2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:39

SMA indicator is one of the simplest and most accessible for trading in all financial markets, including binary options. It is already available on almost all platforms, since literally all traders use this indicator at least from time to time in trading, even those who have been trading for many years. SMA is an abbreviation of the English name simple moving average, which means “simple moving average”.

What is a moving average

The name accurately reflects the method of drawing a smooth line on the chart using the mathematical calculation of a simple arithmetic average of the price over a certain period. At each point in time, the sum of the values of the last n candles or bars is taken. For example, if we are on a daily chart, then the total price value for the last n days is taken and divided by the number n, which the trader sets independently in the indicator settings.

BOn the Metatrader 4 platform, the period of the SMA indicator is practically unlimited, since there trading is also carried out on the long term, that is, on large timeframes, where the optimal moving average with a period of 200 or even more. Binary options platforms usually have a limit. For example, the SMA indicator in the "Olymp Trade" cannot be built with a period greater than 60. This limitation does not reduce trading opportunities in any way, since most binary options traders trade short-term and a larger value of n is simply not needed.

In the settings of the SMA indicator, there is also an opportunity to specify the price value by which the indicator will be calculated. This can be the opening price, closing price, arithmetic average or weighted average for the candle or bar period. The closing price is the most commonly used in trading as it is of particular importance in making trading decisions.

History of occurrence

The SMA indicator first appeared in the 60s of the last century and became very popular with traders, which certainly had a hand in such famous people as James Hurst and Richard Donchian. It is the latter who is credited with authorship back in those days when he worked in investment funds and was fond of trading on the international currency market. By the way, the passion for trading came to him after reading the famous book by Jesse Livermore "Memoirs of a stock speculator". And although the book was written at the beginning of the last century, many successful traders today recommend reading it.one of the first.

When Donchian, along with many other traders, suffered a crushing fiasco in trading during the crisis of 1929, he decided to reconsider his attitude to trading and began to develop a trading system using indicator analysis. And the basis of this system, which was called “trend following”, was precisely the moving averages.

The well-known all over the world "turtle" system is based on the same indicator, which brings even a small but stable profit. James Hurst also developed his own moving average trading system. It is described in his book en titled “Magic Market Timing Returns in the Stock Markets.”

What does the SMA indicator give

The main purpose of a moving average is to visualize the current market trend. It would seem that the trend can be seen without any lines - the price goes either up or down, respectively, the trend is up or down. But not everything is so simple, and SMA allows you to more accurately determine the location of the price at the moment, and also simplifies decision making. The simplest thing to consider when looking at the moving average indicator on a chart is the position of the price relative to the indicator line.

For example, an indicator with a period of 200 is popular in long-term trading, and if the price on the weekly chart is higher than SMA200, then it is recommended to look for a buy entry into the market. And vice versa. On the daily chart, to make such decisions, it is better to use the SMA witha period of 50. In general, many traders choose the indicator period themselves for different assets and different timeframes. In any case, it is not recommended to use it in trading on a real account without testing the strategy.

What are moving average trading strategies based on

There are many strategies based on the SMA indicator. But all of them somehow come down to two options:

- trading on the rebound from the moving average;

- Trading on the breakdown of the moving average.

Each of these options can be customized depending on the period, timeframe, etc. For example, the simplest way to trade is to enter a trade when the price crosses the indicator line on the chart. If the price crosses the line from the bottom up, we buy a Call option, and vice versa. The intersection is considered completed if the candlestick or bar closes behind the indicator line.

False signals and how to avoid them

However, when trading with moving averages, many false signals will invariably appear. To filter them out, someone uses additional indicators from another group, such as oscillators. Another filtering option is to wait until the price not only crosses the indicator line, but also fixes in a new place.

Since the SMA indicator is a trend indicator, it starts to give false signals during a flat. We define a flat when the SMA line takes a horizontal position or close to it. Flat is easier to determine when onOne chart uses several indicators with different periods. If all the lines converge, the price enters a flat and it becomes impossible to trade based on the SMA readings.

Despite the fact that there are universal strategies based on movings, you should always remember a simple rule. The more accurately the SMA indicator is configured for a particular instrument and timeframe, the better the trading results will be. Here are some examples of SMA-based strategies for binary options trading

Trading on a pullback

It is often said that the SMA line becomes support or resistance at different stages of market development. It is this postulate that forms the basis of the pullback trading strategy. At the same time, the words “support” or “resistance” should not be taken literally. In fact, no line is able to influence the price behavior, the price is influenced by traders who massively use indicator tips. So, let's see how to use the SMA indicator on the price rollback from the moving line.

Select the SMA period equal to, for example, 50. The 50-period indicator, popular among traders, is likely to show good results on many timeframes and instruments. We are waiting for the price to approach the moving average and act depending on how it behaves. If the candle did not break through the line, but closed on the same side, then we look at what the next candle will be. It should close in the opposite direction. This will most likely mean that the price bounced off the moving average and went toreverse side.

