2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:39

When insuring, it is important to remember that in any case, a person living in our country, after purchasing a vehicle, is first obliged to insure it. For the absence or overdue date of insurance, large fines are prescribed in the legislation of the Russian Federation.

For those who do not have the opportunity or desire to visit the office to apply for insurance, there is an opportunity to do this via the Internet. Currently, almost all insurance companies provide their customers with such an opportunity. It is very convenient, fast and much cheaper than a regular paper policy issued in the office.

Now electronic OSAGO reviews are numerous. So far, many car owners are confused by this method of insurance. They prefer to issue OSAGO the old fashioned way. At the same time, they overpay quite significantly.

Annually, according to statistics, about 42 million citizens acquire the OSAGO policy. As practice shows, the provision of OSAGO today does not allow to fully cover the insurance of its customers. Because of this, more and more oftenapplications to the courts, and some people simply compensate for their damage from their own funds, believing that it makes absolutely no sense to sue. Naturally, such people leave comments on the Internet about the insolvency of companies. The situation on the insurance services market remains ambiguous.

What is an electronic OSAGO policy?

Which reviews collect electronic OSAGO policies? This question interests many.

Compulsory third party liability insurance dates back to the 20s of the last century.

Initially, such a policy was introduced in the United States, but after a few years (by the 40s) it became widespread throughout Europe. It was intended for financial guarantees of compensation for damage in case of accidents on the roads.

In Russia OSAGO finally took shape much later. The Soviet authorities considered the issue of introducing insurance compensation for accidents on the roads, but considered it necessary to postpone it. Only on July 1, 2003, Federal Law No. 40-FZ “On Compulsory Insurance of Civil Liability of Vehicle Owners” came into force. Now car owners in our country have certain guarantees in case of traffic accidents that caused damage to the insured property.

What's the difference?

What is an electronic OSAGO? Reviews are mostly positive. More on this below.

Compulsory insurance is considered one of the guarantors of safe traffic on the roads, as drivers are more attentive to the rules. However, there are some drivers whoon the contrary, they behave more irresponsibly, completely relying on insurance. Previously, it was possible to insure your motor third party liability only by contacting the office. In this case, you would have to wait in line for quite a long time.

Recently, it became possible to issue an electronic OSAGO, reviews confirm this.

This document has the same validity as a paper policy. Electronic insurance means that the car owner is included in a single database. If necessary, he will be provided with the same services in case of an accident as a driver with a paper copy. All coefficients remain in the database, as a result, the driver will be able to receive a discount on new insurance for driving without accidents. And vice versa, if the driver often gets into traffic accidents, this will definitely be reflected in the database.

Insurance rates for electronic OSAGO

Insurance compensations provide for their own tariffs, which have been officially established since the introduction of compulsory insurance in our country. Later this law was slightly changed by making some amendments, but the basic base remains unchanged to this day.

The base rate of a particular fare depends primarily on the type of vehicle (motorcycle, car, tram, bus, etc.). It forms the basis of each of the tariffs, and is further multiplied by coefficients that depend on many factors.

These moments are provided by electronic OSAGO insurance. Feedback on this is available.

Factors affecting costInsurance:

- car engine size;

- region of residence (or registration) of the car owner;

- the number of owners who had the insured vehicle;

- the length of service of the driver for which the OSAGO policy is issued;

- the region where the office of the insurance company is located.

Thus, the higher your experience and the smaller the engine size of the vehicle that you own, the lower the cost of insurance.

Experienced analysts predict an increase in the base rate of tariffs in the near future, which will significantly raise the direct price of insurance. A distinctive feature of an electronic policy is its lower cost compared to a paper policy.

The procedure for issuing e-insurance

Electronic OSAGO (reviews confirm this) is simple to issue:

- on the official website of the insurance company, you need to fill out an application;

- an individual can sign the form using SNILS;

- pay the insurance premium in any convenient way.

