2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:37

The Moscow Interbank Currency Exchange (MICEX) was founded in 1992. Shares and bonds of 600 Russian issuers are traded here daily, including OAO Gazprom, Lukoil, Sberbank, OAO Tatneft, and others. The total value of assets is 24 trillion rubles. The Interbank Currency Exchange includes 550 professional RZB participants. They serve 280 thousand investors. You will learn about what the Interbank Currency Exchange does in this article.

Development history

In November 1989, the Vnesheconombank of the USSR held currency auctions. For the first time, the exchange rate of the ruble against the dollar was fixed on them. After the creation of the MICEX, all currency trading between enterprises and banks was carried out on this site. Since July of the same year, its rate has been used by the Central Bank to quote the ruble against foreign currencies. Here, for the first time, GKO auctions were held. In the mid-90s, preparations began for transactions with corporate securities and futures. In August 2006, the MICEX accounted for 95% of the trades of Russian companies and 69% of the world volume. The volume of transactions reached 20.4 trillion rubles. Gradually, the network of MICEX partners spread throughout the Russian Federation. One of them is the Siberian Interbankcurrency exchange. In January 2015, the MVB was nationalized in the Autonomous Republic of Crimea.

Organization priorities:

• bidding;

• determination of the exchange rate of monetary units;

• ensuring the circulation of the country's capital;

• Formation of a major financial center;

• creating a competitive market.

Main functions:

• Organization and conduct of tenders.

• Monitoring compliance with commitments.

• Providing informative, settlement, clearing and other services.

Activities

On the MICEX there are electronic trading in the US dollar, euro, hryvnia, tenge, Belarusian ruble, swaps. A risk management system is in place to ensure timely fulfillment of obligations. One of its principles sounds like "payment against payment": the Interbank Currency Exchange settles with the participant only after he fulfills his obligations.

Transactions are made in electronic form on modern depository systems, to which sites and terminals are connected. All payments go through the Clearing House of the Interbank Currency Exchange, and for the Central Bank - through the Depository Center.

In 2006 - with the expansion of the customer base - the index rose by 68%. They began to trade shares of mutual funds on the stock exchange, stimulating their development. An additional impetus was the joining of the institute of clearing services specialists to the process.

Moscow Interbankcurrency exchange - an institution in which the initial placement of the Central Bank takes place. It has long been a leader in the number and volume of corporate bonds. Since 2006, investors began to place shares on the MICEX. The first clients were Rosneft, OGK-5, Severstal and others. At the same time, the Sector of Innovative Companies began to operate. Its goal is to create conditions for effective investment. Listing agencies were created to improve the quality of service on the exchange.

GS and money market

The Interbank Currency Exchange is a nationwide trading system for government securities. Market participants have access to all instruments: GKO, OFZ, OBR, etc. They can use the entire range of operations: primary, secondary placement, conclusion, execution of transactions. To date, more than 280 dealers operate at the GS. The market share of this segment exceeds 17%. In order to effectively invest temporarily free funds, the Moscow Interbank Currency Exchange provides a large number of tools for market analysis: it publishes indicators, a zero-coupon yield curve. The Central Bank of the Russian Federation uses this system to carry out deposit and credit operations. Their list has been expanded with on-demand transactions.

Forward Market

Its share exceeds 97%. Trading on the currency interbank exchange in futures contracts began in 2006. In order to ensure the execution of transactions, a reserve and guarantee fund was formed in the amount of 250 million rubles each, the range of derivatives was expanded by introducingportfolio SPAN. This market trades interest rate futures, which the National Monetary Association and the International Swaps Association (ISDA) use as data for the ruble rate. There are market makers in this segment that maintain two-way quotes and liquidity. The total number of professional members of the section is 190 organizations, and the number of participants is 130 credit and financial companies.

International cooperation

In the context of globalization, the Interbank Currency Exchange of Russia is developing a strategy for integrating into the world market. The number of foreign participants is increasing, the share of transactions of non-resident investors is 20%. The organization cooperates with NYSE, NASDAQ, Chicago, London, German, Vienna and other similar structures. Memorandums have been signed with many. Since 2002, MICEX has been a member of the World Federation of Exchanges. In 2007, the level of its participation was upgraded to affiliate.

Innovation & Growth Sector

Since June 2006, the IGC sector has appeared on the MICEX. It allows companies with a small capitalization to enter the market. Such securities must meet the liquidity requirement. To enter the sector, the revenue growth rate must exceed 20% per year.

Interbank Currency Exchange: exchange rates

One of the activities of the organization is the trade in banknotes of different countries. Most of the courses are formed here. They demonstrate the state of the Russian economy. Although the title saysthe word "currency", over the years of its existence, the scope of the exchange has greatly expanded. MICEX has been providing access to trading via the Internet for more than 10 years.

