2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:26

A power of attorney is a document by which the principal empowers a trusted person. The preparation of such a document has now become standard procedure. It takes a little time. A power of attorney can be drawn up in the presence of a notary or other persons who have the right to certify this document. For example, if you draw up a power of attorney in a bank office, an authorized employee will confirm the validity of the document.

One of the most popular varieties is a document to represent the interests of a legal entity in a financial institution. Today, the legislation does not provide for a single form of such a power of attorney. It can be drawn up arbitrarily or on a form provided by a financial institution (bank).

Who can issue a power of attorney

Write out a power of attorney to represent the organization in a bank or otherfinancial institution can be:

- Director of the organization.

- The executive body, which is spelled out in the charter of the organization.

- Other persons provided for by the charter and legislation of the Russian Federation.

A trustee will be able to entrust authority only if it is written in the power of attorney.

Types of powers of attorney

There are three types of powers of attorney:

- General - gives a wide range of powers that an attorney can exercise on behalf of a legal entity and in its interests.

- Special - allows the trustee to periodically perform only the operations specified in the document. For example, make payments from the account, receive statements, etc.

- One-time - gives permission to an authorized person to perform a specific action (opening / closing an account, making a payment, replenishing an account, etc.)

Most often, organizations issue special powers of attorney to their representatives. They enable the employee to freely perform work duties.

Requirements for a Trustee

In accordance with the legislation of the Russian Federation, any person who meets the following requirements can be appointed as an attorney:

- He is a resident of the Russian Federation.

- Capable.

- Must be 18 years of age.

In accordance with changes in legislation in 2012, the trustee may not be associated with the organization by labor relations.

Powers

In the power of attorney for the bank fromlegal entity (sample in the photo below), the powers of the attorney are prescribed. These include:

- Transactions with settlement accounts (opening, closing, replenishment).

- Processing statements.

- Getting information about settlement accounts.

- Payment orders.

- Loans/deposits.

- And other actions that do not contradict the legislation of the Russian Federation.

If a general power of attorney implies the ability of the attorney to perform any operations in the interests of a legal entity, then in a special and one-time power of attorney, it is necessary to clearly spell out the powers. A sample power of attorney for a legal entity of VTB 24 Bank provides a ready-made list of such powers. The principal only needs to check the boxes next to the required items.

Structure of power of attorney

As mentioned earlier, there is no single form of this type of power of attorney. It can be drawn up in any form at a notary public or in accordance with a sample power of attorney for a bank from a legal entity. But the structure of the document must be respected in both cases:

- Date of the power of attorney.

- Data of the principal and trustee.

- Organization data.

- Name of the bank where the interests of the legal entity will be represented.

- List of powers.

- Signatures and seals.

Brief instructions for drawing up a power of attorney to represent the interests of a legalfaces

Conventionally, the "document body" can be divided into two parts. The first part contains the details and data of the principal and authorized representative. In the second, the powers of the attorney are prescribed, as well as a clause on the possibility of substitution.

Let's start with the first part of the power of attorney. Here is the data that should be written in it:

- At the top are written: the city where the document is issued, the date of issue, the name of the organization (legal entity).

- Company details: where and when it was registered, TIN, PSRN, etc. These data are written in the registration documents.

- Details of the head of the organization and the document on the basis of which he acts. For example, a charter or an agreement.

- Details of the authorized person: full name, passport details, registration address.

- The name of the financial organization in which the authorized person will act on the basis of a power of attorney from a legal entity ("Alfa Bank" for example). When indicating the place of performance of operations by proxy, you need to clarify whether the document will be valid in all branches and departments of the bank.

- Account numbers, if the attorney will perform any manipulations with them.

A sample power of attorney for a bank from legal entities can be found on the official website of the organization in which the power of attorney will be drawn up.

The second part of the document specifies the powers of a trustee. The terms of reference must be specific. It is better to write these actionsin separate paragraphs.

In the same part of the document, a clause on subordination is written. That is, does an authorized person have the right to issue a power of attorney to a third party.

The validity period of the document is also an important requisite. It can be issued for any period. If the power of attorney is not valid, it is valid for 1 year from the date of issue.

In conclusion, the power of attorney is certified by signatures and seals. Since 2016, the seal in the document is not a mandatory requisite. But if the seal is affixed to the charter of the organization, then bank employees may insist that the imprint also be on the power of attorney.

The photo below shows a sample power of attorney from a legal entity (to Bank Vozrozhdenie or any other).

Documents required for issuing a power of attorney

Most often, such powers of attorney are drawn up directly at the bank. It takes 10-20 minutes of time and requires a minimum set of documents:

- Passport (principal and attorney).

- Charter of the organization or a document giving the head the right to give power of attorney.

- Company registration documents.

- Details of accounts to which the power of attorney will apply (if necessary).

You can familiarize yourself with a sample power of attorney for a bank from a legal entity in advance, directly at the bank, on the website of a financial institution or request assistance at a call center.

Recommended:

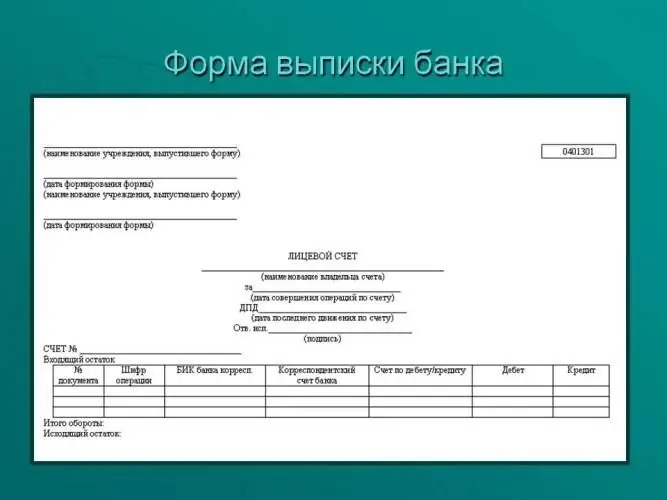

A bank statement is The concept, necessary forms and forms, design examples

When purchasing any banking product, any client, sometimes without knowing it, becomes the owner of an account with which you can carry out income and debit transactions. At the same time, there must certainly be a certain tool that allows any client to exercise control over the movement of their own funds. This is a bank statement. This is a document that is usually issued upon request to the client. However, not everyone is aware of this possibility

Rules for filling out UPD: types of services, procedure for registration with samples, necessary forms and relevant examples

There are many questions about the rules for filling out the UPD (universal transfer document), because there are a limited number of samples with already entered data. The tax authorities are accustomed to returning the paper for correction without explaining what exactly is incorrectly drawn up and how to correct the error

Mutual settlements between organizations: drawing up an agreement, necessary documents, forms of forms and rules for filling out with examples

Settlement transactions (offsets and settlements) between business entities are quite common in business practice. The result of these operations is the termination of the mutual rights and obligations of participants in civil relations

IP - an individual or a legal entity? Is the IP a legal entity?

Is an individual entrepreneur (IP) an individual or a legal entity? Often, even entrepreneurs themselves cannot understand this issue. The article is intended to consider all the nuances of this issue and to clarify

What you need to work in a taxi: necessary documents and requirements, regulations and legal aspects. Feedback and advice from taxi drivers, customers and dispatchers

According to many passengers, the job of a taxi driver is the easiest. You sit, listen to pleasant music and drive back and forth. And they give you money for it. But this is only the outer side of the coin. The reverse is much less rosy. We will talk about it in this article. And we will also highlight what you need to work in a taxi