2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:39

Almost every modern bank offers its customers a set of online services that provide remote access to their accounts and allow them to manage financial flows from anywhere in the world.

The convenience of such offers is ensured by the fact that a person does not have to visit branches of a financial institution or go to a terminal to perform certain banking operations. The main disadvantage is that within each bank only its own set of offers is available, limited by agreements with partners. Users of the service have to look for a financial institution whose services will best meet their needs. As an option - to adapt your needs to the capabilities of a particular institution. A completely different thing is a universal banking application called uBank. What's this? Let's try to figure it out below.

What is the uBank financial app? General information

UBank is a universal mobile application that allows you to control your finances at any time. It makes it as easy as possiblemaking online payments. The software is adapted for electronic payments and payment for specific services.

Let's take a look at the application in general. It has a universal Internet banking format that allows you to manipulate all accounts, credit cards and electronic wallets, regardless of which payment system or bank they are linked to.

Considering the uBank application, what it is and what its capabilities are, it is worth talking about the comprehensive security of each payment and about saving on paying for certain services and goods. Despite the fact that the service removes a certain percentage of the commission for all manipulations, it simultaneously offers a wide range of promotions and discounts.

App Features

The most extended list of services and offers is one of the features of the uBank application. What it is and what it includes, we will consider below. Each participant of the universal financial system can pay for the services of Internet providers and mobile operators, housing and communal services and traffic police fines. The software opens up opportunities for shopping in online games. Members of the system can make transfers to other users. Invoices are issued in a similar way. The uBank app has a simple interface and a modern, minimalist style. Downloading and using the app is absolutely free.

Priority Goals

Development of full-fledged and mobile B2C and B2B payment-type solutions,which are able to meet the needs of modern users not only in terms of ease of use, but also depending on the list of available services and offers, is one of the main tasks of creating the uBank application. What it is is already obvious, but the benefits should be mentioned separately:

- Comfortable and simplified work with credit cards and e-wallets.

- Comprehensive payment security.

- Open registration via mobile phone.

- Unhindered access to the full list of transactions performed.

The team of specialists who developed the application set themselves a simple, but at the same time multifaceted goal. She sought to create a universal language of communication between buyers and sellers, which, in principle, was achieved.

Technical side of the issue

The uBank app is what people used to call an innovative online banking system. It is designed for smartphones that operate on iOS, Android and Windows systems, and is also installed on Samsung, Fly and Huawei devices, which are common in Russia. The program is available in the offer store for every smartphone owner.

Software for iOS is effective in combination with operating system version 6.1 or higher. The program is adapted for Android, requires an operating system of at least version 2.2.3. The software format for Windows is compatible with OS versions 7.5, 8 and 8.1 and has significant external and functional differences.

uBank, reviewswhich is only positive due to its versatility, has a certain similarity with the standard applications of banks. But if in the latter it is customary to enter an account or card number as a user identifier, then in this situation the binding is carried out directly to the mobile phone number.

What does the system user see?

The first window that opens in front of the user presents detailed information about the balance of the client's account in the system. Here you can also get data on the status of your card accounts, on the latest transactions and on payments of the system as a whole.

Considering the question of what uBank is on a phone, it is worth mentioning two formats for working with this application:

- The card is linked to the account for making through payments. When making a payment, a commission is charged from the client's account of the system, but in fact the payment is made through the linked card.

- Operations are carried out directly from the account in the system, after the user of the application replenishes it from the card or by any other available method.

Features of using a virtual bank

By using one of the schemes, you can send funds to a variety of services, to any financial institutions, to any card accounts. To bind a card, it is enough to take a picture of it using the camera in the application. Alternatively, manual deposit is available. When making each payment, the system requests a CVV code, which guarantees an additionalprotection. To connect the card to the account, one monetary unit is debited from it, which, after binding, is returned back.

Commission within the system

Some services are paid without commissions, but for certain manipulations, a fee of two percent of the amount may be charged. It is worth paying attention to the fact that some banks charge a fee for crediting money to a card account. This feature is beyond the responsibility of the system, and at the moment it is better to clarify the features of the service directly at the bank, including when applying for large loans.

The uBank app, which is always positively reviewed due to its convenience and flexibility, does not charge for internal transfers made in favor of any person whose number is in the phone book (provided that this program is already installed on the smartphone).

Summing up. Overall App Rating

After a detailed examination of the program, it becomes quite obvious that questions about how to install or how to remove uBank from your phone cannot be called difficult. Everything is intuitive and clear. In comparison with other payment systems in uBank, everything is implemented as simply as possible and is focused on a wide range of users.

It is worth mentioning that there are a huge number of additional offers, in particular, you can set up a regular payment or a payment history that allows you to control your financialflows. Each operation is transparent, simple and understandable, completely devoid of the possibility of random conduct. Updates are regularly released that make the software even more convenient for everyday use.

Recommended:

How much does a re altor earn in Moscow? How much does a re altor charge to sell an apartment?

Dealing with real estate issues, each client is faced with the same pressing issue. Do it yourself or seek professional help from a qualified re altor? The real estate market is so complex that it is difficult for an inexperienced buyer or seller to navigate it

Work permit for work in electrical installations. Rules for work in electrical installations. Work permit

From August 2014, Law No. 328n comes into force. In accordance with it, a new edition of the "Rules on labor protection during the operation of electrical installations" is being introduced

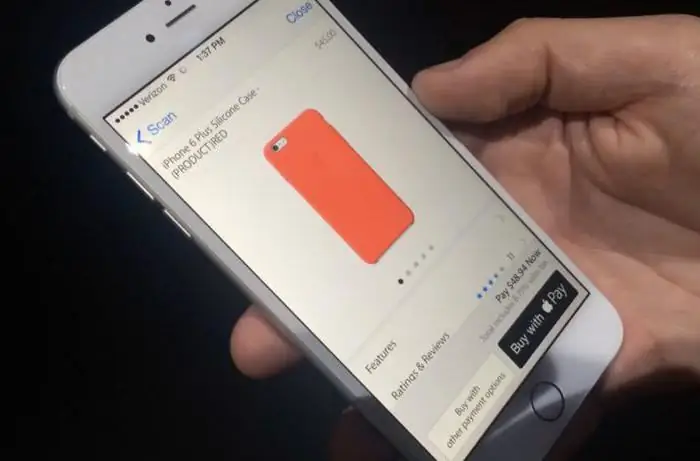

How to pay by phone in a store? Pay for purchases by phone instead of a bank card

Modern technologies do not stand still. They develop so fast that many people simply do not have time to understand them

Why does the ruble depend on oil and not on gas or gold? Why does the ruble exchange rate depend on the price of oil, but the dollar exchange rate does not?

Many in our country are wondering why the ruble depends on oil. Why is it that if the price of black gold decreases, the price of imported goods rises, is it more difficult to get out to rest abroad? At the same time, the national currency becomes less valuable, and with it, all savings

Insurance company "Cardif": reviews, recommendations, hotline phone, addresses, work schedule, insurance conditions and insurance tariff rate

Reviews about the Cardiff insurance company will help potential clients of this company figure out whether it is worth contacting it for services, what level of service they can expect. Choosing an insurer is a responsible and important task that must be taken with all due attention, because your decision will determine whether you can promptly receive payment in the event of an insured event or you will have to litigate for a long time, defending your rights