2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:43

Recently, corporate card payments have become commonplace for most businesses. These payment instruments are easy to use.

Accounting for corporate cards is quite simple. Experienced accountants, as a rule, do not have any problems recording transactions. Difficulties may arise when compiling a report on a corporate card by an employee to whom it was issued. Next, consider the features of the reflection of transactions.

General information

Corporate cards are called bank cards, the funds on which belong to the organization. They are used to pay for the expenses incurred by employees as part of their professional activities.

It is possible to pay with a corporate card for travel, business, hospitality expenses. This payment instrument is not used for personal purposes of the employee, crediting her earnings, as well as social benefits.

Views

There are credit and settlement (debit) cards. By usingthe last payment is made at the expense of funds held on the account of the enterprise, or an overdraft.

On credit cards, respectively, settlements are carried out at the expense of borrowed funds provided by the banking structure.

Features of the operation

Replenishment is made by bank transfer. To do this, a payment order is sent to the banking organization.

Funds are spent only with the use of the card. It can be both ordinary non-cash transactions and cash withdrawals.

Corporate cards are not subject to settlement limits set by the Central Bank for cash payments. Meanwhile, banking organizations, guided by the recommendations of the Central Bank, can set a limit for issuance. For example, on a Sberbank corporate card, the maximum amount is 100 thousand rubles per day.

Advantages of payment instruments

The following advantages of using corporate cards can be noted:

- Controlling employee spending. First, all transactions will be reflected in the company's account. Secondly, a corporate card report is generated, which reflects all expenses incurred for a specific period.

- Ability to use funds at any time. Access to money in the account is around the clock.

- Prompt blocking of the card in case of problems.

- The ability to use funds on business trips abroad. There is no need to purchase foreign currency when leaving the Russian Federation. At the same time, from Russia it is possiblepromptly replenish the account of an employee who is abroad.

- Significant time savings when booking and paying for tickets, hotel rooms.

Notice of the Federal Tax Service and Funds

Information about the opened account must be sent to the FIU, VSS and the tax service. Currently, the notification is sent by the banking organization itself, serving the account.

Notification is made within 7 days (working).

Important nuances

Corporate cards for legal entities are issued for specific employees of the enterprise, i.e. they are registered.

Reflection of transactions in accounting on corporate cards is carried out, as a rule, on a separate account.

A bank account can be opened both in rubles and in foreign currency. In this case, in the first case, there is no need to open an additional foreign currency account. According to the Regulation of the Central Bank No. 266-P, payment with a corporate card can also be made in a currency that differs from the currency of the account. When receiving, for example, dollars, the bank's system will convert the required amount (automatically convert rubles into dollars).

Spending purposes

Regulatory acts establish a list of transactions that can be carried out in foreign currency using a corporate card:

- Receipt of cash foreign currency abroad of the Russian Federation to pay for hospitality, travel expenses.

- Payment of expenses (representative/travel) in trade/service organizations in foreign currency outside Russia.

Other operations are considered illegal. Monitoring compliance with the list is carried out by the banking structure.

Local organization document

The enterprise should develop an act that defines the basic rules for using corporate cards. This document must be installed:

- List of operations and expenses that an employee is allowed to make.

- Settlement limits.

- Procedure for submitting a report on a corporate card.

- Information about the inadmissibility of disclosing the PIN code to third parties.

- The deadline for an employee to submit an advance report on a corporate card. In the same paragraph, it is advisable to list the documents that will confirm the information.

Also:

- The circle of employees en titled to receive corporate cards is determined by the order of the head.

- Conclude liability agreements with relevant employees.

- Employee-cardholders should be familiar with the procedure for using signature cards.

The return and issuance of payment instruments is kept in a special ledger.

Features of reflection

Accounting for the current account is maintained at the enterprise on the account. 55. A sub-account is opened for him 55.4.

If the account has a minimum balance, it is advisable to create sub-accounts of the second order: "Minimum balance" and "Payment limit".

If an organization has opened several accounts (for each card), then subaccount 55.4 is created byto each of them. If several cards of different employees who make payments within the general limit are issued to one account, the need to maintain analytical records in the context of holders is determined by the enterprise independently.

In cases where a corporate card is linked to a single current account, it is advisable to create a subaccount to the account. 51 or 52.

