2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-06-01 07:12:56

Breach of contract

In the event of a delay in fulfilling the obligations assumed under the contract, the party in relation to which this violation took place can count on the payment of a pen alty in the form of a pen alty or a fine. It is charged for each overdue day after the end of the time stipulated by the contract. And its size is set according to one three hundredth of the refinancing rate of the Central Bank of the country, effective on the day of payment. The violator of his obligations will be released if he can prove that the delay was not due to his fault, but due to the intervention of a third party, natural disasters and other unforeseen circumstances. In addition, the provisions on the pen alty in the contract are its necessary elements, since they are stipulated by the legislation of the Russian Federation.

Temporary measurement of charges for breach of contract

Days of delay are calculated after the end of the last day of compliance with obligations under the contract. After their implementation, the delay ceases to count from the moment specified in the act of implementationobligations. If the obligations have not been fulfilled, and the party due to which the violation of the agreements occurred is ready to pay the invoice for the pen alty, then the date for drawing up the invoice is the final term for paying the pen alty.

Calculation of the pen alty at the refinancing rate

The sum of the balance of undelivered goods or services not provided is an indicator of the size of the obligations, according to which the value of unfulfilled obligations is measured. In cases where the contract is partially executed, the calculation of the pen alty at the refinancing rate is carried out according to the difference in the price under the contract and the amount of services or goods received. That is, unfulfilled obligations are measured in their material compliance (in units, pairs, kilograms, etc.) with the price expression stipulated by the contract, whether it is a completely unreceived goods until a certain point of cooperation or several minor points of the contract not fulfilled.

How to calculate the pen alty at the refinancing rate

To carry out the operation of determining the exact amount of payment of the pen alty according to the refinancing rate, it is necessary, taking into account the period of outstanding obligations, to take into account the size of the rate from the first day to the last, as well as any changes over time. Thus, if the pen alty period is 100 days, for which the rate was 6.5% for the first 25 days, 7% for the next 50 days and 7.2% for the remaining 25 days, then the average rate will need to be calculated as follows:

(6,5×25+7×50+7, 2×25)/100=6, 92

Calculation of the pen alty at the refinancing rate with an already determined percentage, regardless of current changes throughout the period of default, should be carried out according to the formula:

A=B×((SR/300)/100)×D;

Where:

A - the amount of the pen alty;

SR - refinancing rate;

B - the amount of outstanding obligations;

D - the number of days overdue.

The elements in the formula are extremely clear and logical for most members of modern society who have the opportunity to conduct business relations. It uses the intuitive calculation of the pen alty at the refinancing rate. Which, in turn, is a kind of percentage tool for measuring financial values, depending on market fluctuations. In addition to calculating the pen alty, it is customary to use it when determining bank rates, tax interest, coefficients of loan agreements and other operations that require the objective intervention of measuring units adapted to market conditions and its fluctuations in different time periods.

Recommended:

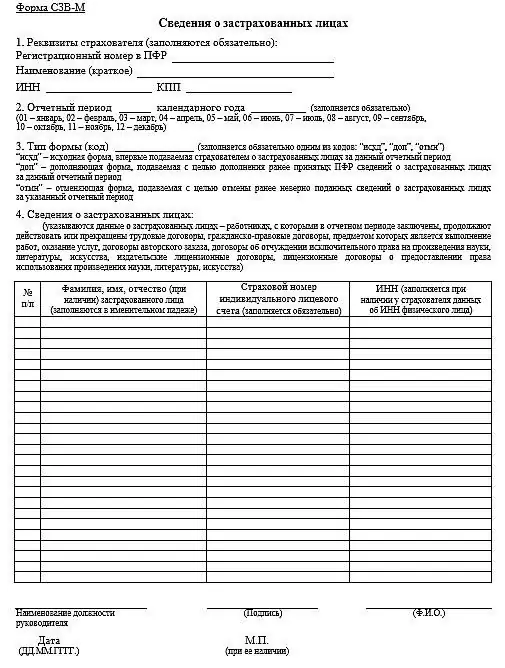

Report on the SZV-M form: how to fill out, who is obliged to hand over, a pen alty for late delivery

The article describes how to fill out the SZV-M, what information is entered into this document, and also when and in what form the report is submitted to the PF department. The main mistakes made by employers are given, as well as what fine is paid for the identified violations

Pen alty for late insurance in 2015

According to the law, every car owner must insure his car every year. A mandatory policy that must be purchased is OSAGO. However, some unscrupulous drivers are in no hurry to renew a new contract and continue to drive on roads with an expired document

What is a pen alty? Pen alty: definition, types, features and accrual procedure

In case of violation of contractual obligations, Russian legislation provides for a special type of pen alties. Such a concept as a pen alty serves as a regulator of compliance with the deadlines for the transfer of tax payments, utilities and many other obligations

CTP pen alty: how to calculate?

Since 2014, changes have been made to the legislation. Now insurance companies that violate the terms of payment of compensation are obliged to pay a pen alty for OSAGO. Its size depends on the amount of payments and the timing of the delay. For more information on when it is applied and how the pen alty for OSAGO is calculated, read on

Pen alty for late submission of the declaration. Pen alty for late submission of VAT returns

Today there are quite a few tools that an accountant can use. However, in practice, there are malfunctions in the functioning of the software, a human factor, various unforeseen circumstances that lead to a violation of the requirements of the NDT. Accordingly, non-compliance with the requirements of the law implies the application of sanctions to the perpetrators. One of them is the pen alty for late submission of the declaration