2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:31

Collective investment - a type of trust management with a low entry threshold, allowing small investors to invest in the stock market, real estate market, precious metals and others, making a profit from investing their money. This is an investment of the joint capital of investors, which makes it possible to earn, significantly increasing their capital.

Available investment market

In states with a developed stock market (European countries, Great Britain, USA), the concept of collective investment is available to almost everyone, because almost the entire population is invested in this tool for increasing capital. Accumulative products of insurance companies and pension funds are especially popular.

Collective investment segment makes it easier for small investors to access income from huge capital invested in financial markets, protecting them from dishonest issuing companies and, in addition, ensuring investment flow into productioncountries.

The financial instruments of the Russian investment market are mostly beyond the means of private investors due to the high entry price threshold, the need to understand the principles of the investment market and the widespread unwillingness of issuing companies and intermediaries to load themselves with unnecessary work with unqualified investors investing small amounts. The market for state debt obligations in the form of securities is not adapted to work with the funds of small investors, and some part of government securities was not originally intended for investment by the population.

Collective investment is an ideal financial instrument that provides a variety (diversification) of securities in the investment portfolio, which significantly reduces the risk of investment. Self-investment requires appropriate knowledge of the market to fully work with the money invested. Even the contribution of several small investors will not be enough to purchase the minimum lot in an investment competition or in a large brokerage company. But the funds of thousands of small investors already have an impressive investment power that can act as a buyer or seller in the investment market.

History of occurrence

Ancient Egypt already had a trust relationship that formed the basis of collective investment. On the basis of trust and guardian relations, the vast we alth and property of the Egyptian pharaohs and their heirs was managed. Guardiansusually representatives of the caste closest to the head of state, the priests, spoke. Discovered historical finds indicate that already in those days there were orders of hereditary property, wills and guardianship of minor royal persons.

The Middle Ages further contributed to the development of relations based on trust, thanks to the Crusades. First, the owners of the property transferred their castles with the family under the protection and management of a trusted person for the duration of their participation in the campaigns. Uncertainty about his return forced him to take long-term measures to transfer the rights of the recipient of income instead of himself - to an heir, spouse. Gradually, this practice began to be used in relation to any property.

The first legally formed investment fund appeared in Belgium in 1822, later in Switzerland in 1849, then in France in 1852. It was only after the Second World War that stable investment funds began to develop in the USA, seriously hindering the investment activities of banks, competing with other financial institutions.

Benefits of collective investment

- Investment funds are managed by professionals, qualified and experienced, with the necessary skills to work, which is essential for working with large investments. This is where funds win over single small investors.

- Managing a large portfolio of small investments leads to significant savings throughscale of operations. As a result, investors do not overpay for management, receiving another benefit from investing in a collective investment fund.

- When buying a small number of stocks on the stock market, it will be incredibly difficult and expensive for a small investor to diversify (diversify) his investment portfolio to reduce risk.

- The activities of collective investment entities are controlled by law and regulated in favor of the interests of investors.

Disadvantages of collective investment

The risk of investing in collective investments is practically reduced to zero thanks to the control and supervision of the Central Bank of the Russian Federation. But still, when considering the possibilities of collective investment of money, it is worth considering one significant disadvantage of this common financial instrument. The disadvantage of collective investment lies in the lack of efficiency in case of significant fluctuations (volatility) of the market. A large money bag changes course too slowly, so it loses in the event of a sharp drop in prices. But if we take into account that the subjects of the collective investment market invest in very conservative instruments, then this shortcoming does not play a decisive role.

Types of collective investment

In the investment market, collective investments are represented in Russia by insurance companies, non-state pension funds (NPFs), mutual funds (UIFs) and general banking management funds (OFBU).

Moreoverinsurance companies not only undertake to pay a small excess profit on invested funds - they provide a range of insurance services. As well as pension funds, which, in addition to effectively managing the collective investments of pensioners, guarantee the payment of a lifetime pension. These are significant differences between NPFs and insurance companies from mutual funds and OFBUs, where financial managers are engaged only in money management, without providing any other services.

Collective investment entities

The following representatives are the subjects of the collective investment market:

- Shareholders - equity holders who bought out a share in the total investment "bag"; shareholders are shareholders.

- Fund is an investment money bag.

- The founders of the department are the owners of the investment fund.

- Collective Investment Management Company is a legal company employing professional financial managers.

- Depository - depository of securities certificates.

- Registrar - keeps records.

- Auditor - revision of documents, process.

- Independent appraiser - determines the market value of assets.

- Supervisory authorities - exercise control.

Objects of collective investment

Collective investment funds invest investors' funds in a wide range of instruments. The main ones are listed below:

- Securities.

- Property.

- High value stocks.

- Paioverseas ETFs (traded on an exchange of funds).

- Cryptocurrency (digital payment instrument).

The role of investment funds in the economy

The principle of operation of investment funds is based on the idea of transferring property under trust management. The investor entrusts his money or property under the management of professionals - this is the basis of the work of all investment funds. The activity of the collective investment fund is the professional management of money, making a profit with further distribution among the investors who invested their money in the fund.

For solid entrepreneurial business structures, collective investment has an economically important meaning, which consists in the efficient distribution of funds in the economy. The funds of institutional investors are directed to increase the liquidity and power of the economy, the development of innovations, and contribute to the solution of civil and social obligations historically placed on the shoulders of this group of investors.

