2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

Options trading provides traders with good opportunities to make money on the exchanges. To earn income, you need to learn the basics of the financial market laws and trading rules. Every beginner should know how to trade options, what factors and conditions must be taken into account, as well as how to analyze market movements.

Option concept

An option is an agreement under which a transaction is carried out with a selected trading asset with predetermined conditions and with a certain and fixed expiration time. Before starting work, each trader analyzes the market movement in order to know in which direction to open a deal, and chooses the instrument that suits him for trading.

Option trading is a financial speculative operation performed by a trader with a certain trading asset. Depending on the specifics of the contract, the speculator can choose the most suitable trading conditions for the transaction and independently determinethe duration of the option, that is, the period and date of expiration.

Since trading instruments are different, and they all differ in their characteristics, it is imperative for a trader to know the features of the chosen instrument and how to trade options in certain market conditions. Only if you follow the general laws of the financial market and trading rules, you can earn in this area.

Types of options and features

All options are divided into two types: to buy and sell the underlying asset. Option Types:

- call option;

- put option.

The first option of trading instruments refers to purchases, that is, a trader has the opportunity to buy the underlying asset he needs at a certain fixed price. The second type involves the sale of the underlying asset. In addition, options are distinguished by several characteristics:

- Interest rate options (contracts on interest rate futures or rates).

- Currency options (currency contracts or futures).

- Stock options (stocks, futures indices).

- Commodity options (physical commodities and commodity futures).

Additionally options can be divided into:

- binary;

- exotic.

And also all contracts are divided into option styles:

- American options.

- European options.

- Asian options.

All trading instruments have their own characteristics and characteristics. For example, American optionscan be closed on any day at the request of its copyright holder before the expiration date of the contract. And the European version can be closed only on a strictly specified date, that is, at the end of the expiration time. Therefore, it is very important to know all the terms of option contracts and the rules on when and how to trade options.

Benefits of options trading

Options as underlying assets are a very convenient tool for trading. The advantages or main advantages of options trading include the following characteristics:

- They do not need to be physically bought, since all speculative transactions take place on the trader's trading account. When it comes to buying or selling an option, in fact, the speculator only predicts the change in market quotes, but does not physically buy anything. If his analytical data is correct, then he will earn a fixed amount. With an unfavorable forecast, the trader will know in advance the amount of the loss.

- Minimal financial risks. In option contracts, the amount of loss or profit is agreed in advance. It is fixed and cannot be changed under any circumstances. And most importantly, the trader will know this amount before buying or selling an option.

- Extensive trading opportunities. Traders have access to a wide variety of strategies and tools for making money. Many use the hedging method, automated programs, copy trade methods and other innovative trading solutions.

- Large selection of trading assets - stocks, marketindices, futures, metals, commodities, currencies.

Financial risks

It is important for every novice trader to remember that any transactions in the financial markets are fraught with risks. Options are no exception. Therefore, it is important to be able to minimize risks in options trading.

There is a special section in trading - Money Management, which allows you to trade in a safer mode. Proper management of capital or deposit funds helps traders minimize financial risks, and in some cases avoid them completely. Beginners should not only know how to trade options, but also how to properly avoid losses.

Most often, for these purposes, traders use the hedging method, which allows you to simultaneously open positions in different directions and thereby reduce losses, and, under favorable circumstances, bring transactions into profit.

For example, consider binary options. Suppose a trader, when buying an option, made a mistake in the calculations, and after some time it becomes completely clear to him that the transaction will close with a loss. In this case, he can use the hedging method and open a position in the opposite direction with an increased bet size. Such actions will help him cover his losses and make a profit.

Basic options trading for beginner traders

Options are a unique financial instrument with which, if used correctly, you canmake good money in the market. These assets allow you to minimize risks and use them both in the derivatives and stock markets.

The advantages of options trading include their main characteristics, namely the ability to trade in any direction of market movement. For traders and speculators, it does not matter which way the price will move. In addition, even if it were completely and had no changes, you can still make money on options.

Types of earnings on options:

- rising market quotes;

- on price decline;

- on the movement of quotes in a certain range (touching a given level or their breakdown).

