2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:39

It would seem that it is worth getting a loan? Find a suitable bank program, collect the necessary documents - and now the money is already in your pocket. But in fact, everything is not so simple. Often people who see an advertisement for a particular lending program are faced with the fact that in reality the conditions turn out to be completely different, and sometimes such a discrepancy is revealed already at the stage of signing documents that a client ignorant of all the intricacies of the process can wave without looking. To minimize the risk of errors on the part of the client and to control the honesty of the bank, there is a credit broker. Reviews, who helped, what these specialists contributed to - you will find all this information further in our review. Let's try now to understand the essence of this profession.

Who is this?

In short, a credit broker is an intermediary between a bank and a potential client. His work is comparable to what re altors do: the broker looks for the best program for a particular client, while he owns information about all possible options and can explain to the client the difference betweenthem, then the broker helps to collect all the necessary documents, and at the last stage of his work, he already makes sure that the bank is extremely honest with the client.

Of course, all this can be done independently, without the involvement of a third-party specialist. But for the most part, the credit broker collects positive reviews. Those who have been helped by these specialists already understand how much the participation of a third party facilitated their relationship with the bank.

Doing what?

It is worth noting that real loan brokers who help collect the best reviews about themselves, thereby promoting their profession. A broker can be useful not only at the stage of searching for the most profitable loan program, but also if you already have a loan: a specialist will tell you whether it is possible to change the amount of payments, their schedule, and whether there are, in principle, options that will help the borrower pay off his debt with minimal loss to your budget. That is, it is never too late to contact a loan broker: even if you already have a lending program that is right for you, it is better to play it safe and consult a specialist if everything is as smooth as you think.

Pitfalls

But in any job there are people who discredit it. The profession of "loan broker" was no exception. Reviews, who was helped, how they helped - all this information can be fabricated to cover up the criminal activities of a specialist. For example, a borrower cannot rely on a loandue to low income or not very good credit history, in such cases, the "black" broker helps to hide all the unwanted nuances of the client's biography, thereby deceiving banks.

There is also the opposite situation: a broker, having an agreement with a certain banking institution, brings his clients there, even if other banks have much more favorable lending conditions. It is worth thinking twice before contacting a broker who is ready to do his job for next to nothing - this may signal that the specialist is not as clean as he wants to seem.

How to choose? Based on reviews

So how do you choose the right loan broker? Reviews, who have already been helped, location, advertising - what part of the information should influence your choice? All of the above! Now many rely on the reviews of previous customers, considering them almost the ultimate truth. Yes, you should definitely find out what other people think about this or that broker, but still you should not fully trust everything written, especially on the official website of the brokerage office. Employees of the office themselves can leave positive reviews by registering under different names, while negative reviews can be deleted. Therefore, when choosing a company based on reviews, make sure that the writing style of the latter is different (after all, all people cannot use the same sentences and phrases), in addition, along with the opinions of satisfiedclients, those who, after the work of specialists, have certain questions, should also be present.

And also look at the location of the office

As for the location of the office, you should pay attention to its "settlement". A company that has been working with clients for a long time will definitely have a landline phone number, in the office itself it will feel inhabited - after all, people eventually adjust their workplace to suit themselves. Special attention should be paid to the information stand, which should contain information about the institution's license, work schedule, the necessary phone numbers and a book of complaints and suggestions.

And pay attention to advertising

You should be even more careful with advertising: it is unlikely that ads that are printed on a black-and-white printer and glued to poles belong to a really reliable brokerage house. In no case should you trust those advertisements that promise assistance in a loan transaction on the most favorable terms only “within a week” or some other promotional time limits. This is usually how unscrupulous brokers lure gullible people in order to then run away with their money. So, when choosing a broker, check everything: what is the reputation of the credit broker (reviews, who was helped), the result of his work (whether the clients were satisfied), the location of the office and its advertising. In addition, to make a final decision, you can contact the "National Association of Credit Brokers and Financial Advisers", memberswhich are only those companies that not only have a license, but also provide really high-quality services.

Credit Broker in Moscow

How to find all the information you need: where to find such a specialist as a good loan broker, reviews, who was helped? Moscow is a city that can give quite specific answers to all these questions. Thus, Creditmart and Ideal Consulting are considered the best brokerage houses in the capital.

"Creditmart", whose branches are located throughout the city, works not only with banks, but also with insurance and investment institutions - that is, expert advice is possible in many areas. The company offers more than five hundred different programs aimed at solving the financial problems of customers - mortgage programs, lending and other banking operations. However, some clients say that the company greatly overestimates the cost of its services and requires payment for almost every step of the lending operation.

Among the approved by the National Association of Credit Brokers and Financial Advisors is Ideal Consulting, whose specialists work not only in the field of consulting, but also deal with the legal registration of logistics and customs services, as well as help in business administration. The membership of this company in ACBR (namely, the aforementioned association is abbreviated) confirms its professionalism and reliability. And versatility allows you to have a huge networkcustomers.

Services of a loan broker in St. Petersburg

Fosborne Home is the oldest credit broker in St. Petersburg. Reviews, whom they helped, how exactly they helped, what the results of the work turned out to be - satisfied customers answer all these questions with their own stories, which only confirm the good reputation of this company. Fosborne Home's field of activity is credit consulting for businesses and individuals, mortgage consulting, as well as assistance in working with real estate (both the selection of the most suitable premises and assistance in their sale). The network, which has been on the market for more than ten years, has branches in many cities of the country.

Cons of broker intervention

Now that we already have an idea of who loan brokers are, whether it is worth contacting them - that's the next question. Of the minuses of intermediary services, one can name a commission (usually it is about 2% of the transaction amount, however, in some cases the broker may request 20%, in which case, most likely, the operation will be associated with crime), and also excessive, according to some, the scrupulousness of consultants who try to collect as much information as possible about their client.

