2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:45

Organizations doing business in Russia must pay taxes. The range of such, which is provided for by Russian legislation, is the widest. Firms operating in the Russian Federation may operate under different tax regimes and be subject to the transfer of fees at different rates. What are the specifics of those payments that Russian entrepreneurs are required to transfer to the state?

Tax determination

Before considering what taxes firms pay in the Russian Federation, let's consider the essence of the corresponding term. What are the most popular theoretical concepts related to this issue?

According to many Russian experts, it is legitimate to understand a tax as a mandatory contribution to the state budget or an institution of the budgetary system, provided for by a specific provision of the law, paid by a citizen, organization or other entity. The tax consists of the following main components:

- object of taxation (this may be an asset or income);

- tax base (an indicator reflecting the value of the object of taxation);

- rate (percentage of base,forming the actual amount of deductions to the budget).

Firm definition

Our next task, prior to considering what taxes firms pay in Russia, is to determine the essence of another term that is the subject of our study. A "firm" is most often understood as a legal entity - an organization duly registered by the state. It can be noted that in Russia this concept can also be associated with the activities of an individual entrepreneur, who, in turn, is an individual. Branches of foreign companies not registered in the Russian Federation also have a special status.

In the general case, a "firm" is still understood as a legal entity. But if an individual entrepreneur hires a staff and deploys a decent-sized production or opens a large office, then, as a rule, he positions himself as a company. Sometimes registered with government agencies as a legal entity.

It can be noted that the concept of "firm" as the scale of business increases, can be used less and less - instead of it, such terms as "corporation", "concern" are used. Thus, a "firm" is a relatively small organization, but has a stable, and at the same time, as a rule, growing business model. In some cases, an entrepreneur who organized the release of goods with the involvement of hired employees or opened an office and hired specialists.

Now, having considered some key nuances of terminology, let's study what taxes firms pay in Russia.

Main taxes for legal entities in Russia

The main payment obligations of legal entities to the budget of the Russian Federation can be called:

- payment of income tax or replacing it - simplified tax system, UTII, PSN;

- transfer of personal income tax for employees;

- introducing VAT payments to the budget;

- payment of excises and duties.

Let's study the specifics of the relevant fees in more detail.

Income tax and its analogues

Firms pay income tax if they work under the general taxation system, or DOS. The relevant fee is 20%. This tax is levied on the difference between the income and expenses of the organization, which are directly related to the implementation of commercial activities.

They do not pay, respectively, the income tax of firms that operate under alternative taxation systems - USN, UTII, PSN. The specificity of the simplified tax system is the ability to transfer significantly smaller amounts to the budget. So, a company that uses this taxation system must pay the state 6% of revenue or 15% of profits. However, not all firms can work under the simplified tax system. Legislation establishes limits on revenue and other criteria, upon exceeding which the company must already pay sales tax. Firms operating within the framework of UTII pay the state fixed deductions, determined on the basis of the provisions of federal and regional regulations. The amount of revenue doesn't matter. To work under UTII, the company must conduct the type of activity thateligible for this system of taxation. The list of such activities is approved by law. PSN, or the patent system of taxation, is a rather new phenomenon for the tax system of the Russian Federation. It can be called quite close to UTII, since the company's taxes under PSN are also fixed. Their size is established in legislative acts at the level of regions of the Russian Federation. It should be noted that only individual entrepreneurs can work within the PSN.

NDFL

In general, the owner of the company does not pay personal income tax for himself, since he is not an employee. The corresponding fee is paid for those people who are hired by the entrepreneur. The personal income tax rate is 13%, and this tax is deducted, therefore, from the salary of the company's employees. The legislation of the Russian Federation provides for a number of deductions for personal income tax. If they are applied, then the firm may not need to transfer the corresponding amounts.

VAT

Another typical tax for commercial organizations is VAT. It belongs to indirect. This means that from a legal point of view, the company is the payer, but in fact the cost of transferring it to the budget is borne by its buyer or client. The fact is that VAT is usually included in the selling price of a product or service.

The VAT rate depends on the specific product that the organization puts on the market and can be 10% or 18%. Russian legislation also provides for the application of a zero VAT rate for certain types of commercial activities.

Excises

Considering what taxes firms pay in the Russian Federation, it is worththe same goes for excises. Obligations to make appropriate payments to the budget are firms that produce and sell certain categories of goods. As a rule, those that are highly profitable are oil, jewelry, some types of engineering products. Payers of excises can be firms that both produce goods related to excisable goods and import them. The object of taxation for excises is the selling price of a particular product. The rates for the type of tax under consideration can vary greatly depending on the specific type of goods. It can be noted that excises are also referred to as indirect taxes. In fact, for the same reason as VAT - de jure, their payer is the company, de facto - the buyer or client, since excises are usually included in the structure of the selling price of goods.

