2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:45

The question of what taxes are paid by individual entrepreneurs, of course, worries all people who want to do business. Indeed, information should be collected in advance, before the start of the direct opening of a business, because the size of payments will significantly affect financial activities. The article describes in detail what taxes are subject to individual entrepreneurs, how to calculate them and how often to pay.

Do I have to pay at all?

It's no secret that many enterprising businessmen are trying in every possible way to evade taxes or reduce the tax base. It is worthwhile to understand: the payment of taxes by an individual entrepreneur is an obligation, and liability is provided for its failure. Moreover, the amounts of fines to date have been set quite high, and often they are many times higher than the amount of non-payment. Therefore, taxes must be paid on time and in full.

Who calculates IP taxes?

The point is to calculatethe amount to be paid is owed by the entrepreneur himself. Because of this, difficulties arise. Not all business owners know what taxes an individual entrepreneur should pay and how to calculate them. As a result, in practice it often turns out that the calculation is made incorrectly, and the wrong amount is paid to the budget. At the same time, if you overpaid, then there is nothing to worry about - you will be refunded the overpaid money or sent it to offset future taxes. But underpayment threatens with pen alties, and in this case no one cares whether you specifically underpaid the tax or out of ignorance. The facts of incorrect calculation, as a rule, are revealed in the process of inspections carried out by the tax office regarding the reports submitted by entrepreneurs.

Tax regimes

To answer the question of what taxes an individual entrepreneur is required to pay, you need to know what system he uses. Now for small businesses, the tax regimes are: DOS (general regime), UTII (single tax), STS (simplified regime), PSN (patent system). Each mode provides its own calculation rules and tax rates for individual entrepreneurs.

General tax system

If an entrepreneur did not choose a special tax regime during registration, it is considered that he applies DOS. In practice, businessmen choose such a taxation system very rarely, almost never, because it becomes necessary to pay VAT (rates are 18, 10, 0 percent). You should also pay personal income tax (rate - 13 percent). In case of no activity, value added taxesthe cost and income of individuals do not have to pay.

Single tax on imputed income

Previously, the application of this tax for entrepreneurs engaged in certain activities was mandatory. From 2013-01-01, the transition to UTII takes place voluntarily, that is, the businessman himself decides whether to use this system or another. It is not possible to say unequivocally which tax is more profitable for individual entrepreneurs. It is necessary to consider each specific case separately.

So, UTII is paid not from the profit actually received, but from imputed (possible) income, calculated taking into account the conditions affecting its receipt. That is, the amount of payment does not affect whether the activity of the entrepreneur is profitable or unprofitable. The tax base is the amount of imputed income, depending on the type of activity. Businessmen using UTII do not pay taxes on income, property, personal income and value added. If the activity is not carried out, the entrepreneur must still pay UTII, because this taxation system uses possible rather than actual income to calculate the amount of payment.

How to calculate UTII

To determine the amount of tax, the formula is used:

UTII=Physical indicator x DB x K1 x K2 x 15%

Physical indicators are established by the Tax Code separately for each type of activity and may include the number of employees, transport units, floor space.

DB is the underlying return. It varies by typeactivities, specific monthly amounts are also spelled out in the Tax Code. It should be borne in mind that for UTII, the tax period is a quarter, so the resulting value must also be multiplied by three months.

K1 is a deflator annually set by the Russian Ministry of Economic Development. In 2014 it is 1,672.

K2 - corrector (regional), annually established by representative local authorities. It is different in each region, but varies between 0.005-1.

Example of UTII calculation

Suppose you live in Rostov-on-Don and own a small retail store. The area of the hall where trade is conducted is twelve square meters. According to the Tax Code of the Russian Federation, the basic profitability for such activities as retail trade through the objects of the distribution network is 1,800 rubles per month, and the physical indicator is the area (in sq. m.) of the trading floor. The regional corrector for Rostov-on-Don is set by the City Duma and is 1. Let's calculate the amount of tax for the 1st quarter of 2014:

12 sq. m x 1800 rubles x 1.672 x 1 x 3 months x 15%=16251.84 rubles - you need to pay this amount.

Simplified tax system

This mode is perhaps the most popular. The fact is that VAT is not paid by individual entrepreneurs on a “simplified” basis. What taxes still do not need to be paid under such a system? You will be relieved from paying property tax, personal income tax, and if the activity is not carried out, then simplified taxesno need to enumerate. An important feature: only those entrepreneurs whose annual revenue is no more than 64.02 million rubles can apply the simplified tax system. Businessmen who decide to switch to a simplified regime from 2015 must have income for the nine months of 2014 in the amount of no more than 48.015 million rubles

The taxpayer must independently choose the object of taxation. There are two options:

- The tax base is income. In this case, the rate is 6 percent.

- The tax base is income minus expenses. The rate is 15 percent.

The procedure for taxation under the simplified tax system

) is the annual tax. The deflator for 2014 under the simplified regime is 1,067.

If you had no income in 2013, then a loss was formed, by the amount of which it will be possible to reduce the tax base at the end of 2014. This applies to annual tax, not quarterly payments. If the loss is greater than the tax base, it can be carried forward to the next periods within ten years.

Minimum tax for USN

You should know what taxes an individual entrepreneur should pay if expenses for the year exceed or equal income, and also if the tax amount calculated in the usual way is less than the minimum(the minimum tax is calculated according to the formula: income for the year x 1%). Let's analyze this situation using a specific example.