Accounting

The rules for recording transactions are presented in the table for convenience:

| db | cd | Destination | Confirmation |

| 55.4 | 51 | Transferring the amount of the payment limit and the minimum balance (in rubles) from the account of the enterprise to the card account (ruble) | Payment order, bank statement. |

| 55.4 | 52 | Transfer of the payment limit and minimum balance in foreign currency from a foreign currency account to a corporate one. | Payment document, bank statement. |

| 55.4 | 67, 66 | Receipt of credit funds to the card account on the date of a single crediting, if an appropriate agreement has been concluded with the banking structure | Bank order, bank statement. |

| 55.4 | 66 | Receipt of credit funds to the cardaccount on the day of payment by credit funds of a banking organization in the absence of the company's own money, if an overdraft agreement has been signed with the bank | Bank statement, warrant. |

| 91.2 | 51, 52 | Paying bank fees for issuing, issuing, servicing a card | Bank statement, accounting statement. |

| 91.2 | 66 | Calculation of interest on a loan provided by a corporate card | Bank statement, accounting statement. |

| 66 | 51, 52 | Transfer of funds to repay a loan or interest on a loan received in connection with the use of a card | Payment order (document), bank statement. |

To reflect the replenishment of a corporate card in "1C" the document "Write-off from account" is used. It is located in the "Bank and cash desk" section.

Accounting for settlements

There are two options for recording transactions: simplified and academic. Their features are shown in the tables.

| db | cd | Destination | Confirmation |

| 71 | 55.4 | Reflection of the amount of work paid by the card,services, goods, as well as cash withdrawn from the card in the context of holders (reporting employees) on the date indicated in the bank statement | Bank statement with decryption application for corporate cards. |

| 10, 15, 25, 20, 26, 44, 40 etc. | 71 | Reflection of paid materials, works, services, in accordance with the advance report submitted by the employee with supporting documents attached, as of the date of the report. | Invoices, tickets, receipts, checks, original slips, ATM checks, etc. |

| db | cd | Destination | Confirmation |

| 10, 20, 26, 44 etc. | 71 | Reflection of materials, works, services paid by a corporate card, in accordance with the report with supporting documentation as of the date of its submission | Tickets, receipts, original slips, terminal receipts, etc. |

| 71 | 57 | Reflection of a transaction made on a card, but not accounted for in a bank account | Accounting reference. |

| 57 | 55.4 | Reflection of the amount of paid goods, works, services, cash withdrawn from the card, in the context of accountable persons on the day they are reflected on a bank statement | Extractbank with decryption by cards. |

If the date of the report on the corporate card coincides with the day the transaction is reflected in the bank statement, the transactions are made according to the first option.

Additionally, for both options, the amount of damage should be taken into account:

| db | cd | Destination | Confirmation |

| 73.2 | 55.4 | Reflection of the amount of material damage caused by the employee's failure to provide supporting documents or in connection with the use of card funds for personal needs | Bank statement, accounting statement. |

| 50, 70 | 73.2 | Compensation for harm by an employee through the cash desk of the enterprise or by deduction from earnings | Accounting statement, receipt order. |

Corporate card report: example

The employee who received the funds for the report must provide a document that describes all the costs incurred. Supporting papers are attached to it. The relevant instructions are established in the order approved by the Central Bank.

Order of the State Statistics Committee of 2001 approved the standard form of the report AO-1.

In the form, however, there are no lines in which you can reflect transactions on corporate cards. There are two ways to fix the situation:

- Supplement the standard form. As established in the Order, the organizationhas the right to add additional lines to the unified form.

- Develop a form yourself. Unified forms from 01.01.2013 are not considered mandatory for enterprises. The corresponding provision follows from Federal Law No. 402.

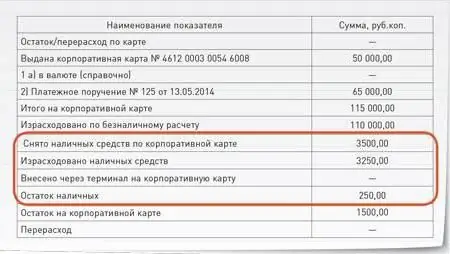

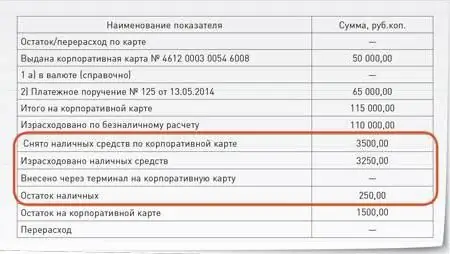

Let's consider an example. The employee was issued a corporate card of Sberbank, on which 50 thousand rubles are available. He was instructed to buy a multifunctional device, the cost of which is 110 thousand rubles. In accordance with the payment order, 65 thousand rubles were transferred to the card. After purchasing the device, the balance turned out to be 5,000 rubles.

