2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:29

In financial planning, the main task is to find the most profitable option for the organization.

The financial plan is a procedure for the development and functioning of the company in terms of value. It provides a forecast of the effectiveness and financial results of the investment, financial and production activities of the enterprise.

Financial planning is the main part of a firm's business plan. When developing it, one must proceed from the definition of funds that are necessary for the development of the company, as well as from the evaluation of the plan as an investment project. That is, the envisaged expenses must be economically justified.

The financial plan of the enterprise should reflect the final results of economic activity. It should cover commodity, material values, interdependence and interconnection of cash flows.

The financial plan is the final results of the firm. The information base includes accounting documentation, the most basic documents are the balance sheet and its appendix.

The financial plan system findsreflection in:

- income and receipts;

- expenses and deductions;

- credit relationships;

- relationship with the budget.

The strategic financial plan is the procedure for implementing the tasks and goals of the company, the proposed savings and investment strategy. Its basis is the determination of the enterprise's need for capital to ensure the production and economic activities of the enterprise.

Tactical financial plan is the annual balance of expenses and income of the organization. Due to inflation, plans are made quarterly and periodically adjusted to reflect the inflation index.

The purpose of drawing up a financial plan is the need to link the income of the enterprise with its expenses. If there are more funds received, then they are sent to the reserve fund of the organization. Otherwise, measures are being developed to minimize costs. The organization may receive additional funds from third-party firms, from the issue of securities, loans, credits, etc.

So, we should take a closer look at the primary task of financial planning. The management of the organization must be aware of changes in economic activity in order to be able to make plans for the coming year. Persons who are interested in the activities of the enterprise have special requirements for its results.

When drawing up a plan for certain types of activities, you should know in which economic resourcesthere will be a need in order to complete the tasks.

When implementing the plans laid down in the budget, it is necessary to register the actual values of the results of management. When comparing the planned with the received, there is a place to be budgetary control. In this case, the main attention should be paid to the indicators that deviated from the planned ones and the analysis of the changes that have occurred.

As a result, the company receives new information about the activities. That is, by conducting budgetary control, it is possible to identify the weaknesses of the organization, to find out in which areas unsatisfactory results are observed. Probably, the problem may be in the financial plan itself, but in this case, the management will know that some points in the planning should be corrected.

Recommended:

Forecasting and planning finances. Financial planning methods. Financial planning in the enterprise

Finance planning combined with forecasting is the most important aspect of enterprise development. What are the specifics of the relevant areas of activity in Russian organizations?

Financial plan of a business plan: prerequisites for drawing up

The largest and most important step in preparing for a business is the financial plan of the business plan. The information contained in this section is the basis for providing it to business partners, investors

What is financial grant assistance. Financial assistance free of charge from the founder

Property owned by an LLC and its founders exists as two separate categories. The company cannot rely on the money of its members. Nevertheless, the owner has the opportunity to assist the company in increasing working capital. You can arrange it in different ways

Financial leverage or financial collapse?

Throughout the times, technologies, cultures, lifestyles and beliefs have changed, but only one thing has remained unchanged - money. For centuries, they have been daily present in people's lives, performing their functions

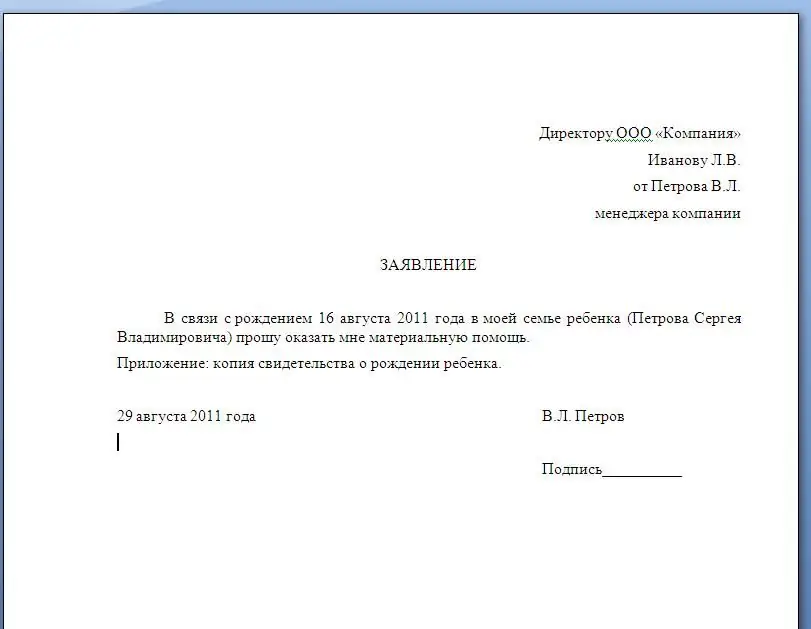

Application for financial assistance: sample and form of writing with an example, types of financial assistance

Material assistance is provided at work to many employees who have significant events in their lives. The article provides sample applications for financial assistance. Describes the rules for assigning payments to the employer