2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:35

Practically every young family faced with financial issues begins to be interested in the concept of a family budget. Someone adopts a financial model from their parents, and someone tries to create their own system. However, many do not know such a thing as a family budget. What is a family budget and why is it needed - this will be discussed in this article.

General concept

One of the main points of the marriage union is the accumulation of funds and the ability to use them correctly. And it doesn’t matter what level of income, because the lack of a competent distribution of money can even turn a millionaire into a person with an average income level. Thus, the concept of a family budget includes a complete list of all income and expenses for a certain period of time. Typically, this period is one month. At the end of the period, an analysis of cash receipts and expenditures is carried out in order to calculate unnecessary expenses in order tofind a way to save. Summing up, a married couple learns to follow the financial plan drawn up in order to achieve monetary well-being. Regardless of the salary of each family and financial we alth, every cell of society can learn to meaningfully manage their wallet. Doing house bookkeeping has the principle of the same action by which the economy is created. The family budget is not much different from it, and knowing its basics will be useful not only for a young family, but also for everyone who wants to learn financial literacy. Having learned about all its advantages, it will be difficult not to try such a financial management system at home.

How to create?

The components of the family budget are closely interconnected. That is why a change in one category entails a change in the entire planning system.

First and foremost, you need to be realistic. To do this, the amount received should be divided into several parts. For example, one part goes to pay utility bills, another part goes to groceries, a third part goes to clothes, and so on. By distributing the total amount of all income received for the month, you can understand where the money goes. Having identified the most priority categories of expenses, it is worth analyzing them carefully. Let's say you can spend less on entertainment, thereby saving money in the "Savings" section. Thus, it becomes clear on a good example how to distribute the family budget. To make it easier with the calculation of expenses, you need to have several envelopes by signingeach. Within a month, you can observe where there is still a reserve, and where funds are already running out. This method allows you to perfectly control the expenses of the family budget.

In addition to savings, money must be invested. It can also be a regular deposit account. Financial resources are gradually depreciating, so they should be invested in something. Accrued interest on a bank account can be an excellent alternative to investment deposits in expensive metals. Naturally, there are few families who can invest in real estate and other assets, but today deposits are available to everyone. That is why you should replenish your bank account every month, even in small amounts. Perhaps someone will save money for the education of their children, and in 10-15 years, insignificant contributions will turn into good capital for a prestigious educational institution.

Who's in charge?

From the name "family budget" it is clear: there are no main ones. In the personal planning of their funds, the leader is the one who earns them. In this case, both parties are responsible for the accumulation of funds and for their spending, respectively. Having asked the question: “Family budget - what is it and for whom is it needed?”, You can not even doubt the correctness of the subsequent answer. The concept carries the meaning of the preservation of family values, not only materially, but also spiritually. By creating something in common, the couple becomes stronger and doubly responsible for their actions. That's whythere is no main category here, everyone has the right to maintain and adjust the family budget. Income and expenses should equally fall on the shoulders of both spouses. Then mutual responsibility will appear in the family and the issue of instant spending of wages will be solved by itself.

Having decided that both spouses are involved in the management of the family budget, it is necessary to draw up a further plan that answers the questions: what is needed, what is needed, what do we want? After that, you should track your expenses for three to four months. Only then will it become clear in which direction it is necessary to move on.

There is general housekeeping, and there is separate, that is, each spouse spends from his salary at his own discretion, but free funds are added to a common piggy bank for the implementation of joint goals. It is necessary to decide on the type of budget before creating it. If it is separate, then the costs must be divided in half. For example, someone pays for utilities, and someone buys groceries. This applies to all graphs, so responsibility should fall on an individual basis.

Family budget planning

As mentioned above, it is necessary to make a monthly plan for the distribution of income and expenses. In order to know how to plan a family budget, you must first decide on joint goals and desires. Sometimes disputes and disagreements can arise. Not always the purchase of a certain thing is necessary for both family members. That is why beforepaint items of expenditure, you should decide on them. Next, you need to highlight priority items and everyday expenses. To save up for the purchase of a large thing, you need to set aside part of your salary for it. If there is not enough money, then some items of expenditure should be reduced. Only at first glance, it seems that planning a budget is difficult. In fact, over time, a certain perception of things will form, when it becomes possible to understand that some thing is absolutely unnecessary and you can save on it. So a person learns to deny himself extra pleasures that only empty the wallet and do not bring anything useful.

