2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:47

Trust funds are a trust property, a peculiar structure of relations in which the property that is the property of the founder of the organization is transferred to the disposal of the trustee. In this case, the beneficiary receives the income.

Trust funds are assets that are transferred from one person to another. For the transfer of ownership, a specialized agreement is signed - a trust agreement. The parties to the agreement are the founder of the fund, the manager and one or several beneficiaries. A trust fund in Russia, as in any other country, is considered to be a full-fledged legal entity.

Distribution of roles and functions: founder and manager

The structure of trust funds provides for a blocked account, which is subordinate to the manager. There are some commercial terms of partnership between the parties. The founder has the full right to choose the manager. It can be a notary, a lawyer, a bank manager, and any other person with the appropriate level of qualification. In accordance withgenerally accepted standards, the manager assumes the responsibility for managing the capital of investors. The manager does not act as the owner of the property, but he is fully responsible for any damage or loss, various omissions related to the property of the depositors for the period of management.

If the founder of the fund reveals a desire to make super-risky investments that do not correspond to the risk distribution structure, he has every right to do so. The only "but" is that in this situation, the responsibility of the manager is completely removed. These freedoms are regulated to the smallest detail by the trust agreement. A blocked account has the following peculiarity: money can be deposited to it in any available way, but when certain conditions are activated, the material resource must be paid only for a specific purpose.

Target Audience

There is a specialized trust fund for children, and there are trusts for large companies and their leaders, associations for individuals who have some savings. In this situation, the fund can act as a reliable tool that ensures the safety of property with low taxation and decent profits. Communities are focused on owners of various kinds of real estate, on owners of securities and offshore organizations. It is worth saying that this category of "institutions" provides comprehensive anonymity to beneficiaries. Funds that are transferred to the management of the trust areinaccessible to creditors and are not subject to taxation.

Purposes of establishing trusts

A trust fund in the USA, in Ukraine, in Russia can be created for different purposes:

- As a means of ensuring the safety of assets, since claims not only of creditors, but also of other third parties cannot be filed against property entrusted to a trust.

- Trust funds are an alternative to the standard will. This is due to the possibility of the existence of several beneficiaries at the same time, as well as trust managers. In the future, property will be distributed between the beneficiaries, but only after the death of the founder.

- Trusts may be of public importance. For example, NATO trust funds were created solely to help Ukraine.

Flaws of the Institute

Despite the rather wide list of advantages of such funds, they also have certain disadvantages. We can say about the partial loss of control over the property that is entrusted to the manager. But there is another side of the coin that completely covers this fact. In accordance with the agreement, the founder cannot terminate the agreement unilaterally. This fact significantly increases the level of protection of property from encroachments of creditors. In the domestic legislation there is no specialized law, which would be subject to the activities of such organizations. A fund can be called a property with an indivisible type of capital. This categorylegal entities has a unique tax status, according to which any income is not taxed.

The subtleties of the fund's existence

Trust funds are associations belonging to the category of companies with indivisible capital. Separate property with the status of a legal entity is used for various purposes, from capital accumulation to covering expenses of various ranks (education, treatment, training, etc.). The purpose of the existence of the fund is implemented by a specialized body, which is called the Council of the fund. The role of beneficiaries can be legal entities and individuals, non-residents, members of one or more families, the founders themselves. The fund has the characteristics of an ordinary company and has some unusual structural solutions. The education structure provides the founder's control over the assets without violating the privacy policy.

Structure of trusts: grantors, beneficiaries, trustees

Trust fund in Ukraine, as in any other country, provides for the presence of a grantor, or donor. This is a person who establishes the foundation itself and donates his property to it. It can be cash, stocks, bonds, any securities. It is the grantor who sets the specifics of the fund's work. There must be a recipient - the person for whom it was created. In the future, the work of the fund will be carried out in such a format in which the beneficiary will receive certain benefits from the work of the organization, established by the founder. As a manager (trustee)act as one person, and the whole company. Multiple trusted advisors are allowed. The manager works for a fixed salary. In some situations, trusts do not hire a trustee, but a highly qualified authorized investor who is able to manage assets as efficiently as possible.

Probable problems and solutions

Creating a trust is now a very popular trend to save money and cut costs by avoiding taxes. Within the framework of almost every state there is a legal framework (with the exception of Russia) that regulates the activities of this category of organizations. In some states, perpetual trust funds are widely practiced, while in others they are strictly prohibited. The government of some countries is concerned that people may receive large fortunes that they have not earned. Before opening a fund, experts recommend consulting a specialist.

Recommended:

What is better - own funds or borrowed funds?

Some founders of enterprises invest exclusively their own funds in the development of their business and use only them, while others, on the contrary, use only borrowed funds. What are these types of capital and what are the advantages of each of them?

Sberbank mutual funds. Reviews of mutual funds of Sberbank

If it's time to think about where to invest the accumulated or earned any amount of money, and the word "investment" says almost nothing, then you have reason to rejoice. Mutual funds of Sberbank of Russia are the best investment option

Gazprombank, mutual funds (mutual investment funds): deposit features, exchange rate and quotes

UIF is designed for investors who want to minimize their risks. The goal is to provide income above bank deposits and inflation. Managers invest shareholders' funds in bonds with a high trust rating, including federal loan bonds (OFZ)

Hedge funds in Russia and in the world: rating, structure, reviews. Hedge funds are

The structure of hedge funds, still unrestricted in the financial sector and inaccessible to the general public, remains the subject of ongoing disputes, discussions and litigation

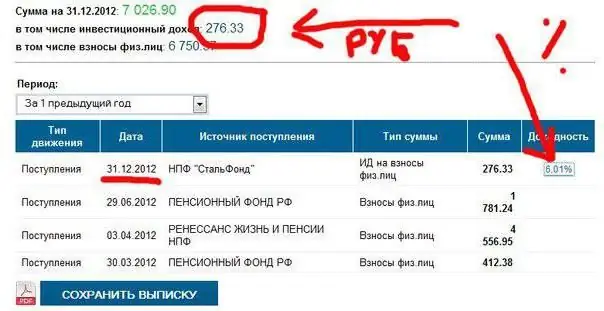

NPF "Stalfond": rating among other funds. Non-state pension funds

Choosing a non-state pension fund is not as easy as it seems. There are many similar organizations in Russia. One of them is "Stalfond". What are her pros and cons? How good is the company? What is the place in the rating of NPFs in Russia?