Taxes and reporting

Paying taxes is not the only obligation of a commercial organization to the state, connected with the transfer of payments stipulated by law to the budget. The fact is that Russian firms must also submit reports to the competent state authorities on each of the relevant obligations. As a rule, this involves sending a declaration to the administrative structure. The frequency of formation of such documents is predetermined by the specifics of the tax. For example, in the case of VAT, a declaration must be submitted by the company to the Federal Tax Service on a quarterly basis. If the company operates under the simplified tax system, then it is enough to transfer the corresponding source to the tax authorities once a year.

It can be noted that firms registered as legal entities must also provide the state with financial statements. This is formed, in turn, on the basis of information within the framework of accounting, and it reflects financial transactions. Some information from tax reporting may correlate with information recorded in accounting records.

Responsibility for non-payment of taxes

So, we have considered the main taxes paid by a company in the Russian Federation. It would also be useful to study such an aspect as responsibility for non-payment of fees to the budget provided for by Russian law.

If a company does not pay taxes, then in accordance with the current legal norms, those bodies that administer this or that fee, for example, the Federal Tax Service, have the right to initiate the procedure for collecting arrears from the organization. Usually, of course, it is preceded by attempts by the Federal Tax Service to interact with the debtor in other ways, for example, by sending notifications that it is desirable to pay off such and such an arrears. If the company ignores such appeals from the tax authorities, then the recovery procedure is already initiated. Repayment of tax debts by the Federal Tax Service can be carried out in different ways. Thus, the legislation of the Russian Federation allows the Federal Tax Service to write off financial resources from the settlement accounts of organizations, as well as repay debts by selling the company's property. In some cases, the actions of the Federal Tax Service can be challenged in court.

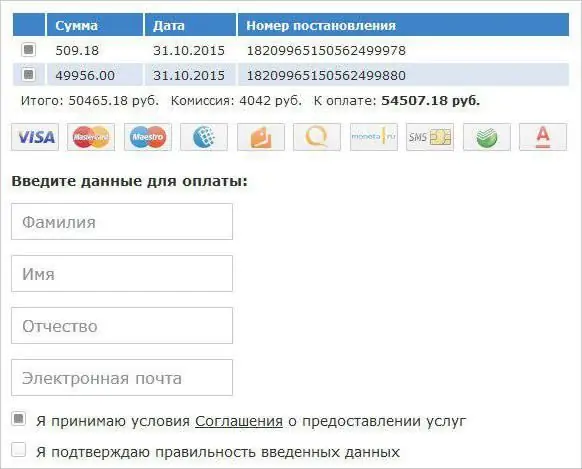

Find out tax arrears firms can in advance - through the sitetax service or through a personal appeal to the Federal Tax Service. Arrears are fixed by the Federal Tax Service after the end of the tax period. If the company is late in making payments to the budget stipulated by law, then fines and pen alties are charged on the amount of the debt.

How to reduce taxes?

How to legally reduce taxes? Firms in the Russian Federation, as we noted above, can operate under a variety of taxation regimes. In most cases, you can choose the one that will best match the specifics of the company's commercial activities in terms of budget obligations.

It is clear that it is very problematic for start-up entrepreneurs to transfer 20% of the proceeds as part of income tax. But they have the opportunity to work under the simplified tax system and pay less to the budget. However, as soon as their turnover becomes large enough, the state expects more taxes from such firms and therefore orders them to switch to the general taxation system. Regarding VAT, firms can use deductions for this tax and significantly reduce the overall payment burden.

Recommended:

What happens if you don't pay taxes? Liability for non-payment of taxes

This article will tell you all about the consequences of not paying taxes. What will happen in this case? What is the punishment for such an act? And does it exist at all?

What taxes do sole proprietors pay? What taxes are subject to I?

The question of what taxes are paid by individual entrepreneurs, of course, worries all people who want to do business. Indeed, information must be collected in advance, even before the start of direct business, because the size of payments will significantly affect financial success. The article describes in detail what taxes are subject to individual entrepreneurs, how to calculate them and how often to pay

How to pay taxes online. How to find out and pay transport, land and road tax via the Internet

Federal Tax Service, in order to save time and create convenience for taxpayers, has implemented such a service as paying taxes online. Now you can go through all the stages - from the formation of a payment order to the direct transfer of money in favor of the Federal Tax Service - while sitting at home at your computer. And then we will take a closer look at how to pay taxes online easily and quickly

How to pay transport tax through "Gosuslugi"? Pay taxes online, through a bank

How to pay transport tax through "Gosuslugi"? In truth, this issue worries many modern citizens. After all, you don’t always want to stand in line at the bank for a long time in order to pay off the state. Sometimes online payment is much faster and more convenient. Fortunately, this possibility officially takes place. Now we will try to understand how to pay the transport tax through the "Gosuslugi" or in any other way

What taxes do citizens of the Russian Federation pay. How much taxes do citizens pay

How many taxes are available to citizens of the Russian Federation? How much do the most popular taxes take?