2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:29

In the process of doing business, there is periodically a need to reorganize the company, that is, its merger with another institution, absorption or withdrawal of a branch into a separate structural unit. This changes the property and liabilities of the company. The assets and liabilities of the firm must be fixed on the date of the changes by compiling a separating balance sheet.

Essence

Each organization submits monthly, quarterly and annual reports. The first two are compiled on an accrual basis and are interim reports. According to paragraph 275 of the Instruction "On reporting" No. 191n, in the event of a reorganization or liquidation of an organization, a separation balance sheet must be submitted to the regulatory authorities on the date of the changes.

Balance sheet

A reorganized company, which changes the volume and structure of the balance sheet, continues to function without interrupting its activities. Dividingthe balance sheet when allocating a branch is formed on the basis of the decision of the founders. The accountant must properly distribute property between organizations.

Information is taken from the last submitted statements, which should also be attached to the balance sheet.

The specific form of the separating balance sheet of the reorganization is not provided for by law. Recommendations for compiling the balance sheet are contained in the Methodological Instructions of the Ministry of Finance No. 44n. The separation balance sheet must contain the following details:

- name of the organization being reorganized;

- names of successors;

- forms of ownership of all participants in the process on the date of the report and after the reorganization;

- assets, liabilities, equity of the reorganized enterprise.

All balance sheet indicators are distributed among new organizations according to the ratio, which is approved and spelled out in the shareholders' decision. No other adjustments are made to the balance sheet and income statement.

The segregation balance sheet of an organization whose assets are divided between "new" enterprises is shown in the table.

| Article | С | A | B |

| 100 % | 20 % | 80 % | |

| Asset | |||

| 1. OS | 22 | 20 | 2 |

| 2. OA | - | - | - |

| Stocks | 36 | 36 | 0 |

| Products | 102 | 0 | 102 |

| Accounts receivable | 165 | 40 | 125 |

| Current financial investments | 10 | 3 | 7 |

| Cash | 42 | 12 | 30 |

| TOTAL OA | 355 | 81 | 274 |

| Balance | 377 | 101 | 276 |

| Passive | |||

| 1. Net worth | |||

| Authorized fund | 125 | 25 | 100 |

| Retained earnings | 30 | 17 | 13 |

| TOTAL P1 | 155 | 42 | 113 |

| 4. Current liabilities | |||

| Credits | 200 | 52 | 148 |

| Indebtedness to the budget | 22 | 7 | 15 |

| TOTAL W4 | 222 | 59 | 163 |

|

Balance |

377 | 101 | 276 |

The separation balance sheet should contain information on the ratio of transferred liabilities and assets. The percentages indicated in the header of the report show how the authorized capital of the "old" company is divided.

Additional documents

The separation balance sheet during the reorganization of the company needs to be reinforced:

- The decision of the founders on the reorganization, which details the procedure for the distribution of property and liabilities, methods for assessing assets and other conditions.

- Statements of the reorganized enterprise, according to which the assets and liabilities of the successor are estimated.

- Act of inventory of the balance sheet of the reorganized company, which is drawn up before reporting. Primary documents for material assets are attached to it.

- Breakdown of accounts payable and receivable, which should contain information about the notification of all counterparties about the reorganization. Additionally, acts of reconciliation of debt amounts are submitted.

- Act of reconciliation of settlements with the budget and state funds.

- List of contracts of the spin-off enterprise under which rights and obligations are transferred. Separately,information on disputed obligations that are pending in court.

Distribution of balance sheet indicators

It is necessary to split assets and liabilities in accordance with the decision of the founders. In doing so, a number of requirements must be met. There are no separate rules for the distribution of assets. Usually property and stocks are transferred to the company that needs them. That is, the rights to intellectual property objects are received by the company that uses them.

The balance of funds is formed based on the balances in the cash register and on all accounts. Frozen funds are not included here. That is, the funds on arrested accounts or in bankrupt banks cannot be attributed to the most liquid assets.

The value of the capital of the old company must be equal to the sum of the capital of the new organizations. If the successor's capital is less than that of the predecessor, then retained earnings increase by the same difference or the loss of the "new" organization decreases. In the reverse situation, the source of capital growth can be an increased value of property, additional capital, or retained earnings. An important condition: the net assets of "new" enterprises must be no less than the value of their authorized capital.

If the assignee receives the revalued property, he must transfer the corresponding amount of additional capital. The cost of additionally purchased fixed assets at the expense of targeted income must be reflected in account 98.

Doubtful debt andThe “new” firm receives financial investments along with the corresponding amount of reserves.

The accounts payable of the "old" firm are distributed among the successors according to the ratio of transferred assets. It is better to transfer receivables and payables for one company to one enterprise. Advances on paid VAT - to the company that received the corresponding contract.