In the defense of brokers, it can be said that they are forced to be too careful, finding out every little thing that can somehow affect the receipt of a loan or mortgage.

Is the game worth the candle?

And what are the reviews about credit brokers? Are they really necessary when concluding transactions? Someexperts note that during the existence of brokers, their role has completely changed: initially, people turned to them because they did not have enough knowledge to carry out banking operations on their own. Today, clients often want to save their time - that is why they entrust the execution of all necessary paperwork to a third party.

Of course, even trusting your banking affairs to a specialist in this matter, you need to have at least the slightest idea about the loans that you are interested in: taking advantage of the client’s ignorance, an unscrupulous loan broker can easily offer far from the best option. Plus, if what the consultant offers turns out to be an unsuitable option for you, you still have to pay for the services. Yes, if you want to spend a minimum of effort, you need a loan broker. Whether it is worth contacting them for help - decide for yourself.

What do people think?

The credit broker collects the most controversial reviews about his work. Some believe that this is just extortion of money, they say, consultants themselves do not comply with all the conditions prescribed in contracts with borrowers, and they charge a lot of money for their services, transferring the client to financial institutions that issue loans at huge interest rates.

Others note that competent specialists helped them get a loan even with a not very good credit history, and generally helped them find the best option for obtaining a loan. Howpeople, so many opinions - everyone knows that. But still, it is necessary to pay attention to the feedback from previous clients when choosing a broker, as mentioned above.

Conclusion

Now we know what loan brokers are. Everyone can make up their own opinion about their need for credit transactions. Of course, among the specialists there are also charlatans who have agreements with banks and lead clients exactly there, without caring at all about the interests of the borrower, there are those who help correct all the dark spots in the credit history. What can I say, in any profession there are those who are dishonest. But still, many people agree that the advice of brokers, their assistance in preparing all the necessary papers and monitoring the process of obtaining a loan have greatly facilitated a rather unpleasant and complex banking operation. Yes, you can do everything yourself, but it is better to entrust some things to professionals.

Recommended:

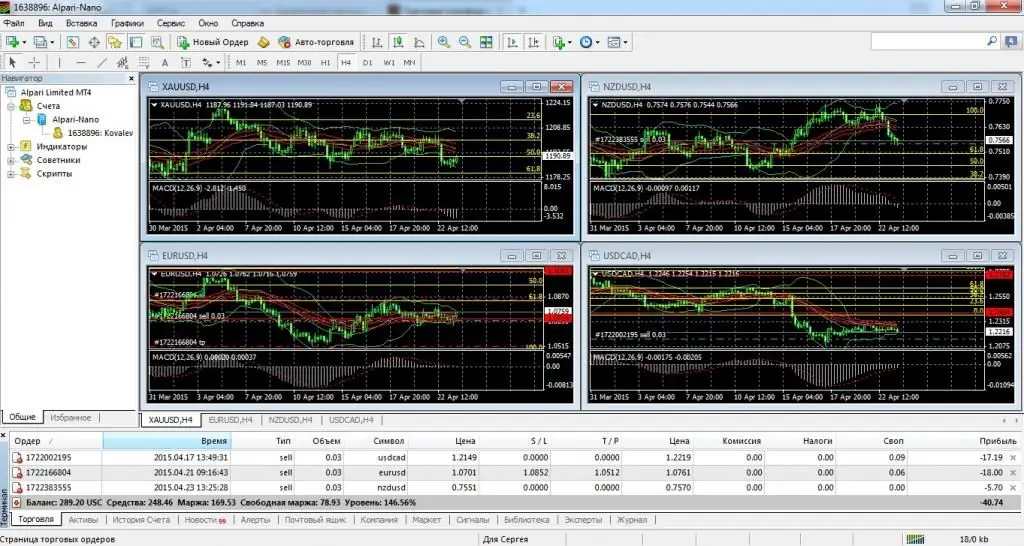

Alpari Broker: reviews, reviews, license and recommendations from experts

Reviews about the broker "Alpari" are very different. Some clients praise the company, which makes it possible to make real money in this difficult time. Others consider them almost scammers who are only engaged in extorting money from people. In this article, we will present a complete overview of the work of the broker, dwell on the advice and recommendations of specialists

"ZUS Corporation": reviews, features and services

People who feel a lack of funds are looking for part-time jobs. Some find their calling in remote work via the Internet, others fall into network marketing. In the article we will talk about one of the subjects of this market - "ZUS Corporation"

How to manage a housing and communal services management company? Licensing, organization and activities of the management company in the field of housing and communal services

Today, there is no competition in the field of housing management in the modern domestic market. And most of those companies that exist are often lacking initiative or even problematic. And this despite the fact that the management company, on the contrary, is designed to improve this area and ensure the rational use of funds. It is the question of how to manage a housing and communal services management company that this article is devoted to

"BCS Broker": reviews. Broker BCS ("BrokerCreditService"): rates, analytics and minimum deposit

"BCS-Broker" is one of the best brokers in Russia, which offers a wide range of services and opportunities. Positive customer reviews and a flexible partnership scheme are just some of the advantages of the company

Sberbank, settlement and cash services: tariffs, features and reviews

In order for financial transactions to be reliable and timely, it is necessary to choose a stable bank. After all, it will ensure the safety of storage of funds and fast speed of settlements. Such an organization is Sberbank. Settlement and cash services, the tariffs of which are very favorable, are carried out there at the highest level, as evidenced by numerous customer reviews. Read more about the service in the article