As you can see, there are many answers about the benefits for those who wish to build a family budget. What is family planning really? This is the creation of joint long-term goals that only strengthen relationships and teach us to adequately relate to different values together.

By pooling their income, the spouses will no longer be able to surprise each other, since the entire level of wages will be known and it will be distributed by day. If this fact confuses someone from the family, then you must first agree on your personal, pocket money.

Learning to save money

Speaking of savings, it is necessary to adequately assess the family budget. Families who even vacation on credit simply have to take care of their financial literacy. First of all, you have to live within your means. Some people, suffering from low self-esteem, try to increase it by buyingexpensive things in debt. They do not think about how to repay these debts later. It is better to refuse to purchase unnecessary trinkets for several months, and then, having accumulated a certain amount, buy the item of your dreams. Thus, you will not have to overpay extra interest on credit loans.

Also, you should always remember what you have to save for. Then it will quickly turn out to put the family budget in order. Family expenses will become meaningful, and the goal will appear to spend less than you earn. Of course, this does not mean that you need to deny yourself everything and everywhere, just spending needs to be analyzed.

There are models of home financial control when one person works and the other is on his payroll. Naturally, the spouse who does not work should adequately relate to his expenses and desires. This applies not only to those families where the income level is good, but also to those where money is not enough. Priority and secondary things should be distinguished.

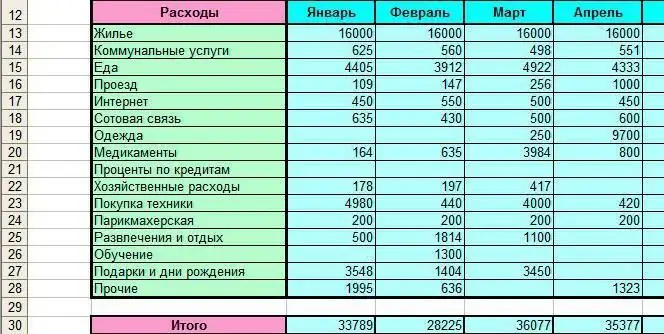

Income and expenses

Family income is the sum of two spouses' salaries. It is important to take into account all receipts, including bonuses and allowances. This is the only way to correctly draw up a family budget. The income and expenses of the family are so carefully planned that it allows you to scrupulously control the movement of funds during the month. If for someone it seems too complicated, then you can simplify the task. For example, you can calculate the cost of groceries by keeping checks from supermarkets. ATa certain day (preferably at the beginning of the month), the amount of checks should be calculated and recorded in the "Expenses" column. The same applies to clothing. Entertainment may not be so controllable, but it is worth having a special envelope for this item and putting the required amount into it.

Answering the question: "Family budget - what is it and how to plan it?", You can get an answer from the monthly control of your financial resources. Even without special knowledge, you can understand where the money disappears.

It is most convenient to use special programs designed for home bookkeeping. Today there are a large number of them on the Internet.

Family budget benefits

Home accounting gives a clear answer to the questions: where does the money come from and where does it go? Only by starting to count your income and expenses, you can understand what it is for. With the advent of new desires, it becomes clear how to distribute the family budget. The need to save money appears by itself when it becomes clear that all wages are not enough to buy what you want. This is where home financial control comes in.

The benefit of the family budget is also that a person becomes more confident in his abilities, develops a sense of control and self-organization. Spouses also learn not only to waste free funds, but also how to plan a family budget. Banal quarrels concerning financial matters cease. SoThus, the benefits of home bookkeeping are undeniable. Every family that wants a stable well-being should introduce such a system into their lives, and this should not depend on the level of income. Money is one of the most significant things in life and should always be under the control of a person.

Sometimes there are disputes about the different levels of salaries of spouses. There are also benefits to be found here. One of the spouses will feel much more comfortable when his income level becomes average, that is, after the amount of salaries is divided between two, they will become equal. Of course, you need to spend money equally, otherwise misunderstandings may arise.

Correct family budget

Before you create your own family accounting, you need to understand that the priorities and desires of both spouses at least somewhat coincide. You should decide on the acquisition of large purchases. It is also worth determining the period during which they must be purchased. As mentioned above, the components of the family budget are primarily income and expenses, then reserves and investment capital can be distinguished.

