2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:41

70 million Russians use Sberbank cards. Each owner of a plastic carrier wants to be aware of account transactions. You can find detailed information using the extract. The company offers several options for making a statement on a Sberbank card.

Methods of obtaining

Obtaining information about account transactions is the right of the holder of a debit or credit card of Sberbank. The client chooses which option to use. Some forms of obtaining information are available in a limited format or are provided only at the place where the plastic card was issued.

How to make a statement on a Sberbank card:

- go to the branch;

- print from a terminal or ATM;

- call support;

- use "Sberbank Online";

- get information in the mobile application of Sberbank;

- send request to number "900".

Term of receipt of information - no more than 24 hours. The statement is provided free of charge.

Who can getdocument?

Only the owner himself can apply for a certificate from a Sberbank card. The exception is when the representative has a properly certified document.

When applying for an extract from a Sberbank card on behalf of another client, the representative must have the original permit and his passport with him. It is prohibited to use another person's cards in the terminal.

Types of certificates

Depending on the type of provision of a document with an account number in Sberbank, you can get:

- Help for a visa. It is issued on a letterhead or A4 sheet, in Russian or English (at the request of the client). An extract for a visa is paid, the cost of the service is 100 rubles. The cardholder can receive the document only at the bank office.

- Card details. In addition to the account number, the document indicates all the data for transferring to the card from an individual or legal entity. The certificate provides details for sending an international transfer using SWIFT.

- A statement for a specific date. It indicates not only the account number, but also all operations on the Sberbank card.

Sberbank credit and debit card statements differ. In the case of a credit card, customers can request not only account transactions, but also information about the reporting period and the amount of debt, the amount of the mandatory payment.

Obtaining an extract at an additional office of Sberbank

If an extract from Sberbank is required for a visa, employment orsubmission to the authorized body, it is recommended to apply for its receipt at the branch. An employee of the institution will issue a certificate within 5-15 minutes and certify it properly.

A client can receive a certificate at a branch of Sberbank only within the framework of a territorial bank. The list of cities and branches that are part of the bank at the place where the credit card was issued is listed on the official website.

When applying for an extract to another region, the cardholder must keep in mind that the term for providing the document in this case increases to 10 business days. An alternative to obtaining a certificate outside a territorial bank is an extract from a Sberbank card through an ATM or online mode.

Tips on paperwork at the branch

How to get a certificate at the Sberbank office:

- Submit your passport and card at a free window or take a service ticket (if the branch is equipped with an electronic queue).

- Formulate the purpose of the help. Depending on this, the types of statements from the Sberbank card may differ from each other.

- Check the correctness of the specified data (full name, account number, address). If a mistake is made in the document, the operator will correct the data and issue a new certificate.

Obtaining information indicating the account number (details) and operations for a certain date or period is provided free of charge. Receiving a document at the office is the only option where you can print a bank statement from Sberbank with the address of residence and other data upon requestcustomer, which the operator can dial manually. The document on the card can be certified by the seal of the institution and the signature of an authorized person in the prescribed form.

Order help through the support service

A Sberbank client has the right to use the services of a contact center around the clock. Support service operators can send information on the Sberbank card to its owner by e-mail. To do this, the cardholder must:

- Call "900".

- Introduce yourself, say the code word and card number.

- Specify what kind of help he is interested in.

- Say email details.

But such an option, how to make a statement on a Sberbank card, is only suitable if the client, due to circumstances, cannot contact the office, receive a document in the terminal or through Sberbank Online.

Provision of information is impossible if the client did not name the code word. This is confidential information that the cardholder indicated in the application for opening an account. Lost data can be restored at the Sberbank office.

An alternative to the code word is the client code. You can get it at the Sberbank terminal using a bank card.

Getting a statement in the terminal

ATMs and terminals are open around the clock. In them, the cardholder can obtain account information in any region of the country, having a plastic carrier at hand.

Unlike a request at a bank or Sberbank Online, card information in a terminal is provided on a fee basis. The client can view the last 15 transactions on the screen or print a receipt. 15 rubles will be debited from the account for providing information.

Sberbank cardholders with a balance of less than 15 rubles cannot use the service. Withdrawal is possible only with a positive account balance with an amount of 15 rubles or more.

ATM statement: instructions

How to make a statement on a Sberbank card using a terminal:

- Insert the plastic media into the device, enter the code.

- Go to the "Card information and mini-statement" menu.

- Click on the "Mini Statement" field.

- Confirm the request.

- Read the data on the screen or print the document.

It is not recommended to insert the card in a terminal where technical work is being carried out or there is no splash screen with the main menu. The device can "swallow" the card. In this case, it is subject to reissue with a replacement within 14 days from the date of application.

