2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:33

A financial asset is a fund that reflects financial liabilities and claims. At the same time, such funds allow the owner to have the right to receive one or more payments from any other institutional unit. The latter in this case acts as a debtor on the basis of an agreement that was previously recorded between them. Thus, a financial asset is a specific form of property relations. Nevertheless, it is she who provides the owner with the opportunity to make a profit. This concept characterizes all the financial resources at the disposal of the enterprise.

Component parts

Like any other accounting item, the financial asset of an enterprise is a fairly complex structure, which consists of many components. We list the most significant of them. This concept traditionally includes cash, securities, deposits and contributions, cash on hand, shares and insurance policies. In addition, it should be noted that to the named article of accounting documentationalso include portfolio investments in the shares of the organization in question, as well as packages and investments in other companies. Accounting for financial assets should be carried out by specialists who do not forget that in addition to all of the above, the following items are also attributed to such an economic term: monetary gold, technical reserves, foreign investment, borrowing from the currency board. When analyzing all of the above, we can conclude that all financial transactions related to this category consist of two main groups, which are called "asset for the creditor" and "liability for the debtor".

Return on financial assets

Like any other product that can be found in a wide range of the modern market, the desired value has a sufficient number of characteristics and factors responsible for the appropriateness of various operations associated with it. However, there are many distinguishing features. The most obvious example is the following: a financial asset is not acquired for immediate use. The purpose of their occurrence is considered to be investment in any part of the production process. If, as a result of such activities, the asset contributed to the increase in profits, then it is considered that it was used rationally. In addition, it should be borne in mind that the receipt of income should be regular and directly depend on the amount of the asset invested to receive it.

Risk, return and price

Economic dataindicators - the most important indicators of a financial asset. Risk is the probability that an entrepreneur will incur losses as a result of their activities. Profitability - an interest rate calculated for the year, which characterizes the amount of return on invested capital investments. The price, in turn, is the valuation of the asset in terms of money.

Recommended:

Forecasting and planning finances. Financial planning methods. Financial planning in the enterprise

Finance planning combined with forecasting is the most important aspect of enterprise development. What are the specifics of the relevant areas of activity in Russian organizations?

What is financial grant assistance. Financial assistance free of charge from the founder

Property owned by an LLC and its founders exists as two separate categories. The company cannot rely on the money of its members. Nevertheless, the owner has the opportunity to assist the company in increasing working capital. You can arrange it in different ways

Financial leverage or financial collapse?

Throughout the times, technologies, cultures, lifestyles and beliefs have changed, but only one thing has remained unchanged - money. For centuries, they have been daily present in people's lives, performing their functions

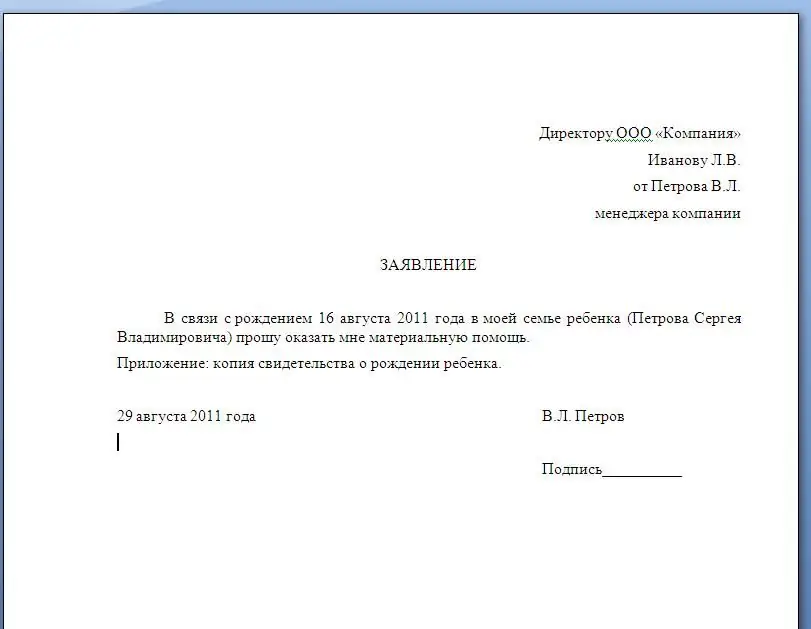

Application for financial assistance: sample and form of writing with an example, types of financial assistance

Material assistance is provided at work to many employees who have significant events in their lives. The article provides sample applications for financial assistance. Describes the rules for assigning payments to the employer

Financial oligarchy - what is it? Methods of domination of the financial oligarchy

Financial oligarchy is an international phenomenon, implying the concentration of material capital in the hands of a certain group of persons who act in their own interests in order to enrich