2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:45

Today there are quite a few tools that an accountant can use. However, in practice, there are malfunctions in the functioning of the software, a human factor, various unforeseen circumstances that lead to a violation of the requirements of the NDT. Accordingly, non-compliance with the requirements of the law implies the application of sanctions to the perpetrators. One of them is a fine for late submission of the declaration.

Regulatory framework

In the first paragraph of Art. 119 of the Tax Code establishes a fine for late submission of the declaration. This violation is considered the most common. As a sanction, the subject is charged with a monetary pen alty in the amount of 5% of the unpaid amount determined in the reporting. The pen alty for late submission of the declaration is charged for each completeor less than a month from the date fixed for its submission. The recovery cannot be more than 30% of the specified amount, but not less than 1 thousand rubles. In addition, liability is provided for under the Code of Administrative Offenses. In particular, under Art. 15.5 a fine for late submission of the declaration is imposed on officials. Its size is 300-500 rubles.

Exceptions

It should be said that not in every case sanctions can be applied to the subject for violating the deadline. So, taking into account the explanations present in the plenary Resolution of the Supreme Arbitration Court No. 57, the supervisory authority (FTS) issued its own explanations. In particular, they say that if the deadlines for submitting documents for the reporting period are violated, then use Art. 119 NK will be incorrect. So, for example, it is impossible to impute a pen alty for late submission of income tax returns for the first, second, third quarters. It is also not charged for individual months - from the 1st to the 11th. In addition, a pen alty for late submission of a property tax return for advance payments cannot be applied.

Explanations

The Letter of the Federal Tax Service No. SA-4-7/16692 serves as a basis for non-imposition of sanctions. It states, in particular, that Art. 58 (clause 3) of the Tax Code provides that the Code may establish the payment of advance payments. The obligation to deduct them is considered fulfilled in the same manner as for the repayment of the amount of tax. Failure to comply with the deadlines for the deduction of advances cannot be considered as a basis for holding liable for violation of the Tax Code. Art. 119 applies if there waslate submission of tax returns. The pen alty is thus set for non-reporting for the entire period, and not for individual parts of it. The FTS explains that Art. 119 does not cover acts that resulted in missing the deadline for submitting settlements on advance payments, regardless of how these documents are named in the chapters of the Tax Code.

St. 126 NK

It establishes a pen alty for late presentation of documents or other information established in the code and other legislative acts, if the act does not contain signs of violations provided for in Art. 129.4 and 119 of the Tax Code. The amount of the pen alty is 200 rubles. from each unsubmitted document. If the deadline for submitting certificates of form 2-NDFL is missed, Art. 126. That is, for each paper you will also have to pay 200 rubles.

Important moment

In case of untimely submission of the declaration on f. 3-NDFL, when the payer is an individual, he may be charged a fine under Art. 119 NK. At the same time, even a small amount from which the agent forgot to withhold the mandatory payment to the budget can become the reason for the recovery. In this case, it will be absolutely unimportant whether the payer himself knew about it. The tax agent must notify the individual and the inspectorate of the impossibility of withholding. But not everyone does it. According to subparagraph 4 of paragraph 1 of Art. 228 of the Tax Code, citizens who receive other income from which personal income tax has not been withheld must calculate and pay in accordance with the amounts of such receipts. The fact that the payereven has no idea that he has such a duty, does not relieve him of responsibility.

Letter from the Ministry of Finance

The fact that the payer, who did not even know that he had to make some deductions from his income, may be charged with a fine, is evidenced by the explanation of the Ministry of Finance. In particular, the Ministry of Finance writes that under Art. 226 (clause 4) of the Tax Code, the tax agent is obliged to withhold the calculated tax amount directly from the income of payers when they are actually paid. Clause 5 of the same article provides that if it is impossible to do this, the subject is obliged, no later than one month from the date of the end of the period in which these circumstances occurred, to notify in writing the individual himself (from whose income the deduction is made) and to the control body (FTS). At the same time, the obligation to calculate and pay personal income tax, as well as to submit a declaration, rests with the payer.

