2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

Corporate bonds are bonds issued by private and public companies. The main purpose of the issue is to raise money on more favorable terms than the bank offers. For an investor, corporate bonds can be a profitable investment.

What are corporate bonds

Corporate bonds are debt securities issued (printed) by businesses to raise money. Any more or less large company can issue such securities. Mostly they are printed on paper, recently it has become possible to purchase them in paperless form on the Internet. Such bonds are nominal, they can be bought only with the help of an electronic signature. To do this, you need to register on the official website of the bank or broker. Investors make all transactions through a special electronic terminal or from the user's personal account. In any case, the person passes the identification.

Corporate bonds of companies, especially private ones, are consideredthe most risky, although much depends on the reliability of the issuer. Large well-known companies are not interested in not paying debts to their investors. Delay or refusal to pay the debt actually means that the company is bankrupt, and this, in turn, leads to a drop in the value of its shares.

Where to buy

Corporate securities, bonds and shares can be purchased both on the exchange, in Russia (this is the Moscow Exchange), and on the over-the-counter market (there are several dozens and even hundreds of well-known and little-known sites for this). Basically, transactions with corporate bonds and other securities take place using modern means of communication: telephones, computers with Internet access.

You can also buy securities at bank branches. When buying, it should be taken into account that corporate bonds must be in documentary form, even if the document is in non-paper form. The buyer must receive a file (message) confirming his right to own the security and the right to claim interest on it.

Benefits of investing in corporate bonds

At first glance, it may seem that investing in corporate bonds is an unprofitable and thankless business. The risk is high, the probability of repayment by the company is low. In fact this is not true. Large companies and enterprises with a good reputation and large volumes of current and non-current assets are not interested in deceiving buyers of their bonds. Temmoreover, it is more profitable for them to issue bonds for two reasons.

Firstly, they receive highly liquid assets (money) at a price much lower than if they took a loan from a bank. The average rate on corporate bonds is 8-12%.

Secondly, during the period for which debt securities are issued, they pay only interest. They pay the principal amount of the debt only at the end of the term.

How can an investor choose reliable corporate bonds

The main task of any investor is to invest with the least risk of loss and with the greatest profit. Corporate bonds of companies are one of the few financial instruments that provide such an opportunity. Many large and medium-sized companies issue bonds, so the investor has a wide choice. In order to secure their investment, an investor should adhere to the following rules when purchasing corporate securities.

- Purchase bonds of the most famous companies.

- If the rate of return on securities is higher than the rate on bank loans, such corporate stocks and bonds should not be bought. This means that the bank does not give a loan to the enterprise for some reason, and it is forced to seek funds in this way. With a high probability, such an enterprise is on the verge of bankruptcy.

- Never buy securities from unfamiliar OTC markets or questionable brokers.

An important condition for choosing an object for investment in the corporate bond market is a stablefinancial condition of the issuing enterprise. The lack of publication of financial statements, as well as documents evidencing their reliability (auditor's report), should alert the investor. Unfortunately, if the money is invested in the wrong company, but in a one-day firm, no one will return it.

Types of corporate bonds

Corporate bonds are no different from ordinary treasury securities in terms of how they generate income. Income is accrued either by coupon or by discount. This is where government and corporate bonds are similar.

On coupon corporate bonds, income is paid in the form of interest, plus the amount indicated on the coupon. For example, the nominal value of a coupon bond is 1,000 rubles, the rate on it is 8% per annum, and plus the owner of the security can count on a coupon income of 50 rubles after a year. The term for which the security is issued is 2 years. This means that at the end of the first year he can take 50 rubles, and after two years another 1166.4 rubles. As a result, the income on the security will be 216.4 rubles.

The discount is also charged in the form of interest. But the bonds themselves at the initial placement are sold at a price below their face value. For example, the nominal price is 1000 rubles, and the company sells them at a price of 900 rubles. Plus 6% per annum. The security is issued for 1 year. The price at circulation on the stock exchange can be either higher or lower than that at which the securities were sold by the issuing enterprise. ittrue for both discount and coupon bonds.

What is the difference between corporate bonds and stocks

The best way to define corporate bonds is by comparing them to other types of securities. For example, with shares of companies. A share is an equity security. It gives its owner the right to vote in management, the right to receive a certain share of the profit - a dividend, the right to part of the property in the event of bankruptcy of the enterprise. Shares are issued by the issuing company, they can be sold both on the stock exchange and on the over-the-counter market.

Corporate securities: shares, bonds are issued by the issuing company. Both those and others can circulate both on the stock exchange and on the over-the-counter market. The main difference between bonds and shares is that they do not give their owner any rights to manage or part of income or property.

All that a buyer of corporate bonds can count on is that he will receive his money back with interest after a certain time. Moreover, he will receive interest either earlier or at the time of closing the transaction. That is, at the time of the sale of the bond to the issuer. An investor can claim compensation in the form of a part of the property from the company only if, under the contract, the bond he acquired is secured by this property.

Corporate and treasury bonds. Difference

Another type of bond is government treasury bonds. They are issued by the state, and itresponsible for their repayment. They are considered as reliable as bank deposits, but the rates on them are higher by 2-5%. The state may not pay for them only in one case - in the event of a default. However, this does not mean that it will not try to cover the debt with depreciated money. And this is a risk. Therefore, when buying government bonds, it is so important that the inflation rate is low. And the economy of the issuing country is stable.

