2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:43

Taxes - this is what gives the population a lot of trouble. In Russia, every citizen is obliged to pay to the state for the property that he has. This rule also applies to cars. Today we have to figure out whether a pensioner should pay transport tax. What can elderly people expect in this or that case? Are there any benefits in this area for the elderly in Russia? All this will be discussed later. In fact, this topic causes a lot of controversy among the population. And lawyers are not always able to give an accurate answer to the questions posed to them. Nevertheless, some points of view are logical. They will clarify the situation with the transport tax in Russia.

Transport tax is…

First of all, you will have to figure out what kind of payment you will have to deal with. This is normal. Each taxpayer has the right to know for what and on what basis he transfers certain funds.

Transport tax is nothing butas an annual payment that is transferred by the population for cars of various types owned by a citizen. The tax is regional in nature. This means that the basic principles for calculating and calculating the amount paid for transport directly depend on the rules in a particular municipality.

Does a pensioner have to pay transport tax? The answer is not as easy as it seems. Therefore, it is necessary to study the question posed from different angles. Only then will it be possible to answer it as accurately as possible.

Tax Code

It's no secret that Russia has a so-called Tax Code. It is a set of rules and regulations that all taxpayers and organizations must follow. It prescribes the features of the calculation and payment of certain taxes.

Some believe that the answer to the topic under study lies precisely in the Tax Code of the Russian Federation. Should a military pensioner pay transport tax? Or just a citizen who has reached retirement age?

This code does not give a definite answer. The thing is that the following is indicated there: all taxpayers are obliged to pay for their property on time. It follows that persons of retirement age do not have any benefits. Along with this, the Tax Code of the Russian Federation states that the transport tax is a regional payment. And he is able to have his own characteristics. This means that it is impossible to say whether pensioners (the Ministry of Internal Affairs or ordinary citizens) pay the transport tax. What do lawyers think about this?

Regions andFeatures

People with legal education point out that each locality has its own rules. Somewhere pensioners pay for cars, somewhere not. Nevertheless, it is difficult to predict. We have to clarify this information in the administration and tax authorities of each city.

If this factor is not taken into account, then the answer to the question of whether a veteran pensioner should pay transport tax will be positive. According to the established rules, taxpayers are required to pay taxes on their property. And any.

Eligible for benefits

But that's not all! Citizens of each city will have to thoroughly study the features of the transport tax for pensioners. Moreover, as practice shows, it is necessary to be interested in information annually.

"Tax-pensioner-benefits" is a normal combination. In Russia, people of retirement age have the right to various bonuses from the state. For example, regarding property payments. Only now the transport tax, as practice shows, is attributed to separate monetary pen alties.

However, citizens are en titled to some benefits. They, as already mentioned, depend on the rules in certain regions of the country. Accordingly, sometimes taxpayers can expect either a discount or a complete tax exemption for vehicles they own. This is normal.

Frequent practice

Does a pensioner have to pay transport tax? The most commona phenomenon is considered to be a situation in which elderly citizens are fully exempted from the payment under study. This means that you do not need to pay taxes on the car.

Only there are some restrictions. What exactly? Full exemption from transport taxes for pensioners is provided for only one car. It follows that a retired citizen who has several vehicles is en titled to tax exemption for one of them. But the choice of payment, from which a person wants to get rid of, remains with the owner of the property.

Payment Discount

There is a slightly different benefit. Transport tax for people of retirement age in some cities is not abolished. Instead, the population is provided with a tax rebate in various sizes.

How much exactly? It all depends on the rules of the locality. In some cases, you can count on a 50% discount, in some - 70-80%. Sometimes the transport tax discount is 90%.

The pensioner of the Russian Federation must transfer the transport tax in accordance with the rules established in the city. But, as already emphasized, often older people are simply exempted from such payments. This is normal practice. It does not contradict the RF Tax Code.

Total release

The next nuance that is recommended to focus on is 100% exemptions in relation to car taxes. They are set at the federal level. This means that the following persons may not pay taxes that came to themfor vehicles.

Who is the beneficiary in this area? Today it is:

- people-order-bearers;

- heroes of the Russian Federation and the USSR;

- parents/guardians of disabled (children);

- all people whose car has less than 70 hp. p.;

- families officially recognized as having many children;

- people accompanying and transporting people with disabilities, if the vehicle is equipped for citizens with disabilities;

- crippled nuclear weapons testers;

- "Chernobyl".

From this it follows that at the federal level, pensioners are not recognized as beneficiaries. Therefore, it is impossible to always speak with confidence about the complete exemption of this category of the population from taxes on cars.

The right is - the tax comes

But what if the citizen actually has certain benefits in relation to the studied payment? Usually, in such a case (with full exemption), payment orders of the established form simply do not come to the owner of the car. But in practice, sometimes things are different.

