2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:47

Among the simplest and most effective Forex tools, experts call the "Keltner channel". This channel got its name from the name of its creator. The principle of operation of this trading tool is based on the same principles as Bollinger bands or moving average envelopes. However, it also has significant differences.

Indicator description

The Keltner Channel is a trend indicator that was developed in 1960 by Charles Keltner and later described by him in the book “How to Make Money Trading Commodities”.

According to the calculation scheme, the operation of the channel is similar to the operation of the Bollinger Bands indicator. However, in this case, the average true range (referred to as ATR) is not used as the basis, but the average true range (referred to as ATR).

Indicator on the chart

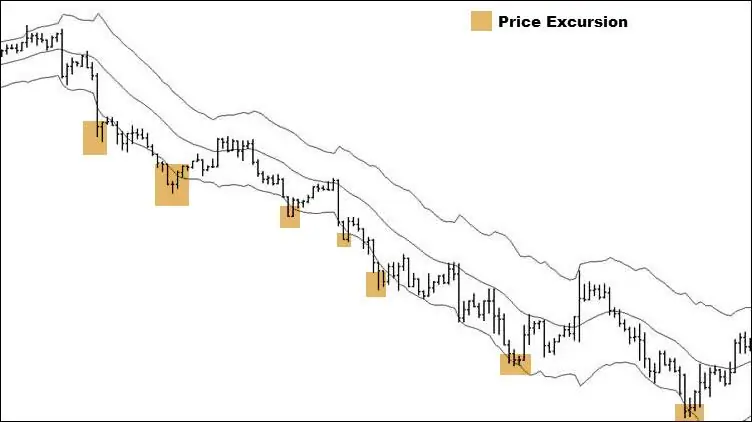

Keltner Channel on the chart is represented by three lines, which are located in close proximity to the price level. The role of the main performs the central line, which is called the moving average. The other two are located above and below the average and represent lines with a certain deviation indicated insettings.

This indicator is one of the standard ones, so it is available on many trading platforms. If the tool is not available, it can be found in the public domain and downloaded. After that, the folder with the trend indicator is moved to the trading terminal.

Settings

To build and calculate the Keltner channel in MT4, you will need the following values:

- EMA (moving average) - the default period is 20 days;

- top line - it is calculated using the formula EMA + ATRˣ2;

- lower line is calculated in a similar way: EMA - ATRˣ2.

At the same time, the period of 10 is often set in the ATR settings.

You can use this tool on different currency pairs and on all timeframes. To reduce the number of false signals, you may need to adjust the settings depending on the selected timeframe.

To choose the right period, you should pay attention to the trading strategy. The default settings are suitable for an intraday chart. However, you should not use a timeframe less than one hour.

Traders entering long-term positions should set a period greater than the specified one.

Signals

The peculiarity of this trading instrument is that it belongs to trend indicators. With its help, an experienced trader will only need a couple of minutes to assess the overall situation on the market.

- The upward channel indicatesrising price.

- Declining Keltner Channel corridor indicates a downward price.

- Lateral movement in a narrow corridor indicates a temporary absence of a trend. In such cases, the price fluctuates slightly between the upper and lower channel line.

This data can be used as the basis for several strategies. Each of them has its own requirements for opening and closing orders. However, there are several common signals.

- Breaking through the upper channel line indicates a sharp increase in market strength.

- When the lower border is broken, we can talk about the weakening of the asset.

- The situation in which candles or bars are located outside the channel is a signal that the trend will soon change its direction.

In this case, it should be remembered: in addition to true signals, numerous false signals will appear on the chart. To minimize risks, you should not choose a short timeframe. In addition, experienced traders are advised to wait for signal confirmation.

Support and Resistance

The upper and lower borders of the corridor act as support and resistance lines. In other words, when moving, the price periodically rebounds from the lower line and moves to the upper one, and vice versa. This characteristic is successfully used by many traders. When rebounding from the upper border of the corridor, a sell order is opened. When rebounding from the bottom line, they buy.

This strategy is for the Keltner channelallows you to trade on any currency pair and on any timeframe. At the same time, both a pronounced trend movement and a flat state are suitable for trading.

This trading option is more suitable for the intraday chart. When using it, there is some risk if the order is opened against the trend.

Breaking strategy

Keltner himself believed that the penetration of the corridor is a sure sign of the emergence of a strong trend. It is for this reason that the crossing of the support and resistance line requires special attention.

It is important to take into account the direction of trade. The order is opened in the direction of penetration.

- If a candle or a bar has broken through the upper boundary of the corridor, then you should open a buy deal.

- Closing a candle or bar outside the lower boundary of the corridor is a sell signal.

It should be noted that trend trading is less risky and therefore suitable for conservative traders. The difficulty lies in the fact that it is not easy to identify the emergence of a new trend. This is due to the appearance of false signals. To eliminate interference, some traders advise using additional technical analysis tools.

Flat trading

In the financial market, it is not always possible to detect a strong price movement in a certain direction (up or down). Quite often, a flat can be observed on the chart.

The term “flat” is commonly understood as a situation in which the market price moves horizontally. A characteristic feature can beslight price fluctuation. Under such circumstances, the Keltner channel becomes narrow, and the price periodically bounces from its borders. At the same time, the price difference between the high and low remains small.

