2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:33

Choosing the right taxation system is one of the tasks of a manager in an enterprise. For individual entrepreneurs, this is especially important, as it allows you to plan and save expenses for future periods. Let us consider in more detail the special taxation regime of the simplified tax system and the rate system.

Tax base for entrepreneurs on the simplified tax system

STS, or "simplification", as it is called in the everyday life of accountants and lawyers, implies a choice of tax base from two options:

- based on income for the period;

- base is the difference between income for the period and expenses.

The betting system is different, depending on the chosen calculation method. For the income system, the rate is 6%, and for "income reduced by expenses" - 15%. Income in this case refers to all cash receipts, both cash and non-cash. The terms "profit" and "income" are not identical.

At the same time, in some regions, special conditions may be established for the rates of the simplified taxation system. For example, for certain categories of entrepreneurs, rates can be reduced to 5%. Before choosing a tax regime and base,you should check if your area has special benefits for a certain type of activity.

In the Altai Territory, for example, since 2017, rates have been reduced to 3% on the income tax system for enterprises engaged in scientific development, and to 7.5% on the income-expenditure system for enterprises engaged in food production in the region.

How to calculate the amount of tax under the simplified tax system on income?

Suppose that Ivanov A. A., after registering as an entrepreneur, switched to the simplified tax system and the “6% income” system was chosen from the rate system. The reporting period for the simplified tax system is a year, but the tax should be paid quarterly. To calculate the required amount of tax in the first quarter, IP Ivanov A. A. should use the data from the income column of the Entrepreneur's Income and Expenses Book (KUDiR).

If income for the first quarter amounted to 337 thousand rubles, then the amount of tax is calculated by multiplying the rate of 6% by the amount of income received:

Tax=337 thousand rubles. x 6%=RUB 20,220

That is, an advance payment under the simplified tax system for the I quarter for IP Ivanov A. A. will be 20,220 rubles. If an individual entrepreneur does not have employees, and the entrepreneur makes insurance contributions to the funds for himself, then the amount of tax can be reduced by the amount of contributions. If an individual entrepreneur has employees, then the amount of taxes for the period can also be reduced, but not more than 50% of the originally calculated amount.

How to calculate the amount of STS tax with expenses?

Suppose that IP Petrov P. P. is registered as a payer of the simplified tax system. We will calculate according to the system of rates "revenues reduced by expenses 15%". Please note that the amount of expenses is also taken from KUDiR, however, there is one remark. Expenses for which the amount of income for the period is reduced must be confirmed by primary documentation and payment orders. The type of confirmation depends on the type of payment - cash or non-cash.

If Petrov P. P.’s income for the first quarter amounted to 437 thousand rubles, and confirmed expenses - 126 thousand rubles, then with a rate of 15% the tax amount will be calculated as follows:

Tax=(437 - 126 thousand rubles) x 15%=311 thousand rubles. x 15%=RUB 46,650

Thus, the advance payment for transfer to the tax office under the simplified tax system "income reduced by expenses at a rate of 15%" is 46,650 rubles.

Which base to choose for calculating the tax on the simplified tax system?

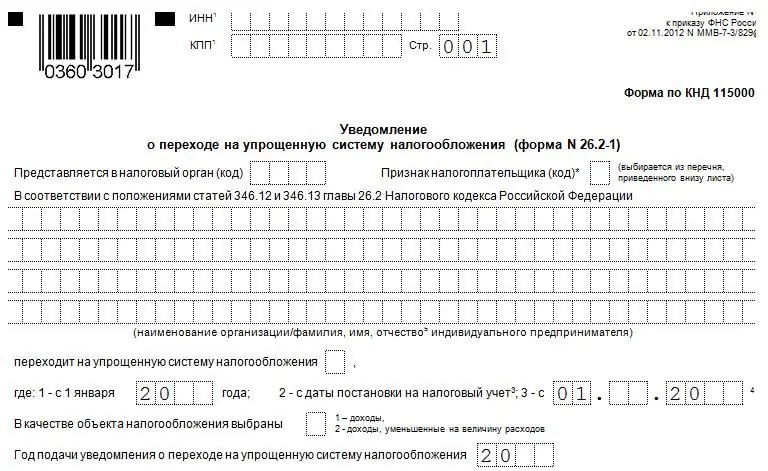

When writing an application for the transition to "simplified", the entrepreneur will need to specify the required rate system, that is, the tax base with which the calculation will be made. For new entrepreneurs, this can be a problem.

The preliminary preparation of a business plan and a marketing plan with cash flow analytics in future periods will help you choose an effective system. It is obvious that with small monthly expenses, which will be less than 30% of the amount of income, it will not be profitable to choose the “income reduced by 15% expenses” system.

After drawing up the planned list of income and expenses for the year ahead, a double calculation of the rate system should be carried out. Make a spreadsheet in Excel and calculate quarterly the amount of taxes on the "income system 6%" and "income reduced by expenses 15%". Compare the annual tax burden of the two systems and make your choice. Remember that the entrepreneur has the right to change the chosen tax regime until the end of December 2018, while the new regime will be applied from the beginning of 2019.

Conclusion

STS taxation rates vary depending on the chosen tax base. So, an individual entrepreneur can pay tax only on income or choose the difference between income and confirmed expenses as a base. In the first case, the simplified tax rate will be 6%, and in the second - 15%.

To calculate quarterly advance payments and annual obligations, data from KUDiR are used, taking into account non-cash and cash transactions. At the same time, expenses must be confirmed by primary documentation and payment orders of the bank, otherwise expenditure transactions will not be accepted by the tax authorities for calculating the amount of tax for the period.

Recommended:

Using the simplified tax system: system features, application procedure

This article explores the characteristics of the most popular taxation system - simplified. The advantages and disadvantages of the system, conditions of application, transition and cancellation are presented. Different rates are considered for different objects of taxation

How to make the transition to the simplified tax system: step by step instructions. Transition to the simplified tax system: VAT recovery

The transition of IP to the simplified tax system is carried out in the manner prescribed by law. Entrepreneurs need to apply to the tax authority at the place of residence

Minimum tax under the simplified taxation system (simplified taxation system)

All start-up entrepreneurs who have chosen a simplified taxation system are faced with such a concept as the minimum tax. And not everyone knows what lies behind it. Therefore, now this topic will be considered in detail, and there will be answers to all relevant questions that concern entrepreneurs

Tax rate for transport tax. How to find the tax rate for the transport tax?

Today we are interested in the tax rate for transport tax. And not only it, but in general taxes that are paid for the fact that you have this or that means of transportation. What are the features here? How to make calculations? What is the due date for paying transport tax?

Do I need a cash register for individual entrepreneurs with the simplified tax system? How to register and use a cash register for individual entrepreneurs under the simplified tax

The article describes the options for processing funds without the participation of cash registers (CCP)