2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:28

Each company must prepare numerous documents that are submitted to various government agencies. With the help of such papers, the officiality and legality of the activities of organizations are confirmed. A special SZV-M report has to be submitted for employees. It is submitted monthly to the PF department, and the documentation is filled out by companies and individual entrepreneurs who use the help of employees. Entrepreneurs and accountants should understand how to fill out the SZV-M, what information is entered in the report, and how documentation is submitted. If the requirements of the law are violated, the management of the company will be held accountable.

Who's dealing?

Significant changes are regularly introduced into modern legislation by officials. SZV-M is an important report that is submitted to the PF by each employer. Its form is regularly changed by government officials, which allows you to get maximum information about each employee of any organization.

Documentation is submitted by each organization or individual entrepreneur,if during the activity hired labor is used. If an individual entrepreneur does not have officially employed workers, then he is exempted from the need to submit this report to the Pension Fund. Companies without employees fill out paperwork anyway.

When filling out the SZV-M according to the new rules, it is important to indicate in the document not only people who work on the basis of a standard employment contract, but also citizens working under civil law agreements. This is due to the fact that the employer in any case transfers contributions to the PF for these citizens.

Who is obliged to take SZV-M? The process is carried out by any entrepreneur who, during work, uses the labor of employees. This applies to individual entrepreneurs or firms. If this requirement is not taken into account by businessmen, they will be held accountable. It is necessary to hand over the document even to firms that do not operate and that do not have employees. This is due to the fact that organizations must have at least one employee, represented by the founder of the company.

Purpose of surrender

The main purpose of submitting this form to the PF is the ability to track all prepensioners. They are represented by citizens who have less than 5 years to retire. With the help of SZV-M, PF specialists can keep statistics on pre-pensioners, as well as track employers who, without legal grounds, stop cooperating with such workers.

But the report includes not only people who are pre-pensioners, but everyoneother employees of the enterprise.

Do I need to prepare in the absence of workers?

The SZV-M report to the FIU is submitted by both entrepreneurs and companies, but the following rules are taken into account:

- if an individual entrepreneur does not have employees, then he may not submit documentation;

- if an individual entrepreneur has employees, you will have to submit a monthly report to the PF;

- firms submit a document regardless of the presence or absence of hired specialists;

- in the process of filling out the documentation, not only people who work under an employment contract are taken into account, but also those who are involved in cooperation by drawing up a civil law contract.

Companies are required to submit a document even in the absence of employees, and this is due to the fact that during the registration of any organization, one employee immediately appears, represented by the director and founder of the enterprise. Sometimes no funds are transferred to the PF for this person, but the company must still submit this form to the PF.

Delivery dates

Each entrepreneur must understand the deadlines for the delivery of SZV-M. Submissions for September must be submitted by October 15th. The report is submitted monthly by the 15th day of the following month. These terms are clearly approved in the legislation, so their violation leads to the imposition of fines.

Until 2017, the document was submitted monthly until the 10th. Firms and entrepreneurs have the right to submit a documentin advance. For example, the SZV-M submission deadline for September was given on October 15, but you can even transfer the report to PF employees on October 1. There is no pen alty for pre-submission of documentation.

Compilation rules

The procedure for filling out the SZV-M form should be well studied by entrepreneurs and accountants. It depends on the correctness of the preparation of this documentation whether there will be any significant errors in it, since if any discrepancies are detected, then you will have to submit an adjustment document to the PF.

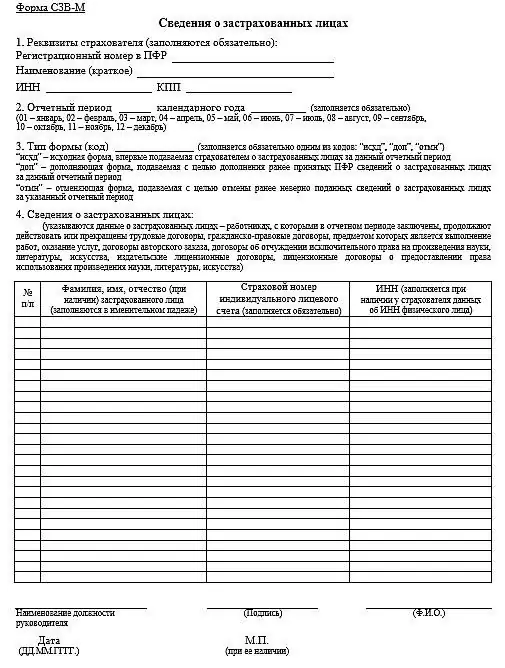

How to fill in SZV-M? To do this, you can deposit funds manually or using special programs. This document has 4 sections, each with its own purpose:

- Section 1. Here are the basic information about the employer. These include an individual number assigned to each entrepreneur by PF specialists. The name of the company, its TIN and KPP are registered.

- Section 2. The period for which the SZV-M form is drawn up is given, and the code for this period, represented by the ordinal number of the month, is also put. If special programs are used for filling, then codes are entered in them automatically.

- Section 3. It includes special ciphers that determine the type of report to be submitted. If the documentation is submitted for the first time, then the code “ref” is put. If a correction form is transmitted to the PF, then the “add” cipher is applied. The additional report should contain any additions or corrections of inaccurate data. Maybethe cipher "cancel" is used, on the basis of which the previously submitted form is canceled. This option is used if any employees of the enterprise are excluded from the previously submitted report, for example, if they quit, therefore they do not work in the current period.