The accountant of the enterprise supplements the standard form of the report with several lines. First of all, columns are provided to reflect the amounts of funds as of the date the card was used:

- "Balance on the card". This line is filled in if the employee did not hand over the payment instrument.

- "Issue card …". This line contains information if the payment instrument was issued before the execution of the task.

The balance on the card is recognized as equal to 0 under the conditions of the example, since the card was issued to the employee before the assignment was completed. The line "Issued a card" indicates its number and the available amount.

To reflect the replenishment of funds, the column "Payment order" has been added to the report. The date, document number is indicated here.

The "Total" line should contain the amount of the balance on the issued card and the size of the additional transfer. According to the conditions of the example, the total is 115RUB thousand

On the reverse side of the report, the documents by which the employee confirms the expenses incurred should be listed. The employee must indicate the date of the expense and the amount.

Cash withdrawal

When developing a report form, it is necessary to provide for a situation where an employee will not be able to pay for services or goods by bank transfer. Accordingly, the employee will have to cash out the required amount.

To reflect such transactions, the following lines are added:

- "Withdrawn from card".

- "Cash spent".

- "Added to card via terminal".

- "Cash balance".

All transactions with funds are reflected on the front of the report.

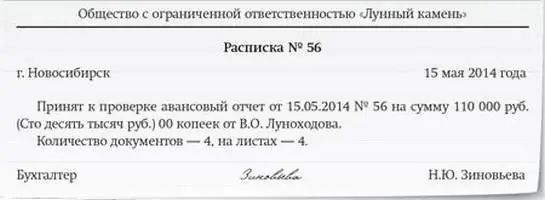

Receipt of receipt of the document

Accountable employee must submit a report to an accountant or head of the enterprise. After that, the document is checked, then approved by the director of the organization.

Goods, services purchased by an employee are credited. The employee receives a receipt for the acceptance of the report - the bottom of the form. If it is not provided in the form developed by the enterprise, the receipt is drawn up in an arbitrary form.

Form Approval

According to general rules, the head must approve the form developed by the enterprise independently. Such a requirement is established in Federal Law No. 402. The same requirement applies if the organization uses a unified form.

Usually samplesforms of primary documents are given in the annexes to the order on approval of the accounting policy.

Opening an account

To create an account with corporate cards, the company will first need the documents necessary to open a regular account. In addition, you must write an application, the form of which is provided by the bank. It is written for each employee-cardholder. Documents by which the relevant employees are identified are also attached. This, in particular, is about a passport, as well as documents confirming labor relations with the enterprise (a copy of the contract). The bank may request other papers if necessary.

Recommended:

Accounting documents are The concept, rules for registration and storage of accounting documents. 402-FZ "On Accounting". Article 9. Primary accounting documents

Proper execution of accounting documentation is very important for the process of generating accounting information and determining tax liabilities. Therefore, it is necessary to treat documents with special care. Specialists of accounting services, representatives of small businesses who keep independent records should know the main requirements for the creation, design, movement, storage of papers

Corporate client. Sberbank for corporate clients. MTS for corporate clients

Each attracted large corporate client is considered an achievement for banks, insurance companies, telecom operators. For him, they offer preferential terms, special programs, bonuses for constant service, trying to attract and subsequently keep him with all his might

Report for husband. Financial report to husband

Home finances are a subject of controversy and problems in many families. Very often, husbands require their wives to be fully accountable for where the money was spent. This article will tell you everything about how to keep a family budget and whether it is worth reporting to your spouse for spending

Accounting for working hours in the summary accounting. Summarized accounting of the working time of drivers with a shift schedule. Overtime hours with summarized accounting of wor

The Labor Code provides for work with a summarized accounting of working hours. In practice, not all enterprises use this assumption. As a rule, this is due to certain difficulties in the calculation

Advance report: postings in 1C. Advance report: accounting entries

Article on the rules for compiling advance reports, accounting entries reflecting transactions for the purchase of goods and services for cash, as well as travel expenses in the accounting of the enterprise