2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:28

Various indicators are not uncommon in trading. There are great online analytics resources with charts, news and lots of embedded ideas and strategies. In addition, the MetaTrader4 platform and its older version are very popular. This article will discuss how to choose an indicator of support and resistance levels for MT4, what they are and whether they should be used at all.

Arguments for

Like any other support and resistance indicator for MT4 can save time spent on price analysis. In addition, the installed add-on will give the trader more confidence in their actions and, perhaps, even increase the number of correct trade entries. Most likely, this will become a reality if the MT4 support and resistance indicator is used in conjunction with independent technical analysis and complements it.

In any case, such additions can help to see some subtle changes on the "bare" chart and in time for themreact or at least start acting more cautiously, for example, reduce the volume of the opened position if there are doubts about the direction of the price.

Arguments against

Trading is a very subjective area, and all the rules of technical analysis are only advisory. The market is moved by its other participants, and not by the formulas and charts that you see on the screen. Accordingly, any indicator of horizontal support and resistance levels for MT4 is written by the same traders. It may not take into account some points or only those conditions that the creator of the add-on considered necessary and convenient for himself in the first place.

The risk associated with errors and false trade entries may increase, and the line drawn by the automatic indicator of support and resistance levels is just a zone of a small price rollback. There are a lot of potential problems with indicators, they will be individual in each case and require attention. For example, an incorrectly specified parameter can turn a useful add-on into a tool that draws chaotic lines in the terminal window or simply breaks all display settings, including colors, chart style, and fonts. There is nothing critical in this, but it will take time to bring the MT4 window into working form.

The best indicator of support and resistance levels

This is probablyvery popular search term. However, any automatic indicator of support and resistance levels cannot be better or worse, this is just a formula and arguments built into the program, as mentioned above. Many traders get themselves into the trap of using dozens of different indicators, which often only confuses and confuses them, and ultimately leads to loss of deposit and frustration.

Of course, exceptions are possible, because there are many robot trading systems that are just based on automation. However, they are used by real professionals who understand how indicators work, they know what support and resistance are and, as a rule, traders write robots for themselves.

If we go back to which indicator of support and resistance levels for MT4 to choose, then first you should look at the classic moving averages, Fibonacci lines and many other relatively popular things.

Self-determination of support and resistance levels

It's really not that hard and this will be the most efficient method. An important aspect will be what reflects support and resistance. They interpret important market information.

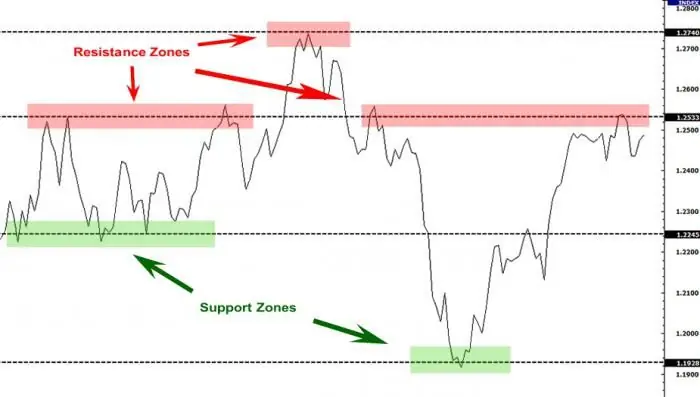

Support reflects current demand. This is the line below. In order to find it, you need to connect the lows of the price on the chart. The value of an asset or a currency pair will, as it were, ricochet from this line, unsuccessfully trying to break through it and leaveway down. This behavior reflects the predominance of bulls, that is, bullish traders, and in addition, this situation means that demand is higher than supply.

The resistance line is the opposite of support. It does not let the price go above a certain level, and the price, in turn, is forced to bounce off it every time. To find support, you need to connect the upper highs, that is, the tops of the value of your asset. The situation when the price cannot break through such a line means that the supply has reached a certain maximum, and then a price decline is possible. It should be noted that the higher the time period on the chart (timeframe), the stronger the levels will be. They will be applicable at smaller intervals and will be the main ones.

It is important to return to the level breakouts once again. As a rule, if the price stops bouncing off the line and quickly crosses it, then it will rush to the next zone, and the current trend will be confirmed. The above concept is simplified as much as possible, so it is recommended that you study more material on this topic on your own.

Why is it needed

By learning to determine the levels yourself, you can save yourself and your chart from unnecessary indicators, or at least use them not thoughtlessly, but understand the principle of operation and filter false information more effectively. In addition, knowing the key principles of building levels will help you advance in further training in technical analysis and help you develop your own trading strategies.

Helpful tips

If you still decide that you need an indicator of support and resistance levels for MT4, it is recommended to look for it only on reputable resources related to trading. You should also avoid various one-page sites with dubious signals, paid add-ons and other potential fraud.

Before installing, it is important to carefully read the description, the principle of operation and settings, as well as the reviews of other traders about the indicator you are downloading. It will be quite difficult to choose due to the large number of different add-ons. Therefore, you should also pay attention to the number of downloads and the specific tasks of the indicator, some of them have many third-party, but nice functions, for example, they signal a level breakdown.

Recommended:

Heat resistance and heat resistance are important characteristics of steels

Ordinary structural steels, when heated, abruptly change their mechanical and physical properties, begin to actively oxidize and form scale, which is completely unacceptable and creates a threat of failure of the entire assembly, and possibly a serious accident. To work at elevated temperatures, materials engineers, with the help of metallurgists, created a number of special steels and alloys. This article gives a brief description of them

Support and resistance level. How to trade support and resistance levels correctly?

Support and resistance levels are the dominant concepts of the technical analysis of the foreign exchange market. Based on them, a large number of trading strategies have been developed, despite the fact that the lines belong to the category of inaccurate instruments

Geodetic support of construction. Topographic survey and support

Correction of errors is an additional cost, the investor will not be happy. That is why they resort to the help of specialists in geodetic support of construction. This is the main reason for using their services. It's worth it. The building material will be exactly the one indicated in the estimate. All payments will pay off due to the lack of restoration measures

How to identify support and resistance levels

Support and resistance levels are the most important tools that are used to analyze the Forex currency market. They are an important part of almost every trading strategy, and their definition plays an important role

How child support is calculated. Formula and example for calculating child support for one and two children

Helping loved ones who cannot take care of themselves on their own is reflected in the legislation of the Russian Federation. The state created alimony as a protection mechanism for low-income relatives. They can be paid both for the maintenance of children and other close relatives who cannot take care of themselves. Read more about how child support is calculated