2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:43

Is there a tax deduction for a pensioner? How to arrange it in one case or another? Understanding all this is not as difficult as it might seem at first glance. In fact, every citizen can thoroughly study the Tax Code of the Russian Federation and get answers to all the questions posed. Tax deductions are not uncommon. Many try to take advantage of this opportunity as soon as possible. After all, to return part of the money at the expense of the state at certain expenses is what the country offers to many citizens. What can be said about pensioners in this area? Are they eligible for refunds? If yes, in what situations? And how to apply for tax deductions in one case or another?

Deduction is…

The first step is to understand what kind of money we are talking about. In Russia, not everyone is en titled to tax deductions. So, you should be aware of what money is being discussed.

Tax deduction - a refund of 13% of certain government spending. Relies only on those who made a certain transaction. In Russia, deductions can be made for specific actions.

Usually the right to receivemoney remains with the able-bodied population with a steady income. Is there a tax deduction for pensioners? The question is very difficult. How can you answer it?

Deductions and pensioners

The point is that there is no single answer. Much depends on what kind of deduction we are talking about. And what kind of pensioner is the taxpayer.

It has already been said that working citizens, as well as able-bodied people who have a permanent income, are en titled to deductions. But what about the elderly?

As practice shows, a 13% deduction is due when a citizen pays taxes and receives income. Otherwise, you will not be eligible for a refund. Pensioners are eternal beneficiaries. In Russia, they have a huge variety of rights and opportunities. What about tax refunds? Can a retiree receive a tax deduction?

An unequivocal answer "yes" will only work when it comes to working citizens. They receive a salary subject to personal income tax at 13%. And so they are en titled to deductions. And what about the idle?

For the unemployed

They, like other citizens who went on a well-deserved rest, are en titled to a tax deduction in the amount established by the legislation of the Russian Federation. But for this, certain conditions must be met. As a rule, they are always observed in Russia.

What rules are we talking about? This is:

- A retired citizen must be a tax resident of the country. That is, to stand on the register with the tax authoritiesat the place of residence for more than 183 days.

- A person applying for a deduction must necessarily receive income subject to 13% tax. Retirement doesn't count. It is legally exempt from tax payments.

- Before the end of the reporting tax period, you must submit a tax return of the established form. Then you have to pay 13% of the profits received. This is a required item.

There are no more essential conditions. Accordingly, non-working pensioners are also en titled to one or another deduction. True, the workers have more of them. In what situations can you claim a refund of money spent on a particular transaction?

When deductions are due

The thing is that in Russia there is a fairly large range of deductions. They are divided into different types. Accurate knowledge of the ownership of monetary compensation helps to determine the documents provided to the tax service at the place of residence in one case or another.

Deductions can be:

- from salary (for example, if there are minor children);

- for education;

- during treatment (most often teeth);

- for transactions with property and land.

These are the most common scenarios. As a rule, the tax deduction for a pensioner for tuition does not occur in practice. Property return of funds is in great demand. In the presence of work - from wages. Treatment also very often helps citizens to recover part of the money paid for the service. In all situations, you must be guidedthe same principles for granting a deduction, but with different packages of papers. What should I pay attention to first?

From salary

To begin with, it is best to study a few specific deductions - from the earnings that a citizen receives. Why? This cashback is a little different from all the others. How exactly?

Deduction from salary is a way to reduce the tax base, which is necessary to recover 13% of a citizen's income in the form of tax. That is, this method does not allow you to receive money. It serves to reduce the tax base when calculating the income tax payment.

Usually reserved for disabled people. Such a tax deduction for pensioners is useful, but it is provided only to those who work officially. Neither entrepreneurs nor people who receive income from the sale of property can use this bonus.

Another feature of deductions from wages is that you need to apply for it not to the tax authorities, but to your employer. The list of documents is minimal. About them a little later. To begin with, it is worth considering all the refunds due to pensioners. They have certain conditions and restrictions. If you do not know about them, you may not be able to issue a refund.

For education

The tuition deduction is extremely rare for pensioners, as already mentioned. You can get it when a citizen pays for his education at a university on a full-time basis. Or if a person teaches his child (grandson - if there are no parents) on"point" until the age of 23. In this case, the student must not work officially.