One of the options for bonds are Eurobonds. This is a security, the nominal value of which is expressed in any foreign currency (dollars, euros, pounds). There are two main differences between corporate bonds and government bonds. First, an enterprise may not repay its debts on bonds if it is in a state of bankruptcy and its assets are not enough to repay all debts. In this case, the owner of corporate bonds is left with nothing.

Second difference. Availability of levels of corporate bonds. Tiers is a rating system for bonds in terms of reliability and risk. Russia has a rating system for securities, including corporate bonds. However, such a system does not give a complete guarantee that the company will not go bankrupt in a few years, but such a system is better than nothing at all. There are nine levels in total: A1, A2, A3, B1, B2, B3, C1, C2, C3. Corporate bonds of well-known Russian companies have the highest rating. The lowest have those companies whose financial condition is in an unstable position. But even valuablepapers with a low rating are better than those that do not pass the ranking system.

It is much more risky to buy corporate bonds of those companies whose securities are out of the rating and out of the stock exchange. The rating includes stocks and bonds of companies that publish their financial statements. The reasons for the downgrade of such enterprises can be both temporary difficulties and serious problems. When buying corporate bonds outside the rating and off the exchange, the investor runs the risk of acquiring securities of a non-existent enterprise.

Features of the corporate securities market in Russia

The stock exchange and OTC market in Russia have their own characteristics that make them unlike other trading platforms. This is due to the fact that exchange trading in Russia is practically not developed. And there are few companies that issue stocks and bonds for free circulation. The shares of mining companies are mainly traded on the stock exchange and on the OTC market.

Unfortunately, there is still a strong dependence of the domestic economy on the prices of metals, oil and gas, which are the main export commodities. This leads not only to an unstable exchange rate (the ruble is in a fever), but also to the country's economy as a whole. And although commodity prices have been steadily declining recently, mining companies are still considered the most reliable and attractive objects for investment, including foreign ones.

Investors - both Russian and foreign, prefer to buycorporate bonds of "blue chips", which are represented on the Moscow Exchange by oil companies. However, even a company's affiliation with the "blue chips" does not guarantee that the company will not go bankrupt. Unlike treasury bonds, corporate bonds are not backed by government. And in the event of the bankruptcy of the issuing company, the investor will not receive anything.

Foreign investors, although attracted by high bond rates, are afraid to invest their money in Russian enterprises. The risks for Russian corporate bonds are very high, given not only the unstable state of the economy, but also the imperfection of the legislation. Insufficiently developed laws allow some companies, which by definition will not be able to pay off investors, to issue and place bonds on the over-the-counter market.

Selection Tips

However, not everything is so bad. Investors can use the instability of the Russian economy to their advantage, provided they adhere to certain rules.

- Purchase only government and corporate bonds only on the stock exchange through official brokers and banks.

- SOE bonds are preferable, as they have almost the same security level as Treasury bonds, but yield higher returns.

- Only buy Eurobonds denominated in a stable currency: dollar, euro, Swiss franc or pound.

- Before buying, analyzefinancial statements of the issuing enterprise, compare the reports of different companies with each other.

- To get acquainted with the ratings of corporate bonds. Blue chip companies are the most reliable enterprises in Russia. And although they depend on commodity prices, they are the most successful and stable ones so far.

When concluding a deal, it is necessary to take into account not only the cost of the bond, its type and yield level, but also possible commission costs.

Corporate bonds are another investment tool that allows you to use capital to generate income. In the conditions of the Russian economy, the most reliable type of bonds are Eurobonds. Despite the fact that the yield on them is 1-3%, taking into account the falling ruble, such an investment of money will be the most profitable.

Important

When buying corporate bonds, you should remember that these are risky securities, and much depends on the financial condition of the company that issued them. Therefore, it is necessary to pay attention not only to what is the yield or nominal currency. What is important is the financial condition of the issuing enterprise, the state of the economy of the country in which this enterprise is located. Are there prospects for the development of the company, or is it facing bankruptcy. The safety of invested funds depends on this.

Recommended:

Municipal bonds: concept, types, yield, advantages and disadvantages

Government bodies are implementing economic policy aimed at improving the standard of living of citizens. Covering the deficit of finance intended for the implementation of state programs is carried out by attracting loans. One of the ways to fill local budgets is the sale of municipal bonds

Corporate websites: creation, development, design, promotion. How to create a corporate website?

What do corporate websites mean? When do they become necessary? This article will discuss the main nuances that accompany the development of such projects

Corporate lawyer: duties. Corporate Lawyer Job Description

This article discusses the position of "corporate lawyer", what duties are assigned to a person in this profession, which is included in the range of his competencies. In addition, at the end it will be considered what must be indicated in the resume in order to draw the attention of a potential employer to your candidacy

Corporate client. Sberbank for corporate clients. MTS for corporate clients

Each attracted large corporate client is considered an achievement for banks, insurance companies, telecom operators. For him, they offer preferential terms, special programs, bonuses for constant service, trying to attract and subsequently keep him with all his might

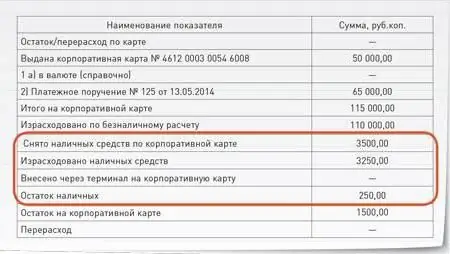

Corporate card report: example. Accounting for a corporate bank card

Accounting for corporate cards is quite simple. Experienced accountants, as a rule, do not have any problems recording transactions. Difficulties may arise when compiling a report on a corporate card by an employee to whom it was issued