2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:27

Bank customers actively use debit and credit cards. It's simple and convenient. However, not everyone knows how to replenish the Post Bank card. It is worth noting that credit institutions strive to make the most attractive service for customers, the use of which will not cause difficulties.

Translation methods

Let's list the most popular methods used by customers.

- ATM "Post Bank" or VTB.

- Online translation.

- Payment system.

- Post Office.

It is worth noting that all methods are relevant, so each client can independently choose the most preferable one.

Online Services

This option is often offered by banking organizations to those who are interested in how to replenish the Post Bank card. This option may be preferable not only for credit institutions, butand for the clients themselves. This is due to saving time, lack of queues and the ability to make money transfers from absolutely anywhere.

The official website of "Post Bank" allows each client to use the so-called Internet bank. This service is completely free. If the transfer amount does not exceed three thousand rubles, no commission is charged from the client.

A client can carry out a similar financial transaction using not only the official website, but also the Post Bank mobile application, which must first be downloaded and then installed on their own electronic device.

It is worth noting that using the application, you can get a lot of additional information regarding your accounts, transfers, etc. Now you know one of the ways to replenish the balance of the Post Bank card. By the way, a similar method is relevant for customers who use a loan product.

It is also convenient to top up the phone from the "Post Bank" card using the Internet service. After all, this method saves you from having to search for an ATM, payment system office or post office, which, you see, is especially convenient.

ATM

This is another affordable option for customers who are interested in how to top up a Post Bank card. However, it is worth noting that not everyone can find such a device nearby. However, giventhe option is relevant and a considerable number of customers find it convenient.

Free transfer of funds is carried out if the client uses an ATM "Post Bank" or VTB. It should be clarified that in a third-party device, funds are credited within a day. That's why you don't have to worry if the funds are not credited to your card account on the day of replenishment.

Be prepared to use the card or information specified in the contract. An important addition is that the amount of one ongoing transaction should not exceed fifteen thousand rubles.

As a rule, all customers manage to quickly find out how to replenish the Post Bank card. This is due to the fact that the devices have a simple menu that is quite easy to understand.

After all the steps are completed, be sure to take the check, which will be automatically printed by the ATM. It will come in handy in case of unforeseen failures, as a result of which funds may not be credited to your card.

Now you have learned another way to top up your Post Bank card account.

Payment systems

The credit institution has entered into agreements with a considerable number of partners for the convenience of its own customers. This allows you to top up your card balance not only online or at an ATM, but also in Qiwi, Golden Crown, Euroset, etc.

As a rule, funds are credited in such ways inreplenishment day. Also, be prepared to pay a commission. When using these methods, it is possible to conduct a transaction for an amount that does not exceed fifteen thousand rubles.

For some customers, it is the use of various means of payment that turns out to be the most convenient option when answering the question of where to replenish the Post Bank card.

Be prepared to provide the contract number, cardholder details, and the passport of the person depositing the funds.

Russian Post

This bank fully justifies its own name. Customers got the opportunity to replenish the Post Bank card at post offices, which are located not only in large cities, but also in remote villages. This is why some customers will find this method more convenient than others.

It should be noted that it will not work to replenish the Post Bank card without a commission in this way. Be prepared to pay two percent more than the amount you plan to deposit. In this case, the minimum commission is forty rubles.

The Russian Post also has restrictions on the amount of replenishment. It is no more than five hundred thousand rubles.

Procedure of actions

There is no single universal procedure for clients, according to which it is required to replenish a bank card. Let's describe what steps you need to take if you use the Post Bank ATM.

- So, first of all, the client mustprepare funds and a card that you plan to replenish.

- On the display of the device, you need to select the item "Deposit money". Follow the ATM prompts if necessary.

- Next, deposit money using a bill acceptor.

- Don't forget to get a check confirming the deposit. It will come in handy in case of a technical failure.

As a rule, when using a Post Bank ATM, funds are credited on the same day. So you won't have to wait long.

Tips & Tricks

It is impossible to say for sure which method will be the most convenient and preferable for you. Moreover, in different situations, you can use different options from those proposed. For example, someone prefers Internet banking, as this method allows you to transfer funds without commission. Some users, on the contrary, turn to representatives of payment systems or post offices, as they only need to provide money and present documents, and the specialist will do the rest.