Options trading for beginners implies a mandatory basic training program. Trading is a specialized type of business with its own specific features. It is impossible to start trading in financial markets without having the appropriate knowledge, the necessary preparation and some experience.

Therefore, at the initial stage of trading, all beginners should learn how options are traded, learn the patterns of the financial market, the psychological factors of the Money Management rules, that is, risk and capital management. And besides, the mastery of analytical forecasting of the movement of market prices will be the key to success for the trader. To do this, you will need to learn how to use statistical and world fundamental data in the analysis.

Instruction for beginners

Each novice trader before trading on the financial marketmust do several things. First of all, he needs to be trained in trading.

Basic Training:

- Terminology.

- Theoretical basis (patterns of the financial market, trading rules).

- Money management (money and financial risk management).

- Trading psychology.

- Forecasting market movement (learning the basics of using analytical and statistical data, technical and fundamental market analysis).

After a beginner learns the basic course, he must choose a trading strategy for himself, with which you can further earn on the financial market. And then get practice on a special virtual demo account, which completely excludes any financial risks. And after receiving positive and stable results, you can move on to the real market.

How to trade options on the stock exchange

Option contracts can be traded on any market where this instrument is available. Along with futures contracts, they can be used on stock exchanges or on the derivatives market. Profit or loss in trading with options is calculated on the basis of the accrual and deduction of variation margin. Usually this happens at 19-00 hours, and the trading itself is available from 10-00 am to 23-50 according to the derivatives market schedule.

Option deals are concluded using margin margin method. The trader chooses the underlying asset he needs with predetermined trading conditionsand expiration time and makes a deal. In order to further profit from the contract, all novice traders are strongly recommended to learn the basics of options trading and their specification.

Binary options trading

Unlike stock options, binary contracts are the simplest and most understandable tool for beginners. The task of the trader will be the correct prediction of changes in market quotes. How accurately the analytical forecast will be made depends on the income or loss on the transaction.

For example, a speculator, after an appropriate analysis of the market movement on the asset he needs, decided to buy the "Higher" option, since, in his opinion, the price will rise in the future. He chose the size of the bet and the expiration time and opened the deal. As soon as the binary contract expires, the position will be closed and the trader will immediately receive the result.

If the outcome is positive, the amount spent on the bet will be returned to his trading account, plus the winning yield, which was previously agreed upon under the terms of the contract purchase. Let's say the amount of his transaction was 20 USD, and the profitability of the trading asset was 80%, therefore, these 20 USD and plus 16 USD winnings will be returned to his account. As a result, his deposit will be replenished by $36, since the amount of the bet was deducted when opening a position.

In cases where a trade closes with a loss, that is, a trader has incorrectly predicted a change in the market movement, only the amount ofrates. As a result, in binary options trading, all financial risks are limited, and the profit in case of successful trading is known in advance.

Mobile trading

Almost all brokerage companies where binary contracts are traded provide their clients with opportunities to use mobile trading. This is a very convenient feature, since you do not always have access to a computer or laptop. You don’t even need to specifically learn how to trade binary options from your phone, since there is no difference between computer and mobile trading. The only thing a trader needs is to install a special trading platform on his phone, choose a broker and enter his data for authorization.

According to traders, trading from a mobile device is not very convenient, as some functions are limited, but all the basics for trading are available. That is, you can use some trading instruments, open and close positions, replenish your account and withdraw profits.

Mobile trading has one big plus - you can trade anywhere and at any time, the main thing is to have access to the Internet. For example, on a walk, in queues, during lunch breaks or during outdoor recreation.

Forts options: risk-free trading

Binary contracts and options Forts are different instruments. The fact is that their trading takes place on various platforms. Trading with Forts contracts is traded on exchanges. In Russia, the main exchange tradingthe platform is the Moscow Exchange, which provides traders with the opportunity to trade Forts options. Risk-free options trading consists in the proper management of equity, financial risks and the choice of the most relevant trading strategy for a particular market situation.

For example, consider the "Box Spread" method. Its essence lies in the simultaneous purchase of "Call" and "Put" options for the same trading asset. In this strategy, it does not matter for the trader which way the price will go in this case. He does not even need to analyze the market movement. Wherever the market moves, it will still remain with a profit, as the gain will cover the losing position.