- Section 4. It is intended to enter information about all insured persons. They are employees of an enterprise or individual entrepreneur. Labor agreements or contracts of a civil law nature can be concluded with them. Their full names and individual numbers of personal accounts in the Pension Fund are given. Additionally, the TIN of each citizen is entered. This section is presented in the form of a table.

At the end is the seal of the company and the signature of the head. All employees with whom any contract has been concluded are indicated, and it does not take into account whether any contributions were transferred to the PF for these citizens. Therefore, even specialists who are on sick leave, on maternity leave or vacation are included.

Can a document be null?

Each entrepreneur and accountant should know how to fill out the SZV-M, since if any violations or errors are detected, you will have to pay a fine. Entrepreneurs often think about whether this report can be zero.

The SZV-M form cannot be zero, because if an individual entrepreneur does not have employees, then he simply does not submit this document to the PF. In any case, the head of the enterprise is obliged to draw up this report. This is due to the fact that even if there are no employees,then the immediate director acts as an employee of the company. Therefore, SZV-M includes information about the head of the enterprise. This is necessary even if the company is not actually doing business, so the director does not receive any payments.

Methods for submitting documentation

It is important to understand not only how to fill out the SZV-M, but also in what ways you can submit the report to the PF branch located in the region where the entrepreneur or company operates. The procedure can be performed in the following ways:

- if the company employs more than 25 employees, then the documentation is submitted exclusively in electronic form, so the employer will have to register the EDS;

- if information about employees whose number does not exceed 25 is entered in the document, then it is allowed to reflect the necessary data in paper form, after which the report is submitted to the PF department personally by the entrepreneur or his official representative;

- paper version of the report can additionally be sent to the PF by registered mail, but you will definitely have to use the attachment inventory.

Large companies are forced to submit the document only in electronic form. To do this, the manager will have to take care of registering the EDS.

When is the fine paid?

Entrepreneurs and company owners pay a fine for late delivery of SZV-M. If this documentation is not submitted to the PF department by the 15th day of the month following the reporting one, this leads toimposition of a sanction. The pen alty for late delivery of SZV-M is 500 rubles. This amount is paid for each employee for whom the necessary information was not transferred to the PF.

If a company employs a sufficient number of hired specialists, then the sanction will have a significant amount. Therefore, managers and accountants of such enterprises should take a responsible approach to their obligations to compile and submit numerous reports containing information about employees.

For example, if a company employs 100 people, then the fine for one month will be 5 thousand rubles.

Other reasons for fines

A fine is imposed not only for missing a strictly established deadline, but also for violations or errors in the SZV-M. If it is revealed that the information in the document is incomplete or unreliable, then 500 rubles are paid. for each employee who has been violated.

Sometimes there are controversial points in which the tax authorities insist on paying a fine, but the company owners refuse to transfer this amount of funds. This refers to a situation where a company with more than 25 employees submits a paper report to the PF.

How are mistakes corrected?

If any mistakes or violations are made while filling out this report by the entrepreneur or responsible person, then corrective documentation will have to be drawn up. Initially, the policyholder receives a special request from the PF to correct the identified errors.

It is necessary to submit an adjustment report within 5 days from the date of receipt of this request. If the procedure is not completed, it will be considered that the company or individual entrepreneur has violated the deadlines for submitting the report to the PF. Therefore, company managers should take a responsible approach to their obligation to fill out and timely submit SZV-M to the PF department.

In the process of filling out this documentation, it is important to indicate even employees who, for various reasons, did not fulfill their labor duties. This includes professionals on maternity leave or sick leave.

Conclusion

SZV-M is represented by a report that must be submitted by all firms and entrepreneurs hiring other citizens. The process of completing this document is considered simple and quick. It can be handed over in electronic or paper form, depending on the number of employees.

If the company does not submit the report to the PF in a timely manner or makes mistakes while filling out this documentation, then it will have to pay a fine of 500 rubles. for each employee. Therefore, the process of filling out the report is entrusted only to an experienced and responsible employee of the enterprise.

Recommended:

Report for husband. Financial report to husband

Home finances are a subject of controversy and problems in many families. Very often, husbands require their wives to be fully accountable for where the money was spent. This article will tell you everything about how to keep a family budget and whether it is worth reporting to your spouse for spending

Pen alty for late insurance in 2015

According to the law, every car owner must insure his car every year. A mandatory policy that must be purchased is OSAGO. However, some unscrupulous drivers are in no hurry to renew a new contract and continue to drive on roads with an expired document

What is a pen alty? Pen alty: definition, types, features and accrual procedure

In case of violation of contractual obligations, Russian legislation provides for a special type of pen alties. Such a concept as a pen alty serves as a regulator of compliance with the deadlines for the transfer of tax payments, utilities and many other obligations

Pen alty for late submission of the declaration. Pen alty for late submission of VAT returns

Today there are quite a few tools that an accountant can use. However, in practice, there are malfunctions in the functioning of the software, a human factor, various unforeseen circumstances that lead to a violation of the requirements of the NDT. Accordingly, non-compliance with the requirements of the law implies the application of sanctions to the perpetrators. One of them is the pen alty for late submission of the declaration

Advance report on a business trip. Advance report form

To account for funds that are issued to employees of the organization for travel or other needs, a special form is used. It's called a travel expense report. This document is proof of the use of money. The basis for the issuance of funds is the order of the head