2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:29

Cash documents are papers that are drawn up in connection with the movement of funds of a legal entity or an individual entrepreneur. Their forms are approved by the State Statistics Committee. Let us consider further what cash documents enterprises can use.

Orders

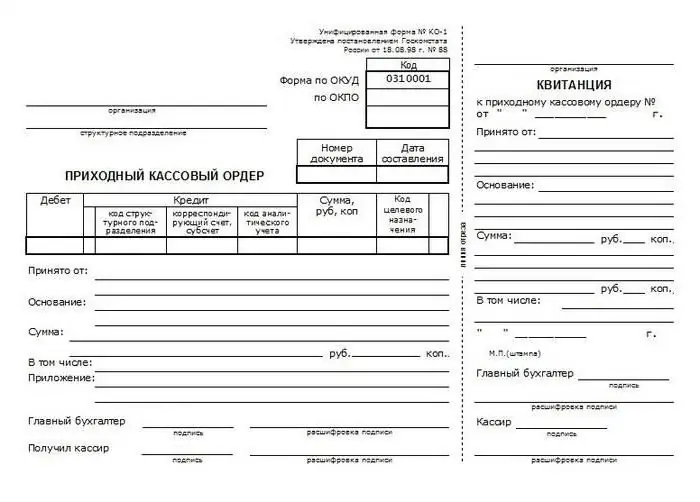

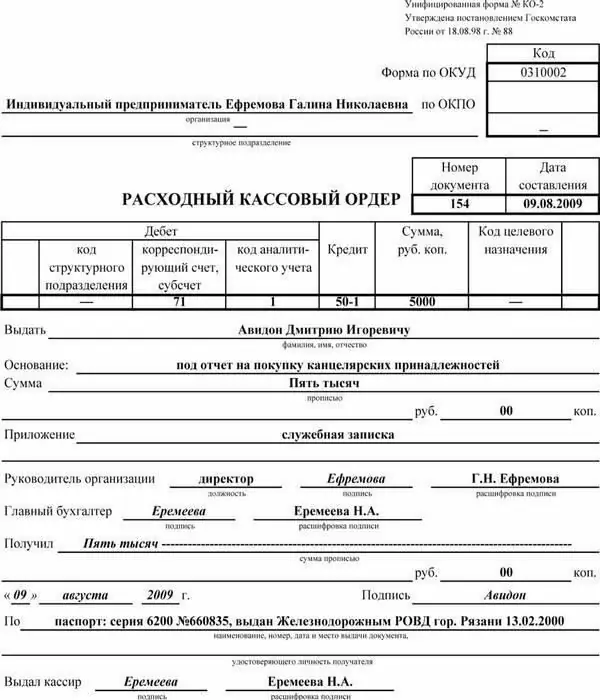

They act as primary cash documents. Orders can be incoming or outgoing. The first is applied when cash is received. A receipt order is issued in one copy by an accounting officer and signed by Ch. an accountant or an official authorized to do so. In the absence of responsible officials, the head of the legal entity or the individual entrepreneur himself can endorse primary cash documents. The receipt for the receipt order must be signed by authorized persons (accountant and cashier), certified by a stamp (seal). In addition, it is registered in the relevant journal. The receipt is given to the subject who deposited the money. The receipt order itself remains at the cash desk. Expenditure paper is filled in when issuing cash. It must be said that cash documents are compiled if the enterprise uses both traditional methods of information processing and BT tools. An outgoing order, like an incoming one, is issued in 1 copy. It must also be endorsed by authorized persons and registered in the appropriate journal.

Filling

How to issue the cash documents mentioned above? Filling is carried out as follows:

- The line "Basis" refers to a business transaction.

- In the column "Including" the amount of VAT is entered. It is written in numbers. If services, goods or work are not taxed, then the line indicates "without VAT".

- In the "Appendix" line, accompanying and other papers should be listed, indicating the dates of their compilation and numbers.

- In the column "Credit, subdivision code" the corresponding designation of the structural department to which the funds are received is put down.