It is important to understand that only officially registered companies can issue this type of insurance. Broker, agent, any intermediary cannot do this.

If everything is done correctly, after a while you will receive an email with an attached policy. You need to print it out and take it with you. This is how an electronic OSAGO insurance policy is drawn up. Reviews can be found online.

Fraud in this area is not uncommon. In order to verify the authenticity of the policy, you can verify its number in the PCA. The name of the insurance company is also verified.

The electronic policy looks the same as regular OSAGO insurance. Even the color scheme is preserved.

Major insurance changes in 2017

New amendments in the field of OSAGO were officially published at the end of August 2016. Presumably, by July 2017 they will already come into force. Car owners should pay attention to the following changes:

Regular payment of compensation will now be difficult. First of all, the insurance company will give a referral to a service station for free car repairs

The limit under the European protocol in case of an accident has been increased to 100,000 rubles (in the cities of Moscow and St. Petersburg up to 400,000 rubles). This is already provided for by the electronic policy of OSAGO VSK (reviews are available)

There will be a ban on the collection of additional payments from pedestrians guilty of an accident who were injured in an accident

It will be possible to receive personal data from the RSA database (Russian Union of Motor Insurers) without the request of the insurance company. As a result, e-insurance is becoming more and more popular. After all, you can get a policy without leaving your home

Another change that will be necessary for car owners will be a new principle for calculating the KBM. It will be assigned on an individual basis.

Positive OSAGO innovations

So, here is a list of positiveinnovations.

MTPL registration in electronic form (mostly good reviews)

Possibility to increase the CBM without reference to the vehicle

- Group insurance made easy.

- The recalculation of the MSC with the introduction of amendments to the Basic Law will become annual. Previously, it was made only after the expiration of the contract.

Uralsib CMTPL electronic policy

Reviews confirm that you can buy an insurance policy in electronic form in this insurance company. Uralsib has established itself as a stable organization. Therefore, OSAGO policies issued here are popular. The company's payouts for various insurances are huge. As a result, satisfied customers have no reason to go to court.

OSAGO insurance policy can be issued when visiting the office or via the Internet. The second option becomes more preferable. This is because there is no need to wait in lines, get through traffic jams.

In order to get an electronic version of OSAGO insurance, you need to go to the official website of Uralsib. There is a special section "Online Insurance". You will first need to use an electronic calculator to calculate the amount of the insurance premium.

You need to get a password to your email box to enter your personal account.

In the special columns, the policyholder enters information about himself and the car.

What information could this be?

- Passport of the car owner.

- Passport of the insured,because it can be different faces.

- Vehicle Registration Certificate or Title.

- All driving licenses of those persons who will be allowed to drive the vehicle.

- Diagnostic card confirming the fact that the car is working. Accordingly, the map must be up to date.

These are all required documents. You also need to decide whether the client wants to purchase limited or unlimited insurance, for how long.

After all the information is entered, you can proceed to payment. It is most convenient to make it from a bank card. In just a few minutes, the policy will be sent to the e-mail specified during registration.

Electronic insurance of OSAGO "Rosgosstrakh"

Reviews confirm that Rosgosstrakh is the undisputed leader in the insurance services market. This is due to the fact that it has existed for a long time and inspires confidence in many people. There is also an opportunity to purchase an electronic policy in this organization.

In order to issue an electronic OSAGO "Rosgosstrakh" (reviews confirm this), you need:

- go to the official website rgs.ru;

- find a calculator for calculating the cost of an electronic policy;

- fill in the required fields;

- wait. The system will check the data with the PCA and give the final price of insurance. After that, it will be possible to enter your personal account, where you can pay for electronic OSAGO. Rosgosstrakh (reviews available) inspires confidence.

WhenYou need to be extremely careful when filling in the data. All information will be checked against a common database. Also, this information fully affects the calculation of KBM and, accordingly, the cost of insurance.

