. Every person who has ever received income must pay it. Income tax (that's what it was called before, and even now its name is often heard) is paid to the budget from the income of both Russian citizens and temporarily working in the country.

In accordance with the requirements of the tax code of the Russian Federation, you can pay personal income tax both independently, by submitting an income declaration at the end of the tax period, and using the services of a tax agent, i.e. the employer paying the income. The latter is more common. This is convenient: the taxpayer does not need to know how to calculate personal income tax, an experienced accountant or an employer personally will do this for him, having paid the tax and providing the necessary information to the tax service. The amount of tax is deducted from the salary, and the employee receives hisincome minus personal income tax.

Despite this, in order to control the correct calculation and payment of wages, knowledge of how to calculate personal income tax will still be useful. It's not difficult at all. First you need to understand some concepts.

The tax base for personal income tax is the income from which the specified tax must be paid. In accordance with the law, they include all income received both in cash and in kind, both in rubles and in foreign currency. The exception is various benefits, except for sick pay: pensions, alimony, student scholarships, donation payments, inexpensive (worth within 4,000 rubles) gifts from the employer.

Tax period - the period for income during which tax must be paid. Regarding personal income tax - this is a calendar year. Although it is deducted from the monthly salary, the correctness of its calculation and payment is controlled at the end of the year. But personal income tax must be paid as soon as the income was received.

Tax deductions are fixed, statutory amounts by which the tax base is reduced when calculating tax. That is, before calculating personal income tax, it is necessary to take into account all the parameters for which deductions are due, then subtract their total amount from the amount of income, and only then calculate the tax. There are several types of deductions.

Most commonly used: personal income tax deductions for children, the so-called standard deductions. They apply to the income of all taxpayers with children under 18 or 24 years old -provided that they study in any educational institution on a stationary basis. Such deductions are provided subject to the taxpayer writing an appropriate application and submitting supporting documents (copies of birth certificates, certificates from educational institutions). The amount of the standard tax deduction is 1,400 rubles per month for the first and second children, 3,000 for the third and subsequent, as well as for disabled children. This deduction is provided until the amount of income exceeds 280,000 rubles during the year.

Other deductions, social and property, most often the taxpayer receives independently at the tax office, providing documents confirming the right to receive them at the end of the calendar year.

How to calculate personal income tax?

The tax itself is calculated at the rate approved by the tax code of the Russian Federation: 9, 13, 15, 30 or 35 percent of the tax base minus tax deductions. The most common rate is 13%, the rest relate to income in the form of dividends or income of non-residents of the Russian Federation, as well as from winnings, prizes and other income that is not wages and payment for services.

Recommended:

The main elements of personal income tax. General characteristics of personal income tax

What is personal income tax? What are its main elements? Characteristics of taxpayers, objects of taxation, tax base, tax period, deductions (professional, standard, social, property), rates, calculation of personal income tax, its payment and reporting. What is meant by an invalid element of personal income tax?

Advances on income tax. Income tax: advance payments

Large Russian enterprises, as a rule, are payers of income tax, as well as advance payments on it. How are their amounts calculated?

How much personal income tax percent is? Personal Income Tax

Today we will find out how much personal income tax percent is in 2016. In addition, we will learn how to calculate it correctly. And, of course, we will study everything that can only relate to this contribution to the state treasury

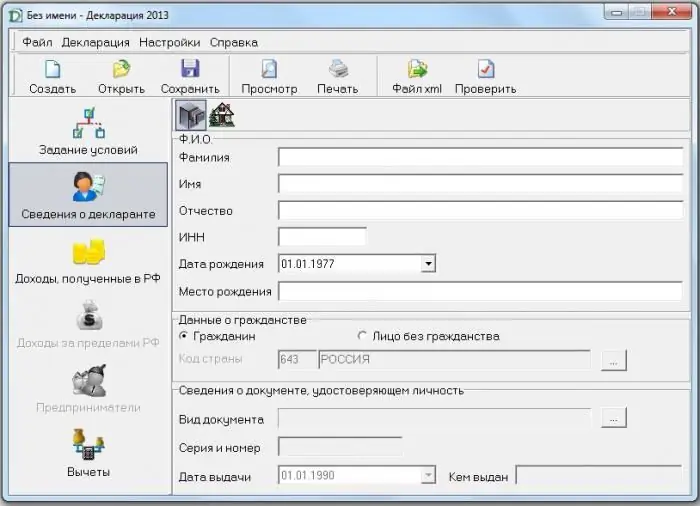

Declaration 3-personal income tax: how to fill it out correctly

From time to time in our lives there come moments when we need a 3-NDFL declaration. Not all taxpayers know how to fill it out. Yes, and the fear of messing up something discourages doing this business. However, everything is not so scary. The main thing is to be careful when filling out and not be nervous. And within the framework of this article, we will try to tell in detail when a 3-personal income tax declaration is needed, how to fill it out and how to simplify this process

How to calculate income tax: an example. How to calculate income tax correctly?

All adult citizens pay certain taxes. Only some of them can be reduced, and calculated exactly on their own. The most common tax is income tax. It is also called income tax. What are the features of this contribution to the state treasury?