How exactly? Do pensioners have to pay transport tax? If it turns out that the answer to this question is negative, you must report this to the tax authorities at the place of residence of the elderly person.

Why do this? To keep the receipts from coming to the old man's name. In Russia, transport tax benefits are declarative in nature. In other words, cities only grant the right to a discount or a complete exemption from the payment. And the pensioner decides directly whether to realize such an opportunity or not.

So, if a pensioner receives payments for a car, you need to report the availability of benefits to the tax authorities. Until that time, you will have to transfer funds to the state treasury. Or ignore the received receipts. But it is not recommended to act in this way - a citizen who has not reported benefits will have a debt. This is not the best phenomenon.

How to apply for benefits

Now it is clear that a pensioner usually does not pay transport tax. But what is the right way to claim your rights? There is a small algorithm of actions, adhering to which, a citizen will be able to legally get rid of the car tax.

To be exempted from the studied payment (if it is provided for by regional rules) is required:

- Collect a certain package of documents. It will be discussed later.

- Apply to the tax authorities at the place of registration of a citizen of retirement age with the collected papers and a statement of the established form. The finished form can be memorized at home.

- Wait for approval of benefits. More precisely, a response from the tax authorities that the service was informed about the implementation of the rights to a discount or full exemption from tax on a car.

There is nothing difficult or special about the process. If a pensioner first paid for the car, and then found out that he has benefits, you can issue a refund. Thisthe procedure is also carried out in the tax office.

About documents

What papers can be useful for a pensioner to be exempt from transport tax? What will you need to bring with you? Take:

- identity card (preferably a passport);

- certificate of registration (if a civil passport is provided, this paper is not needed);

- certificates of ownership for all cars;

- a statement of the established form for the provision of benefits (if there are several cars, be sure to register the car covered by the "bonus");

- SNILS;

- TIN (desirable);

- pension certificate (if any);

- Documents indicating special status and Federal benefits (if any).

It is advisable to provide all of the listed papers with copies. There is no need to verify them. If you need to additionally return the money paid for transport, the listed list is supplemented:

- tax receipts;

- details of the account to which the funds are transferred.

From now on, it is clear whether a military pensioner should pay transport tax. And all the issues related to taxes for cars and pensioners are also not a mystery. Lawyers emphasize that it is best to find out the specifics of making a payment in each region separately. All this, as you might guess, is due to the regional nature of the tax. Only in the tax authorities of a particularlocality will be able to answer with 100% accuracy about the availability of benefits provided to people of retirement age.

Recommended:

Relief on transport tax for families with many children. What tax benefits do large families have?

Families with many children in Russia often receive a variety of benefits. For example, they can receive free textbooks in schools. And what about taxes? Are there any transport tax exemptions for families with many children? And if so, how do you arrange them?

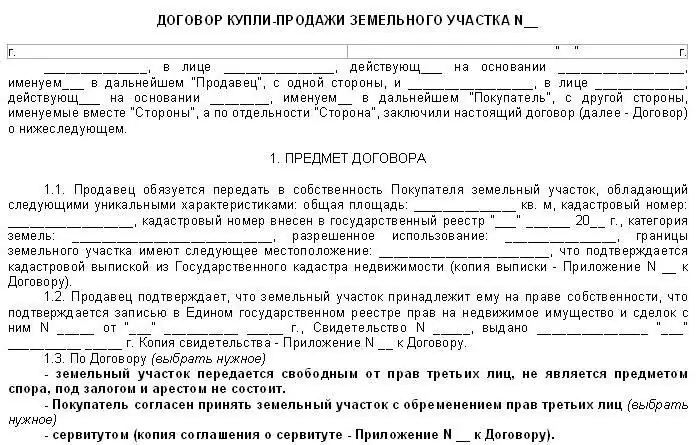

Tax on the sale of land. Do I have to pay tax on the sale of land?

Today we will be interested in the tax on the sale of land. For many, this topic becomes really important. After all, when receiving this or that income, citizens must make certain payments (interest) to the state treasury. With only a few exceptions. If this is not done, then you can run into many problems

Transport tax in the Rostov region. Transport tax for legal entities

Transport tax is a payment that worries many drivers. What amounts and in what order should residents of the Rostov region pay for their car? Can the payment be avoided?

Tax rate for transport tax. How to find the tax rate for the transport tax?

Today we are interested in the tax rate for transport tax. And not only it, but in general taxes that are paid for the fact that you have this or that means of transportation. What are the features here? How to make calculations? What is the due date for paying transport tax?

How to pay the transport tax. Transport tax rate

Transport tax is a huge problem for many taxpayers. How to pay for it? How to correctly calculate the payment amount? And who has the right not to pay for it? About all this - more