2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

Financial obligations are a complex system of interactions between a creditor and a debtor. Unfortunately, when borrowing money, many do not fully understand what the consequences may be in case of delay and non-repayment of loans. But even if such a situation occurs, do not despair and panic. They put pressure on you, require you to pay fines and pen alties. As a rule, such events are carried out by specialized organizations. How to communicate with collectors correctly and protect your legal rights? We will try to study all the nuances.

General aspects

Outdated loans and pen alties, the inability to pay delinquencies - this situation is probably familiar to many. Banks transfer your debt to collectors, and the real "harassment" begins. They call you, write and lie in wait in the most unexpected places. Man falls into a trap andknows how to act. Very often, such pressure is very effective, and the debtor pays not only the loan, but also fabulous fines. The thing is that many are not familiar with their legal rights and therefore do not know how to communicate with collectors. And extortionists take advantage of this situation. But there is a way out! It is necessary to know the law, and then the dialogue will become much easier and more productive.

The law will help you

Know that the activities of such organizations are strictly regulated by law, which protects our rights and freedoms. Therefore, no one has the right to violate them! The main threats used by collectors:

- Article 177 of the Criminal Code of the Russian Federation "Malicious evasion of repayment of accounts payable". Remember, such threats are an absolute bluff on the part of the collector! There are no more than a dozen precedents for attracting under this article in our country.

- Article 159 Fraud. This argument is the most common. Remember, if you have paid at least once, even the minimum amount of obligations, this “letter” of the law does not apply to you. There is no intent and you will not be prosecuted.

Very often, collectors themselves do not know the laws, but as soon as they see a competent debtor, their impudence and assertiveness simply disappear.

Psychological pressure

Practice shows that collection organizations have rather narrow rights. These are commercial firms that can only persuade a person to pay a debt. More powers forthey are not, of course, if the issue is not in court, and there is no verdict on it, which they transfer to the executive service. So formidable they can only be in conversation. How to communicate with debt collectors on the phone? First of all, know that they want to intimidate and excite you as much as possible. And it is in this state that a person panics and is ready to fulfill any requirements.

Try to keep cool and calm, do not shout, swear, insult employees. And if threats come to your address, be sure to report that this fact has been recorded by you, and the police will already communicate with them. It is advisable to record such calls for the purpose of further presentation to law enforcement agencies. Do not respond to attacks about your dishonesty, ignore such remarks and ask for reasons on which they dared to intimidate and insult you.

Collecting information

You need to be prepared for a dialogue with extortionists. Yes, that's right, because without a court order and a writ of execution, they are engaged in illegal activities. How to talk to collectors on the phone correctly? Remember a few important points:

- Ask to introduce yourself and write down all the information.

- Specify which office you are concerned about (name, details).

- Which bank transferred your debt, let them clarify the details of the contract (document number, date of signing, amount of claims).

- Ask for a copy of the assignment agreement for your debt.

If you were refused to provide such information, feel free to hanghandset. It will be useful to install a device with a caller ID in order to record all calls and their time. Be sure to tell the collectors that you are ready to complain to the police about illegal actions on their part.

Communication algorithm

How to talk to collectors on the phone so that they understand your intentions? First, do not be afraid and make excuses. Do not allow yourself to be insulted, threatened by your family or relatives. Such actions qualify as hooliganism or extortion. As soon as the calls become intrusive, try to explain to the collector that you intend to solve this problem.

If the situation does not change and you are constantly being harassed, report harassment and threats to the police. In no case do not communicate with them after 11 pm or in the early morning before 7, otherwise such calls will become permanent. If you feel that you are openly provoked to aggression, hang up. Upon learning that these dishonest citizens began to threaten loved ones, immediately report to the police. If calls to work have begun, this is already the disclosure of your personal information. Here you have the right to sue them for illegal activities!