In addition, "Post Bank" offers a free service called "Auto Redemption" and is intended for credit card holders. This option is relevant for those users who for some reason forget to make the minimum payments on time. This service allows you not to worry about any delays, as the funds will be automaticallybe written off on the date set by the user. It is enough just to take care of the availability of funds on the date of debiting.

Recommended:

Analysis of shares: methods of conducting, choosing methods of analysis, tips and tricks

What are stocks. How to analyze stocks, what sources of information are used for this. What are the risks associated with buying shares? Types of stock analysis, what formulas are used. What are the features of the analysis of shares of Russian companies, tips and tricks for collecting information and analyzing shares

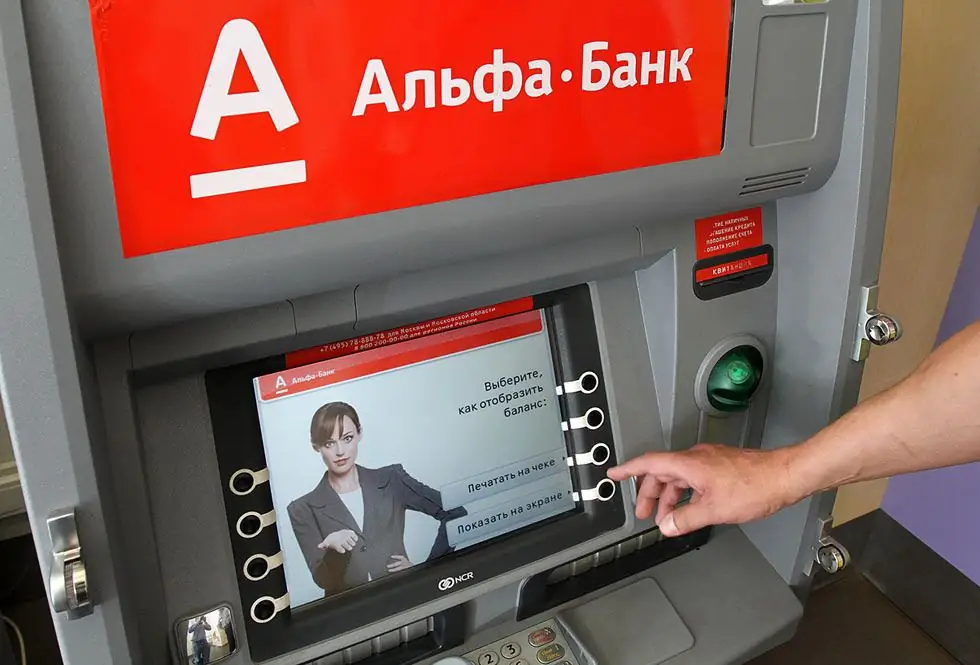

How to put money on the Alfa-Bank card? The main ways to replenish the Alfa-Bank card

The holders of this payment instrument have several options for how to put money on an Alfa-Bank card. Due to the variety, the user can choose for himself the most convenient and profitable way to replenish. You can deposit funds to your account by contacting the offices of this financial institution or a branch of another bank, using an ATM or self-service terminal, as well as using the possibilities of online services

How to replenish a Sberbank credit card: methods and rules, step-by-step instructions for replenishment

Clients of the country's largest bank actively use credit products with a grace period. Sberbank credit card is a profitable way to buy goods without waiting for wages. In order not to pay a commission, the user must be aware of how to replenish a Sberbank credit card

How to replenish the "Corn" card: features, methods and recommendations

Bank card "Corn" from the company "Evroset" appeared on the market a long time ago, but is still very popular. The reasons for demand are the improvement of the available range of opportunities and the discovery of new profitable features and offers for customers

Which bank serves the "Corn" card? How to issue and replenish the credit card "Corn"?

A credit card can serve as a good analogue of a bank loan while traveling abroad. If you pay off the debt on time, then the money can be used an unlimited number of times. Previously, they were issued only by banks. Today in Russia, Euroset and Svyaznoy offer to issue such a plastic payment instrument. You will learn more about what kind of “Corn” card is, which bank services it, from this article