Register

Cash documents must be recorded in a special journal. It registers both incoming / outgoing orders, and papers that replace them. The latter, for example, include payrolls, applications for the issuance of funds, invoices and others. At the same time, it should be noted that the expense orders, which are issued on the payroll for wages and other amounts equivalent to it, must be registered after the issuance of payments.

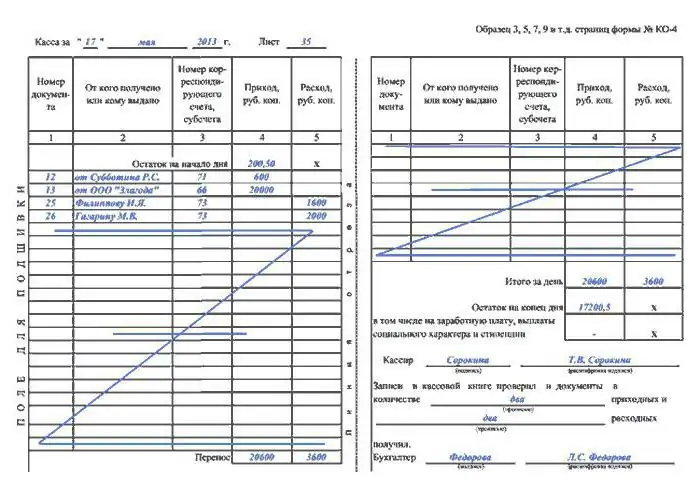

Cash book

It is used to account for the issuance and receipt of cash. The book is numbered, laced and certified with a seal, which is placed on the last page. A record is also made here indicating the number of sheets. The last page must be signed. accountant and business manager. Each sheet of the book is divided into 2 equal parts. One (with a horizontal ruler) should be filled in as the first copy, the other as the second copy. The latter is issued from the back and front sides using carbon paper. Both instances are numbered with the same number. The former remain in the book, while the latter are detachable. The latter act as reporting cash documents. Until the end of all operations for the current day, they do not come off. Entries begin on the front side of the first copy after the column "Balance at the beginning of the day." Before filling, the sheet must be folded along the tear line. The cut-off part is placed under the one that remains in the book. To enter information after the "Transfer", the tear-off side is superimposed on the front side of the second copy. Entries continue along the horizontal line on the reverse side of the inseparable part.

Additional documents

Cash transactions can be registered with various papers. One of them, for example, is an advance report. It is used to account for funds that are issued to accountable persons for administrative and business expenses. How are such documents prepared? Cash transactions of this type are accounted for directly by the reporting entity, andAlso an accountant. Advance reports are drawn up on paper or computer media. Registration of cash documents is carried out strictly in accordance with the rules. Each form is filled out in one copy. On its reverse side, the accountable person indicates a list of papers that confirm the expenses incurred. These, for example, include a travel certificate, bills of lading, checks, receipts, etc. Here, the subject indicates the amount of expenses. The papers that are attached to the report must be numbered in the order in which they are listed. Checking cash documents is carried out by employees of the accounting department. Employees, in particular, conduct an audit of the targeted spending of funds, the completeness of the provided corroborative papers, the correctness of their completion and calculation of amounts. The reverse side indicates the costs that are accepted for accounting, the accounts in the debit of which they are recorded.

Important nuances

Details that refer to foreign currency (page 1a on the front and columns 6 and 8 on the back) must be filled in only if the accountable person receives funds not in rubles. The advance report after verification must be approved by the head of the enterprise or a person authorized by him. Only after that it is taken into account. If the advance has not been fully used, the accountable person returns the balance back to the cashier. At the same time, the receipt order is filled. Funds are written off in accordance with the approved report.