This 50-period MA strategy shows good results on the 15-minute timeframe. The deal is concluded after the closing of the pivot candle. The expiration time is 6 candles, that is, an hour and a half. A significant drawback of the strategy is rare signals. You can increase their number by trading on several assets at the same time.

Two moving average strategy

Periods can be selected independently for each asset. But there are SMA indicators for binary options with such periods that show good results on different instruments. For example, SMA with periods of 5 and 25. We buy a Call option when SMA 5 crosses the SMA 25 line from below and vice versa. Expiry time 4-6 candles. We remind you that the strategy must be tested on a demo account before moving on to real trading.

The disadvantage of the strategy is the same as the previous one - signals appear infrequently. The following strategy based on the SMA indicator for binary options, which requires four moving averages to be drawn on the chart, does not have this drawback.

4 SMA strategy

Take SMA with periods of 5, 21, 55, 89. We mark them on the chart with different colors. And there are three types of signals here:

- SMA5 crosses SMA21, call or put option depending on the direction of the cross, expiration 1-2 candles;

- SMA21 crosses SMA55, expiry time 4-6 candles;

- SMA55 crosses SMA89, expiry timeextends to 24 candles.

For all strategies based on moving averages, it is better to choose volatile assets and trade during the European and early US sessions.

Recommended:

Momentum indicator: description, configuration and use, methods of application

The probability of trend continuation can be predicted by assessing the intensity of trading. The strength of a market movement is often referred to as momentum and there are a number of indicators designed to measure it. The Momentum indicator helps identify when players have bought or sold too much

WACC - what is this indicator? Concept, formula, example, use and criticism of the concept

Today, all companies use borrowed resources to some extent. Thus, they function not only at the expense of their own funds, but also credit. For the use of the latter, the company is forced to pay a percentage. This means that the cost of equity is not equal to the discount rate. Therefore, another method is needed. WACC is one of the most popular ways to evaluate investment projects. It allows you to take into account not only the interests of shareholders and creditors, but also taxes

How to use the MACD indicator in the Forex market

MACD indicator is without a doubt one of the most popular trading tools in the Forex market. Proper use of this indicator allows you to determine the direction of the trend and timely show a possible entry point to the market

ADX indicator. ADX technical indicator and its features

ADX-indicator is a unique trading tool that allows you to determine the strength of a trend. It gives clear signals to traders about the time to enter and exit the market

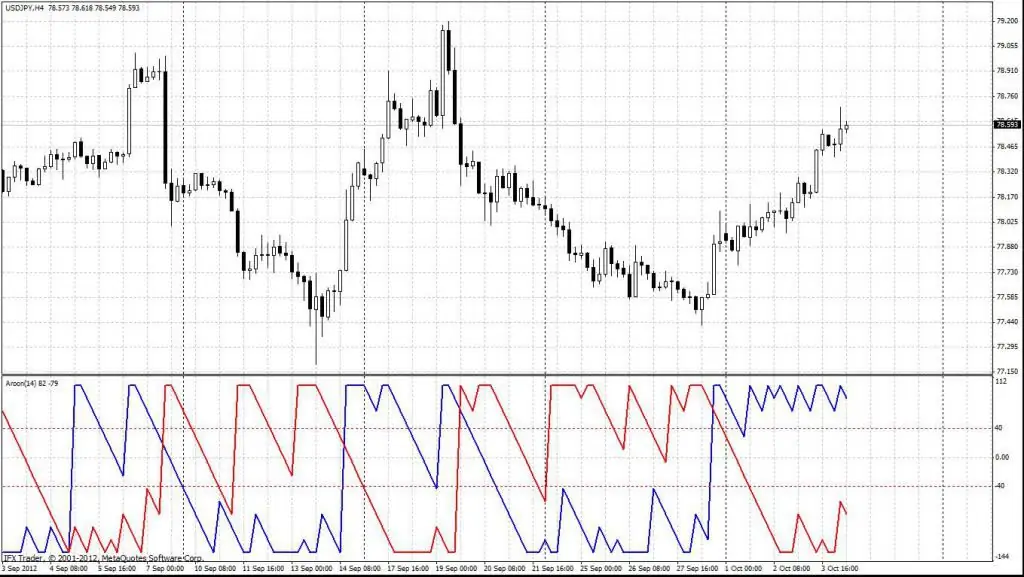

Indicator Aroon: description of the indicator, application in trading

The Aroon indicator is a great tool that every trader should have in their arsenal. It is a visual representation of the market movement that can be easily interpreted to make decisions according to price direction and momentum. You can also significantly increase the chances of a profitable trade if you build a trading technique around Aruna in combination with a breakout strategy or any other based on price movement