2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

Before you start making money on Forex, all beginners choose a brokerage company with which they will cooperate in the future. Each organization provides traders with trading conditions, which may vary. For example, for Forex trading in some brokerage companies, the minimum deposit can be only one US dollar, while in others - from $2,500.

And also, before starting work with the chosen broker, which is an intermediary between the client and the financial markets, it is necessary to check its reliability and the availability of relevant documentation. Among the huge variety of brokerage companies, one can single out the "Forex" dealer VTB, reviews of which the reader will find in this article, and also learn about the trading conditions that this organization provides to clients.

About company

VTB Broker is a subsidiary of a commercial bank"VTB 24". His specialization is the provision of trading services in the financial markets for traders and investors exclusively for the foreign exchange market. The history of this "Forex" dealer began in 2010, and it still provides services to its clients. The broker has all the necessary documentation and a license to carry out such activities from the Bank of Russia. He is a member of the National Association of Forex Dealers. Its offices are located in many cities of the Russian Federation, and the main one is in Moscow.

One of the features of the Forex broker VTB is its narrow specialization with ECN contracts. As a result, all transactions of traders are brought to the real market, and are not distributed among clients, as in other companies. It offers 32 currency pairs for trading as trading assets.

According to the reviews about VTB Forex, one can understand that it will not be possible to use the method of locking positions, since there are no such conditions on the interbank market. Therefore, many traders perceive this fact as a disadvantage compared to other brokerage organizations where such opportunities are available. And besides, the VTB broker does not have CFD instruments, and clients are offered to trade only foreign exchange market assets.

According to traders and their feedback on VTB Forex, the following can be noted as positive points:

- no fees for registering a trading account, as well as its maintenance;

- no trading fees;

- relativelysmall spreads.

However, it should be borne in mind that on popular and underlying assets, such as cross pairs, spreads periodically expand, that is, increase. This feature can be noticed at the beginning of the trading week and at the release of the most important macro and micro news. As traders note, when spreads widen, trading with scalping strategies becomes difficult, and sometimes simply unprofitable. This fact also applies to trading when using automated programs based on "Scalping" algorithms.

Terms for trading on VTB "Forex"

"Forex" broker VTB offers very convenient and favorable conditions for traders and investors. Each interested client can engage in speculative operations with the selected trading asset and earn money in financial markets

For traders there is an opportunity to open an account with VTB "Forex" with a minimum deposit of 50 thousand rubles. This amount will be enough to enter the market and comfortable trading. All clients can use both an independent trading option, making speculative transactions, and automated methods, using advisors and robots.

According to traders, auto trading significantly reduces time costs and allows you to earn in a passive round-the-clock mode, without making independent transactions and without using an analytical forecast of market movement.

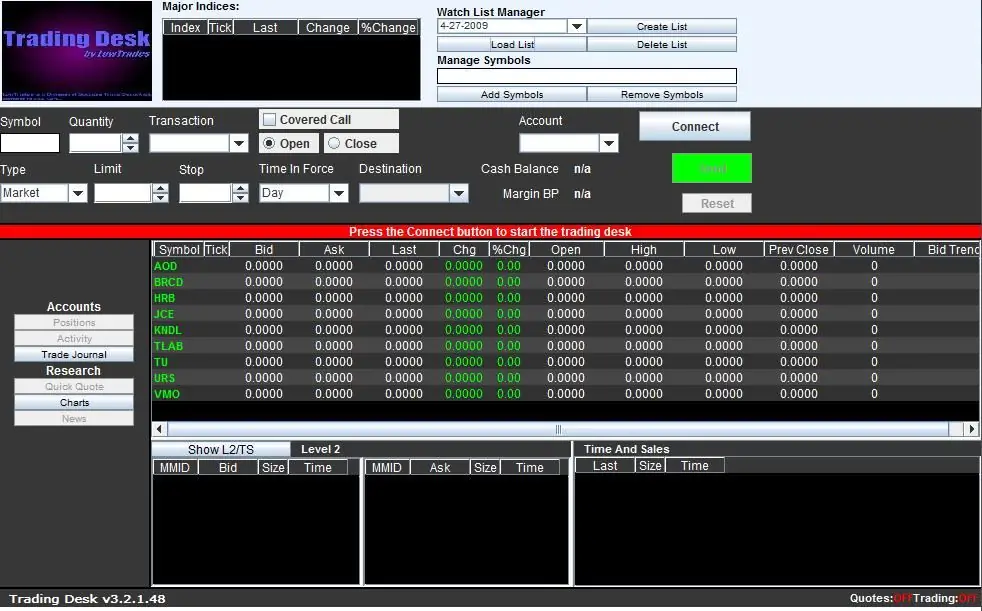

VTB broker has the opportunity to use three options for trading platforms:

- MetaTrader.

- OnlineBroker - an online platform where you can make transactions without downloading software and using a browser.

- Quik.

Also, clients can always use mobile trading.

Mobile trading

What is this? This is the same trading in VTB "Forex" without any changes, but only from mobile devices. Many traders call this method very convenient, since it can be done anywhere from your phone. The main thing is Internet access.

