2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:41

Land tax must be paid by all land owners. It is calculated both by individuals and by various companies that own land. The process of calculating and paying the fee is considered quite simple. In addition to transferring funds to the budget, it is required to draw up and regularly submit a tax return on land tax to firms. The absence of this document becomes the basis for bringing the taxpayer to administrative responsibility. You should figure out when this declaration is submitted, how it is filled out correctly, and also what its appearance is.

Who submits documentation?

Based on Art. 398 of the Tax Code, the need to submit a declaration for land tax arises for each taxpayer of this fee, represented by a legal entity. These include companies that bought the land or received it on the right of permanent use or lifeinherited ownership.

The land tax return is considered easy to prepare, so every accountant can handle this process.

Who does not need to submit a document?

It is not required to make a declaration to companies if the land was received by them on the grounds:

- right of free use;

- right of urgent free use;

- drawing up a lease agreement, according to which, for the use of land, the company pays certain funds.

In this case, it is the owner of the site who acts as a taxpayer, therefore he must pay tax and keep records.

Additionally, the declaration is not formed by private land owners or entrepreneurs. They should only transfer funds to the budget in a timely manner.

How is tax calculated?

The rules for calculating this fee are listed in Art. 390 NK. Based on this legislative act, a predetermined cadastral value of a particular territory is applied to obtain a tax base. It is calculated and set by regional authorities.

The cadastral value changes annually from the beginning of the year, and it is allowed to change even during the year, if there are appropriate reasons for this.

If the owner of the territory believes that this figure for his land is too high, he can challenge it in court. This requiresuse the help of independent appraisers. In practice, this indicator is indeed often changed by court decision.

When calculating, it is allowed to use a tax deduction equal to 10 thousand rubles. The tax base is reduced by this amount, after which it is multiplied by the tax rate. Rates are listed in Art. 394 NK:

- 0.3% is used for agricultural land, land used for private housing or personal farming, and also includes restricted land;

- 1.5% applies to all other territories.

The calculation is considered simple, so the process does not require significant effort. Private land owners do not have to deal with the calculations themselves, since this procedure is carried out by employees of the Federal Tax Service, after which taxpayers simply receive receipts ready for payment.

Companies must handle the settlement and transfer of funds themselves.

Declaration form

It is important not only to correctly calculate and transfer the fee in a timely manner, but also to correctly fill out and submit the land tax return to the Federal Tax Service.

For this, a standard form is used, approved by order of the Federal Tax Service No. ММВ-7-21/347 in 2017. A sample land tax return is below.

When is the document submitted to the Federal Tax Service?

In art. 393 of the Tax Code additionally contains information on exactly when the declaration should be submitted to the Federal Tax Service. Deadlinetax return for land tax is the need to submit documentation quarterly, if the company transfers quarterly payments. At the end of the year, a document is formed for the entire year, which is submitted before February 1 of the next year.

In some regions, companies must pay quarterly advance payments, with the timing of their transfer set by regional authorities. In certain cities, the tax is paid in a single payment at the end of the reporting period, represented by a year. In this case, the declaration is submitted once a year.

Private land owners do not have to file a land tax return, so they only have to pay this fee. Funds are transferred until December 1 of the next year.

Where can I get the form?

The land tax return form can be obtained in different ways:

- download from the Internet, but in this case it is important to make sure that the existing document is up-to-date for 2018;

- get the document at the FTS office.

On the website of the Federal Tax Service it is possible to download various documents. This includes the land tax return form.

Document rules

Only companies have to draw up a declaration, and usually an officially employed accountant does this. The process is considered quite simple, but the rules for filling out a tax return for land tax are taken into account. These include:

- onthe formation of the document is provided only for one month, since it must be transferred to the employees of the Federal Tax Service before February of the new year;

- if the documentation is not submitted within the prescribed period, this leads to the company being held administratively liable, therefore, a fine of 5% of the calculated tax is charged for each month of delay;

- if the number of employees in the organization for the past year exceeds 100 people, then it is allowed to submit the document exclusively in electronic form;

- documentation is transferred at the location of the immediate plot of land.

The largest taxpayers must report on all taxes based on Art. 398 of the Tax Code to a special inspection department intended for such fee payers.

How to fill in?

The procedure for filling out a tax return for land tax involves the need to enter information in the title page and two sections. The title page is intended to include information about the taxpayer himself and the available land for which the fee is paid.

The first section contains data on the direct amount of tax payable. The second section includes information about the tax base, as well as the correct calculation of the fee.

Amounts are indicated exclusively in rubles, and decimal places are rounded to an integer value.

What information is included on the title page?

When filling out the first page, it is important to indicate relevantdata about the enterprise itself and the existing site. A sample of filling out a tax return for land tax is located on a stand in any department of the Federal Tax Service. If there are difficulties with the preparation of the document, then you can contact the tax service directly or use the unique services of specialized companies.

Information is entered into the title page:

- TIN of the company, as well as KPP;

- indicate the period for which this declaration is formed;

- should correctly determine the code of the department of the Federal Tax Service, where the documentation is transferred;

- enter the name of the company that owns the specific land;

- the OKVED code is prescribed, relating to the main field of activity of the enterprise.

At the end, there should be a contact phone number for a company representative so that tax officials can quickly contact him if necessary. The title page additionally indicates which sheets are filled out, as well as which documents are attached to the declaration.

If the land tax return is submitted by a representative, then the first page of the document should contain information about him.

Rules for filling in the first section

Its main purpose is to include information about the correct amount of tax calculated in the second section. Must have information:

- full amount of calculated tax;

- indicates the OKTMO code, which is determined onbased on the location of the land plot;

- represents all advance payments transferred for the three quarters of the reporting year.