What not to report

How to communicate with collectors on the phone, so as not to harm yourself? Do not provide any extra information. Do not give the phone numbers of the organization where you work, do not give the coordinates of your home. Don't share information about loved onesfriends. Many in an attempt to solve the problem tell the collectors the date of receipt of the salary or the fact of the sale of real estate or property, this should not be done. This is another reason for them to put pressure on you and intimidate. If you are really going to pay off the debt, you can name the date of repayment. But lawyers do not recommend paying them off at all, it is better to go to court, because it can significantly reduce the amount of pen alties.

Unpleasant visit

And how to deal with collectors if they dared to pay you a visit home? First of all, know that you are not obliged to open the door for them and let them into your own home. The law is on your side. If they started screaming and swearing, disturbing the neighbors and frightening you, immediately call the police squad with a statement that unknown citizens are breaking into your house. Believe me, this cools their ardor perfectly. If you still decide to talk to them, do not let them into the apartment until they provide you with:

- Assignment of your debt.

- Documents proving their identity.

- The article against which you are being charged.

- Documents confirming the rights of the organization to carry out collection activities.

As a rule, the conversation stops already at this stage. But if the workers started to threaten you, defiantly record everything on a camera or a voice recorder, invite neighbors who are witnesses. Experts recommend documenting the entire communication process as carefully as possible. If they write letters to you, be sure to save them, and send the answer by registered mail withdescription of attached documents. An excellent way out of the problem will be the involvement of a loan lawyer. These specialists are well aware of how to properly communicate with collectors.

In any case, do not panic and give in to pressure under any circumstances, even if you are wrong. Remember that knowing and understanding how to communicate with collectors correctly is the key to your psychological he alth. Seek help from a lawyer or lawyer who will protect you from attacks and help you deal with debt. After all, there are many algorithms for solving accounts payable.

Recommended:

Collectors: legal or not? How to talk to collectors

Today, there are a huge number of collection agencies. In fact, they are not a state body, but use all the methods permitted by state law. That is why the attitude of people to collectors is very different. Many are interested in the question: collectors - legally or not, they act and take measures in relation to debtors

How to deal with collectors: practical recommendations

It is pointless to argue about whether or not to take a bank loan. It all depends on the circumstances: for some, this opportunity helps a lot, while for others it turns into a real hard labor. Often, credit organizations turn to collectors - private firms offering their debt collection services. The activities of such organizations are poorly regulated by law and therefore often there are various abuses of their powers on their part

Sale of debt to collectors. Agreement for the sale of debts of legal entities and individuals by banks to collectors: sample

If you are interested in this topic, then most likely you overdue the loan and the same thing happened to you as with most debtors - the sale of debt. First of all, this means that when applying for a loan, you, trying to take the money in your hands as quickly as possible, did not consider it necessary to carefully study the contract

Debt sold to collectors: does the bank have the right to do so? What to do if the debt is sold to collectors?

Collectors are a huge problem for many. What to do if the bank has contacted similar companies for debts? Does he have the right to do so? What will be the consequences? What to prepare for?

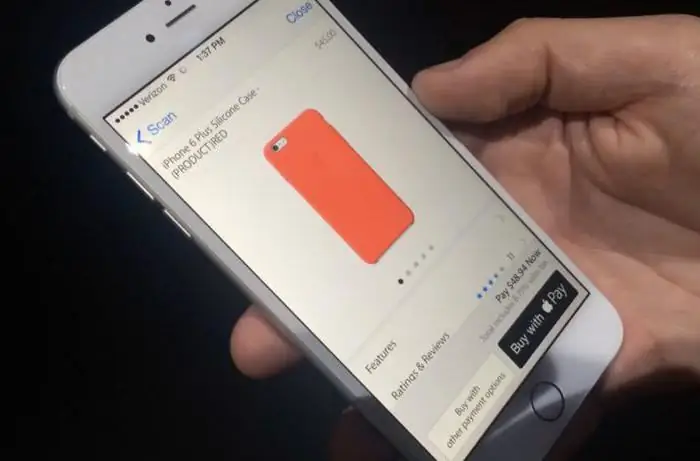

How to pay by phone in a store? Pay for purchases by phone instead of a bank card

Modern technologies do not stand still. They develop so fast that many people simply do not have time to understand them