According to reviews of VTB Forex, mobile trading is provided to clients in two versions:

- available for free on the MetaTrader platform;

- paid alternative on the Quick marketplace.

However, there are some limitations. For example, mobile trading on MetaTrader is available with only 30 currency pairs, and there is no possibility to simultaneously trade on the Online Broker platform. As well as ruble assets are available only in viewing mode. But you can use any automated program.

If we consider Quik, then although you will have to pay, but the trader will have the opportunity to trade on the FORTS stock and derivatives market. Here you can also use robots and additionally view the news background presented in the trading terminal.

The mobile version is very relevant when it is not possible to trade in the usual mode from a computer or laptop. For example, while on vacationaway or for a walk. Such trading allows you to control existing positions and open new orders, replenish your trading account, leave requests for withdrawal of funds, resolve issues in the support service, and much more.

Trading conditions

Trading conditions at VTB "Forex" attract many customers. In the rating of brokerage companies licensed by the Bank of Russia, this organization occupies one of the leading places.

Trading conditions have the following parameters:

- On VTB "Forex" the minimum deposit is 50,000 rubles or 1,000 US dollars.

- All trading financial transactions are settled in Russian rubles.

- Withdrawal of funds and replenishment of the trading account occurs within the established regulations.

- On VTB "Forex" the minimum lot does not exceed 0.5.

- The size of the spread may change from time to time, as it depends on certain market conditions, that is, on the liquidity and volatility of the selected trading asset. In addition, these indicators are affected by the size of the lot volume. Average values in normal market conditions with little volatility range from 2.5 pips to 5 pips (up to 10 lots inclusive). Up-to-date information is always indicated on the official website of the broker.

- 32 currency pair instruments.

- Leverage up to 1:45 (forced closing of trades when leverage reaches 4:50).

- Margin trading within one trading session.

Each customer canreplenish your deposit funds in several ways: through bank transfers (cards of third-party banks), with a VTB card or using an application, through VTB Internet Bank. To withdraw funds from a trading account, you must first leave a request, and you can also use a phone number. However, this service is available only for clients of VTB Bank who opened a trading account through this structure, and not for all traders and investors of the "Forex" dealer.

Please note that when withdrawing funds, a commission will be charged, namely 13% income tax. According to traders, this fact is an indicator of the company's reliability and a guarantee of withdrawal of funds within the regulated time frame.

VTB investments

For investors, as well as for traders, the broker offers very favorable and convenient conditions. The most popular version is investing in PAMM accounts. At VTB Forex, you can choose PAMM accounts yourself or use the help of experts.

Scheme of earning on a PAMM account:

- Choose a managing trader.

- Invest the desired amount into the investment account.

- Receive income and withdraw earned profit.

The PAMM account algorithm works as follows. The managing trader opens an investment account, having previously replenished it independently. Then other investors connect to it and transfer their money to this investment account. As a result, the manager tradessignificantly larger financially. After a certain time, which is stipulated in the terms of the contract, the profit earned by the managing trader is divided between the participants of the investment account, that is, between the depositors. This division occurs as a percentage.

If, for example, the total amount before the start of trading operations was 10,000 dollars, and within a month the manager was able to increase it by 50% - up to 15,000 US dollars, then the profit is divided among all investors as a percentage. Whoever invested 10% will receive the same amount from the profit; if the investor's share was 30% at the beginning, then in the future he will receive the same profit from the total return. The manager himself, under the terms of the PAMM account agreement, receives remuneration for trading and earning profit on this account.

Trading account types

As for trading accounts, the broker provides three types. Each client can choose the most profitable option for themselves, taking into account their financial capabilities.

Types of accounts in VTB "Forex":

- "Investor Standard".

- "Professional standard".

- "Universal".

The first option is great for beginners who have little experience in trading in financial markets. The broker's commission in this case will be 0.04% for all trading operations. It does not depend on daily trading volume, which is undoubtedly a positive side.

Tariff "Professional"designed for more advanced traders with experience and skills in trading who actively trade. Commission fees in this case depend on the daily number of transactions (trade turnover) and range from 0.02% to 0.04%. On the "Universal" tariff, the commission varies from 0.02% to 0.09% per day.

Demo account

All beginners can start trading with a VTB dealer in demo mode. This method allows you to get the first trading skills and experience in using the platform. VTB "Forex" demo account is an excellent solution for novice traders who expect to become professional players in the financial markets in the future. This is the first step on the ladder to a professional career. According to the feedback from VTB Forex customers, the demo version is a completely safe tool, and it excludes any financial risks. All trades made by a trader take place in virtual units, which can be independently selected in the parameters when opening a demo account. Also, the client can choose a leverage, which will allow him to bring testing closer to real future opportunities.

In addition, the demo version is used not only by beginners, but also by experienced traders. They check the work of new technical indicators, trading strategies, select parameters for them and improve overall performance. In the future, they use the results obtained on real trading accounts.

According to traders of VTB "Forex", demoThe account is great for testing automated programs such as robots, experts or advisors. In order not to risk their own money, they run demo robots and record the results.