If a special computer program is used to draw up a document, then all calculations are usually carried out automatically.

What data is in the second section?

The main purpose of this section is to provide information about the correct calculation of tax. When filling out this part of the declaration, the nuances are taken into account:

- if the company has several sites, you will have to fill out this section several times;

- include information about the parcel category code;

- gives data on the cadastral value of each object;

- if not the entire plot belongs to the company, then it is important to indicate exactly what share the company owns;

- if the firm can enjoy benefits, they are listed in the second section;

- in addition, information is entered on the tax rate, months of ownership of the territory within one year, and it is also indicated how much money has already been paid by the company in the form of advance payments.

Filling out the document is actually quite simple, so the accountant usually has no difficulties.

Where do I donate documentation?

The land tax return is submitted on the basis of Art. 398 of the Tax Code to the department of the Federal Tax Service at the location of the plot of land itself.

If the company is the largest taxpayer, then you need to submit reports to a special body openfor such fee payers.

Responsibility for violations

Each taxpayer must understand that he has certain obligations to the state. He is obliged to correctly calculate and pay taxes, as well as to form and submit reports on them. If the requirements of the law are violated, then firms are held administratively liable:

- if the deadlines established by Art. 119 of the Tax Code, the company pays for each month of delay 5% of the calculated tax, although such a fine cannot exceed 30% of the fee;

- if a tax-exempt company fails to submit a document, it will pay a fine of 1,000 rubles;

- in addition, officials who must pay on the basis of Art. 15.5 of the Code of Administrative Offenses, a fine in the amount of 300 to 500 rubles.

Due to the above harsh consequences, all taxpayers must responsibly approach their obligation to draw up and submit a declaration. Only companies have it, since citizens must pay taxes on time only.

Other details

If the payer of the land tax is an individual entrepreneur, then the same rules apply to him as to private owners of the territory. They are not legal entities, therefore, the calculation for them is carried out by employees of the Federal Tax Service. They only get righta completed receipt, which is paid by them in different ways. To do this, you can use terminals, bank branches or the services of postal workers.

Additionally, regional authorities may provide different types of benefits for vulnerable categories of the population. Usually, large or low-income families, the disabled or pensioners can use concessions. You can find out about the possibility of applying benefits by personally contacting the department of the Federal Tax Service at the location of the site. Such concessions can be represented by benefits or complete exemption of the owner of the territory from the need to pay a fee.

Conclusion

Land tax must be paid by all owners of territories, which may be represented by individuals or businesses. Funds must be transferred within strict deadlines. Citizens should not be engaged in calculations or filing a declaration, as they receive a correctly drawn up receipt from the Federal Tax Service, with which they pay tax.

Companies must independently calculate and transfer the fee. In addition, they have an obligation to correctly draw up and timely submit to the Federal Tax Service a declaration for this fee. The absence of a document within the established time frame is the basis for holding the enterprise liable.

Recommended:

Application for the return of loan insurance: sample, application rules, submission deadlines

In the process of obtaining a credit loan, banks offer potential borrowers to conclude an insurance contract. If the client is unable to pay off the debt, the obligation to close it to the bank lies with the insurance company. But in practice, the opposite situation often arises, and conscientious payers are wondering about the possibility of returning insurance on a loan in case of early repayment. But how much will be received? And who should give the money - the insurer or the bank?

Filling out a 3-personal income tax return: instructions, procedure, sample

Filling out a 3-personal income tax return: what does a taxpayer need to know in order to avoid mistakes? Nuances and features of reporting in the form 3-NDFL

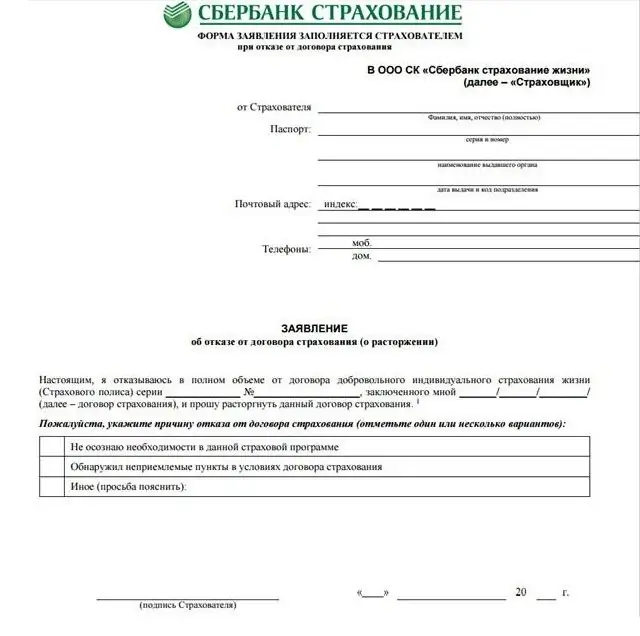

How to return insurance at Sberbank: types, procedures and a sample of filling out the form

In our time, credit institutions are actively trying to increase their profits in a variety of ways. One of them is the purchase by the client of the policy when applying for any banking service. In this regard, you need to know how to return Sberbank insurance in case of early repayment of the loan. In order to have a complete understanding of this program, you need to know what it is

Clarifying VAT declaration: sample filling, deadlines

If the declaration for the specified tax has already been filed, and the error in the calculations was discovered later, then it is impossible to correct it in the document itself. It will be necessary to submit an additionally specified VAT return (UD)

Transport tax return. Sample filling and deadlines for filing a declaration

In Russia, cars that are equipped with engines are taxed. The higher the power of the vehicle (TC), the more money you have to pay. For more information on how to make a calculation and fill out a declaration, read on