Price fixing

Before drawing up a separation act-balance sheet, you need to calculate the value of the property. For these purposes, you can use the residual value from the balance sheet or the market value. For an accountant, the first option is more convenient, since it prevents the appearance of differences in NU and BU. It is beneficial for shareholders to evaluate the value of property based on market prices so that the real value of assets is not distorted. For these purposes, you should use the services of an independent appraiser. And the candidate should be approved in the decision on reorganization. The mode of transfer of property is chosen by the managers. The value of the property in the report must match the data in the applications.

Obligations of the enterprise are transferred only at book value. That is, in the amount in which the debt must be repaid by the creditor. Redeemable claims are valued at market value.

Unrecorded liabilities and assets

Liabilities unaccounted for in the balance sheet must be recorded in the annexes to the reporting. Such a situation may arise if, for example, the company entered into a supply contract even before the reorganization, did not ship the goods, andpayment has not been received. Nevertheless, such an agreement must be transferred to one of the successors. Assets and liabilities in off-balance accounts should be distributed along with the debt and investments in respect of which they were made. Leased property is transferred to an organization that needs it more.

Separation balance in 1С

In the 1C program, the period is selected in the report generation settings in the General tab. If there is a need to fill out a report for the previous period, then the form of the form can be viewed in the reference book "Reporting periods". Each new configuration contains sample forms for the previous three periods. All of them are presented in the form of a hierarchical list. Any form can be opened and edited. If desired, you can draw up a balance at least daily. To do this, select the “Day” type as the reporting date, and specify the previous date in the settings. To generate a report, you need to click on the "Create" button.

Conclusion

The separation balance sheet, the form of which is presented on the website of the Federal Tax Service, is made up if the company merges with another organization or allocates a separate division. Assets are divided by residual or market value. All balance figures must match the data in the applications. The debt is distributed in proportion to the transferable assets. The amount of net assets must not be less than the amount of the authorized capital.

Recommended:

Net sales in the balance sheet: string. Sales volume in the balance sheet: how to calculate?

Annually, enterprises prepare financial statements. According to the data from the balance sheet and income statement, you can determine the effectiveness of the organization, as well as calculate the main planned indicators. Provided that the management and finance department understand the meaning of terms such as profit, revenue and sales in the balance sheet

General concepts of the balance sheet: assets, liabilities, balance sheet currency

The balance sheet contains important information for assessing the company's financial results. Each section of the asset, liability, as well as the balance sheet currency is necessary to calculate many financial indicators

Formula of net assets on the balance sheet. How to calculate net assets on a balance sheet: formula. Calculation of net assets of LLC: formula

Net assets are one of the key indicators of the financial and economic efficiency of a commercial firm. How is this calculation carried out?

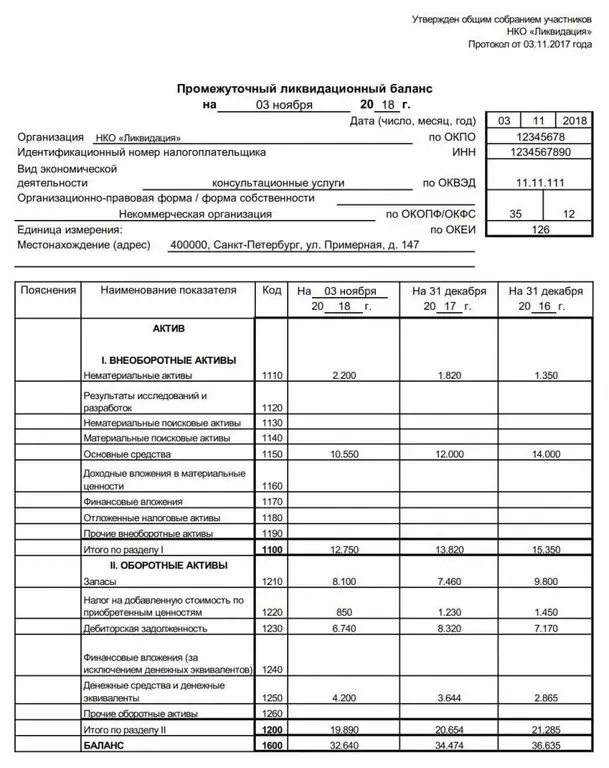

Liquidation balance sheet is Definition of the concept, approval, form and sample of filling out the liquidation balance sheet

The liquidation balance sheet is an important financial act drawn up during the closing of an organization. It can be intermediate or final. The article tells what is the purpose of these documents, what information is entered into them, as well as how and when they are approved and submitted to the Federal Tax Service

Balance: types of balance. Types of balance sheet

The balance sheet is the most important accounting document of an institution. What is it, what are the rules for filling it out, types and classification