2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:41

Apply a single tax on imputed income can companies that meet certain requirements. This regime applies to small businesses and has preferential tax treatment.

What is interesting about the UTII regime and who can use it

UTII is a rather attractive regime, but, unfortunately, not all companies can use it. In order to switch to "imputation", the company needs to fulfill a number of requirements.

When planning the transition to UTII, first of all, it is necessary to clarify whether such a regime operates on the territory of the subject where the company is registered. Currently, not all cities have introduced such a regime. The following important conditions for the implementation of the transition to the "imputation" are the observance of certain parameters of the number and size of the retail space. The limit of hired employees should not exceed one hundred people, and the sales area of the premises should not exceed 150 square meters. m.

The UTII special regime was developed for small organizations in order to reduce tax and accounting obligations, so individual entrepreneurs and LLCs planning to operate on a small scale can apply for UTII. Very important,so that the company is not listed in the register of large taxpayers.

When can I apply for UTII and how to do it

In order to switch to a special taxation regime, you need to register as a taxpayer with the tax office. This is usually done at the time of filing documents for registration, but no later than five days after receiving the certificate. An application for UTII can be submitted on any day of the reporting period, but an entrepreneur will be able to use the regime only from January 1. If a company opens a new type of business, then you can switch to UTII on any day of the year.

To provide the necessary documents for the transition, you need to contact the regulatory authority at the place of business. In some cases, entrepreneurs are required to register a special regime at the place of registration of the company. These activities include advertising, distribution and passenger transportation.

Rules for filling out a transitional application for UTII

The tax office has developed an application form that is used when switching to this special regime. For firms registered as an LLC, an application for UTII 1 is used, and for entrepreneurs - a UTII form 2.

Additional delivery of registration documents is not required. The application can be submitted to the tax office by a valuable letter with a list of attachments by Russian post, sent via electronic communication channels or bring the document in person. If the UTII form is handed over by a courier, thenan officially completed power of attorney will be required.

The time limit for considering an application is five working days, after which the regulatory authority registers the taxpayer or gives him a reasoned refusal.

Setting up accounting using a special regime

Accounting and tax reporting when using UTII is simple and a small number of declarations submitted at the end of tax periods. The transition to UTII exempts companies from paying many tax payments, replacing them with a single tax on imputed income.

If a company pays wages to hired employees, then insurance premiums must be accrued from these accruals to the funds and report on them at the end of the quarter. In addition, accounting for UTII does not exempt from the submission of financial statements at the end of the year. An imputed tax return is submitted quarterly no later than the 20th day of the next month, and the tax is transferred before the 25th day of the same month.

What indicators are included in the single tax formula

The formula for calculating the final amount of tax consists of several variables and depends on the personal indicators of the company. When calculating UTII, two main coefficients are used, which are adjusted annually by regulatory authorities. In this regard, the accrued tax is constantly changing its values. In order to find out the current coefficient, you must contact the local tax office.

Also, an important role in the calculation of the tax is played by the indicator of basic income, whichestablished by the state and depends on the type of services provided.

The single tax on imputed income is the most beneficial and widespread tax regime, so companies whose activities meet the conditions of the special regime are recommended to pay close attention to it in order to optimize tax deductions.

Recommended:

Why do you need a business plan. Tasks, structure and goals of the business plan

A business plan is needed to identify the strengths and weaknesses of a product/service. It is also important for the reason that it allows you to draw up a complete and competent strategy for the development of the project, taking into account the characteristics of the market. In addition, without such a document, investors will not consider a specific idea

Toothbrush case - why do you need it and how to choose?

Toothbrush case is an item that is needed not only for travel. What is its purpose, how to choose the right case, what types exist at the moment? More on this later

UEC - what is it? Universal electronic card: why you need it, where to get it and how to use it

Surely, everyone has already heard that there is such a thing as a universal electronic card (UEC). Unfortunately, not everyone knows the meaning and purpose of this card. So let's talk about UEC - what is it and why is it needed

Do I need to pay tax when buying an apartment? What you need to know when buying an apartment?

Taxes are the responsibility of all citizens. The corresponding payments must be transferred to the state treasury on time. Do I need to pay taxes when buying an apartment? And if so, in what sizes? This article will tell you all about taxation after the acquisition of housing

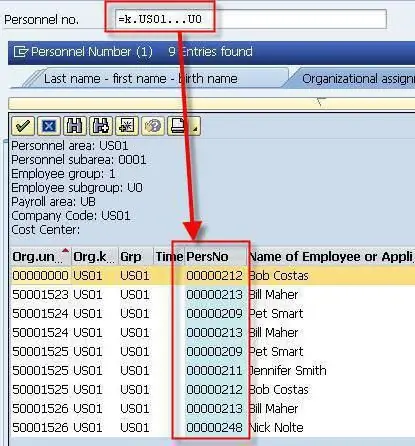

Employee personnel number: how is it assigned? Why do you need a payroll number?

Personnel number is a concept not familiar to everyone. However, most employees have it. Some employees of the personnel department have difficulty thinking about how to correctly assign this number. However, there are no difficulties in this operation