Until 1998, the sale and purchase of monetary units of different countries of the world took place in the form of auctions. The seller sold dollars, marks, pounds and francs for the national currency through competitive bidding. Now they are held online through SELT at 8 sites. Based on these transactions, the rate of the Interbank Currency Exchange is formed. With the increase in trading volumes, a payment versus payment risk management system has emerged.

Stock market

This is the largest trading platform where securities are sold. 98% of transactions on the domestic stock market take place here. There are more than 1500 different securities in circulation. The total capitalization of issuers is 29 trillion rubles.

In the stock market, companies carry out the initial placement of the Central Bank in order to attract additional investment. Young and promising people who have come up with an interesting and useful project can try to place it on the RII exchange. At the moment, this is the only real way to raise funds from all those interested in the idea. The legal status of the company must be designated as OJSC, and the capitalization must be at least 50 million rubles. A large number of companies and we althy people are ready to invest in interesting projects. And they turn to RII for ideas. Young companies can beinterested in the prospects for great growth. A similar organization in the US is called the NASDAQ. It sells: Apple, Microsoft, Amazon.com, Google, Dell, Intel, etc.

Development Indicators

We should also mention the MICEX index. It shows how 30 liquid Russian companies have changed in the price of the Central Bank: Lukoil, Gazprom, Sberbank, Rosneft, MTS, VTB, Aeroflot and others. The exchange index demonstrates the general state of the market. If companies operate in profit, then investors buy their shares, that is, the index grows. The family of indices of the domestic exchange includes 8 sectoral, three capitalization and two composite ones. For bonds, municipal (MICEX MBI) and corporate (MICEX CBI) are calculated.

Let's say an individual decides to invest temporarily free funds in shares, and after a while - to check their value. The Central Bank of 3 out of 5 purchased companies rose in price, while the remaining two fell. But if you sell them all, then the investor will still remain in profit. The total yield will be, for example, + 20%. This is the indicator that signals the state of the market. 280 dealers trade GS on MICEX.

You can also place bonds on the stock market. In 2013, 400 issuers made 700 issues with a total value of RUB 4 trillion. For comparison: in 2010, 66 organizations were registered that traded bonds with a total volume of 965 billion rubles. Developed infrastructure played an important role in the increase in volumes. In the stock market, participants canconclude transactions during placement and circulation, and qualified investors - to conduct REPO.

Clearing and custody services

These operations are performed by the Clearing House. Non-cash transactions are carried out through the website of the Interbank Currency Exchange. The Clearing Center is the first specific organization in Russia. It leads in terms of volume and turnover of stored assets. Clients transfer the Central Bank to them, the depository carries out all operations and settlements.

CV

The Moscow Interbank Currency Exchange is the largest structure in Russia that provides information, depository, electronic trading services, clearing and settlement of transactions. All divisions of the MICEX serve about one and a half thousand market participants - the largest banks and brokerage companies. The main task of the exchange is the development of market mechanisms for determining the exchange rate and the effective allocation of temporarily free funds.

Recommended:

The currency of Finland. History, appearance, currency exchange rate

In this article, the reader will get acquainted with the currency of Finland, its history, appearance, and some other characteristics. In addition, you will find out where you can exchange money in Finland

China Exchange for Cryptocurrency, Stocks, Metals, Rare Earths, Commodities. Chinese currency exchange. China Stock Exchange

It is difficult to surprise anyone with electronic money today. Webmoney, "Yandex.Money", PayPal and other services are used to pay for goods and services via the Internet. Not so long ago, a new type of digital currency appeared - cryptocurrency. The very first was Bitcoin. Cryptographic services are engaged in its emission. Scope of application - computer networks

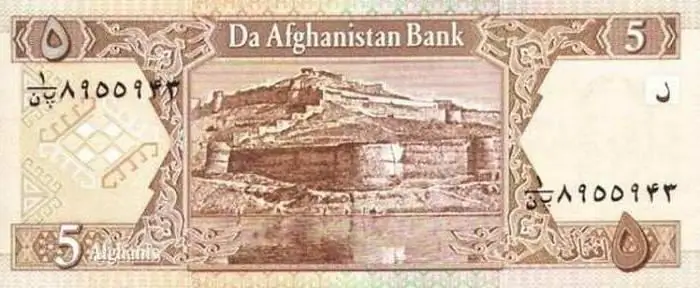

The currency of Afghanistan: the history of the currency. Curious information about the currency

Afghan currency Afghani has almost a century of history, which will be discussed in this material

What is a currency? Russian currency. Dollar currency

What is the state currency? What does currency turnover mean? What needs to be done to make the Russian currency freely convertible? What currencies are classified as world currencies? Why do I need a currency converter and where can I find it? We answer these and other questions in the article

Currency market of the Moscow Exchange. Currency trading on the Moscow Exchange

Moscow Exchange was opened in 2011. Every year its popularity is growing. So, in 2012, the growth of trading on the exchange amounted to 33%, and in 2014 - 46.5%. Private investors were also allowed to trade on the stock exchange through brokerage companies. How to trade on the Moscow Exchange and how is it different from Forex? These and other questions are answered in this article