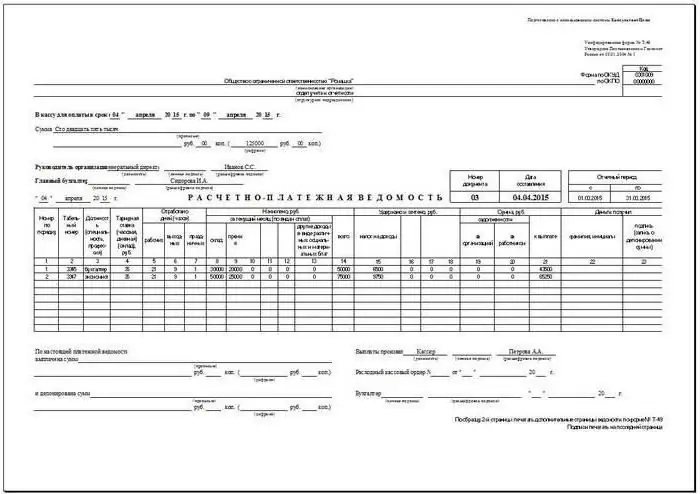

Payrolls

Payment of cash documents is carried out when calculating and paying salaries to employees of the enterprise. The accounting department draws up the corresponding statement in 1 copy. The accrual of wages is made according to the information present in the primary documentation for accounting for the actual time worked, output, etc. The lines "Accrued" indicate the amounts in accordance with the types of payments from the payroll. Other incomes (material and social benefits) provided to the employee, repaid at the expense of the enterprise's profit and subject to inclusion in the taxable base are also affixed here. At the same time, deductions from the salary are calculated and the amount to be handed over to the employee is established. On the cover page of the statement, the total amount to be paid to employees is affixed. The head of the enterprise must sign the permission to issue wages. In case of its absence, this document is issued by an authorized employee. At the end of the statement, the amounts of the deposited and issued salaries are entered. After the period established for the payment of funds to employees, the names of employees who did not receive money in column 23 are marked "Deposited". For the issued amount, an expense order is drawn up. Its number and date of completion must be indicated in the payroll on the last sheet.

Help-report

This document contains the readings of KKM meters and revenue per shift (working day). Help-report is filled in 1 copy daily. The cashier-operator must sign it and hand it over to the chief official(The head of the company). At the same time, the receipt order is filled. In small companies, money is handed over directly to collectors. When transferring cash, the relevant cash documents of the bank are filled out. Revenue per shift (working day) is set in accordance with the indicators of the summing counters at the beginning and end of the day. At the same time, the amounts returned to customers on unused checks are deducted. The established revenue is confirmed by the heads of departments. In the posting of funds in the report, the senior cashier, as well as the head of the enterprise, signs. The reference report acts as the basis for compiling a consolidated "Information on the readings of KKM meters and the company's revenue".

Journal of teller

This document is required to account for the expense and receipt of cash for each KKM of the enterprise. The journal also acts as a control and registration report of meter readings. This document is laced, numbered and sealed with the signatures of Ch. accountant, head of the company, as well as a tax inspector. The journal is also certified by the seal of the enterprise. All entries are made by the teller every day. The procedure for issuing cash documents does not allow erasures and blots in the journal. All corrections made must be agreed upon and certified by the signatures of authorized persons. If the readings match, they are logged for the current shift at the beginning of work. These data must be certified by the signatures of the administrator on duty and the cashier. Line 15 indicates the amounts that are entered onchecks returned by customers. Information for this is taken from the relevant act. The same column indicates the number of zero checks printed during the shift. At the end of the working day, the operator generates a final report for the shift and hands over the received revenue with it. This creates an incoming order. After the meter readings are taken, the actual amount of receipts is checked, the corresponding entry is made in the journal. It is confirmed by the signatures of the head (duty administrator), senior cashier and teller. In the event of discrepancies between the amounts indicated on the control tape and the amount of revenue, the reason for the difference is identified. Surpluses or shortages found are recorded in the corresponding log lines.

Data on KKM meter readings and revenue

They are used to generate a summary report for the current shift. These data act as an appendix to the statement of the teller, compiled daily. Data on indications and revenue are formed in one copy. Together with expenditure and receipt orders, statements of tellers, they are transferred to the accounting department of the enterprise until the next shift. The sample of cash documents, in accordance with the meter readings, at the beginning and end of the working day for each cash register includes the calculation of revenue. At the same time, among other things, its distribution by departments is indicated. The latter must be confirmed by the signatures of the managers. At the end of the completed table, the results are displayed according to the readings of the counters of all cash registers, andthe company's revenue is also summed up with the distribution of funds by departments. In accordance with the acts, the total amount of money that was issued to customers on the checks they returned is indicated. This amount reduces the total revenue of the company. The information must be signed by the senior cashier and the head of the enterprise.