Exemption from punishment

To bring the person who received the income to responsibility, the Federal Tax Service should prove the fact that the violation took place. The supervisory authority should find out what actions/omissions resulted in non-compliance with the requirements. In Art. 109 of the Tax Code provides that if the subject is not guilty of committing a violation, he cannot be held accountable. In Art. 111 of the Tax Code establishes the circumstances under which Art. 109. This means that if the payer has not been notified by the agent of the impossibility of making a withholding, then the question ofsentencing is decided on the basis of his guilt.

Exceptional circumstances

The payer may violate the provisions of the law due to:

- Major circumstances, natural disasters and other emergencies.

- Being in a state in which the subject could not be aware of his behavior or direct his actions, due to illness.

- Execution of written explanations on the issues of calculation, payment of mandatory contributions or other situations related to the application of the provisions of the Tax Code, which were given to the subject personally (or related to an indefinite circle of persons) by the Federal Tax Service or another authorized body within their competence.

- Other circumstances that may be recognized by the tax authority or the court as excluding guilt.

This list, despite the presence of paragraph 4, is considered by many officials to be exhaustive. In this regard, payers who did not submit a declaration under f. 3-NDFL, are fined on the basis that ignorance of the law does not exempt from liability. In such cases, experts recommend requesting a 2-NDFL certificate from the company that paid the salary or other income. The information that will be present in the document will show whether the tax was withheld from these receipts.

EUND

A single declaration is submitted by those entities whoseduring the tax period there was no movement of funds in the accounts. In this case, we are talking not only about income, but also about expenses. If, after reporting, it was found that the company carried out a business transaction, for example, the shipment of products, it must submit updated documentation.

But the control body sometimes does not accept this reporting, requiring the presentation of the primary. In such situations, the Federal Tax Service may impose a fine for late submission of a VAT return. As the authorized authorities explain, the EUND is submitted in accordance with paragraph 2 of clause 2 of Art. 80 NK. If an enterprise does not perform transactions that result in the movement of funds in bank accounts or cash, it has the right to file a simplified (single) one instead of declarations for each tax. If an object of taxation is found for the period in which the reporting was submitted, the payer has an obligation to make changes to the documentation and submit it in the manner prescribed in Art. 81. If the subject has done this, then he cannot be charged with a fine for late submission of the VAT return. Such reporting will be considered updated.

Timing

A separate case was considered above, when a fine for late submission of a VAT return cannot be charged. In 2015, the amount of pen alties did not undergo any changes. The legislation, however, sets the time limits after which the amount may increase. So, for example, the pen alty for late submission of the VAT return in 2015year was 5% of the imputed amount of the fee, but not less than 1000 rubles. This value was set for entities that missed up to 180 days from the date of reporting. This period is also set for other charges. For example, the pen alty for late submission of the declaration on the simplified tax system for 2014 was also 5% of the imputed amount, but not less than 1000 rubles. If the payer does not submit documents for more than 180 days, then the percentage increases significantly. This order also applies to each imputed fee. For example, the pen alty for late submission of the transport tax declaration will be 30% of the deduction amount. Here, too, the size of the sanction should not be less than 1 thousand rubles.

Can sanctions be reduced?

The legislation provides for cases when the payer can reduce the amount of the fine. They are established in Art. 114 NK. For example, a fine has been imposed for late submission of a land tax declaration. The Federal Tax Service, as a rule, calls the payer with a notification. In the inspection, the subject gets acquainted with the act of verification against signature. After the payer has signed this document, he has two weeks to apply for a reduction in the imputed amount.

Extenuating circumstances

The pen alty for late submission of VAT returns in 2013, as well as in 2016, can be reduced by at least half. In part 1 of Art. 112 the following conditions are provided:

- Difficult family or personal circumstances.

- Committing a violation under the influence of coercion or under the threat of service, material or other dependence.

- Difficult financial situationpayer who is held liable.

- Other circumstances that will be recognized by the Federal Tax Service or the court as mitigating.

What are the last factors? For example, the most common circumstances that reduce the pen alty for late submission of the UTII 2014 declaration were:

- Commission of the first violation of Tax Code.

- The subject has dependents. In addition to minors, they include children under 23 years old if they study full-time.

The more circumstances are indicated, the higher the likelihood that the amount of the pen alty will be reduced by more than half. For example, in practice there are many cases when the fine was reduced by 4 times.

