2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:37

The exchange of goods existed in the Stone Age, when the division of labor arose. As civilization developed, the monetary system changed. People minted coins from gold, silver and other metals. But these resources are limited. And wars and other large-scale crises greatly depreciated the currency. To replace coins made of precious metals, banknotes appeared. As long as their release was provided with state resources, there were no problems. They arose when the nominal value began to differ from the real one. Such money was even given a separate name - fiat currencies. What is it?

History of occurrence

The state has the right to restrict the freedom of citizens. In particular, the use of a certain currency for settlements. The state has the authority to deprive the monetary unit of backing with gold or silver. Such a decision carries a large number of risks. But if it is accepted, then the money ceases to be commodity and becomes fiat.

The ancient Greek thinker Plato was the first to suggest the idea of using such a currency. He believed that citizens should not store gold as a unit of payment. It is better to create your own currency, the use of which will be limited to a certain territory of the state.

Many countries have tried to implement the idea of fiat money. The first was the Roman emperor Diocletian. At that time, the level of inflation in the country greatly increased, and many counterfeiters appeared. The emperor ordered the use of only solidus minted in Rome. In addition, uniform prices for goods were established. They operated throughout the empire. The execution of the order was monitored by the executioners. They immediately executed any merchant who dared to break the law. The emperor made such a tough decision, because he understood the danger of neglecting the currency. She was not provided with anything. This is where the concept of "money on trust" came from. But even such drastic measures could not change the situation. The law was soon repealed.

Second attempt

Only in China did this idea really work. During the Tang Dynasty in the 8th century, fiat money was issued. These measures were taken to prevent inflation. But the experiment failed - merchants preferred to deal with gold. By the 10th century, the state was issuing coins fully guaranteed by the government.

By the beginning of the First World War, almost every state used secured currency. But the high costs of warfare led to the widespread emergence of fiat money. To normalize the situation, the Betton Woods Agreement was adopted. According to this document, one dollar was equal to 1/35 of a troy ounce. All other currencies were pegged to the US currency. This system lasted until February 13, 1973. The dollar exchange rate was then 1/42.2. The agreement was terminated.

Fiat money - what is it?

In Latin, the word "fiat" means decree, decree. Literal translation: "So be it." Fiat money is the currency that the government positions as the only legal tender. Their intrinsic value is either very small or non-existent. Currently, most paper money is fiat, including the US dollar. Its value is guaranteed by the authority of the state. Fiat currency is not pegged to gold. She is not provided with anything at all.

The main difference between fiat money and commodity money is the free conversion of the latter. The government cannot print more secured currency than it has the resources. That is, any expansion of the world economy is limited by the amount of gold reserves humanity has.

Features

Fiat currency is fiat money. The government, by a special decree, declares a certain monetary unit as the only means of payment. The difference between the nominal and real value of such a currency is the fiat currency. The course is most often set against citizens. There are many stories about the denomination of currencies. But there are no examples when the government agreed to voluntary inflation by adding a zero to each bill.

Recently, more and more states refuse to use secured money. They are switching to fiat. This is due to the fact that the state has practically no limit on the issue of currency. Such a solution improvesrisk in government. Fiat currencies are unstable to fluctuations in the economy.

Alternative

A return to the gold standard is out of the question. Such a decision carries two main dangers:

1. Some economists believe that gold can also be called an "artificial currency". Its value is converted.

2. Sooner or later, but the rise in gold prices forms a new "bubble". And then no one will be able to control the quotes. The government is behind fiat money. There will be no one behind the gold.

Fiat currency has a lot of value. It is formed on the basis of government decrees. This also causes the main difficulty - the low level of management. With any mistakes at the state level, the artificial currency becomes very vulnerable. This is one of the causes of the latest international financial crisis. A natural consequence of this situation is that investors' interest in gold increases. Prices for this precious metal have been rising for several years. In Russia, banks offer appropriate deposits. By the way, they do not fall under the compulsory insurance system. But there are still many who want to.

The future of "air bubbles"

During ancient Egypt, the dead pharaohs were buried together with gold in rebuilt burial grounds. People believed that they would enjoy their we alth for all eternity. This idea worked. Their gold has not been touched by thieves or tax authorities for a millennium. But then it was real money. Today the governments of manycountries are constantly experimenting with paper money. Fiat currency is the result of their experiments.

The rapid growth of paper bills has created dangerous bubbles. They almost simultaneously set all-time highs in every major financial asset class. A solution to this problem cannot be found. By printing money, the National Bank creates inflation. In the event of a refusal to issue an opposite situation will arise. And it is worth uttering an extra word, as the financial markets begin to panic. Europe is already seeing negative interest rates. Central banks are trying to restore confidence in poorly capitalized banking systems as quickly as possible. And well-developed markets want to create their own financial structure.

Financial systems, currencies and ways of trading have already changed many times. This process is repeated again. Today, the dollar and the US Central Bank are the main elements of the global financial system. But many are already tired of constantly obeying the rules of the state, which manages to constantly increase its debts on the security of "risk-free" bonds. Soon the dollar will lose its importance and a new financial system will emerge. Already today there are technologies that eliminate the need for banks: crypto-currencies, trading platforms. It is believed that most of the money supply today is stored digitally. Including your bank account.

