2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:35

One of the reliable financial commercial institutions, formed in 1995, is known in the Russian financial market as "Mast-Bank". Whether his license was revoked or not, let's look further, but for now let's start with the story.

The main partners of the institution are private investors and small entrepreneurs, representatives of small and medium-sized businesses. One of the developed areas of activity is the service of individual entrepreneurs. In general, the financial institution offers a whole range of banking services that both fully satisfy the needs of individuals and meet the interests of entrepreneurs. A number of specific products are available.

Wide range of services

Mast-Bank branches in Moscow are not the only representative offices of a financial institution. The bank's clients have branches outside the capital, additional offices, operating cash desks and ATMs at their disposal. Among the main services of a commercial enterprise, one can single out money transfers and loans, deposit programs and card processing. It is about these possibilities that customersrespond best.

Like the major banks in the country, Mast-Bank has its own online service. Since 2005, the financial institution has been an official participant in the deposit insurance system (DIS). This opens up opportunities in terms of providing dealer and brokerage services. Securities management and activities related to information encryption are available. Clients note the convenient and flexible partnership scheme, as well as the availability of a wide range of banking offers.

Rating agency ratings

According to many rating agencies of the country, Mast-Bank's reliability rating is relatively high. At the first stages, the institution had a high credit rating - at the A level, at the end of 2014 this rating was lowered to the B ++ level, which is also a worthy indicator of the institution's reliability. The agency's forecasts previously identified this business as developing, but today it has been given stable status.

Prestige Membership

Member of the Moscow Interbank Exchange, a member of the Association of Russian Banks, an authorized representative of such payment systems as MasterCard Worldwide and VISA International - all this is Mast-Bank. Has the license of this institution been revoked? Fortunately, this is erroneous information, they have nothing to do with this financial institution. The company has worked and is still working, and is part of the community of interbank communications of a financial type. Moreover, the institution is a partner of such money transfer systems as Unistream andContact, Migom and Western Union.

How did temporary difficulties begin?

Talking about the fact that the Mast-Bank financial institution had its license revoked began due to the fact that at the end of 2014, from December 16 to 17, operational measures were taken to verify its activities. From official sources, it became known that the Ministry of Internal Affairs and the FSB were checking the bank, as it was suspected of involvement in the illegal embezzlement of funds from the budget. On December 16, representatives of the authorized bodies completely seized all the servers of the financial institution, from where all the information was copied.

Panic arose because of a criminal case on the embezzlement of funds for the construction of an oceanarium on Russky Island, which was handled by the Construction Directorate in the Far Eastern Federal District, and for the construction of the Russian bridge across the Eastern Bosphorus, which was entrusted to NPO Mostovik. Andrey Poplavsky and Oleg Shishov, managers of construction organizations, were detained by representatives of the TFR, they were also clients of the bank in question.

Unreasonable panic

In the period from 16 to 17 December, against the backdrop of a general crisis and a sharp rise in the dollar exchange rate, panic began among depositors. The main office did not work for only one day, and depositors and partner banks began to actively withdraw their funds. Even though the representatives of the bank said that the financial institution was not working due to the lack of electricity, this did not play a big role. As a result, long queues formed, and a large flow of applications caused someoverlays at work.

Rumors spread that Mast-Bank's license was revoked, and that the bank is trying to borrow a large amount of funds in rubles at 30% per annum on the Interbank Market. Both claims were soon refuted. The capital's print media announced that only a few days remained until the license was revoked, as the Central Bank of the Russian Federation deprives the bank of the right to offer services on the domestic financial market due to the illegal transfer of budget funds to the accounts of outside organizations.

How did it all end?

The situation was completely resolved already on December 29, when representatives of the authorized bodies stated that they had no complaints about the activities of the Mast-Bank organization. Reviews about the bank at this point in time began to appear negative. In accordance with the documentation that was confiscated from the organization, it did not ask for any loans at 30% per annum, it did not have any difficulties with partner banks. The indignation was due to the fact that the financial institution could not pay dollar deposits. As an alternative, he offered to withdraw a foreign currency deposit in rubles.

The situation in the state financial market, when dozens of banks simply refused to fulfill their obligations and declared themselves bankrupt, makes it clear that the work of the institution (with the interest rate of the Central Bank of the Russian Federation at 17%) remained at a fairly high level, albeit not on flawless. Authorized representatives of the bank confirmed the fact that in the period from 17 to 22 December, the officesOAO CB "Mast-bank" was really crowded with customers. The reason for the phenomenon was not temporary difficulties and suspicions of the government, but a sharp jump in the ruble exchange rate and desperate attempts by depositors to keep at least part of their savings. At peak times, work was carried out as normal as possible.

Incredibly good deal

Starting from December 2014 to March 2015, despite the ambiguous situation, Mast-Bank increased the volume of deposits by almost 43%. The total investment of private individuals amounted to 15.4 billion rubles. This figure contains the financial statement of the institution. Almost 3.5 billion rubles increased private deposits with a duration of 91 to 180 days. The situation became the basis for the fact that an increased rating was recorded for the Mast-Bank organization (certificate from the official website of the institution). The reason for the influx of funds was the high interest rate at 22%.