Accordingly, under such circumstances, you can issue a tax deduction. But at the same time, the pensioner must be the official representative of the student or study himself. Tuition is paid at the expense of the elderly citizen.

It is also worth paying attention to the fact that you can get a refund in the amount of 13% of all expenses for the last 3 years of study. In this case, the amount cannot ultimately exceed 50,000 rubles. It is best to submit a request to the tax office immediately in 36 months than to deal with the task every year.

For real estate

The next question is the tax deduction for retirees for real estate transactions. This is quite an interesting question. After all, you have to pay attention to numerous nuances. Real estate transactions among pensioners and other citizens are constantly encountered. And you can get a cash refund in the amount of 13% of the amount of expenses for purchasing an apartment.

What restrictions apply in this regard? The thing is that you can not return more than 13% of 2 million rubles. That is, the maximum return is about 260 thousand. This rule applies not only to pensioners, but also to all other citizens.

If the amount of the deduction indicated earlier is not collected, then it can be received in full in the future. Otherwise, when the limit of 260,000 rubles is exhausted, it is no longer possible to issue a refundsucceed.

When buying real estate on a mortgage, you can return a large amount. To be more precise, at the moment it is 350 thousand rubles.

Other property

And what if we are talking about the sale of land, for example? Or any other property? Then the tax deduction for the pensioner is also due. The same conditions apply to it as in the case of real estate such as apartments, rooms and cottages.

In other words, after buying an apartment, a pensioner receives a tax deduction with a total amount of no more than 260 thousand, after acquiring a land plot or a car, a similar maximum refund is due. Mortgages generally do not apply to other property.

It should be noted that both in the case of real estate and in the case of other property, the deduction is considered property. This means that 260,000 rubles is money that can be returned at the expense of the state, taking into account all property expenses. That is, for an apartment, and for a car, and for land, for example. The tax deduction for a pensioner and an ordinary citizen is summed up in these situations.

Treatment

The next refund is a compensation for the treatment. A very common deduction among the general population. Relies when a citizen pays for his or someone else's treatment in private centers. If a citizen uses the CHI program, he cannot return certain funds to himself.

Tax deductionpensioners for treatment are offered for:

- acquisition of certain medicines;

- direct access to treatment services;

- according to the CHI program, if, according to the contract, the insurance company covers only the service, but not the expenses for its provision.

As mentioned, there is a fairly common deduction for dental care. You can get, as in previous cases, 13% of the amount spent. But at the same time, the deduction cannot exceed 15,600 rubles.

In Russia there is a special list of expensive treatment, which is not subject to the specified compensation limit. In this case, it will be possible to issue a deduction of 13% from the entire amount spent on a particular medical intervention.

Procedure of treatment

How to get a tax deduction for a pensioner? It all depends on what kind of refund you are talking about. It has already been said that in the case of a deduction from the salary, it is enough to come to the employer. And if we talk about all other returns, you will have to contact the tax authorities at the place of residence of the applicant. Or it is proposed to come to one or another MFC to bring the idea to life.

The order of registration is extremely simple. Required:

- Collect a certain list of documents. It is different for each case. A complete list of securities will be presented below.

- Find the MFC or the tax service of the citizen's registration area. If we are talking about a deduction from earnings, then it is enough to contact the employer.

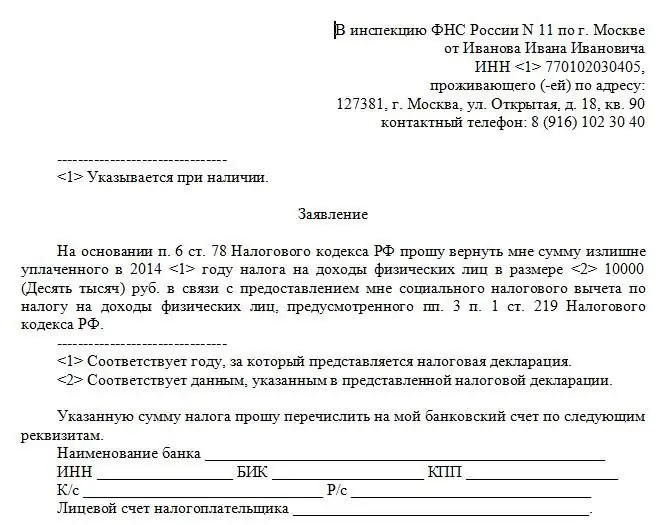

- Complete a statement of the established form. The right to a tax deduction for pensioners and other citizensmust be requested. Or rather, inform about your desire to return the money. Documents and their copies are attached to the application.