Deposit acceleration

Acceleration of the deposit is a very important point for many beginners. Not every novice trader has a sufficiently large capital, and, moreover, any trading in the financial market always involves inherent risks. To increase trading opportunities and your capital, you need to know how to disperse the deposit on options using safe methods. The most promising trading method for binary options is hedging trades. You can use this method as follows:

- Make an analytical forecast of the market movement and find out in which direction the quotes will move.

- Open a trade with pre-selected parameters and expiry time.

- Wait for the option to expire.

- If the deal closes with a negative result, then open two positions at once in opposite directions.

- Analyze the position before the end of the expiration time and open an additional trade in the right direction.

As a result, one deal will close with a negative result, and the other two with a positive one. They will cover the losses and bring the position to profit.

Hedging can be used without waiting for the closing of the very first trade with a loss. For example, when there is little time left before the end of the aspiration period and it becomes completely clear that the position will be closed at a loss, you need to open a position with an increased bet volume in the opposite direction for a shorter time range.

There are a lot of different options trading strategies in trading and how to disperse the deposit on options in a short time. The main thing is to be able to minimize financial risks and correctly predict changes in market quotes.

Choosing a trading strategy for trading

Each trader, after completing the basic training course, chooses the most suitable trading strategy for him. All trading methods are divided into several groups:

- for short-term trades;

- for long-term positions;

- for mid-term or intraday trades.

The first option includes positions with an expiration time from several minutes to several hours. Long-term transactions can last even several months. In addition, tradingstrategies are divided by aggressiveness, the higher it is, the greater the financial risks.

For beginners, professionals advise using classic trading strategies, with risks not exceeding 1%, maximum 2% of the deposit. Whichever tactic a trader chooses, before starting to use it, it is necessary to carefully study the features of the trading strategy and options descriptions that are recommended for this technique, since they all have different specifics.

Trader reviews

To work profitably in the financial markets with contracts, you need to know how to trade options and be able to do it. According to traders, learning to trade to achieve positive stable results requires several months. But, over time, with enough time, patience and desire, beginners achieve their goals and earn money by trading options.

Recommended:

Trade union - what is it? Russian trade unions. Law on Trade Unions

Today, the trade union is the only organization designed to fully represent and protect the rights and interests of employees of enterprises. And also able to help the company itself control labor safety, resolve labor disputes, etc

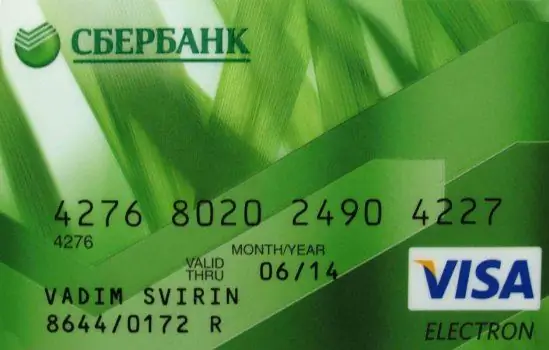

How to find out the pincode of a Sberbank card if you forgot: step by step instructions, recommendations and reviews

The popularity of cash payments is gradually declining, and users prefer plastic cards. This is quite convenient, as it eliminates the need to carry money with you, and if you lose it, your savings will not be affected. After all, a bank card can be restored. Seemingly solid benefits

How to cancel credit insurance: instructions, nuances, recommendations and reviews

Recently, future borrowers are increasingly faced with the need to purchase an insurance policy, and sometimes several at once. The Bank thus seeks to insure itself against defaulted borrowed funds and increase its income. Borrowers, in turn, do not want to overpay for the imposed service and do not want to be deceived

How to transfer money through mobile banking: step-by-step instructions, recommendations and reviews

Mobile banking is a service that helps to easily and simply work with a bank card via a mobile phone. This service is especially popular with Sberbank customers. Today we will learn how to work with this feature

How to create your own cryptocurrency: instructions, recommendations and reviews

Globalization of national economies, the penetration of the Internet into all spheres of life, the search for ways to further accelerate the world economy - all this often leads to unexpected decisions in the economic sphere. One of these is the emergence of cryptocurrencies. What it is? How can you earn money with them? How to create a cryptocurrency "teapot"? We will talk about all this in the article