Favorable credit conditions

After the end of the investigation, all bank services were resumed. Good reviews about the partnership with the financial institution are left by borrowers. According to them, the partnership scheme is very flexible. Depending on the lending program, an interest rate of 23% to 33% is available. The loan term is from 36 to 42 months. The maximum available amount of consumer credit corresponds to 250 thousand rubles. There are unique programs for entrepreneurs and businessmen.

Restrictions from the Central Bank of the Russian Federation, or How the government regulates the inflow of deposits

Due to the large inflow of funds, the Central Bank of the Russian Federation imposed a moratorium on the activities of a financial institution. The Bank is prohibited from accepting new deposits and replenishing existing ones. This preventive measure is temporary. The restriction went into effect on April 17, with an expiration date scheduled for the end of May.

On the official website of the Central Bank of the Russian Federation there is an order that at the moment the financial institution has a valid license. At the same time, we note that for each of the contracts today there is an automatic prolongation in accordance with the previous terms of the partnership.

According to official data, by April 1, 2015, the volume of net assets was 24.17 billion rubles. This indicator brought the bank to 159th position in Russia. The capital is 3.2 billion. This indicator is calculated by the Central Bank of the Russian Federation. The loan portfolio is 16.36 billion dollars. The volume of obligations to the population corresponds to 15.38 billion. As a result of all of the above, one can note the good performance indicators that Mast-Bank has. Deposits, loans, reviews of which are set up for partnership, continue to attract consumers. It is too early to talk about what will happen after the lifting of the moratorium on the bank. It remains to wait for the end of May and follow further developments.

Recommended:

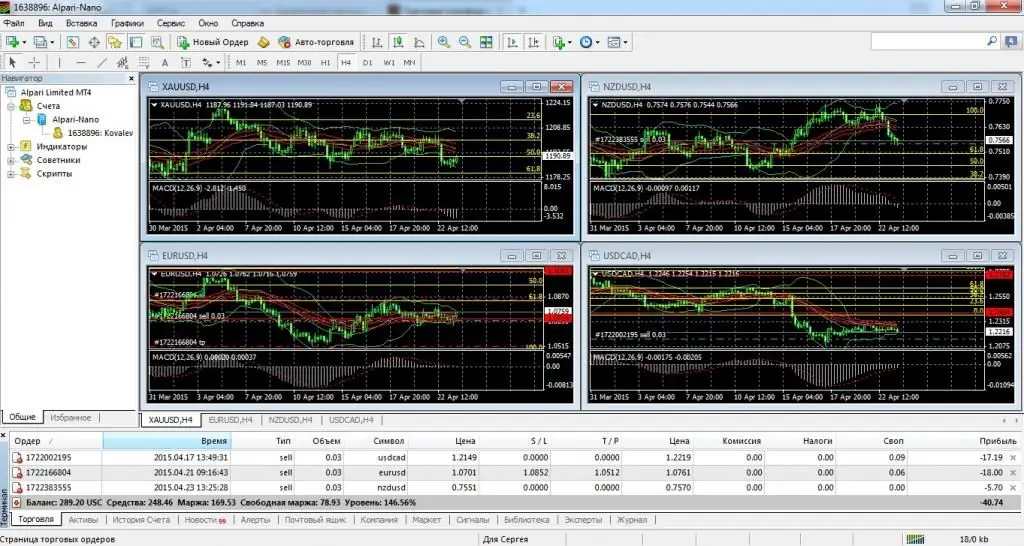

Alpari Broker: reviews, reviews, license and recommendations from experts

Reviews about the broker "Alpari" are very different. Some clients praise the company, which makes it possible to make real money in this difficult time. Others consider them almost scammers who are only engaged in extorting money from people. In this article, we will present a complete overview of the work of the broker, dwell on the advice and recommendations of specialists

Bank "Active Bank": customer reviews, loans and deposits

Finding a good bank is not easy. An expert financial institution is able to increase money with the help of a deposit and issue a loan on favorable terms. One of the leading banks in Saransk "Active Bank" has been serving clients since 1990 and at the moment has practically no competitors in its field, annually taking the highest places and becoming the winner of industry awards

Asia-Pacific Bank: reviews of bank customers on loans, deposits

"Asia-Pacific Bank" is a universal bank that has been providing a full range of services to individuals and businesses for more than twenty years. It is a member of the deposit insurance system. The commercial bank is confidently included in the top hundred in terms of high financial performance of banking activities. The branch network of the credit institution is located in most regions of our country

"TransKapitalBank": customer reviews, description, services, deposits and loans

This article will tell you what "TransKapitalBank" is. What services does it offer? Are customers satisfied with the service? What features of the company should every client be aware of?

Frozen deposits of Sberbank. Can deposits be frozen? How secure are deposits in Russian banks?

The frozen deposits of Sberbank in 1991 are systematically paid out by a financial institution. The bank does not refuse from its obligations, and guarantees the complete safety of their funds to new depositors