Thus, in addition to the usual expenses and receipts, there should be accumulative funds that will act as a "safety cushion". When there are such reserves, the family feels much more confident and calm.

Having learned tips on how to save the family budget, you can start saving 5-10% of your salary every month. After some time, this amount will beof an impressive size, this will allow you to further plan purchases and form goals. Those funds that remain after all payments under the mandatory columns of the budget are called free. They can be disposed of at your discretion, but do not forget about your goals. It is the goals that serve as the main deterrent to pointless purchases.

Big buys

Some people look with surprise at those families who receive an average salary, but at the same time constantly go on vacation and make expensive purchases. How do they do it? It's all about proper bookkeeping. Having distributed all the income and competently organized your budget, you can safely set goals for yourself. And they are indeed becoming achievable.

People who live on loan are constantly under stress. By purchasing expensive things on credit, they fall into a debt hole. All these emotional purchases not only make you spend much more money, but also constantly worry about your ability to pay. And what if something unforeseen happens and there is nothing to pay on loans? That is why you should borrow money only if the thing is purchased for earning money (for example, a truck for transportation). You can also take out a cash loan to expand your business or to open it. But not for the purchase of some kind of jewelry or the same household appliances that do not pay for themselves, but only grow old with time.

Getting a large amount of money, do not try to immediately spend it. It is known that human psychology is so arranged,that he tries to spend more than he receives. He is always missing something. Therefore, having learned to control your desires and emotions, you will be able to manage your capital, which will soon lead to stable well-being.

Helpful tips

To save the family budget, you need to know some tricks. For example, some people like to have a snack in a cafe. Of course, it’s not convenient for everyone to get home at lunchtime, but when you buy food in catering establishments, you spend a decent amount on it in a month. Therefore, in order not to expose the wallet to unnecessary expenses, it would be better to take food with you to work or dine at home. Naturally, sometimes you have to have a bite to eat in a cafe, but this should be in a budget option. Do not order gourmet dishes, thinking that this happens quite rarely. So it will not work to save the family's piggy bank and plan the family budget correctly. Income must exceed expenses - don't forget this principle.

A person who cannot afford to buy expensive and high-quality things can become even poorer. This is explained by the fact that when buying cheap clothes, low-quality furniture and equipment, you have to do it much more often. That is, these purchases have a short service life, and they have to be replaced by the following, the same short-lived ones. That is why, in order to save and accumulate money, it is necessary to purchase only high-quality things, even if it will be less often. This applies to everything: clothing, equipment, and even food.

Speaking of food, you should carefully study what "pulls" the mostwallet. In many families, most (namely 30%) goes to sweets. These products are not only harmful, but also undesirable. They can be replaced with fruits and vegetables. This will not only save your budget, but it will also be he althier. The same goes for unhe althy foods like chips, pistachios, and soda. It is better to replace them with he althier and cheaper food. It may be difficult at first to refuse tasty but unhe althy dishes, but over time the body will get used to he althy food, and home accounting will be replenished with several thousand rubles.

Thus, the management of the family budget should not become austerity for all areas of life, but competent and thoughtful handling of money. Do not immediately abandon the above ideas on how to save the family's financial resources. It is better to try it first and after a while it will become clear that this is actually a good system that allows you to build relationships with money.

Recommended:

Family budget: the impossible is possible?

If you manage your family's budget correctly, you can cut down on unnecessary expenses and save up faster for the purchases you want

Family budget: structure of income and expenses

You need to be able to manage finances. Especially in the family. In this article we will talk about the formation and distribution of the family budget

Family budget: plan, recommendations, tips

Financial quarrels are not in vain considered the most difficult. Often, not only a lot of accusations, but even divorces arise on their soil. You can solve all this by simply planning your family budget, and this is not so difficult

How to find out the budget classification code? Budget classification codes for taxes

The problem of how to find out the budget classification code arises in front of almost every taxpayer when the deadline for paying taxes comes. No one can avoid it: neither the accountant of the organization responsible for the relevant transfers to the tax office, nor ordinary citizens who own housing, land, a car or a simple outboard motor

How to spend money correctly? Family budget: an example. home bookkeeping

You need to be able to spend money. More precisely, each person can learn how to properly manage money. This will help you save and save. What techniques can help? How to do home bookkeeping? Top tips and tricks next