2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:43

More and more citizens prefer bank deposits, gradually refusing to keep money at home. The reasons for this are logical and lie on the surface: the increased financial literacy of the population, media advertising about the benefits that await those who have bank deposits, and so on. And the understanding that storing money in a glass jar is much less secure due to the risks of fire, theft and other unpleasant circumstances, speaks of the need to save money away from home.

Another advantage of a bank deposit is the opportunity to take part in various loy alty programs, including preferential lending conditions.

Interest rates and risks

The idea that if you give money to a bank for use, then at the highest interest rate on deposits, visits almost everyone, but in addition to this desire, when choosing a deposit and where to open it, one cannot but consider other factors.

When opening a deposit, it is worth considering that these highest rates can only be obtained if you deposit a large amount of money for a period of a year or more. The second trouble may be the news thatthis interest rate is valid only for a certain period of time, in most cases falling within the last three months of placing money in the account.

And, finally, one of the most obvious factors: the highest rates are offered on deposits in rubles, which can hardly be called a stable currency. So, the next crisis can completely devalue ruble savings, which has already happened and, alas, more than once. If we talk about reliability, then the leadership in this indicator is clearly occupied by a multi-currency deposit. The average interest rate on it, most likely, will occupy an intermediate position between the indicators of ruble and foreign currency deposits.

Benefits of investing in different currencies

Multi-currency deposit in most banks assumes different interest rates for each currency included in it, but some offer a single average interest rate. Technically, when opening it, the client receives one account for each currency placed on deposit. During the term of the deposit, it is possible to move the placed funds from one currency to another, however, the bank, as a rule, announces the minimum amount that can remain on each account.

The program "Multi-currency deposit" can be found in almost any bank. Traditionally in Russia, such deposits can be replenished with rubles, dollars and euros, which can be made both in equal shares and in other ratios.

State insurance, which in the event of a bank failure allows you to return up to 700 thousand rubles to the borrower, also applies to a multi-currency deposit, which certainly gives confidence in its reliability.

The fact that opening a bank deposit does not require any knowledge and a large package of documents makes it a very attractive tool to save your savings.

Differences in deposits from different banks

In various financial and credit institutions, the conditions for opening and servicing such deposits may vary according to such parameters as:

- minimum amounts to open a deposit;

- possibility of early closure;

- recharge option;

- terms of deposits and other conditions.

Thus, by opening such a deposit as a multi-currency deposit, you can make a good investment with minimal risks. However, you should not get carried away with transferring money from account to account within the deposit, as the bank's exchange rates for such operations may not be the most profitable and nullify all profits from such an investment.

Recommended:

What is better - own funds or borrowed funds?

Some founders of enterprises invest exclusively their own funds in the development of their business and use only them, while others, on the contrary, use only borrowed funds. What are these types of capital and what are the advantages of each of them?

Sberbank mutual funds. Reviews of mutual funds of Sberbank

If it's time to think about where to invest the accumulated or earned any amount of money, and the word "investment" says almost nothing, then you have reason to rejoice. Mutual funds of Sberbank of Russia are the best investment option

Gazprombank, mutual funds (mutual investment funds): deposit features, exchange rate and quotes

UIF is designed for investors who want to minimize their risks. The goal is to provide income above bank deposits and inflation. Managers invest shareholders' funds in bonds with a high trust rating, including federal loan bonds (OFZ)

Hedge funds in Russia and in the world: rating, structure, reviews. Hedge funds are

The structure of hedge funds, still unrestricted in the financial sector and inaccessible to the general public, remains the subject of ongoing disputes, discussions and litigation

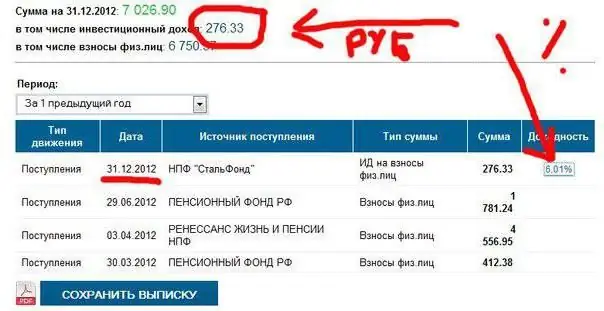

NPF "Stalfond": rating among other funds. Non-state pension funds

Choosing a non-state pension fund is not as easy as it seems. There are many similar organizations in Russia. One of them is "Stalfond". What are her pros and cons? How good is the company? What is the place in the rating of NPFs in Russia?