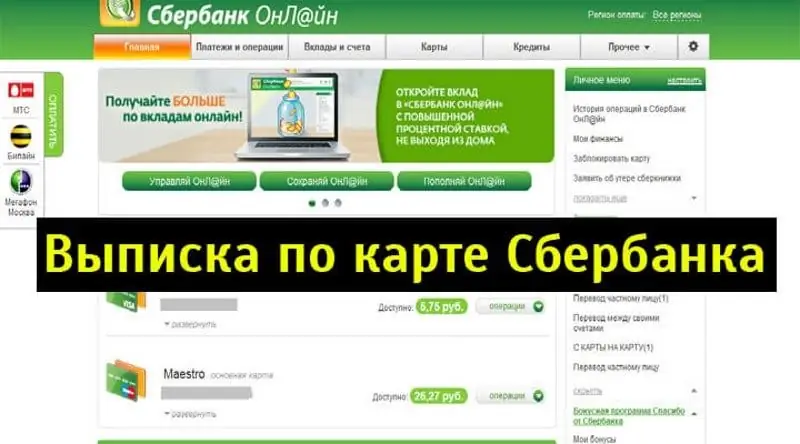

How to get an online bank statement: instructions

With the help of the "Sberbank Online" service, customers can print information on the card at any time of the day without visiting a branch. To use the application, you must register. It is free, you only need to get a login in the terminal.

The condition of "Sberbank Online" is the presenceactive service "Mobile Bank". You can print information for any period, such as a specific date or month.

How to make a statement from a Sberbank card for a month through Sberbank Online:

- Enter the app.

- Click on the card for which information is required (if there is more than one).

- Select the "Full Bank Statement" line in the "Recent Transactions" section.

- Generate the period - the last month (or click on the dates in the calendar).

- Click on "Show Statement".

In the additional window that opens, information for the specified period will be displayed. If the client needs to receive a printed format of the document, they should click on the "Print" button in the upper right corner.

Clients can get a statement through Sberbank Online at any office. You should take your card, login from your personal account and mobile phone with you.

When printing an extract at the Sberbank office, the owner has the right to ask to certify the document with the seal of the bank.

Mobile card details

The client can quickly find out the account number or get the latest data using the mobile application. To download the service, you need to use the App Store or Google Play.

After installation, the client must register, come up with a password to enter the system. After logging in, follow:

- Click on the map.

- Select the "History" tab.

- Check out the latest transactions (list below, with detailed information).

Mobile application - an option on how to make an account statement for a Sberbank card sent by mail. The client can transfer information to e-mail, social networks or instant messengers. To do this, click on "Full bank statement" in the "History" section, select the format for viewing information and where to send the information.

To access the mobile application, the client must use a smartphone. The card must be connected to the "Mobile Bank" service.

Information via SMS command

Users of the "Mobile Bank" service can request information by sending a notification to "900". The option is not to allow the document to be printed, but you can make a statement on the Sberbank card with the last 10 transactions.

Receiving help via SMS is a paid service. 15 rubles will be debited from the client's card account after receiving the information.

How to request information about recent transactions:

- Dial "Statement 1234". Instead of "1234" the last digits of the card are indicated.

- Confirm with SMS code.

Payment from the card is debited immediately after the confirmation of the operation. The number of requests that can be sent from one account is not limited. Information will not be provided if the client's balance is less than 15 rubles.

Difficulties when using USSD SMS banking codes

Sometimes the service cannot be performed even if the "Mobile Bank" service is active. This may be due to the fact that the cardholder has the "Fast payment" function disabled. It is available only in Sberbank Online.

To do this, go to the tab with customer data, find information about the "Mobile Bank". In the section with connected services to the owner's cards there is a column about "Quick payment". If it is disabled, the client will see this and can correct the situation by confirming the code from SMS.

The service can be used by clients who have any "Mobile Bank" package activated.

Recommended:

Make money on the Internet on assignments: ideas and options for earning money, tips and tricks, reviews

There are a lot of ways to make money on the Internet without investments and deception. But where and how much can you earn online? Is it necessary to create your own website? How to get the first profit? What tasks need to be completed in order to receive income, and how to withdraw money?

Sheep shearing: technology, methods of shearing, tips and tricks

A herd of sheep has always accompanied man. History does not know a civilization that could do without this animal. Useful meat is obtained from a sheep, its milk is used, and sheep's wool is used to make clothes and many household items. Since the beginning of the 21st century, sheep breeding has become a popular pastime again. People began to return to the earth, to remember many forgotten crafts. They are learning the art of shearing sheep again. Farming revived

Analysis of shares: methods of conducting, choosing methods of analysis, tips and tricks

What are stocks. How to analyze stocks, what sources of information are used for this. What are the risks associated with buying shares? Types of stock analysis, what formulas are used. What are the features of the analysis of shares of Russian companies, tips and tricks for collecting information and analyzing shares

How to replenish the Post Bank card: transfer methods, procedures, tips and tricks

Bank customers actively use debit and credit cards. It's simple and convenient. However, not everyone knows how to replenish the Post Bank card. It is worth noting that credit institutions strive to make the most attractive service for customers, the use of which will not cause difficulties

How to increase the average check: effective ways and methods, tips and tricks

The problem of how to increase the average check is puzzled by almost all entrepreneurs working in various industries. After all, the final income of a businessman, the success of his enterprise directly depends on this. In this article, we will provide general tips to help you do this, as well as analyze some examples in specific industries