2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:41

For many people, the fact that part of the money spent on education can be returned to your wallet is still unknown. How do I get a tuition tax deduction? Now we will consider in detail in what cases it is due, what maximum amount you can count on, and what actions you should take.

So, the tax deduction for training in a driving school or any other is finance in the form of personal income tax, which can be returned to the personal budget. How is the maximum amount calculated? Calculate your total income for the year before taxes and take 13% - this is the tax you paid, it is also the maximum possible amount of the social deduction. How do I get a tax deduction for tuition with this money? Calculate how much you spent on education during the same year and take 13% of it. If the received number does not exceed the previous one, then that is how much you will be reimbursed, if on the contrary, you can only count on the maximum value of taxes paid. It can be said that the deduction is paidfrom your funds that were received in the budget in the form of personal income tax, you will not be able to receive more than you have.

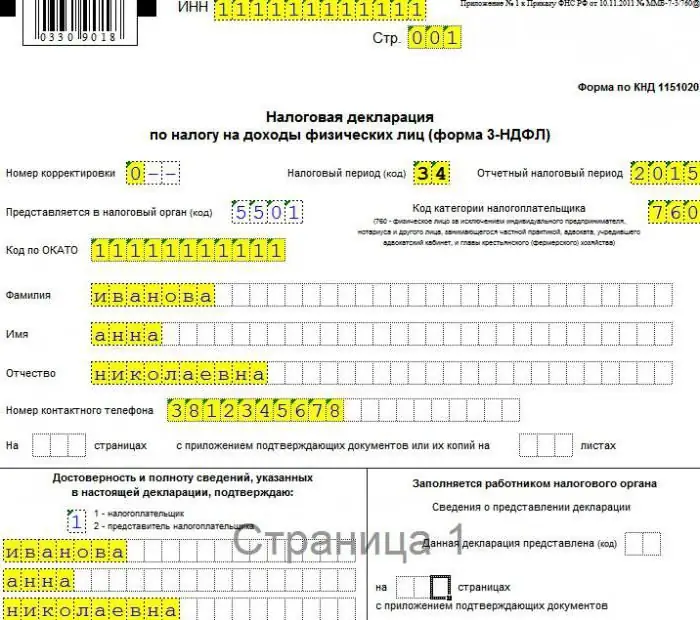

There are some more features. Firstly, the educational institution with which the contract is concluded must necessarily have a license. How do I get a tuition tax deduction? Collect the necessary package of documents (an application for a deduction, the second for a tax refund, a copy of the agreement with the educational institution and its license, payment documents for payment, a certificate of completion of training and 2-personal income tax for you). You must contact the tax office before the expiration of three years from the date when the training took place. That is, it will not work to get a deduction for the first year, when a young person has already graduated from a university. Therefore, do not postpone the issue for a long time, contact the tax office every year.

Every citizen of the country has the right to a deduction. This includes: own education (any); study of native children (full-time, until they reach the age of 24 years); education of children in care (full-time, up to 18 years old) or previously in care (full-time, up to 24 years old); education of siblings (full-time, up to 24 years). There is no deduction for the education of a husband or wife. They must apply for it themselves. The right to deduction is canceled if maternity capital funds were used or the employer paid for the training (except for the situation when the employee later returns the amount paid from the salary, for example).

How to get a tax deductionfor studying? Payment is made only for the period in which the amount of tuition was paid. If it was paid at a time for all years and 13% of the fee exceeds the allowable threshold, the remainder of the deduction burns out and cannot be received in another year. Therefore, think over the question in advance. It may be worth paying tuition fees for courses and submitting an application to the tax office annually. If the contract is concluded between the educational institution and the parent, and the payment receipt is issued in the same name, there will be no problems. If all documents are issued in the name of the child, the father or mother will have to prove the right to the deduction in court. Therefore, immediately draw up an agreement for one of the parents, so that later there will be no unnecessary questions from the tax office.

Can I get a tax deduction for studying at a driving school? You can, under the same conditions.

Recommended:

Three options when you can return the tax deduction for tuition

The Tax Code of the Russian Federation provides for a social deduction for tuition - the return of part of the tax-free funds paid. An officially employed person has the right to submit a declaration to the tax office and return the money in the amount of 13% of the cost of his education. Money can be received only if a person constantly transfers personal income tax in the amount of 13% of all types of earnings

Study tax deduction: not as difficult to get as it might seem at first glance

Most of the population regularly pays income and other taxes. Few people know that some of them can be returned in the form of compensation for the purchase of real estate, medical treatment, and expensive education. You can find out who is en titled to a tuition tax deduction, and how to get it, by reading the article

Required documents for the tuition tax deduction: list and requirements

Tax deductions in Russia are provided for a variety of expenses. For example, for education. This article will talk about how to return part of the money spent on studying in Russia

Application for a refund of personal income tax for education: when you can get it, the rules for applying for a tax deduction

Getting tax deductions in Russia is a very simple process. This article will tell you all about how to get a tuition deduction and apply for a refund of the money spent

What can I get tax deductions for? Where to get a tax deduction

The legislation of the Russian Federation allows citizens to apply for various tax deductions. They may be related to the acquisition or sale of property, the implementation of social protection mechanisms, professional activities, training, medical treatment, the birth of children