Other measures

In addition to a monetary recovery, the tax service may freeze the subject's bank accounts. This opportunity is provided by the Federal Tax Service in accordance with Art. 76 NK. Paragraph 3 of this article establishes the right of the inspectorate to suspend operations on accounts in the payer's bank if the declaration has not been submitted after 10 days after the date stipulated by law. It should be said here that all debit transactions are blocked on the account. That is, you can deposit funds.

At the same time, the legislation establishes the priority of collecting funds from the debtor. The fine imposed by the tax authority is in the third order. The decision to cancel the blocking must be made no later than 1 day after the submission of the declaration.

Controversial issues

In the new edition of Art.119 of the Tax Code establishes that the pen alty for late submission of the declaration is calculated based on the amount of tax not paid within the period specified by law. This provision was absent in the previous article, which gave rise to controversy. It was not entirely clear at what point the sanctions should be determined - on the day the deadline expires or the actual submission of reports. If the tax was paid in full, but the declaration was not submitted, then the fine will be 1000 rubles. If part of the amount was deducted, the amount of the sanction is determined by the difference between the actually paid and the imputed amount of the mandatory payment.

Conclusion

The tax legislation clearly sets the deadlines for filing a declaration. Such strict regulation is due to the fact that mandatory contributions from individuals and legal entities make up a significant share of budget revenues. Accordingly, the state seeks to ensure proper control over the timeliness of receipts. Violations, as can be seen from the article, can be caused by different circumstances. The law, of course, provides for payers certain opportunities to reduce sanctions. In addition, the Tax Code establishes a number of responsibilities for control bodies. But as practice shows, circumstances are often not taken into account. In this regard, it is better to do everything on time: how to pay taxes and file reports on them. In this case, there will be no proceedings and problems.

Recommended:

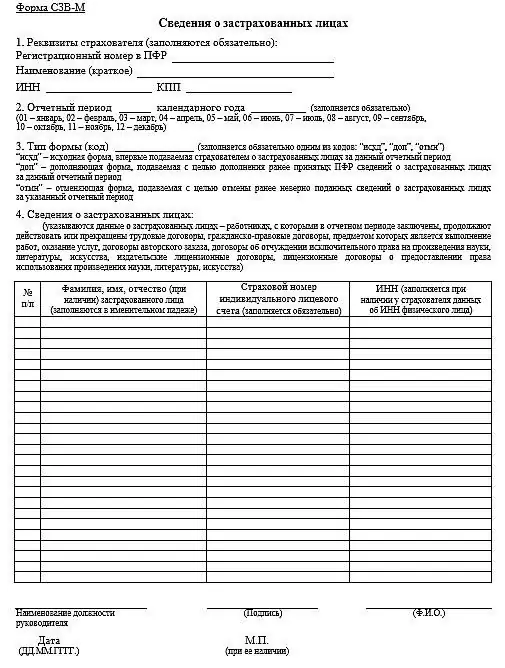

Report on the SZV-M form: how to fill out, who is obliged to hand over, a pen alty for late delivery

The article describes how to fill out the SZV-M, what information is entered into this document, and also when and in what form the report is submitted to the PF department. The main mistakes made by employers are given, as well as what fine is paid for the identified violations

Pen alty for late insurance in 2015

According to the law, every car owner must insure his car every year. A mandatory policy that must be purchased is OSAGO. However, some unscrupulous drivers are in no hurry to renew a new contract and continue to drive on roads with an expired document

What is a pen alty? Pen alty: definition, types, features and accrual procedure

In case of violation of contractual obligations, Russian legislation provides for a special type of pen alties. Such a concept as a pen alty serves as a regulator of compliance with the deadlines for the transfer of tax payments, utilities and many other obligations

Sold the car, do I need to file a declaration? Machine sale declaration

What to do when you've sold your car? Is it necessary to file a declaration for such a transaction? How to do it if needed?

How to fill out a VAT return? Calculate VAT. Completing a VAT return

implementation. Therefore, you need to know how to fill out a VAT return. What is VAT? If you tell the layman in simple words what VAT is, it will look something like this: this is a type of tax paid by a manufacturer to the state for creating (or selling something created by others) a product from which he will then make a profit, exceeding the cost of its production.