Yuan as a replacement for the dollar

If China converts part of its reserves into gold, the country's currency will suddenly become of great importance in the international financial system. Of course, an attempt to dislodge the United States from the world's leading position in reserves of the most expensive metal (328 billion in the spring of 2014) is very risky. But the price of a mistake is lost profits.

Most countries favor artificial money and floating exchange rates. But gold has special properties. For more than two thousand years, it has been the main means of payment in the world. Third party credit guarantees were not needed. No one had any unnecessary questions when people paid with gold receipts for bonds. Artificial money is now accepted thanks to government loan guarantees. In crisis situations, they cannot compete with the universal means of payment.

If the dollar, euro or other fiat currency were accepted everywhere, the Central Bank would not store precious metals. But they do it. "Money at the behest" did not become a full-fledged equivalent. Of the three dozen countries participating in the International Monetary Fund, only four do not have a gold reserve. Small statistics for January 1, 2014:

- the cost of gold on the balance sheet of the Central Bank of developed countries - 762 billion dollars;

- their share in the reserve is 10.3%.

Need to reduce inventory

British economist John Keynes calls gold a "relic of theft" because the return on this asset, taking into account the cost of storage, is negative. Then why are Central Banks around the world collecting it?

Politicians have repeatedly offered to sell part of the gold reserves. In 1976, this idea was presented by US Treasury Secretary WilliamSimon and Fed Chairman Arturt Byrne to President Gerald Ford. They offered to sell 275 million ounces of gold and invest the proceeds in profitable assets. They motivated their idea by the fact that this metal has lost its great monetary value. But they never found a common language with Burns.

How are things today

Subsequently, this issue was repeatedly discussed at the meeting of the heads of the Big Ten Central Bank. They sought to reduce the gold and foreign exchange reserves, but they understood that mass quoting would greatly reduce the price. Therefore, we agreed on who, when and how much will sell. But Beijing had no ideological views on gold. Until 2002, their stock was 13 million ounces. They increased it by 45% in a year. After another 7 years, they brought it to the mark of 34 million. At the beginning of 2014, China ranked fifth in the world in terms of gold and foreign exchange reserves, behind the United States (261 million), Germany (109 million), Italy (79 million) and France (87 million).

Fiat money: examples from the modern world

Practically no state conducts an issue backed by national we alth. Therefore, the dollar, euro, Russian ruble and other monetary units can be classified as artificial. But in addition to paper, there are also electronic fiat currencies. What is it?

Artificial digital money is expressed in one of the state currencies. The government by law forces citizens to accept them for payment. Issue, redemption and circulation takes place according to the rules of national legislation. Electronic non-fiat currency expresses the value of non-state payment systems. The latter control its turnover and redemption.

Both types are further divided into two groups. Network currency - electronic money that is transferred on a hardware basis. Examples: PayPal, M-Pesa (African payment system). The second group is systems based on SIM cards. Examples: Visa cash, Mondex, Chicknip. But the popular in Russia Webmoney, QIWI, RBK Money, EasyPay are non-fiat payment systems. Just like Yandex. Money. Both groups exchange electronic currencies among themselves.

CV

The government by a special decree determines what currency will be used for settlements in the state. As long as its release is provided with national we alth, it is called commodity. As soon as there is a difference between real and nominal value, artificial money appears. Fiat currencies are issued under government guarantees. They are not resilient to financial crises and can severely hurt the economy.

Recommended:

Currency borrowers. All-Russian movement of foreign currency borrowers

At the end of last year, an all-Russian movement of foreign currency mortgage borrowers was formed. This was due to the sharp devaluation of the ruble, which made it almost impossible to service loans of this type

How to make money without money? Ways to make money. How to earn real money in the game

Today everyone can make good money. To do this, you need to have free time, desire, and also a little patience, because not everything will work out the first time. Many are interested in the question: "How to make money without money?" It's a perfectly natural desire. After all, not everyone wants to invest their money, if any, in, say, the Internet. This is a risk, and quite a big one. Let's deal with this issue and consider the main ways to make money online without vlo

Chinese money. Chinese money: names. Chinese money: photo

China continues its active growth amid the crisis of Western economies. Perhaps the secret of China's economic stability in the national currency?

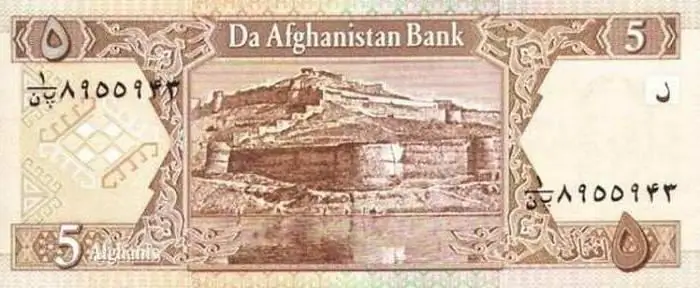

The currency of Afghanistan: the history of the currency. Curious information about the currency

Afghan currency Afghani has almost a century of history, which will be discussed in this material

What is a currency? Russian currency. Dollar currency

What is the state currency? What does currency turnover mean? What needs to be done to make the Russian currency freely convertible? What currencies are classified as world currencies? Why do I need a currency converter and where can I find it? We answer these and other questions in the article