After the payment is made, you can wait for the email.

The question often arises: is it necessary to print out the policy. While this is necessary, since the traffic police do not have the opportunity to obtain information from the PCA.

VSK

VSK ("Military Insurance Company") is well-known and reliable. It is not difficult to issue an OSAGO policy in electronic form here. As in other organizations, you will need to make a calculation from the official website. In your personal account, fill in information about the owner and the car. This must be done carefully, as a policy with errors will be invalid.

The company reports that insurance issued via the Internet is extremely convenient in registration, because the whole process does not take much time. Also, this method of obtaining OSAGO is reliable, safe and profitable. The cost of the electronic version is much cheaper than the paper version.

The break-even discount is maintained, which is convenient for regular customers.

All information filled in is immediately checked through PCA, so this insurance method is very fast. The data on the insured and his car are checked, it remains only to pay the policy. It is possible to do this with a credit card. After a while, the insurance will come to the mailbox.

Reviews

How common are OSAGO policies in electronic form? There are reviews that so far not everyone trusts such insurance.

On many official websites, the majority of reviews carry negative characteristics of both the companies themselves and any insurance products. All this happens because car owners, with compensation that is beneficial to them, rarely go to the site to specifically leave gratitude to their insurance company there. As a rule, they are looking for help or leaving complaints here.

One of the main themes of negative reviews is the "mandatory" purchase of additional services. It comes to the point of absurdity when the life of one person is insured in one company several times. Such complaints take up to several months, so car owners buy such a package of services because of hopelessness.

However, it is worth remembering that each situation on the road is individual, which is why reviews in this case should not always be trusted.

And in general, the electronic insurance of OSAGO collects good reviews. After all, it helps car owners save money. In addition, e-insurance eliminated the need to sit in queues. It has become very convenient to insure your civil liability without leaving your home.

Recommended:

Electronic warfare equipment. The latest Russian electronic warfare complex

An effective countermeasure can be the interception of a signal, its decoding and transmission to the enemy in a distorted form. Such an electronic warfare system creates an effect that has received the name "non-energy interference" from specialists. It leads to complete disorganization of command and control of hostile armed forces

How to enter a driver in an electronic OSAGO policy? How to make changes to the electronic OSAGO policy

How to calculate the cost of the policy if you need to enter a driver or make other changes to it? The principle of calculating the cost of an OSAGO policy with a new driver

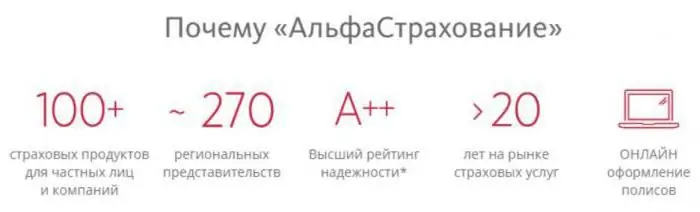

How to issue an electronic OSAGO policy at Alfastrakhovanie? Electronic policy "AlfaStrakhovanie": reviews

AlfaStrakhovanie is one of the most popular and most reliable insurance companies in the country. In more than 400 additional offices in all regions of Russia, the insurer provides a wide range of insurance products. But especially in demand today is the electronic OSAGO policy. How to apply for it in AlfaStrakhovanie?

"Rosgosstrakh": customer reviews of the insurance company. Customer reviews of NPF "Rosgosstrakh"

Rosgosstrakh is a large insurance company that has been operating in the CIS market for over 20 years. There is a wide range of insurance products for every taste. Reliability is something you shouldn't skimp on

How to add a driver to an electronic OSAGO policy? Rules for issuing an electronic OSAGO and making changes

Many are interested in the question of how to add a driver to an electronic OSAGO policy? In fact, the possibilities depend on the chosen insurance company. Some provide their customers with the opportunity to correct data directly via the Internet for some parameters, while most require a personal visit to the office