Suppose that in 2013 your income amounted to 100 thousand rubles, and expenses - 95 thousand rubles. You apply the object of taxation: income minus expenses. That is, the tax base will be 5 thousand rubles. Multiplying it by a rate of 15 percent, we get the amount of tax - 750 rubles. Let's calculate the minimum tax: 100 thousand rubles are multiplied by 1 percent. We get 1 thousand rubles. Let's compare the results. It turned out that the minimum tax is more than the one that is calculated in the usual way. What taxes do individual entrepreneurs pay to the budget in this case? You will have to pay the minimum tax, that is, 1000 rubles. And you can include the difference between 1000 rubles and 750 rubles in the expenses of 2014.

Calculation of advance payments for USN

At the end of the quarter, the amount of income actually received since the beginning of the year should be determined. If the object of income minus expenses is used, then it is also necessary to determine the amount of expenses and subtract it from the amount of income. The resulting figure must be multiplied by the applicable rate: 6 or 15 percent, respectively. From the total amount, the amount of insurance premiums paid (we will talk about them later) and sick leave paid to employees should be subtracted. Similar payments already paid since the beginning of the year are also deducted from the amount of the quarterly advance.

Patent system

Now let's talk about what taxes are paid by individual entrepreneurs who have bought a patent for doing business. Firstly,a businessman must, within 25 days after the patent began to operate, pay one third of its cost, and the remaining two thirds - no later than 30 days before the end of the tax period. Such terms apply if the patent is issued for a period of six months, otherwise the entire amount must be paid in full within 25 days from the start of the validity. As with the simplified regime, you can use the patent system until the annual income exceeds 64.02 million rubles.

The cost of a patent should be determined by the formula: multiply the basic yield by 6 percent. The size of the database, as with UTII, depends on the type of activity. The owner of a patent is exempted from paying taxes on property, profit, value added, personal income. If the activity is not carried out, the cost of the patent still needs to be paid.

Insurance premiums and payroll taxes

You have already found out what taxes individual entrepreneurs pay. The entrepreneur must make all of the above payments, regardless of the presence or absence of employees. But insurance premiums and payroll taxes are paid just based on the number of employees. These include contributions to the Pension Fund - 22 percent of the accrued salary; to the medical fund - 5.1 percent; in the FSS - 2.9 percent (for temporary disability insurance, including in connection with maternity) and 0.2 percent for insurance against occupational diseases and accidents). The amount of the last installment may be higher (depending on the type of activity of the entrepreneur).

Alsoa businessman must pay contributions for himself to the Pension Fund (in 2014 the amount is 17328.48 rubles) and for he alth insurance (in 2014 - 3399.05 rubles). The total amount of payments, therefore, will be equal to 20,727.53 rubles. It can be paid in a lump sum or in installments until December 31, 2014.

New 2014

An innovation was an additional contribution to the pension fund, paid in the amount of 1 percent of the proceeds, if it is more than three hundred thousand rubles. This amount must be transferred to the budget no later than April 1 of the year following the reporting year.

Entrepreneurs who do not have employees, using a single tax or a simplified regime at a rate of 6 percent, can reduce the tax for the entire amount of contributions at the end of the year. Those businessmen who have employees and apply the same tax regimes can reduce the tax on the amount of contributions, but only by no more than fifty percent of the tax at the end of the year. Under the simplified regime at 15 percent, pension contributions are treated as regular expenses, just as under the general regime.

Recommended:

What happens if you don't pay taxes? Liability for non-payment of taxes

This article will tell you all about the consequences of not paying taxes. What will happen in this case? What is the punishment for such an act? And does it exist at all?

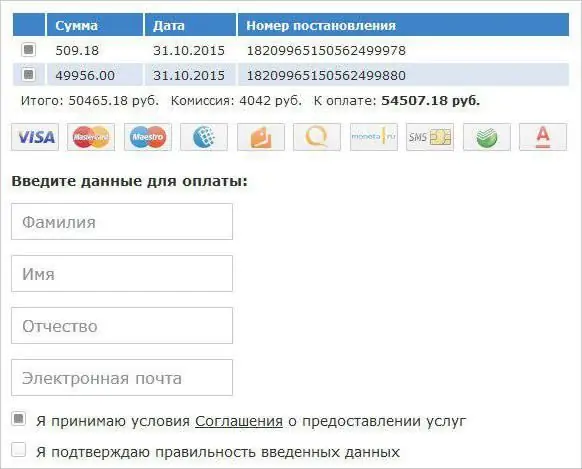

How to pay taxes online. How to find out and pay transport, land and road tax via the Internet

Federal Tax Service, in order to save time and create convenience for taxpayers, has implemented such a service as paying taxes online. Now you can go through all the stages - from the formation of a payment order to the direct transfer of money in favor of the Federal Tax Service - while sitting at home at your computer. And then we will take a closer look at how to pay taxes online easily and quickly

What is better to open: LLC or IP? Pros and cons of sole proprietorship and LLC. The difference between sole proprietorship and LLC

What is better to open: LLC or IP? Having decided to throw off the shackles of office slavery and no longer work "for your uncle", developing your own business, you should know that it must be legal from a legal point of view

How to pay transport tax through "Gosuslugi"? Pay taxes online, through a bank

How to pay transport tax through "Gosuslugi"? In truth, this issue worries many modern citizens. After all, you don’t always want to stand in line at the bank for a long time in order to pay off the state. Sometimes online payment is much faster and more convenient. Fortunately, this possibility officially takes place. Now we will try to understand how to pay the transport tax through the "Gosuslugi" or in any other way

What taxes do citizens of the Russian Federation pay. How much taxes do citizens pay

How many taxes are available to citizens of the Russian Federation? How much do the most popular taxes take?