Almost every beginner takes his first steps in trading on a virtual practice account. On it, he learns to open and close positions, calculate and place protective orders that limit losses and fix profits. It is here that he studies the functionality of the trading platform, the operation and settings of technical indicators, graphical constructions, learns to conduct technical analysis of the market and much more.

Binary options on VTB

After the broker received a Russian license to provide services in this field of activity, he expanded the opportunities for traders. Now they can use not only standard speculative transactions, but also VTB "Forex" binary options. The broker guarantees a return on option contracts of up to 80%.

Unlike the Forex market, binary options have two differences:

- Option contracts are concluded with a certain expiration time, that is, they are limited. As soon as the term of the contract expires, the option will be considered completed, and the transaction will be closed. There is no statute of limitations on Forex, and a trader can hold a trade for an unlimited amount of time.

- In options trading, the profitability of the contract or the loss is known in advance. That is, if a trader opened a position in the correctdirection, he will receive a guaranteed profit, agreed upon when buying a contract. If he gets a loss, then he will only lose the initial amount of the bet.

VTB broker offers clients a variety of trading assets: company shares, bonds, securities, metals, commodities, market indices and other instruments.

Binary options trading takes place on a special platform where you can choose the amount of the bet, the type of trading asset and contract, Put-option or Call, expiration time, as well as conduct graphical and technical analyzes of the market movement. The platform has all the necessary functionality for trading with binary contracts. Its interface is provided in good quality and is understandable even for beginners.

Training traders and investors

The broker pays special attention to new clients. A training program was developed for them, which includes the following "disciplines":

- Terminology of the financial market. With its help, a beginner can learn the basic concepts of trading (what is a trend, momentum, flat, pip, pip, locking, hedging, consolidation zone, accumulation, lot, swap, spread and much more).

- Theoretical knowledge. This section allows you to get an idea of the patterns of the financial market and the rules of trading on it.

- Trading instruments. A beginner gets acquainted with the types, features and characteristics of the underlying investment assets. He learns about their advantages and disadvantages, parameters and in what cases it is necessary to use this or that asset inaccording to a certain market phase.

- Trading tools. In this section, novice traders get acquainted with various technical indicators, automated programs, trading signals, and the method of copying transactions. They will learn about the features of trading instruments, their correct use in trading / investing and for analyzing market movements.

- Market forecasting. One of the most voluminous and complex sections. Beginners receive information about the rules for predicting market movement, how to do it, and what tools to use in analytics. Here they also learn how to use analytical and statistical data to analyze market quotes. In addition, a novice trader receives the necessary knowledge on the types of forecasting (basics of fundamental analysis, technical and graphical methods).

- Choosing a trading strategy. The broker provides information on various trading methods, rules for opening and closing positions, parameters, indicator settings, placing protective and profit-taking orders.

- Demo account. Acquaintance with the functionality of the trading platform, working out the chosen strategy. This is the final stage of learning, which is equivalent to practice.

According to VTB Forex broker reviews, all clients have access to various webinars, video tutorials, reviews and recommendations from experts, as well as other necessary information. In addition, they have the opportunity to receive personal advice, answers to questions and recommendations frommanagers and specialists.

Trader reviews

According to traders, the Forex dealer VTB is great for investment and for trading in the long term. It provides clients with the entire portfolio of instruments they need. This is a reliable broker that has the appropriate documentation and license, which you can trust with your money. Among the negative points, there are only isolated cases of slow work of the support service. But still, positive reviews about the brokerage company remain a priority and outweigh negative comments.

Recommended:

Bank accounts: current and current account. What is the difference between a checking account and a current account

There are different types of accounts. Some are designed for companies and are not suitable for personal use. Others, on the contrary, are suitable only for shopping. With some knowledge, the type of account can be easily determined by its number. This article will discuss this and other properties of bank accounts

Just2Trade: reviews, account opening procedure, personal account

Choosing a broker is a very responsible step. Every beginner who has made the decision to become a trader faces it. To understand the degree of reliability of any brokerage company, you need to study the information and find out reviews about it

Minimum minimum deposit balance: features and calculation

Many of us want to keep money away from home for many reasons, but term deposits are not suitable because the money can be needed at any moment. That is why there are deposits with the possibility of withdrawal. This article discusses the concept of the minimum balance, its features and types

Mortgage: minimum term, conditions for obtaining. Minimum term of a military mortgage

People who want to solve financial problems often decide to apply for a loan. Or, if you need housing, take a mortgage. And everyone wants to get even with debts as soon as possible. Therefore, all people, before deciding to take such a responsible step, carefully calculate the amounts, terms, interest - just to get the maximum benefit. Well, the topic is interesting, therefore it is worth considering it in all its details

A settlement account is Opening a settlement account. IP account. Closing a current account

Settlement account - what is it? Why is it needed? How to get a savings bank account? What documents need to be submitted to the bank? What are the features of opening, servicing and closing accounts for individual entrepreneurs and LLCs? How to decrypt bank account number?