For many traders, the flat situation in the market is a signal for successful trading. The profit from each transaction is small, but the number of orders can compensate for minor fluctuations.

Difference from Bollinger Bands

Many novice traders wonder about the difference between the Bollinger Bands and the Keltner channel. The appearance of this question is explained by some similarities in the appearance of these indicators and the general principles of construction.

There are several differences.

- Keltner Channel can be said to be smoother as the ATR is more stable than the standard deviation. As a result of using such data, the line is smooth and devoid of many of the noise present in Bollinger Bands.

- The difference lies in the features of use. The Keltner channel indicator is based on the ATR, which allows you to get a corridor with the same width throughout. This feature makes it easy to use any trading strategy..

Benefits of using Keltner Channel

The frequency of using this trading tool is due to several advantages of the indicator.

- Versatility. You can apply this indicator on all types of timeframe andfor any currency pair. To do this, you will only need to correct the data in the settings.

- Easy to use. The Keltner channel indicator for MT4 is suitable for experienced traders and for beginners. This is explained by the absence of complex constructions: it is enough just to indicate the initial data for the calculation.

- No extra noise on the chart. Compared to some other technical analysis tools, Keltner Channel not only provides information about the direction of the trend, but also provides clear signals to start trading.

Disadvantages of the tool

Like any other indicator for trading in the financial market, this tool has several drawbacks.

- Lack of universal settings. The need to make adjustments to the calculations can be called a kind of disadvantage. The fact is that for each timeframe, data should be carefully selected. Otherwise, trading will be ineffective.

- The need to use additional tools. It is possible to easily determine the direction of the trend and identify signals about the next change in direction using the Keltner channel. In Yemanzhelinsk and other cities of Russia, there are special courses that teach you how to use trading strategies, because additional tools will be required to filter out false signals.

So, Keltner Channel is an indicator for trading in the financial market, which has earned wide popularity due to its convenience and ease of settings, the possibility of using it ongraph with absolutely any source data. Forex experts note its high efficiency. However, to achieve such indicators, experience in tracking signals and developing a strategy using additional tools will be required. In addition, it is worth entering the Keltner channel data into the Expert Advisor, which will significantly optimize the process.

Recommended:

Momentum indicator: description, configuration and use, methods of application

The probability of trend continuation can be predicted by assessing the intensity of trading. The strength of a market movement is often referred to as momentum and there are a number of indicators designed to measure it. The Momentum indicator helps identify when players have bought or sold too much

EMA indicator: description, how to use?

Indicators on the Forex exchange serve to make life easier for traders. The most famous of them is the EMA indicator. It allows you to predict the trend and smoothes the quote data. This is important in times of high volatility

Volume indicator: description, classification, setting and use

Technical indicators are indispensable tools in trading. A special role is played by instruments showing volumes, for example, the Volume indicator. We will talk about its characteristics, features, varieties, as well as how it can be used in trading and for analyzing the financial market

ATR-indicator: description and use on Forex

What is the ATR indicator and how is it used in the Forex market. How to understand its signals, what can be seen with its help

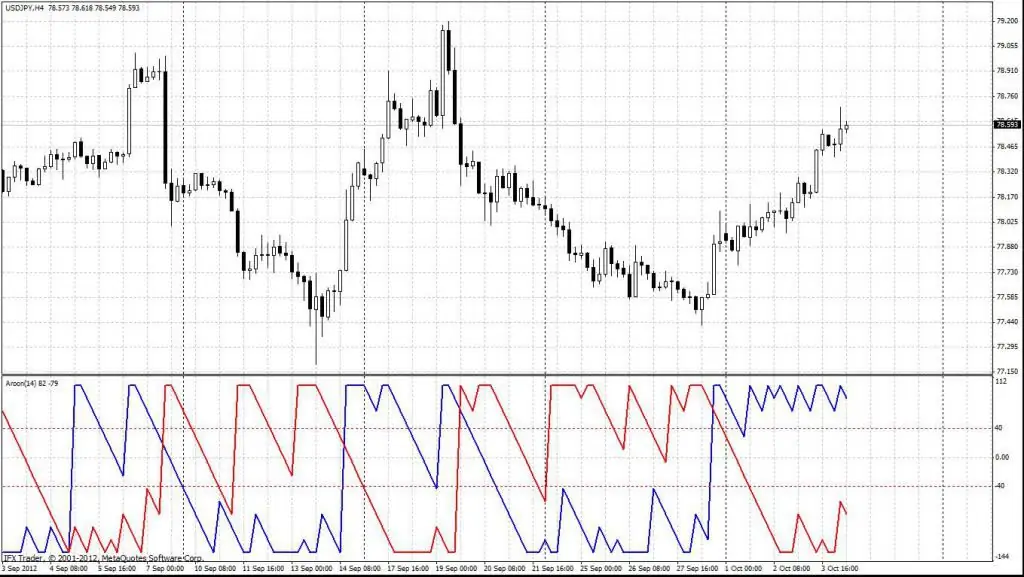

Indicator Aroon: description of the indicator, application in trading

The Aroon indicator is a great tool that every trader should have in their arsenal. It is a visual representation of the market movement that can be easily interpreted to make decisions according to price direction and momentum. You can also significantly increase the chances of a profitable trade if you build a trading technique around Aruna in combination with a breakout strategy or any other based on price movement