2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:28

A payment order is mentioned in the Regulation of the Central Bank No. 383-P of 2012. This settlement document is created in a banking institution to make a partial transfer of funds. Consider further the features of the payment order.

General information

For the formation of a payment order, a partial acceptance of the payer is required and the absence of the required amount of funds on the account. This document in banking practice is designated as an order that has not been executed until a certain time.

The procedure for issuing a payment order is similar to the procedure provided for filling out settlement papers.

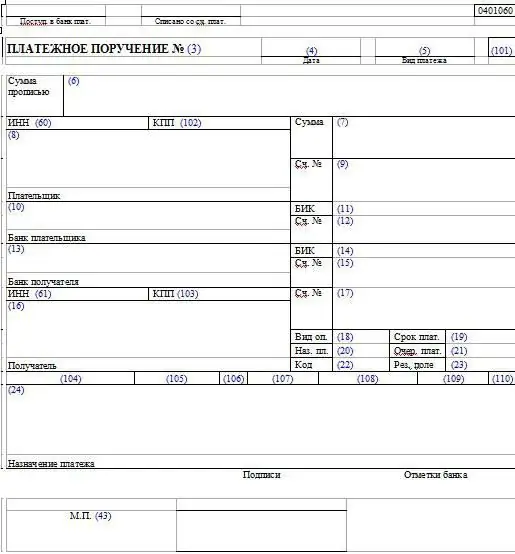

All copies of the document must have the stamp of the bank, the signature of the responsible officer and the date. The first copy is certified by the signature of a bank employee. The payment order form has the code 0401066.

Nuances

On the front of the payment order marked "partial payment". On the reverse side, the responsible bank officer makes an entry about the partial transfer. In particular, the payment number, the number and date of the order, the amount and the amount of the balance are indicated. This data is certified by the signature of the employee.

Storagedocuments

When transferring funds on behalf of the first copy of the order, through which the payment was made, remains in the bank documents. The last copy is used as an attachment to the payer's account statement.

When making the last payment on an order, the first copy of the order, together with the first copy of this order, is stored in bank documents. The remaining copies are issued to the payer along with the last copy of the cash order, which is attached to the extract from the l / s.

Document to write off

It is worth saying that a cash order for debiting funds is used quite rarely in banking practice. A document is created in the automated system of a financial organization and a specific type of transaction is selected:

- Paying the supplier.

- Settlement on credit/loan.

- Transfer of tax payment.

- Refund to the buyer.

- Other settlements with counterparties.

- Transfer to another company's account.

- Payroll.

- Transfer of funds to accountable person.

- Another write-off of non-cash funds.

Filling out a payment order for debiting is carried out on the basis of a bank statement. When registering, it is considered that the transfer has already been made and is confirmed by the relevant documents.

Order for receipt of funds

It is issued on papers that differ from the incoming order. It should be noted that payment orders for receipt of money and orders are usedwith almost the same frequency.

As in the previous case, when creating a document, the corresponding type of operation is selected:

- Payment from buyer.

- Settlement on credit/loan.

- Supplier refund.

- Other settlements with counterparties.

- Proceeds from sales from bank loans and payment cards.

- Collection of funds.

- Acquisition of foreign currency.

- Proceeds from the sale of foreign currency.

- Other non-cash transfers.

Example

Let's consider the features of the warrant used for the collection of funds. This document does not include payment details. Funds are transferred between money accounts. When specifying a corresponding item, you can select one of sub-accounts 57 of the "Transfers on the way" account.

During the cash collection operation, a transaction is generated:

- dB ch. 51 cd sc. 57 - by the amount deposited in the bank account.

Money goes to account 57 when a collection transaction is reflected by a cash order (expenditure order) of the appropriate type. At the same time, when it is selected and the corresponding sub-account 57 of the account is indicated, the posting is made:

- dB ch. 57 cd sc. 50 - for the amount of funds collected.

Design features

In case of partial payment on all instances of the order put down:

- Bank details.

- Number of transactions that were made.

- Signature of responsible officer.

The first copy must be certified by an employee of the banking organization who controlled the execution of the order. The inscription about partial payment should be indicated at the top, on the right side of the front side.

Payment order

It is a settlement document expressing a written order of the account holder sent to a banking organization to transfer a certain amount to the recipient's account. The latter can be opened in this or another bank.

The execution of the order is carried out within the time period established by law, or in another, shorter period, if it is provided for in the account service agreement or determined by customs.

This payment document is used to transfer funds:

- For the supply of goods, provision of services, production of works.

- To the budget of any level, off-budget funds.

- For the purpose of repayment/placement of a loan/loan, payment of interest on borrowed funds.

- For other purposes provided for in the contract or law.

In accordance with the main contract, the order can be used to transfer an advance (prepayment) of services, works, goods, or to perform periodic settlement transactions. The document can be presented within 10 days (calendar). The countdown starts from the next day after the date of discharge.

Payment order and payment order: differences

These two documents have one thing in common. Both the order and the order are used as a way to carry outtransactions involving partial payments. However, the documents have significant differences.

The first is that a payment order cannot be used to fully pay an invoice or receipt. A payment order, on the other hand, usually performs just such a function.

A payment order is a direct transfer of money. At the same time, it is not expected that the client of the banking organization issues an order to perform a settlement transaction. The payment order, in turn, provides for the transfer to the banking structure of the right to transfer money from the client's account to another account.

A payment order can be used, for example, by the judicial authorities. The authorities apply to a banking organization with a request to debit a certain amount from the debtor's account in favor of another person or any structure. At the same time, the account holder is not notified in advance about the operations that will be carried out with his money. He can learn about the transfer after the transfer of funds, that is, upon the execution of the order. For example, it can be an SMS notification. He may not find out about the operation until he visits the banking structure (if, for example, the mobile bank is not installed).

Accordingly, a payment order and an instruction are documents of different content. They can be executed independently of each other or be interconnected settlement securities.

Recommended:

Filling out TORG-12: rules for filling out a consignment note

This article discusses the primary documents, the TORG-12 consignment note, the rules for filling out, the form and the form, its purpose and the requirements of the inspection inspections

Samples of filling out a consignment note. Rules for filling out a consignment note

In order for the company's activities to fully comply with the requirements of the law, when filling out the documents, you must follow the established instructions. This article discusses samples of filling out a consignment note and other accompanying documents, their purpose, structure and meaning in the activities of organizations

Samples of filling out payment orders. Payment order: sample

Most enterprises pay various taxes and fees to the budget. Most often this is done with the help of payment orders. How to compose them correctly?

Trading fee: payment details. How to fill out a payment order?

In the cities of regional significance, a sales tax has been introduced since 2015. You need to pay it in case of registration for the use of the object of trade in one of the types of activities. Next, we’ll talk about when and how to transfer the trading fee, payment details will also be indicated

UIP - what is it in a payment order? Unique payment identifier

Since 2014, the UIP is an important requisite that must be filled in if it is provided by the seller, and also if this identifier should be considered as a UIN when it is indicated in payment documents for paying fines, pen alties for taxes and fees . This code is indicated in the field of the payment order at number 22. It can be filled in both manually and using special software tools, the main of which is "1C: Enterprise"