- Wait for the decision of the tax authorities. Within 2 months from the date of filing the application, the citizen will receive a notification about the appointment of a return or about its rejection. In the second case, there will be about a month to correct errors. Otherwise, you will have to start the design from scratch.

- Wait for the funds to be credited. As a rule, it takes about 1.5 months from the moment of receiving a notification from the tax authority to transfers.

That's all. The tax deduction for working pensioners and non-working is provided in the same way as for all other citizens. The difference lies only in the documents provided.

Documents for deductions

If we are talking about a deduction from wages, it is enough for the employer to bring a pension certificate, an application and a passport. It is also necessary to attach the basis for reducing the tax base. For example, a he alth certificate.

Otherwise, the tax deduction for a pensioner is provided after submitting the following papers to the tax service:

- statement indicating the type of refund;

- Russian passport;

- SNILS citizen;

- service agreement;

- student certificate (tuition refund);

- documents indicating the citizen's expenses (checks and receipts);

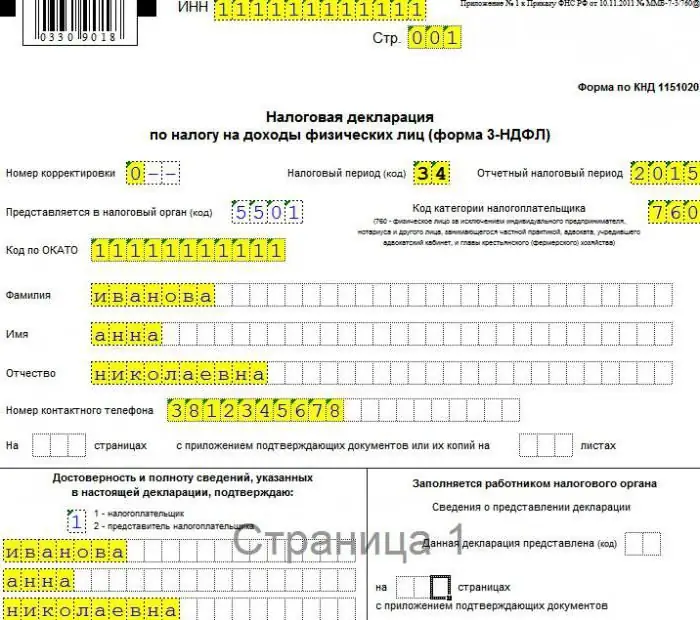

- tax return form 3-personal income tax;

- certificate of income (form 2-personal income tax for employees);

- licenseorganizations (training, treatment);

- accreditation (for education);

- certificate of ownership of real estate (if available);

- pension certificate (since 2016 - certificate of a pensioner);

- details of the account to which you want to transfer money.

Recommended:

Exemption from transport tax: the right exemption for exemption, conditions for obtaining, necessary documentation, registration rules and legal advice

At the beginning of 2018, a rumor appeared on the net about the exemption from transport tax for all categories of citizens. This is nothing more than a misunderstanding, since the transport tax refers to mandatory payments, it is paid once a year, and its amount depends on the region of residence and the power of the vehicle

Tax deduction for mortgage interest. property tax deduction

Today, not every citizen has enough free cash to buy an apartment. Many have to use loans. Targeted loans give the right to claim a tax deduction for mortgage interest, provided that the documents are executed in the territory of the Russian Federation

Property tax deduction for an apartment. Mortgage apartment: tax deduction

When buying an apartment, a tax deduction is required. It consists of several parts, but is invariably present and amounts to a significant amount. To work correctly with this aspect, you need to study its features

Application for a refund of personal income tax for education: when you can get it, the rules for applying for a tax deduction

Getting tax deductions in Russia is a very simple process. This article will tell you all about how to get a tuition deduction and apply for a refund of the money spent

Tax deduction for treatment: who is en titled, how to get it, what documents are needed, rules for registration

This article will tell you how to get a tax deduction for treatment. What is it and what are the rules for issuing a return?