The main participants in the collective investment and trust management market, such as insurance companies, NPFs, are the most important source of medium-term and long-term financing due to their large investment horizons, in contrast to speculative investment, which is characterized by high risk, while the attitude towards the risk of institutional participants is exclusively conservative.

Classification of investment funds

Collective investment funds are grouped according to the following criteria: by investment objectives, by types ofportfolio assets, operating structure, legal form.

- According to legal forms. Collective investment funds are formed as a legal entity - an open joint stock company or as a property complex, the management of which is entrusted to a specialized management company, under an agreement with the owners of the managed property. Trusts as a type of investment fund and trust deeds between settlors and trustees have historically been created only in countries with the English legal system.

- Corporate funds. The most recognized structure among funds. A closed corporate fund is formed in the same way as a joint-stock company, with a subscription to issued shares or the purchase of shares by investors in the secondary market. Such corporate investment funds are legally owned by their shareholders, but are managed by a director on behalf of the shareholders. Corporate funds invest in assets agreed with shareholders - stocks, bonds, collective investments in real estate and others. Dividend income and interest on the assets of the investment portfolio are usually distributed among the participants of the fund - the shareholders.

- The earliest corporate funds were formed in the UK in the form of trusts in the 1860s and still exist.

- A common type of corporate fund is mutual funds or mutual funds in the US. In the UK - open investment companies for private small investors. In France - investment companies with variable capital, which at any momentlifetime corresponds to the real value of the fund.

Supervisory authority

By Order of the Bank of Russia (dated June 15, 2016 No. OD-1860), distributive control and supervision over the work of the collective investment segment is carried out through the collective investment and trust management department.

In particular, the Pension Fund of the Russian Federation is controlled by the point of investing funds of insurance premiums for a funded pension, there are also employer contributions in favor of the insured person.

The Department of Collective Investments controls the work of management companies - on the point of their implementation of actions to distribute pension reserves and invest funds in order to accumulate pension income and trust management of investment reserves of joint-stock investment funds.

Collective investors

Investors participating in collective investments are market investors. It is thanks to numerous collective investors that funds are collected and accumulated. The latter form the basis of the collective investment segment. Commercial banks and similar organizations represented by investors in the form of deposits and other mutually beneficial short-term placements act as intermediaries collecting investors' money. On the accounts of insurance companies and pension funds, the funds of potential investors are kept for longer periods and are withdrawn only whenthe occurrence of an insured event or retirement age. In the case of mutual funds, where the functions of collecting and investing funds are performed in one person, a private investor carries his money for the specific purpose of increasing his capital.

The aspect of the long-term investment of funds in the system of collective investments in Russia is of great importance in improving the welfare of citizens through participation in the growth of capitalization of the economy. The funds of collective investors, realized through investment mechanisms, are involved in the general financial turnover, thereby launching the necessary economic process for the effective distribution of funds.

Taxation

The personal income tax rate for collective investment is 13%. It is the profit from the sale of the investee that is taxed. The tax is withheld by the company that was engaged in investment management. Tax is calculated at the beginning of the year for the previous year. The income is transferred to the investor's account already in a "clean" form.

Recommended:

Long-term investments are The concept, types, characteristics and possible risks of long-term investments

Is it profitable to invest money for the long term? Are there any risks for investors? What are the types of long-term investments and how to choose the right source of future income? What steps should an investor take in order to invest money for the long term safely and profitably?

Municipal bonds: concept, types, yield, advantages and disadvantages

Government bodies are implementing economic policy aimed at improving the standard of living of citizens. Covering the deficit of finance intended for the implementation of state programs is carried out by attracting loans. One of the ways to fill local budgets is the sale of municipal bonds

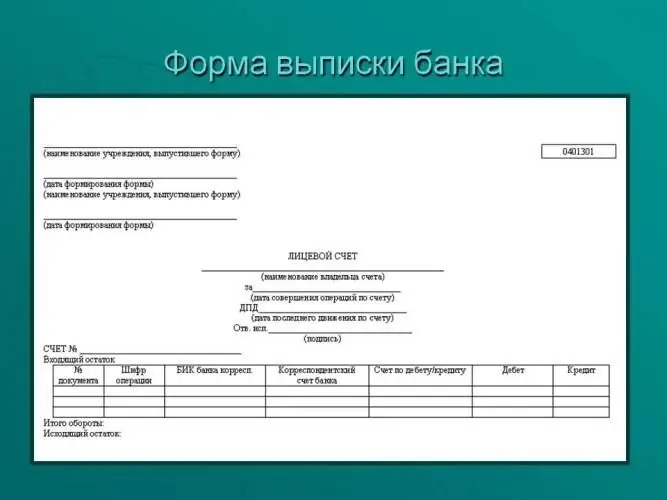

A bank statement is The concept, necessary forms and forms, design examples

When purchasing any banking product, any client, sometimes without knowing it, becomes the owner of an account with which you can carry out income and debit transactions. At the same time, there must certainly be a certain tool that allows any client to exercise control over the movement of their own funds. This is a bank statement. This is a document that is usually issued upon request to the client. However, not everyone is aware of this possibility

Insurance: essence, functions, forms, concept of insurance and types of insurance. The concept and types of social insurance

Today, insurance plays an important role in all spheres of life of citizens. The concept, essence, types of such relations are diverse, since the conditions and content of the contract directly depend on its object and parties

Investments in production: concept, types, risks, advantages and disadvantages

Investment in production can be full or equity. They depend on the company chosen for investment and the features of its work. The article describes what types of productive investments exist, how to choose the right investment object, and what risks investors face