2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:30

Rockefeller or Rothschild must be born. Or, if you're lucky, get an inheritance from some American uncle who left before the revolution for a better life. For the majority of our fellow citizens, the question of how to accumulate money, based on modest resources and opportunities, is relevant. Let's make a reservation right away: methods that cannot be considered completely legal,

we will not even consider. Of course, if you ask yourself the question "how to save up for an apartment", for example, by begging or fortune telling, then you can find a lot of role models. It is enough to go down to any underground passage in the city center and ask "future colleagues" and agree on recommendations with them.

But jokes are jokes, but the question is urgent for many. And the point is most often not in meager earnings, but in psychology. Alas, many of us theoretically know how to accumulate money: firstly, to save, secondly, to save small amounts, but do it systematically and regularly, thirdly, not to spend onmomentary pleasures and unnecessary things. But in practice, these qualities must be cultivated in oneself. In Russia, misers have never enjoyed honor and respect. Moreover, there is something in our mentality that makes us live in a big way, as soon as the opportunity presents itself, rush from one extreme to another. We either work for days, driven by thoughts only about how to save money, then we “break down” and indulge in unnecessary spending, parties, make grand gestures, try to do good to all the disadvantaged…

There is one more problem on the way to systematic accumulation. This is the undermined confidence of Russians in the banking system and savings banks. Many people remember the default of 1998, when people had only one “zilch” left from many years of savings. And even these funds were very difficult to withdraw. Foreign banks seem much more reliable to us, but not everyone can open an account abroad.

And yet, how to accumulate money, suppose, from a regular salary? First, you need to make a spending plan. There are expenses absolutely necessary for survival: groceries, utilities. Calculate how much you spend now on these items. The next step is to look for ways to save money. For example, by replacing light bulbs with energy-saving ones, we will pay less in total on the meter. You will have to analyze your daily habits. Of course, you should not refuse ordinary hygiene, but you can save water when washing dishes. To do this, just do not perform this operation with constantlyopen faucet. First, you can soak the dirt and grease by adding detergent. With running water, then it will be enough just to rinse the dishes.

The same principles can be applied to the daily menu. Simple foods (cereals, meat, potatoes, eggs) are not very expensive by themselves. Therefore, you can refuse all kinds of semi-finished products, canned food, delicacies, ready meals. Simplify the diet - it will be he althier and cheaper. With regard to all kinds of goods, one should also be guided by the principle of reasonable spending. For example, why do you need a newfangled "fancy" phone if you use only two or three functions? Or "signature" sneakers, if you are not involved in professional sports? Realize that up to 90% of the value we pay for products is the firm's advertising, anti-competition, "prestige" and positioning costs.

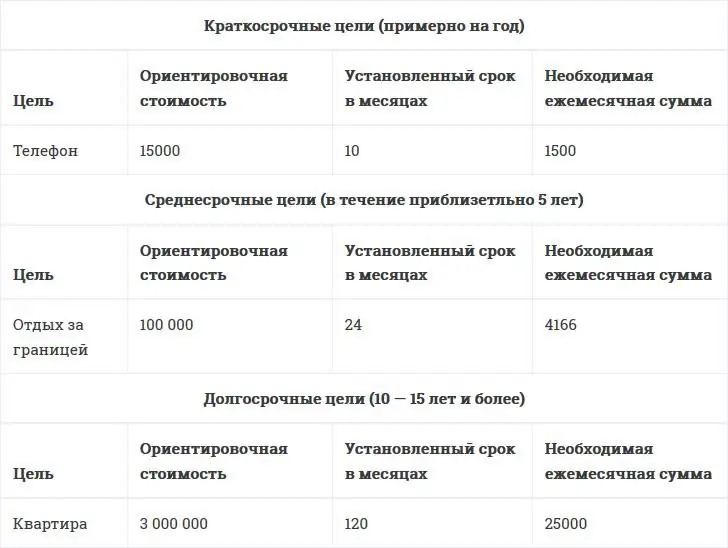

Once you have determined how much you can save per month using these methods, proceed to the third step. How to save money from current earnings? Don't spend everything. Set aside systematically and regularly. Of course, there may be unforeseen circumstances in which you have to get and break the piggy bank. But the amount that you (according to your calculations) can save should be put there regularly. The piggy bank doesn't have to be a glass jar or a sock. You can transfer money to a savings account or to an electronic wallet. It is important not to succumb to the temptation to take them out of there "for pleasure." This should also be taughtchildren.

How to save money for a student who has few opportunities to earn money on his own? First of all, try to limit spending, for example, on games for a mobile phone, on paid SMS, on sweets. Thanks to this, pocket money given by parents can be partially saved. Secondly, look for available earning opportunities. A teenager and high school student may well go shopping or walk the dog during the day. Let this be a small income, but independent. If you own a computer, you can start posting on pay-per-post forums or learn how to make simple websites. Opportunities are always there - enough desire and desire to use them.

Recommended:

Golden rules of money. How to earn, save and increase money

The current economic situation can be called unstable. Most people sooner or later begin to think about how to save money with a small salary. Indeed, in addition to mandatory expenses, a person wants to create a financial cushion for himself, entertainment is also needed. There is a lot of information presented as the "rules of money", or rather, their receipt, preservation and increase. And often these rules contradict each other. But some of them are worth paying attention to

How to save money with a small salary? How to save correctly?

In addition to monthly expenses for utility bills, groceries and other expenses, I want to save up money for a long-awaited vacation, buying real estate or educating children. Unfortunately, not everyone succeeds, and some are so obsessed with savings that they cross the line on the path to outright stinginess. So how to save money with a small salary, while not infringing on the little things?

How to save money fast at 12? Real money options for teenagers

Modern teenagers are often looking for places to earn extra money. This article will talk about how you can earn income at 12 years old

Some tips on how to transfer money from phone to card

Very often in everyday life there are circumstances when cash is urgently needed. At the same time, the situation is complicated by the fact that they are available only on the mobile phone account, and this amount is quite large

Deposit "Save" (Sberbank): interest and conditions. What is the interest rate of the "Save" pension deposit in Sberbank of Russia?

Deposit "Save" is one of the most profitable deposit programs of Sberbank. There are higher interest rates for pensioners. Flexible partnership terms available