Recommendations for filling

When issuing cash documents, it is necessary to adhere to the procedure established by legislative and other regulatory acts. In addition, there are several fairly simple rules, the observance of which will avoid inaccuracies when filling out paperwork:

- Amount in words should always be capitalized. In this case, pennies are allowed to be written in numbers. For example: Eighteen thousand rubles 10 kopecks.

- Paperwork can be completed either by hand or using technical means (a computer, for example).

- Regulatory acts allow the adjustment of information in cash documents. However, a number of requirements must be met. An incorrect entry should be carefully crossed out with one line. Correct information is indicated next to or (if possible) above it. Here you should make a postscript: "Corrected to believe", "Crossed out is invalid" or "True". Next to this entry should be signed ch. accountant and head of the organization (or individual entrepreneur).

- If there are blots, erasures, smears with a "stroke" and other similar correction methods, the document is considered invalid.

Additional rules

Storage of cash documents, in accordance with applicable law, is carried out for 5 years. The calculation of this period begins on January 1 of the year following the period of completion of office work. This rule is considered general. A special procedure has been established for payroll statements. If employees do not have personal accounts, these papers are kept at the enterprise for 75 years. At the end of this period, all documentation may be transferred to the archive or destroyed if there are no court cases, disagreements or disputes on it. When working with papers, the following rules must be followed:

- Formation of documents into staples should be carried out for each day no later than the next working day or the first day off.

- Before transferring the papers to the archive, their inventory must be made.

- Control of the formation of cases is carried out either by a cashier or by the direct manager of the enterprise.

- In the process of creating a staple, papers are collected in ascending order of account numbers (first by debit, then by credit).

Responsibility for the safety of cash documents rests with the head of the enterprise. In case of non-compliance with the above rules, an administrative pen alty in the form of a monetary pen alty may be applied to the violator. The amount of the fine is set in accordance with the law.

Conclusion

Keepingcash documentation is considered a fairly responsible job. Filling out paperwork must be approached with all responsibility. Cash documents are used when summarizing various data, reporting, accounting. In this regard, errors made at the initial stages of fixing transactions can lead to serious distortions in the final papers. An employee who is appointed to the position responsible for processing cash documents must have relevant knowledge and experience. It must be remembered that all the papers that the operator fills out are reviewed by senior officials and approved by the head of the company. Particular attention should be paid to the registration of documents. Entries in journals and books must be made on time in accordance with the rules. Since cash documents are used in the preparation of reports, all corrections in them are carried out strictly in a certain order. If the established rules are not followed, the papers lose their validity, and the information in them cannot be used by the company in further management work.

Recommended:

Accounting documents are The concept, rules for registration and storage of accounting documents. 402-FZ "On Accounting". Article 9. Primary accounting documents

Proper execution of accounting documentation is very important for the process of generating accounting information and determining tax liabilities. Therefore, it is necessary to treat documents with special care. Specialists of accounting services, representatives of small businesses who keep independent records should know the main requirements for the creation, design, movement, storage of papers

Processing primary documentation: requirements, example. Primary accounting documentation

The activity of any enterprise is closely connected with the maintenance and processing of primary documentation. It is necessary for reporting, calculating tax payments, making management decisions

Primary accounting documents: types, processing and storage

Carrying out accounting at enterprises of various forms of ownership is impossible without documentary reflection. Not a single procedure, not a single project, not a single business transaction is carried out without a correctly executed document, regulated by the internal orders of the enterprise and external legislative norms. Each action performed by an employee is reflected in the documentary base, which is based on a list of primary documents

What documents are needed for registration of SNILS: list, procedure for registration, terms

SNILS is an important document that every resident of the Russian Federation should have. This article will show you how to arrange it. What is useful for obtaining SNILS? And what are the most common challenges people face?

Conditions and period of storage of primary documents in accounting

The term for storing primary documents in an organization is legally established, which means that getting rid of “paper” just won’t work, you will have to store them for at least a few years and only then destroy them. How long to store?