2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:37

According to the law, every car owner must insure his car every year. A mandatory policy that must be purchased is OSAGO. However, some unscrupulous drivers are in no hurry to renew a new contract and continue to drive on roads with an expired document. Naturally, this is punishable by law, and for such a violation it will be necessary to pay a fine. About what a fine is charged for overdue insurance in 2015, will be discussed in this article.

Policy term

When concluding a new insurance contract and paying for it, you first need to ask about its validity period. It is simply necessary to find out this fact in order not to ask the inspector later: “What is the pen alty for overdue insurance?”.

In the recent past, it was possible to purchase OSAGO for a minimum period of only three months. In 2015, the policy period increased to one year. Thus, twelve months afterthe conclusion of the insurance contract, the driver is obliged to extend the OSAGO or purchase a new one from another insurer. If for some reason the car owner could not buy new insurance or simply forgot to do it, the company automatically extends the term of the mandatory contract without the participation of the insured. If, two months before the termination of the policy, the driver informed the insurer that he would not renew the contract, then the company terminates it on the day after the expiration date. Thus, the car owner is left without OSAGO, unless, of course, he bought a new one from another organization.

Expired insurance and accidents - consequences

Situations often occur that in the event of an accident, the guilty party has an expired OSAGO policy. What to do and what is the pen alty for overdue insurance in this case? The fact is that there are several options, depending on which the fine will be calculated. For example, there is a period of validity of the policy, and there is a period of use of the vehicle under insurance. If the car owner uses the car for only a few months a year, then this period is indicated in the insurance contract. If he got behind the wheel in the month that is not registered in the policy, and made an accident, then his OSAGO will be considered overdue. Then the violator faces an administrative pen alty, which is issued by the traffic police officer. The fine for overdue OSAGO insurance will be 800 rubles. It can be paid at any branch of the bank or through payment terminals,using the payment system. By the way, the culprit of the accident, and not the insurance company, will restore the damage caused to the injured party.

Fine for driving with expired insurance

In the event that the traffic inspector stopped the car, and the driver did not have a mandatory insurance policy, he will write him a fine of 500 rubles.

Indeed, there are times when OSAGO stays at home due to ordinary forgetfulness. Then the car owner can appeal such a decision of the traffic police officer in court. Only this should happen no later than 10 days from the date of issue of the protocol. This fact does not mean at all that the presence of a valid policy allows drivers to drive without it. Thus, valid insurance must be in the car at the time the driver drives it. Its absence is an offense, and then the car owner will be charged an administrative pen alty in the amount of 500 rubles and equated as a fine for overdue insurance.

How to renew the policy?

It is enough to come to the office of the company and write an application for the extension of its validity. The agent will make these changes to the database and register a new contract for another year. The driver only needs to pay for OSAGO at the rates that will be valid for the next period.

If the car owner was caught driving the vehicle at the wrong time indicated incontract, in addition to the fact that he will need to pay a fine for overdue insurance, he will also need to pay extra for the policy.

How to add another driver

There are options when the vehicle is registered with a company, and the driver who drives it fits into the insurance. If this did not happen, then in the event of a stop and check of documents, a fine will be issued to the company. Therefore, before sending your employees on the route, you should make sure that they all have the right to drive this vehicle. In order to include in the insurance policy persons who will also drive a car in the future, it is necessary to inform the agent of the company when concluding the contract. The calculation coefficient will then be somewhat different than when calculating per driver. A logical question arises: “How much will the fine for overdue insurance be in this situation?”. Everything remains the same as with individuals, that is, for refusal of insurance - 800 rubles, for forgotten insurance - 500 rubles.

If a new driver appeared after the policy was issued, then you should immediately go to the office of the organization and pay an additional amount for making changes to the insurance calculation.

Helpful tips

Thus, from the above, we can conclude that there are several types of administrative pen alty for the lack of a policy. And what pen alty for overdue insurance will be issued by the traffic police officer will be decided solely by him, depending on the situation. The heaviest offenseaccording to the law, the driver will refuse to insure his motor third party liability, for which he must pay 800 rubles. And so every time he is stopped. In other cases, as mentioned above, the fine will be 500 rubles and the removal of license plates in all situations.

Naturally, it will be cheaper to buy one policy than to pay a fine for late insurance every time. Moreover, every year the size of the sanctions is increasing, and soon they will be equal to the full cost of the annual contract for the protection of motor third party liability.

Recommended:

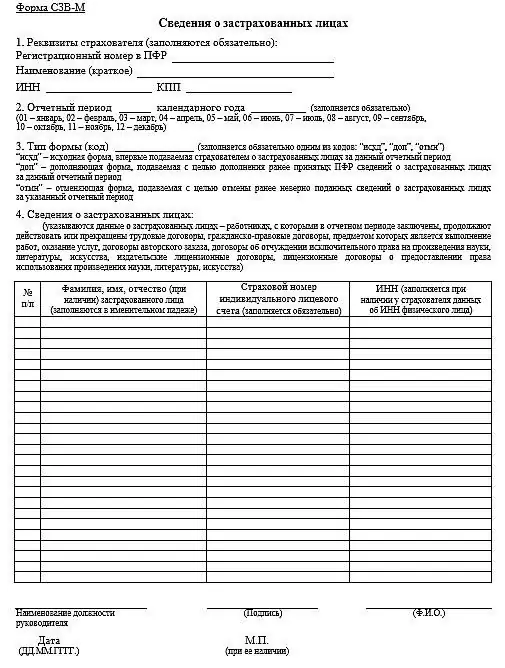

Report on the SZV-M form: how to fill out, who is obliged to hand over, a pen alty for late delivery

The article describes how to fill out the SZV-M, what information is entered into this document, and also when and in what form the report is submitted to the PF department. The main mistakes made by employers are given, as well as what fine is paid for the identified violations

Mathematical calculation of the pen alty at the refinancing rate

Today, due to various market fluctuations, volatility of price and percentage ratios, there is a tool for determining monetary values, which serves as a coefficient for various financial transactions and is called the refinancing rate

What is a pen alty? Pen alty: definition, types, features and accrual procedure

In case of violation of contractual obligations, Russian legislation provides for a special type of pen alties. Such a concept as a pen alty serves as a regulator of compliance with the deadlines for the transfer of tax payments, utilities and many other obligations

CTP pen alty: how to calculate?

Since 2014, changes have been made to the legislation. Now insurance companies that violate the terms of payment of compensation are obliged to pay a pen alty for OSAGO. Its size depends on the amount of payments and the timing of the delay. For more information on when it is applied and how the pen alty for OSAGO is calculated, read on

Pen alty for late submission of the declaration. Pen alty for late submission of VAT returns

Today there are quite a few tools that an accountant can use. However, in practice, there are malfunctions in the functioning of the software, a human factor, various unforeseen circumstances that lead to a violation of the requirements of the NDT. Accordingly, non-compliance with the requirements of the law implies the application of sanctions to the perpetrators. One of them is the pen alty for late submission of the declaration